Cash Ratio

What is the Cash Ratio?

A cash ratio is a liquidity metric which indicates the company’s capacity to pay short-term debt obligations with its cash and Cash Equivalents.

Cash ratio is more strict than other liquidity ratios such as current ratio and quick ratio. A company’s most liquid assets are taken for the calculation.

Cash Ratio Formula

Cash ratio is calculated by using the following formula:

Cash ratio= (Cash and Cash Equivalents + Marketable Securities) / Current Liabilities

Wherein,

Cash includes coins & currency, and demand deposits

Cash equivalents are assets that can be converted into cash quickly. Example- T-bills, Savings Account and money market instruments

Current liabilities are obligations due within one year

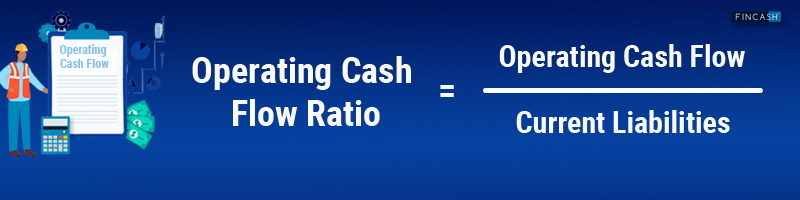

The current ratio measures the liquidity by comparing all the current assets with current liabilities.

The quick ratio is conventional as it measures the liquidity with the use of quick assets such as cash and cash equivalents marketable securities and short-term Receivables. Cash ratio is a more conventional ratio that considers cash and marketable securities.

Talk to our investment specialist

Cash Ratio Example

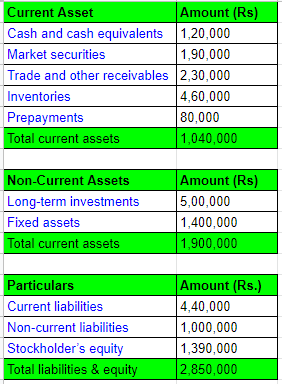

ABC Company has the following figures drawn out from its Balance Sheet.

The example of the cash ratio is as follows:

Cash ratio= (Cash and Cash Equivalents + Marketable Securities) / Current Liabilities

= Rs. 1,20,000+ Rs. 1,90,000/4,40,000. Cash Ratio= 0.70

Use of Cash Ratio

Usually, creditors are more likely to look at the cash ratio of the company than the investors. This is because the company can service its debt or not. As the ratio does not use inventory and accounts receivables, the creditors are assured that their debt is serviceable - if the ratio is greater than 1.

The cash ratio is a strict liquidity measure that the investors do not look during a fundamental analysis of the company. Investors want the company to utilize idle cash to generate profit.

Account receivables can take weeks or months to be converted into cash, and inventory can take months to be sold. Although, cash is the best form of an asset which is used to pay off liabilities.

A cash ratio of more than 1 suggests that the company has too high cash assets and it is not able to use it for profitable activities.

The companies are unable to preserve high cash assets due to the idle cash in the Bank account and do not generate returns. Hence, the company tries to use the cash for projects, acquiring new business, mergers and acquisition, research & development to get higher returns. It is always said that a cash ratio in the Range of 0.5 to 1 is considered as good.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.