Table of Contents

What is Valuation Analysis?

Valuation Analysis is one such procedure that helps to evaluate the approximate worth or value of an asset, be it a Real Estate, commodity, fixed Income security, equity, business or other similar assets.

The analyst might use varying approaches to valuation analysis for different asset types. However, in a common thread, everybody will be looking at the fundamentals of assets.

How Does Valuation Analysis Work?

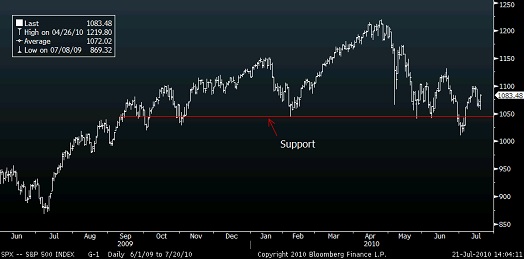

Mostly, valuation analysis is all about science. But you may also find a tinge of art involved as analysts are compelled to assume for model inputs. Basically, the asset’s value is present value (PV) of all the future cash flows that an asset is predicted to generate. For instance, in terms of the estimation model of a firm, inherently, there will be several assumptions associated with the discounting rate for the formula of PV, tax rates, Capital expenses, financing choices, margins, growth, sales and more.

After setting up the model, an analyst may play around with variables to figure out how valuation alters with different predictions. For mixed asset classes, no one-size-fits-all model applies. For a Manufacturing organization, whereas, the valuation might be agreeable to a multi-year DCF model. And, for a real estate company, it would be adequately modelled with Capitalization Rate (cap rate) and Net Operating Income (NOI).

Talk to our investment specialist

Uses of Valuation Analysis

The valuation analysis outcome can take several forms. It could be one individual number, like a firm having a valuation of about 5 billion. Or, it could be several numbers if an asset’s value is majorly based on a variable that frequently fluctuates, like a corporate bond with high duration and a valuation that ranges anywhere between Par and 90% of par based on the outcome. Also, valuation can be stated as a price multiple. And then, valuation analysis can also take the last form of Net Asset Value (NAV) per share or an asset value per share. For investors, valuation analysis is essential to compute the intrinsic values of a company’s shares to make cautious and informed decisions of investment.

If a bond has a Fair Value, it will not deviate much from the intrinsic values. However, during the times of Financial Stress or the company being heavily indebted, the scenario could be different. As far as comparing firms and companies in a sector is concerned, valuation analysis is an efficient tool. Moreover, it is also useful for estimating the Return on Investment over a specific time period.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.