Table of Contents

- What is the RBI Retail Direct Scheme?

- Features of the RBI Retail Direct Scheme

- Government Securities to Invest Through the RBI Retail Direct Scheme

- Advantages of the RBI Retail Direct Scheme

- What is a Retail Direct Gilt (RDG) Account?

- Eligibility for Opening an RDG Account

- How to Open an RDG Account?

- How to Purchase and Sell securities via the Retail Direct Platform?

- Limitations of the RBI Retail Direct Schemes

- Conclusion

Everything to Know About RBI Retail Direct Scheme

The RBI Retail Direct Scheme, initiated by the Reserve Bank of India (RBI), offers retail investors the opportunity to directly invest in government securities, commonly known as G-secs. This program enables investors to establish a Retail Direct Gilt (RDG) account with the RBI to purchase and sell government securities. The primary objective of introducing this scheme is to democratise retail participation in India's bond markets. As a result, everyday investors are no longer compelled to invest through intermediaries such as Mutual Funds and brokers.

This article comprehensively explains the RBI Retail Direct Scheme interest rate 2023, its advantages, the procedure for opening an RDG account, associated fees, and how to buy and sell government securities via this online platform.

What is the RBI Retail Direct Scheme?

The scheme is designed to advance Financial Inclusion by granting small investors access to G-secs, regarded as a secure and reliable investment choice. Previously, retail investors were required to invest in G-secs through intermediaries like banks, brokers, or depositories. The RBI Retail Direct Scheme aims to eliminate these intermediaries and provide an uncomplicated, cost-effective means for Investing in government securities.

Features of the RBI Retail Direct Scheme

The RBI Retail Direct Scheme is accessible to any individual investor residing in India. Investors can apply for the scheme through their bank or the RBI's online portal. Jotted down below are some essential characteristics of this scheme:

Investment Amount: The RBI retail direct scheme's minimum investment amount is Rs. 10,000, with a maximum investment cap of Rs. 2 crores per security

Interest Rates: The RBI retail direct scheme interest rate is determined through an auction process, where investors submit bids for the securities. The interest rate remains fixed for the entire security duration and is paid semi-annually or annually

Maturity Period: Securities offered under this scheme come with tenures ranging from 1 year to 40 years

Liquidity: The scheme provides high liquidity since investors can trade their securities on the stock exchange. Furthermore, these securities can be utilised as Collateral for obtaining loans

Talk to our investment specialist

Government Securities to Invest Through the RBI Retail Direct Scheme

The RBI Retail Direct platform enables investment in four primary categories of securities:

1. Government of India Dated Securities

These, also known as Dated G-Secs, are long-term debt instruments issued by the Government of India to secure long-term funds. They offer fixed or floating coupon rates, are paid semi-annually, and have 5 to 40 years of tenure. Investment in these securities starts at a minimum of Rs. 10,000 with no upper limit.

2. Government of India Treasury Bills

Treasury Bills (T-Bills) are issued by the Indian government and are such short-term debt instruments that raise funds for short periods. T-Bills are zero-coupon securities, meaning they don't pay interest but are issued at a discount and redeemed at Face Value. Common tenures for RBI retail direct T-bills are 91 days, 182 days, and 364 days. The minimum investment amount for a GOI T-bill is Rs. 25,000.

3. State Development Loans

These are long-term dated securities issued by State Governments in India to secure funds for a year or longer. The minimum investment required to begin investing in an SDL is Rs. 10,000, with a tenure of 10 years.

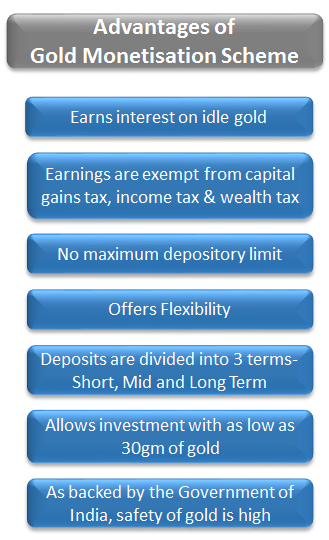

4. Sovereign Gold Bonds

SGBs are government securities denominated in grams of gold and serve as substitutes for physical gold. The minimum investment is equivalent to 1 gram of gold. The tenure is eight years, and an annual interest of 2.5% is paid until maturity.

Advantages of the RBI Retail Direct Scheme

Here are some noteworthy advantages of the RBI Retail Direct Scheme:

Enhanced Returns: Government securities typically offer higher interest rates than fixed-Income investments such as fixed deposits and savings accounts. Additionally, this scheme provides even better returns than regular government securities due to the absence of intermediaries

Convenient Accessibility: The RBI Retail Direct Scheme simplifies access to G-secs for retail investors. Investors have the option to apply for the scheme either through their bank or via the RBI's online portal

Cost-Effective Investment: This cost-effective scheme imposes no entry or exit fees. Consequently, the overall cost of investment is lower than other available options

Portfolio Diversification: Investing in G-secs contributes to Portfolio diversification, reducing risk for retail investors

Zero Charges: The Retail Direct Account is free and does not involve intermediaries. This reduces overall transaction costs for individual investors, as they are no longer required to pay the fees associated with investing through aggregators or indirectly through mutual funds

What is a Retail Direct Gilt (RDG) Account?

Within the framework of this scheme, individual retail investors are mandated to establish a Retail Direct Gilt (RDG) account with the RBI, and this account is both opened and operated without any charges. Retail investors gain direct access to trading government securities via an online portal through this account. The opening of an RDG account empowers you to directly purchase government securities in the primary Market and buy and sell G-secs in the secondary market.

Eligibility for Opening an RDG Account

You must meet the following criteria to open an RDG Account:

- Possession of a rupee savings bank account in India

- Possession of a Permanent Account Number (PAN) issued by the income tax Department

- The ability to provide an Official Valid Document (OVD) for Know Your Customer (KYC) purposes

- Possession of a valid email ID

- Possession of a registered mobile number

How to Open an RDG Account?

The RBI retail direct scheme registration process involves five straightforward steps:

Commence the registration process by visiting the website at rbiretaildirect[.]org[.]in and completing the RBI retail direct login process

Provide essential information, including your full name, PAN, email address, mobile number, and date of birth. The email ID and mobile number are authenticated using a One-Time Password (OTP) process. Subsequently, a Reference Number is provided to monitor the application's progress

The KYC verification process can be completed via the Central KYC option or video KYC

You must furnish nomination details in the next step. The application allows for the inclusion of up to two nominees, and these details can be modified later through the portal

Your Rupee Savings Bank Account is linked with the RDG account. This is accomplished by crediting your Savings Account with a nominal amount and subsequently verifying the same

Furthermore, once the KYC verification is completed, you will receive the login ID and password.

How to Purchase and Sell securities via the Retail Direct Platform?

There are two methods for acquiring G-secs:

Method 1: Participate in Primary Market Auctions

Primary auctions are conducted on different days of the week for instruments like dated G-secs, T-bills, and SDLs. This process occurs through the platform, and individuals must fund their bids before the bidding or subscription window closes to prevent cancellations.

Method 2: Quote a Price in the Secondary Market Portal

This method functions similarly to purchasing shares through an online Trading Account.

Limitations of the RBI Retail Direct Schemes

Certain considerations should be taken into account when choosing this scheme, such as:

- Government securities are long-term debt instruments with high-interest rate risk. If an individual purchases a long-term bond with an 8% interest rate, the bond's value will decrease if the market rate rises. Holding the bond for an extended period exposes investors to greater interest rate risk

- While the RBI Retail Direct Scheme enhances participation in G-secs, the process is less seamless or straightforward than equities

Conclusion

The RBI Retail Direct Scheme empowers investors to conveniently buy and sell government securities in primary and secondary markets through RDG accounts. This initiative enhances the affordability and security of investing in government Bonds. Investors are encouraged to leverage this platform, as it provides a safe and secure means to diversify their investment portfolios. Nevertheless, it's essential to recognise that these securities offer limited returns, so a thorough evaluation of your financial requirements is advised before investing in these funds.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.