Table of Contents

History of Mutual Funds in India

Mutual Funds history in India started in the year 1963 with the formation of Unit Trust of India(UTI). This was initiated by Government of India with the help of Reserve Bank Of India(RBI). The first-ever mutual fund scheme in India was launched in 1964 by UTI called the Unit Scheme 1964. Mutual Funds history in India can be broadly categorised into a number of distinct phases. We will line them up as follows:

Mutual Funds History: Initiation Phase (1963-1987)

1963's Act of Parliament led to the formation of Unit Trust of India (UTI). It was set up by the Reserve Bank of India. It functioned under its Regulatory and Administrative Control. UTI enjoyed a complete monopoly in the sector as it was the only entity to offer the services. It was later delinked from the RBI in the year 1978 and it’s regulatory & administrative control was taken over by Industrial Development Bank of India (IDBI). Unit Scheme (1964) was the first scheme launched by UTI. In the subsequent years, UTI innovated and offered multiple schemes for investment in mutual funds. Unit Linked Insurance Plan(ULIP) was one such scheme launched in 1971. By the end of 1988, the assets under management (AUM) of UTI was around Rs. 6,700 crores.

Mutual Funds History: Public Sector Phase ( 1987-1993)

Other players from the public sector entered the Market in the year 1987 as a result of the expansion of the Economy. SBI Mutual Fund was the first Non-UTI Mutual Fund set up in November 1987. This was followed by LIC Mutual Fund, Canbank Mutual Fund, Indian Bank Mutual Fund, GIC Mutual Fund, Bank of India Mutual Fund and PNB Mutual Fund. During the period of 1987-1993, the AUM had increased almost seven times, from Rs. 6,700 crores to Rs. 47,004 crores. It was during this period, the investors allocated large parts of their earned money to investments in the mutual funds.

Mutual Funds History: Private Sector Phase (1993-1996)

The private sector in India was granted permission to enter the mutual fund market in 1993. It has played a significant part in the Mutual Funds history. It provided investors with wider options for investment which consequently led to increased competition with the existing public sector mutual funds. Liberalisation and deregulation of Indian economy allowed many foreign fund companies to trade in India. Many of these operated through a joint venture with Indian promoters. Till 1995, 11 private sector fund houses were set up to compete with existing ones. Since 1996, the growth of the mutual fund Industry reached newer heights.

Talk to our investment specialist

Mutual Funds History: AMFI, SEBI (1996 - 2003)

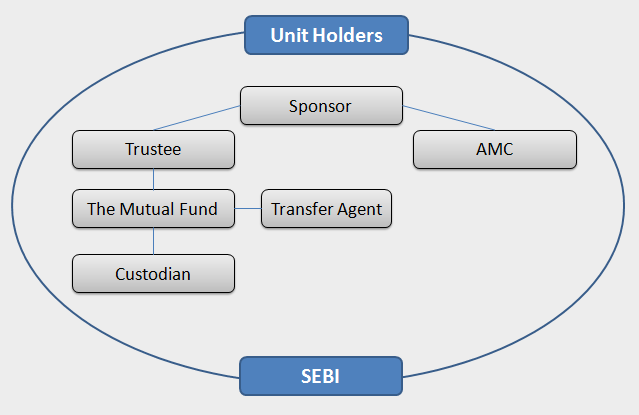

SEBI (Mutual Fund) Regulations came into existence in 1996 to set a uniform standard of norms for all the operating mutual funds. Also, Union Budget of 1999 took a big decision of exempting all mutual fund dividends from income tax. During this time, both SEBI and Association of Mutual Funds of India (AMFI) introduced investor Awareness Programme in order to educate investors about investing in Mutual Funds. AMFI & SEBI have set up a governance framework for Mutual Funds as well as those distributing these products. Between both bodies investor protection is taken care of as well as providing data services including NAV of Mutual Funds. AMFI India through its website provides daily NAV of all funds and also historical mutual fund prices.

The UTI act was repealed in 2003, stripping it of its special legal status as a trust according to the act of Parliament. Instead, UTI adopted a similar structure as any other fund house in the country and is under SEBI’s (Mutual Fund) Regulations.

Establishment of uniform industry in mutual funds has made it easier for investors to trade with any fund house. This saw the surge of AUM from above Rs. 68,000 crores to over 15,00,000 crores ( September '16).

Mutual Funds History in India

Mutual Funds History in India

Present Condition of Consolidation and Growth (2004-Today)

Since the repeal of the UTI Act, 1963, UTI was divided into two separate entities. The first one is Specified Undertaking of UTI with AUM of under Rs. 29,835 as at the end of January 2003. It functions under an administrator and rules framed by Government of India and does not comply with the SEBI’s (Mutual Fund) Regulations.

The second is the UTI Mutual Fund which is sponsored by State Bank of India, Bank Of Baroda, Punjab National Bank and Life Insurance Corporation of India. It is registered and complies with the regulations sanctioned by SEBI.

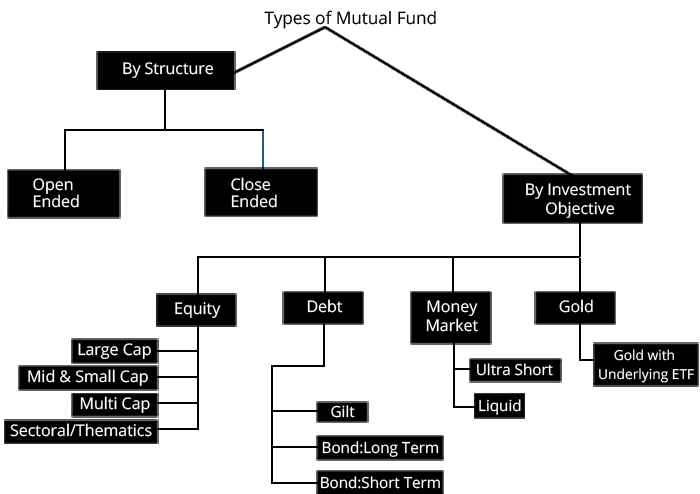

India boasts of total 44 Mutual Funds as of today. With the permission from the RBI, fund houses have opened up and investors can now invest in foreign markets like the United States. And with such positive development, the asset classes today have also moved on from just equity and debt to gold funds, Inflation funds and more innovative funds like arbitrage funds.

The industry has now entered the phase of consolidation and growth with recent mergers among different private sector fund houses. A takeover of Lotus India Mutual Fund(LIMF) by Religare Mutual Fund in 2009 is one of the major consolidations in the modern era of Mutual Fund industry in India. Morgan Stanley chose to hand over its Mutual Fund schemes to HDFC Asset Management Company in late 2013. It was widely regarded as a welcome move as it helped HDFC expand its user base. Another noticeable merger was announced on March 22nd, 2016 as Edelweiss Asset Management (EAML) declared the purchase of domestic assets of JP Morgan Asset Management India (JPMAM). The combined AUM of both the companies is estimated to approximately around INR 8,757 crores. Last year, Goldman Sachs Mutual Fund handed over its assets to Reliance Capital Asset Management Company, which were initially taken over from Benchmark AMC. ING Investment Management sold its Mutual Fund business to Birla Sun Life Asset Management. Hence, over the last couple of years, the industry has seen a degree of consolidation taking place.

The Mutual fund business is a highly untapped market as 74% of the asset under management(AUM) come for the country’s top five cities. Also, with such large and noticeable mergers, there has been consolidation in the Mutual Fund industry. SEBI also has come up with various initiatives including investor awareness as well as trying to expand reach beyond the top 15 cities.With various investor-friendly initiatives, the industry assets under management or AUM has seen a rise over the years. With increasing Income, urbanisation of the population, ever increasing reach via technology, better connectivity, the Mutual Funds industry is in for a bright future.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.