Table of Contents

- Quick Summary

- Why To Invest in Debt Mutual Funds?

- Key Benefits of Debt Funds in 2025

- Risks in Debt Mutual Funds

- Debt Mutual Fund Taxation

- Best Debt Mutual Funds in India for Investments FY 25 - 26

- Top 5 Liquid Mutual Funds

- Top 5 Ultra Short Term Bond Mutual Funds

- Top and Best Floating Rate Mutual Funds

- Top 5 Best Money Market Mutual Funds

- Top 5 Short Term Bond Mutual Funds

- Top 5 Medium to Long Term Bond Mutual Funds

- Top 5 Banking and PSU Debt Mutual Funds

- Top 5 Credit Risk Mutual Funds

- Top 5 Dynamic Bond Mutual Funds

- Top 5 Corporate Bond Mutual Funds

- Top 5 Gilt Mutual Funds

- How to Evaluate Best Debt Mutual Funds

- Things to consider as an investor

- How to Invest in Best Debt Funds Online?

- Conclusion

Top 5 Funds

Best Debt Mutual Funds in India for 2025 | Top Funds by Tenure & Tax Benefits

Best debt funds vary according to the tenor of investment of the investor. Investors need to be clear on their time horizon of investment when selecting the best Debt fund for their investment and also factor in the interest rate scenario.

For investors with a very short holding period, say for a couple of days to a month, Liquid Funds and ultra-short term funds may be relevant. When the time horizon is one to two years then short-term funds may be the desired vehicle. For longer tenors, for more than 3 years, long-term debt funds are the most preferred instruments by investors, especially during falling interest rates. Above all, debt funds have proved to be less risky than equities when looking for short-term investments, however, the volatility of long-term income funds may match that of equities.

As debt funds invest in fixed income instruments like government securities, treasury bills, corporate Bonds, etc., they have the capacity of generating consistent and regular returns over time. However, there are many qualitative and quantitative factors that one needs to understand before selecting the best debt funds to invest, viz - AUM, Average Maturity, Taxation, the credit quality of the portfolio, etc. Below we have listed the top 5 best debt funds to invest across the various categories of debt funds - Best Liquid Funds, best ultra short-term funds, best short-term funds, best long-term funds and best Gilt Funds to invest in 2025 - 2026.

Quick Summary

✅ Best for short-term: Liquid, Ultra-Short, and Money market funds

✅ Best for 1–2 years: Short-term bond funds

✅ Best for 3+ years: Gilt funds, Corporate bond funds, Dynamic Bond Funds

✅ Risks: Credit risk, Interest rate risk

✅ Tax: 20% with indexation if held for more than 3 years

Why To Invest in Debt Mutual Funds?

Debt funds are considered to be an ideal investment for generating regular income. For example, choosing dividend payout can be an option for regular income.

In debt funds, investors can withdraw required money from the investment at any point in time and can let the remaining money stay invested.

Since debt funds largely invest in government securities, corporate debt and other securities like treasury bills, etc., they are not affected by equity market volatility.

If an investor is planning to achieve short-term Financial goals or invest for short periods then debt funds can be a good option. Liquid funds, ultra short-term funds, and short-term income funds may be the desired options.

In debt funds, investors can generate fixed income every month by starting a Systematic Withdrawal Plan (SWP is a reverse of SIP / STP) to withdraw a fixed amount on a monthly basis. Also, you can change the amount of the SWP when required.

Key Benefits of Debt Funds in 2025

- Safer than equities in volatile markets

- Offer liquidity and low lock-in

- Tax-efficient with indexation benefit after 3 years

- Flexible options for all durations and risk profiles

- Suitable for conservative and semi-aggressive investors alike

Risks in Debt Mutual Funds

While Investing in debt funds, investors should be cautious about two major risks associated with them - credit risk and interest rate risk.

Credit Risk

A credit risk arises when a company that has issued the debt instruments does not make regular payments. In such cases, it has a major impact on the fund, depending on how much portion the fund has in the portfolio. Hence, it is suggested to be in debt instruments with a rating higher credit rating. An AAA rating is considered to be the highest quality with little or negligible payment default risk.

Interest Risks

The interest rate risk refers to a change in the bond price due to the change in the prevailing interest rate. When the interest rate rises in the economy the bond prices fall down and vice versa. The higher the maturity of the funds’ portfolio, the more prone it is to the interest rate risk. So in a rising interest rate scenario, it is advisable to go for lower maturity debt funds. And the reverse in a falling interest rate scenario.

Debt Mutual Fund Taxation

Tax implication on debt funds is computed in the following manner-

a. Short Term Capital Gains

If the holding period of a debt investment is less than 36 months, then it is classified as a short-term investment and these are taxed as per individual's tax slab.

b. Long Term Capital Gains

If the holding period of debt investment is more than 36 months, then it is classified as a long-term investment and is taxed at 20% with an indexation benefit.

| Capital Gains | Investment Holding Gains | Taxation |

|---|---|---|

| Short Term Capital Gains | Less than 36 months | As per individual's tax slab |

| Long Term Capital Gains | More than 36 months | 20% with indexation benefits |

📌 Note: Indexation helps adjust the purchase price with Inflation, effectively reducing your tax liability.

Talk to our investment specialist

Best Debt Mutual Funds in India for Investments FY 25 - 26

Top 5 Liquid Mutual Funds

Top Liquid funds with AUM/Net Assets > 10,000 Crore.

Fund NAV Net Assets (Cr) Min Investment 1 MO (%) 3 MO (%) 6 MO (%) 1 YR (%) 2023 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Axis Liquid Fund Growth ₹2,873.69

↑ 0.49 ₹32,609 500 0.7 1.9 3.7 7.3 7.4 7.08% 2M 4D 2M 4D Invesco India Liquid Fund Growth ₹3,547.37

↑ 0.59 ₹10,945 5,000 0.7 1.9 3.6 7.3 7.4 7.01% 2M 5D 2M 5D Aditya Birla Sun Life Liquid Fund Growth ₹415.902

↑ 0.07 ₹41,051 5,000 0.7 1.9 3.6 7.3 7.3 7.2% 2M 8D 2M 8D ICICI Prudential Liquid Fund Growth ₹382.113

↑ 0.06 ₹42,293 500 0.7 1.9 3.6 7.3 7.4 6.99% 2M 5D 2M 10D Tata Liquid Fund Growth ₹4,065.07

↑ 0.72 ₹19,074 5,000 0.7 1.9 3.6 7.3 7.3 7.06% 2M 17D 2M 17D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 23 Apr 25

Top 5 Ultra Short Term Bond Mutual Funds

Top Ultra Short Bond funds with AUM/Net Assets > 1,000 Crore.

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2023 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Aditya Birla Sun Life Savings Fund Growth ₹541.303

↑ 0.20 ₹13,294 1,000 2.2 4.1 8 7 7.9 7.75% 6M 25D 7M 28D UTI Ultra Short Term Fund Growth ₹4,189.39

↑ 0.85 ₹3,143 5,000 2 3.7 7.3 6.5 7.2 7.57% 5M 23D 6M 23D SBI Magnum Ultra Short Duration Fund Growth ₹5,902.82

↑ 1.51 ₹12,470 5,000 2.1 3.8 7.5 6.7 7.4 7.28% 5M 8D 8M 16D ICICI Prudential Ultra Short Term Fund Growth ₹27.3546

↑ 0.01 ₹12,674 5,000 2.1 3.9 7.5 6.8 7.5 7.53% 5M 8D 7M 28D Kotak Savings Fund Growth ₹42.3697

↑ 0.01 ₹11,873 5,000 2.1 3.8 7.4 6.6 7.2 7.32% 6M 4D 6M 14D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 23 Apr 25

Top and Best Floating Rate Mutual Funds

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2023 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Aditya Birla Sun Life Floating Rate Fund - Long Term Growth ₹343.773

↑ 0.11 ₹13,275 1,000 2.6 4.3 8.4 7.3 7.9 7.5% 1Y 25D 1Y 11M 26D Nippon India Floating Rate Fund Growth ₹44.7248

↑ 0.03 ₹7,646 5,000 3.1 4.8 9.4 7.3 8.2 7.51% 2Y 6M 18D 3Y 6M ICICI Prudential Floating Interest Fund Growth ₹419.48

↑ 0.16 ₹6,964 5,000 2.5 4.1 8.4 7.5 8 7.86% 1Y 4M 28D 4Y 7M 17D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 23 Apr 25

Top 5 Best Money Market Mutual Funds

Fund NAV Net Assets (Cr) Min Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2023 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Aditya Birla Sun Life Money Manager Fund Growth ₹365.687

↑ 0.07 ₹25,581 1,000 2.3 4.1 8 7.2 7.8 7.35% 9M 9M 4D UTI Money Market Fund Growth ₹3,047.8

↑ 0.69 ₹16,265 10,000 2.4 4.2 8 7.2 7.7 7.24% 9M 16D 9M 17D ICICI Prudential Money Market Fund Growth ₹375.096

↑ 0.08 ₹24,184 500 2.4 4.2 8 7.2 7.7 7.23% 10M 2D 10M 25D Kotak Money Market Scheme Growth ₹4,439.08

↑ 0.93 ₹25,008 5,000 2.4 4.1 8 7.1 7.7 7.17% 10M 10D 10M 10D L&T Money Market Fund Growth ₹26.0922

↑ 0.01 ₹2,536 10,000 2.3 4.1 7.8 6.7 7.5 7% 8M 26D 9M 14D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 23 Apr 25

Top 5 Short Term Bond Mutual Funds

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2023 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity PGIM India Short Maturity Fund Growth ₹39.3202

↓ 0.00 ₹28 1.2 3.1 6.1 4.2 7.18% 1Y 7M 28D 1Y 11M 1D Nippon India Short Term Fund Growth ₹52.2712

↑ 0.04 ₹6,232 3.2 5 9.5 7 8 7.65% 2Y 9M 3Y 7M 13D Aditya Birla Sun Life Short Term Opportunities Fund Growth ₹47.1451

↑ 0.03 ₹8,068 3.1 4.9 9.4 7.2 7.9 7.49% 2Y 9M 7D 3Y 8M 1D ICICI Prudential Short Term Fund Growth ₹59.5627

↑ 0.02 ₹20,428 3.1 4.8 9.1 7.6 7.8 7.6% 2Y 9M 29D 4Y 10M 17D UTI Short Term Income Fund Growth ₹31.4204

↑ 0.01 ₹2,566 3 4.6 8.9 7.1 7.9 7.29% 2Y 11M 23D 3Y 11M 1D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 29 Sep 23

Top 5 Medium to Long Term Bond Mutual Funds

Top Medium to Long Term Bond funds with AUM/Net Assets > 500 Crore.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2023 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity SBI Magnum Income Fund Growth ₹70.6555

↑ 0.05 ₹1,918 3.8 5.2 10.4 7.7 8.1 7.42% 6Y 2M 26D 10Y 6M 14D ICICI Prudential Bond Fund Growth ₹40.1761

↑ 0.01 ₹2,816 4.1 5.9 11.2 8.2 8.6 7.13% 6Y 7M 24D 13Y 9M 18D Aditya Birla Sun Life Income Fund Growth ₹125.834

↑ 0.10 ₹2,242 3.8 5.3 10.9 7.2 8.4 7.1% 6Y 7M 10D 16Y 25D HDFC Income Fund Growth ₹58.4041

↑ 0.04 ₹885 4.2 5.6 11.1 7.4 9 6.95% 6Y 8M 23D 12Y 3M 18D Kotak Bond Fund Growth ₹76.799

↑ 0.03 ₹2,031 3.6 5 10.4 7.4 8.2 6.91% 6Y 6M 18D 12Y 10M 10D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 23 Apr 25

Top 5 Banking and PSU Debt Mutual Funds

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2023 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity HDFC Banking and PSU Debt Fund Growth ₹22.835

↑ 0.01 ₹5,996 3.3 4.9 9.4 7.1 7.9 7.25% 3Y 10M 10D 5Y 6M 4D UTI Banking & PSU Debt Fund Growth ₹21.6778

↑ 0.01 ₹785 2.9 4.5 8.9 9.2 7.6 7.14% 2Y 29D 2Y 4M 24D DSP BlackRock Banking and PSU Debt Fund Growth ₹23.9902

↑ 0.02 ₹3,409 3.5 4.9 10.2 7.3 8.6 7.16% 5Y 5M 1D 9Y 10M 13D Kotak Banking and PSU Debt fund Growth ₹64.9085

↑ 0.04 ₹6,011 3.3 5 9.6 7.2 8 7.28% 3Y 6M 29D 5Y 4M 6D Aditya Birla Sun Life Banking & PSU Debt Fund Growth ₹363.954

↑ 0.23 ₹8,588 3.3 4.9 9.5 7.1 7.9 7.22% 3Y 6M 7D 4Y 9M Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 23 Apr 25

Top 5 Credit Risk Mutual Funds

Top Credit Risk funds with AUM/Net Assets > 500 Crore.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2023 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity SBI Credit Risk Fund Growth ₹45.0984

↑ 0.01 ₹2,255 2.9 4.8 9.2 7.6 8.1 8.51% 2Y 2M 12D 3Y 14D HDFC Credit Risk Debt Fund Growth ₹23.7677

↑ 0.01 ₹7,230 2.7 4.3 8.9 7 8.2 8.33% 2Y 7M 13D 4Y 25D L&T Credit Risk Fund Growth ₹28.7923

↑ 0.01 ₹598 3.9 5.6 9.6 6.9 7.2 7.89% 2Y 2M 19D 2Y 11M 5D Kotak Credit Risk Fund Growth ₹28.9813

↑ 0.02 ₹709 2.8 4.1 7.6 5.6 7.1 8.57% 2Y 4M 13D 2Y 11M 23D Nippon India Credit Risk Fund Growth ₹34.4888

↑ 0.02 ₹1,001 3 4.9 9.4 7.5 8.3 9.01% 2Y 4D 2Y 4M 10D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 23 Apr 25

Top 5 Dynamic Bond Mutual Funds

Top Dynamic Bond funds with AUM/Net Assets > 500 Crore.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2023 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity SBI Dynamic Bond Fund Growth ₹35.9085

↑ 0.02 ₹3,410 4.3 5.3 11.3 8.3 8.6 7.22% 8Y 5M 5D 17Y 2M 5D IDFC Dynamic Bond Fund Growth ₹34.5514

↑ 0.06 ₹2,962 4.5 5.1 12.1 7.6 10 7.24% 11Y 10M 20D 28Y 3M 29D Aditya Birla Sun Life Dynamic Bond Fund Growth ₹46.3685

↑ 0.04 ₹1,767 4.3 5.7 11.7 8.9 8.8 7.33% 7Y 7M 2D 14Y 7M 20D Axis Dynamic Bond Fund Growth ₹29.6758

↑ 0.02 ₹1,355 4.4 5.8 11.1 7.8 8.6 7.01% 8Y 2M 1D 18Y 4M 10D HDFC Dynamic Debt Fund Growth ₹90.1017

↑ 0.03 ₹778 4 5.2 10.9 7.5 8.5 6.96% 7Y 9M 18D 16Y 11M 1D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 23 Apr 25

Top 5 Corporate Bond Mutual Funds

Top Corporate Bond funds with AUM/Net Assets > 500 Crore.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2023 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Aditya Birla Sun Life Corporate Bond Fund Growth ₹112.197

↑ 0.05 ₹24,570 3.4 5.2 10.1 7.6 8.5 7.31% 3Y 5M 16D 4Y 9M 14D HDFC Corporate Bond Fund Growth ₹32.3302

↑ 0.02 ₹32,527 3.3 5 9.9 7.5 8.6 7.31% 3Y 9M 5Y 10M 2D Nippon India Prime Debt Fund Growth ₹59.5425

↑ 0.04 ₹6,738 3.5 5.2 10.1 7.7 8.4 7.44% 3Y 10M 6D 5Y 2M 26D Kotak Corporate Bond Fund Standard Growth ₹3,741.25

↑ 1.70 ₹14,639 3.3 5 9.8 7.3 8.3 7.31% 3Y 2M 8D 4Y 5M 8D ICICI Prudential Corporate Bond Fund Growth ₹29.5479

↑ 0.01 ₹29,929 3.1 4.9 9.3 7.7 8 7.37% 2Y 11M 5D 4Y 11M 26D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 23 Apr 25

Top 5 Gilt Mutual Funds

Top To generate income through investments in a range of debt and money market instruments of various maturities with a view to maximising income while maintaining the optimum balance of yield, safety and liquidity. ICICI Prudential Long Term Plan is a Debt - Dynamic Bond fund was launched on 20 Jan 10. It is a fund with Moderate risk and has given a Below is the key information for ICICI Prudential Long Term Plan Returns up to 1 year are on The investment objective of the scheme is to generate optimal returns with adequate liquidity through active management of the portfolio, by investing in debt and money market instruments. However, there can be no assurance that the investment objective of the scheme will be realized. UTI Dynamic Bond Fund is a Debt - Dynamic Bond fund was launched on 16 Jun 10. It is a fund with Moderate risk and has given a Below is the key information for UTI Dynamic Bond Fund Returns up to 1 year are on (Erstwhile Aditya Birla Sun Life Short Term Fund) An Open-ended income scheme with the objective to generate income and capital appreciation by investing 100% of the corpus in a diversified portfolio of debt and money market securities. Aditya Birla Sun Life Corporate Bond Fund is a Debt - Corporate Bond fund was launched on 3 Mar 97. It is a fund with Moderately Low risk and has given a Below is the key information for Aditya Birla Sun Life Corporate Bond Fund Returns up to 1 year are on (Erstwhile HDFC Medium Term Opportunities Fund) To generate regular income through investments in Debt/

Money Market Instruments and Government Securities with

maturities not exceeding 60 months. HDFC Corporate Bond Fund is a Debt - Corporate Bond fund was launched on 29 Jun 10. It is a fund with Moderately Low risk and has given a Below is the key information for HDFC Corporate Bond Fund Returns up to 1 year are on To generate regular income through investments in debt and money market instruments consisting predominantly of securities issued by entities such as Scheduled Commercial Banks and Public Sector undertakings. There is no assurance that the investment objective of the Scheme will be realized. HDFC Banking and PSU Debt Fund is a Debt - Banking & PSU Debt fund was launched on 26 Mar 14. It is a fund with Moderately Low risk and has given a Below is the key information for HDFC Banking and PSU Debt Fund Returns up to 1 year are on GILT funds with AUM/Net Assets > 500 Crore.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2023 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity SBI Magnum Gilt Fund Growth ₹66.8899

↑ 0.06 ₹11,489 4.8 6 12.2 8.8 8.9 6.97% 10Y 2M 1D 24Y 14D SBI Magnum Constant Maturity Fund Growth ₹63.8107

↓ -0.02 ₹1,831 4.5 6.3 12.2 8.5 9.1 6.74% 6Y 9M 22D 9Y 9M 29D Aditya Birla Sun Life Government Securities Fund Growth ₹82.4791

↑ 0.12 ₹1,972 4.8 5.9 12 7.9 9.1 7.01% 11Y 8M 26D 29Y 11M 16D Nippon India Gilt Securities Fund Growth ₹38.5294

↑ 0.03 ₹2,060 4.5 5.7 11.7 7.8 8.9 7.1% 9Y 3M 22D 20Y 10M 24D UTI Gilt Fund Growth ₹63.4339

↑ 0.05 ₹733 4.4 5.9 11.6 8 8.9 6.87% 9Y 1M 13D 20Y 2M 26D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 23 Apr 25 1. ICICI Prudential Long Term Plan

CAGR/Annualized return of 8.9% since its launch. Ranked 1 in Dynamic Bond category. Return for 2024 was 8.2% , 2023 was 7.6% and 2022 was 4.5% . ICICI Prudential Long Term Plan

Growth Launch Date 20 Jan 10 NAV (23 Apr 25) ₹36.7735 ↑ 0.01 (0.02 %) Net Assets (Cr) ₹14,363 on 31 Mar 25 Category Debt - Dynamic Bond AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆☆☆ Risk Moderate Expense Ratio 1.36 Sharpe Ratio 1.24 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Months (0.25%),1 Months and above(NIL) Yield to Maturity 7.64% Effective Maturity 10 Years 2 Months 23 Days Modified Duration 4 Years 11 Months 16 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,898 31 Mar 22 ₹11,374 31 Mar 23 ₹12,035 31 Mar 24 ₹12,989 31 Mar 25 ₹14,122 Returns for ICICI Prudential Long Term Plan

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 2.1% 3 Month 3.6% 6 Month 5.4% 1 Year 10.4% 3 Year 8.1% 5 Year 7.1% 10 Year 15 Year Since launch 8.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 8.2% 2022 7.6% 2021 4.5% 2020 4.3% 2019 11.8% 2018 10.2% 2017 6.2% 2016 5.1% 2015 16.9% 2014 5.7% Fund Manager information for ICICI Prudential Long Term Plan

Name Since Tenure Manish Banthia 28 Sep 12 12.43 Yr. Nikhil Kabra 22 Jan 24 1.11 Yr. Data below for ICICI Prudential Long Term Plan as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 6.54% Debt 93.2% Other 0.26% Debt Sector Allocation

Sector Value Government 55.23% Corporate 37.97% Cash Equivalent 6.54% Credit Quality

Rating Value AA 36.8% AAA 63.2% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.1% Govt Stock 2034

Sovereign Bonds | -29% ₹4,010 Cr 391,931,490

↓ -45,000,000 7.34% Govt Stock 2064

Sovereign Bonds | -10% ₹1,383 Cr 133,212,000

↑ 20,000,000 7.93% Govt Stock 2033

Sovereign Bonds | -5% ₹688 Cr 66,848,050 7.53% Govt Stock 2034

Sovereign Bonds | -3% ₹459 Cr 45,460,800 Vedanta Limited

Debentures | -3% ₹399 Cr 40,000 7.09% Govt Stock 2054

Sovereign Bonds | -2% ₹302 Cr 30,000,000 7.12% Maharashtra SDL 2038

Sovereign Bonds | -2% ₹264 Cr 26,457,100

↑ 26,457,100 7.14% Maharashtra SDL 2039

Sovereign Bonds | -2% ₹240 Cr 24,000,000

↑ 24,000,000 Godrej Properties Limited

Debentures | -1% ₹201 Cr 20,000 Nirma Limited

Debentures | -1% ₹200 Cr 20,000 2. UTI Dynamic Bond Fund

CAGR/Annualized return of 7.9% since its launch. Ranked 3 in Dynamic Bond category. Return for 2024 was 8.6% , 2023 was 6.2% and 2022 was 10.1% . UTI Dynamic Bond Fund

Growth Launch Date 16 Jun 10 NAV (23 Apr 25) ₹30.9253 ↑ 0.01 (0.04 %) Net Assets (Cr) ₹447 on 31 Mar 25 Category Debt - Dynamic Bond AMC UTI Asset Management Company Ltd Rating ☆☆☆☆☆ Risk Moderate Expense Ratio 1.54 Sharpe Ratio 0.55 Information Ratio 0 Alpha Ratio 0 Min Investment 10,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 6.94% Effective Maturity 8 Years 14 Days Modified Duration 5 Years 5 Months 23 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,684 31 Mar 22 ₹11,866 31 Mar 23 ₹13,300 31 Mar 24 ₹14,296 31 Mar 25 ₹15,455 Returns for UTI Dynamic Bond Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 2.4% 3 Month 3.7% 6 Month 5.1% 1 Year 10.4% 3 Year 9.8% 5 Year 9% 10 Year 15 Year Since launch 7.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 8.6% 2022 6.2% 2021 10.1% 2020 10.8% 2019 5.9% 2018 -3.9% 2017 5.2% 2016 4.2% 2015 14.9% 2014 6.9% Fund Manager information for UTI Dynamic Bond Fund

Name Since Tenure Sudhir Agarwal 1 Dec 21 3.25 Yr. Data below for UTI Dynamic Bond Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 8.21% Debt 91.57% Other 0.22% Debt Sector Allocation

Sector Value Government 73.93% Corporate 17.65% Cash Equivalent 8.21% Credit Quality

Rating Value AA 0.94% AAA 99.06% Top Securities Holdings / Portfolio

Name Holding Value Quantity 6.79% Government Of India (07/10/2034)

Sovereign Bonds | -44% ₹277 Cr 2,750,000,000 6.92% Govt Stock 2039

Sovereign Bonds | -14% ₹91 Cr 900,000,000 Small Industries Development Bank Of India

Debentures | -6% ₹40 Cr 4,000 National Bank For Agriculture And Rural Development

Debentures | -6% ₹40 Cr 4,000 Rural Electrification Corporation Limited

Debentures | -6% ₹40 Cr 4,000 Power Finance Corporation Ltd.

Debentures | -4% ₹25 Cr 2,500 Chhattisgarh (Government of) 7.32%

- | -3% ₹20 Cr 200,000,000

↑ 200,000,000 Assam (Government of) 7.34%

- | -3% ₹20 Cr 200,000,000

↑ 200,000,000 7.1% Govt Stock 2034

Sovereign Bonds | -2% ₹15 Cr 150,000,000 Mankind Pharma Ltd

Debentures | -1% ₹5 Cr 500 3. Aditya Birla Sun Life Corporate Bond Fund

CAGR/Annualized return of 9% since its launch. Ranked 1 in Corporate Bond category. Return for 2024 was 8.5% , 2023 was 7.3% and 2022 was 4.1% . Aditya Birla Sun Life Corporate Bond Fund

Growth Launch Date 3 Mar 97 NAV (23 Apr 25) ₹112.197 ↑ 0.05 (0.04 %) Net Assets (Cr) ₹24,570 on 31 Mar 25 Category Debt - Corporate Bond AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆☆☆ Risk Moderately Low Expense Ratio 0.5 Sharpe Ratio 1.63 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 100 Exit Load NIL Yield to Maturity 7.31% Effective Maturity 4 Years 9 Months 14 Days Modified Duration 3 Years 5 Months 16 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,978 31 Mar 22 ₹11,525 31 Mar 23 ₹12,062 31 Mar 24 ₹13,003 31 Mar 25 ₹14,137 Returns for Aditya Birla Sun Life Corporate Bond Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 2% 3 Month 3.4% 6 Month 5.2% 1 Year 10.1% 3 Year 7.6% 5 Year 7.2% 10 Year 15 Year Since launch 9% Historical performance (Yearly) on absolute basis

Year Returns 2023 8.5% 2022 7.3% 2021 4.1% 2020 4% 2019 11.9% 2018 9.6% 2017 7% 2016 6.5% 2015 10.2% 2014 8.9% Fund Manager information for Aditya Birla Sun Life Corporate Bond Fund

Name Since Tenure Kaustubh Gupta 12 Apr 21 3.89 Yr. Data below for Aditya Birla Sun Life Corporate Bond Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 3.8% Debt 95.93% Other 0.27% Debt Sector Allocation

Sector Value Corporate 60.28% Government 35.65% Cash Equivalent 3.8% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.1% Govt Stock 2034

Sovereign Bonds | -8% ₹2,033 Cr 198,661,700 7.18% Govt Stock 2033

Sovereign Bonds | -7% ₹1,751 Cr 170,500,000

↓ -33,000,000 7.18% Govt Stock 2037

Sovereign Bonds | -5% ₹1,267 Cr 123,324,100

↓ -30,000,000 Small Industries Development Bank Of India

Debentures | -3% ₹744 Cr 74,550

↓ -2,500 Small Industries Development Bank Of India

Debentures | -2% ₹599 Cr 6,000 Bajaj Housing Finance Limited

Debentures | -2% ₹555 Cr 55,000 6.92% Govt Stock 2039

Sovereign Bonds | -2% ₹502 Cr 49,779,000

↓ -2,500,000 Bajaj Finance Limited

Debentures | -2% ₹452 Cr 45,000 National Bank For Agriculture And Rural Development

Debentures | -2% ₹411 Cr 41,000

↓ -2,500 6.79% Government Of India (07/10/2034)

Sovereign Bonds | -2% ₹408 Cr 40,500,000

↑ 25,500,000 4. HDFC Corporate Bond Fund

CAGR/Annualized return of 8.2% since its launch. Ranked 2 in Corporate Bond category. Return for 2024 was 8.6% , 2023 was 7.2% and 2022 was 3.3% . HDFC Corporate Bond Fund

Growth Launch Date 29 Jun 10 NAV (23 Apr 25) ₹32.3302 ↑ 0.02 (0.07 %) Net Assets (Cr) ₹32,527 on 31 Mar 25 Category Debt - Corporate Bond AMC HDFC Asset Management Company Limited Rating ☆☆☆☆☆ Risk Moderately Low Expense Ratio 0.59 Sharpe Ratio 1.6 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 300 Exit Load NIL Yield to Maturity 7.31% Effective Maturity 5 Years 10 Months 2 Days Modified Duration 3 Years 9 Months Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,879 31 Mar 22 ₹11,405 31 Mar 23 ₹11,862 31 Mar 24 ₹12,802 31 Mar 25 ₹13,906 Returns for HDFC Corporate Bond Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 2.1% 3 Month 3.3% 6 Month 5% 1 Year 9.9% 3 Year 7.5% 5 Year 6.9% 10 Year 15 Year Since launch 8.2% Historical performance (Yearly) on absolute basis

Year Returns 2023 8.6% 2022 7.2% 2021 3.3% 2020 3.9% 2019 11.8% 2018 10.3% 2017 6.5% 2016 6.5% 2015 10.6% 2014 8.6% Fund Manager information for HDFC Corporate Bond Fund

Name Since Tenure Anupam Joshi 27 Oct 15 9.35 Yr. Dhruv Muchhal 22 Jun 23 1.69 Yr. Data below for HDFC Corporate Bond Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 3.2% Debt 96.52% Other 0.28% Debt Sector Allocation

Sector Value Corporate 61.07% Government 35.46% Cash Equivalent 3.2% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.23% Government Of India (15/04/2039)

Sovereign Bonds | -4% ₹1,293 Cr 125,000,000

↓ -25,000,000 7.93% Govt Stock 2033

Sovereign Bonds | -4% ₹1,286 Cr 125,000,000 6.92% Govt Stock 2039

Sovereign Bonds | -3% ₹1,008 Cr 100,000,000

↓ -15,000,000 7.53% Govt Stock 2034

Sovereign Bonds | -3% ₹818 Cr 81,000,000 State Bank Of India

Debentures | -2% ₹789 Cr 800 HDFC Bank Limited

Debentures | -2% ₹509 Cr 50,000 Bajaj Housing Finance Limited

Debentures | -2% ₹504 Cr 50,000 Ncd Small Industries Development Bank Of India

Debentures | -2% ₹500 Cr 50,000 LIC Housing Finance Limited

Debentures | -2% ₹500 Cr 5,000 Reliance Industries Limited

Debentures | -1% ₹472 Cr 4,500 5. HDFC Banking and PSU Debt Fund

CAGR/Annualized return of 7.7% since its launch. Ranked 6 in Banking & PSU Debt category. Return for 2024 was 7.9% , 2023 was 6.8% and 2022 was 3.3% . HDFC Banking and PSU Debt Fund

Growth Launch Date 26 Mar 14 NAV (23 Apr 25) ₹22.835 ↑ 0.01 (0.06 %) Net Assets (Cr) ₹5,996 on 31 Mar 25 Category Debt - Banking & PSU Debt AMC HDFC Asset Management Company Limited Rating ☆☆☆☆☆ Risk Moderately Low Expense Ratio 0.79 Sharpe Ratio 1.05 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 300 Exit Load NIL Yield to Maturity 7.25% Effective Maturity 5 Years 6 Months 4 Days Modified Duration 3 Years 10 Months 10 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,797 31 Mar 22 ₹11,284 31 Mar 23 ₹11,743 31 Mar 24 ₹12,607 31 Mar 25 ₹13,628 Returns for HDFC Banking and PSU Debt Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 2.1% 3 Month 3.3% 6 Month 4.9% 1 Year 9.4% 3 Year 7.1% 5 Year 6.6% 10 Year 15 Year Since launch 7.7% Historical performance (Yearly) on absolute basis

Year Returns 2023 7.9% 2022 6.8% 2021 3.3% 2020 3.7% 2019 10.6% 2018 10.2% 2017 5.9% 2016 6.3% 2015 10.8% 2014 9.8% Fund Manager information for HDFC Banking and PSU Debt Fund

Name Since Tenure Anil Bamboli 26 Mar 14 10.94 Yr. Dhruv Muchhal 22 Jun 23 1.69 Yr. Data below for HDFC Banking and PSU Debt Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 3.97% Debt 95.73% Other 0.29% Debt Sector Allocation

Sector Value Corporate 52.31% Government 43.43% Cash Equivalent 3.97% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity Indian Railway Finance Corporation Limited

Debentures | -5% ₹276 Cr 27,500 Small Industries Development Bank Of India

Debentures | -4% ₹225 Cr 22,500 Indian Railway Finance Corporation Limited

Debentures | -3% ₹202 Cr 20,000 7.18% Govt Stock 2033

Sovereign Bonds | -3% ₹195 Cr 19,000,000

↓ -3,000,000 7.26% Govt Stock 2033

Sovereign Bonds | -3% ₹175 Cr 17,000,000

↓ -2,000,000 State Bank Of India

Debentures | -3% ₹173 Cr 175 Bajaj Housing Finance Limited

Debentures | -3% ₹151 Cr 15,000 Rural Electrification Corporation Limited

Debentures | -3% ₹150 Cr 1,500 Housing And Urban Development Corporation Ltd.

Debentures | -3% ₹149 Cr 15,000 Housing And Urban Development Corporation Limited

Debentures | -2% ₹130 Cr 1,250

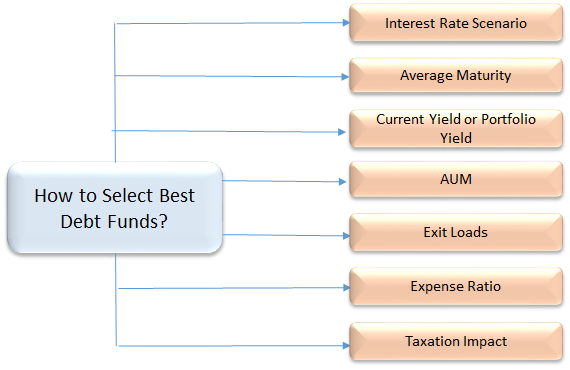

How to Evaluate Best Debt Mutual Funds

In order to select the best debt funds you wish to invest in, it is necessary to consider some of the important parameters such as average maturity, credit quality, AUM, expense ratio, tax implication., etc. Let's have an in-depth look-

1. Average Maturity/Duration

Average maturity is an essential parameter in debt funds that is sometimes overlooked by investors, who tend to invest for a long period without considering the risks involved. Investors need to decide their debt fund investment based on its maturity period, Matching the time period of investment with the maturity period of the debt fund is a good way to ensure you don't end up taking unnecessary risk. Thus, it is advisable to know the average maturity of a debt fund, before investing, in order to aim for optimum risk returns in debt funds. Looking at the average maturity (duration is a similar factor) is important, for example, a liquid fund may have an average maturity of a couple of days to maybe a month, this would mean it is a great option for an investor who is looking to invest money for a couple of days. Similarly, if you are looking at the time frame of one-year Investment plan then, a short-term debt fund can be ideal.

2. Interest Rate Scenario

Understanding the market environment is very important in debt funds which are affected by interest rates and its fluctuations. When the interest rate rises in the economy, the bond price falls and vice-versa. Also, during the time when the interest rates rise, new bonds are issued in the market with a higher yield than the older bonds, making those older bonds of lower value. Therefore, investors are more attracted towards newer bonds in the market and also a re-pricing of older bonds takes place. In case a debt fund is having an exposure to such "older bonds" then when the interest rates rise, the NAV of the debt fund would be impacted negatively. Furthermore, as debt funds are exposed to interest rate fluctuations, it disturbs the prices of the underlying bonds in the fund portfolio. For instance, long-term debt funds are at a higher risk during times of rising interest rates. During this time making a short-term investment plan will lower your interest rate risks.

If one has good knowledge of interest rates and can monitor the same, one can even take advantage of this. In a falling interest rate market, long-term debt funds would be a good choice. However, during the times of rising interest rates then it would be wise to be in funds with shorter average maturities like short-term funds, Ultra Short Term fund or even liquid funds.

3. Current Yield or Portfolio Yield

The yield is a measure of the interest income generated by the bonds in the portfolio. Funds that invest in debt or bonds that have a higher coupon rate (or yield) would have a higher overall portfolio yield. The yield to maturity(ytm) of a debt mutual fund indicates the running yield of the fund. When comparing debt funds on the basis of YTM, one should also look at that fact that how is the extra yield being generated. Is this at the cost of as lower portfolio quality? Investing in not so good quality instruments has its own issues. You don't want to end up investing in a debt fund which has such bonds or securities that may default later on. So, always look at the portfolio yield and balance it off with the credit quality.

4. Credit Quality of Portfolio

In order to invest in best debt funds, checking the credit quality of the bonds and debt securities is an essential parameter. Bonds are assigned a credit rating by various agencies based on their ability to pay the money back. A bond with AAA rating is considered to be the best credit rating and also implies a safe and secure investment. If one truly wants safety and considers this as the paramount parameter in selecting the best debt fund, then getting into a fund with very high-quality debt instruments (AAA or AA+) may be the desired option.

5. Assets Under Management (AUM)

This is the foremost parameter to consider while choosing the best debt funds. AUM is the total amount invested in a particular scheme by all investors. Since, most Mutual Funds’ total AUM is invested in debt funds, investors need to select scheme assets that have a considerable AUM. Being in a fund which has a large exposure to corporates may be risky, since their withdrawals may be large which may affect the overall fund performance.

6. Expense Ratio

An important factor to be considered in debt funds is its expense ratio. A higher expense ratio creates a larger impact on the funds’ performance. For example, liquid funds have the lowest expense ratios which are up to 50 bps (BPS is a unit to measure interest rates wherein one bps is equal to 1/100th of 1%) whereas, other debt funds could charge up to 150 bps. So to make a choice between one debt mutual fund, it is important to consider the management fee or the fund running expense.

7. Taxation Impacts

Debt funds offer the benefit of long-term capital gains (more than 3 years) with indexation benefits. And the short term capital gains (less than 3 years) is taxed at 30%.

Things to consider as an investor

1. Fund Objectives

Debt Fund aims to earn optimal returns by maintaining a diversified portfolio of various types of securities. You can expect them to perform in a predictable manner. It is because of this reason, that debt funds are popular among conservative investors.

2. Fund Types

Debt funds are further divided into various categories like liquid funds, Monthly Income Plan (MIP), fixed maturity plans (FMP), dynamic bond funds, income funds, credit opportunities funds, GILT funds, short-term funds and ultra short-term funds.

3. Risks

Debt funds are basically exposed to interest rate risk, credit risk, and liquidity risk. The fund value may fluctuate due to the overall interest rate movements. There’s a risk of default in the payment of interest and principal by the issuer. Liquidity risk happens when the fund manager is unable to sell the underlying security due to lack of demand.

4. Cost

Debt funds charge an expense ratio to manage your money. Till now SEBI had mandated the upper limit of expense ratio to be 2.25% (Might change time to time with regulations.).

5. Investment Horizon

An investment of 3 months to 1 year would be ideal for liquid funds. If you have a longer horizon of say 2 to 3 years, you may go for short-term bond funds.

6. Financial Goals

Debt funds can be used to achieve a variety of goals like earning additional income or for purpose of liquidity.

How to Invest in Best Debt Funds Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

Conclusion

Debt funds are one of the best ways to invest your money and generate income on a regular basis by choosing the relevant product matching your risk profile. So, investors looking to generate steady income or take advantage of the debt markets, can consider the above best debt funds for 2025 - 2026 and start investing!_

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.