Fincash » Mutual Funds India » Best SIP Plans in India for ₹500 to ₹1000 Monthly

Table of Contents

- What is a SIP? (Explained in Simple Words)

- What is a Mutual Fund?

- What is a SIP Calculator?

- Why First-Time Investors Should Start SIPs

- Monthly Best SIP Plans Based on Your Budget

- Best SIP Plans Based on Time Horizon

- Best Monthly SIP Plans from SBI

- Pro Tips for First-Time SIP Investors

- 🚫 SIP Mistakes to Avoid (And What to Do Instead)

- How to Invest in SIP Mutual Funds Online?

- FAQs for First-Time SIP Investors

- A Real-Life SIP Story: From ₹1,000 to ₹9.8 Lakh

- ✨ Final Thought

Best SIP Plans in India (2025): Start with Just ₹500 or ₹1000 a Month!

Build wealth slowly, just like how you brew your morning chai—one cup at a time.

What is a SIP? (Explained in Simple Words)

SIP stands for Systematic Investment plan. It’s a way to invest a fixed amount every month into a mutual fund—just like saving in a piggy Bank, but smarter.

Think of it like this:

- Instead of spending ₹1,000 on extra coffee and snacks each month, you put it into a mutual fund via SIP.

- That money is then invested into businesses across India — helping them grow, and your money grows with them.

✨ Top SIP Plan for ₹1000 in 2025:

- Type: Equity Mutual Fund (Flexi-cap or Large-cap preferred)

- Expected Returns: 10–14% CAGR (if held long-term)

- Ideal Duration: Minimum 5–7 years

- Suitable for: Moderate to High risk appetite

- Investment Mode: Monthly Systematic Investment Plan (SIP)

What is a Mutual Fund?

A mutual fund is like a big basket of investments (shares, Bonds, etc.), managed by experts. You don’t need to pick individual stocks. Instead, professionals invest on your behalf.

Imagine it like a pizza:

A share is one topping.

A mutual fund is the whole pizza with lots of toppings. By Investing via SIP, you buy small slices of that pizza each month.

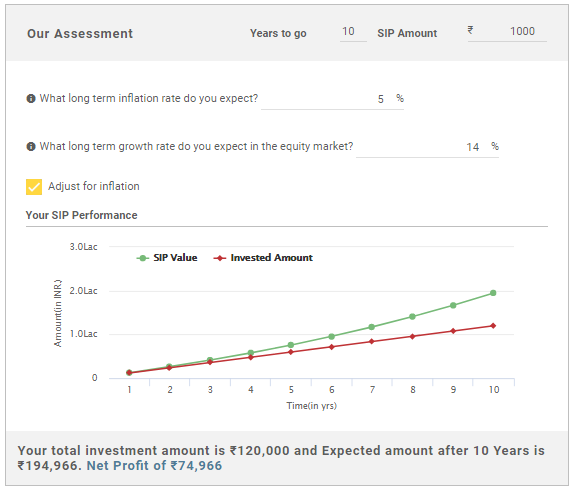

What is a SIP Calculator?

A sip calculator tells you how much wealth you can build based on:

- Your monthly SIP

- Investment period

- Expected returns (usually 10–14% for Equity Funds)

Example: If you invest ₹1,000/month for 10 years at 12% return, you’ll get around ₹2.3 lakh.

Why First-Time Investors Should Start SIPs

- No need for big money — start with ₹500 or ₹1,000/month

- Safer than direct stock investing

- Builds wealth without stress

- Auto-debit every month = easy savings habit

- Helps beat Inflation in the long run

Monthly Best SIP Plans Based on Your Budget

🔹 For ₹500 Per Month

- Good for college students or those in their first job.

- Start with a Large cap fund for stability and lower risk.

- Consider an ELSS fund if you also want to save tax under Section 80C.

💡 Start early — investing ₹500/month from age 21 could grow to ₹12–₹15 lakh by 40 age

🔹 For ₹1,000 Per Month

- This is where your SIP starts gaining real momentum.

- A Flexi-cap fund offers diversification across Market caps.

- A Balanced/Hybrid Fund gives a mix of growth (stocks) and safety (bonds).

💡 Use a SIP calculator to map your goals — be it a Europe trip, a home down payment, or your child’s education.

Talk to our investment specialist

Best SIP Plans Based on Time Horizon

Best SIP Plan for 3 Years

- Use if you want to save for a short-term goal (laptop, wedding, vacation)

- Choose: Conservative Hybrid Funds or Short-Term Debt fund

- Return expectation: 6%–8% per annum

Best SIP Plan for 5 Years

- Use if you want a mid-term goal (bike, higher studies, marriage)

- Choose: Balanced Advantage Funds or Flexi-Cap Funds

- Return expectation: 9%–11% per annum

Best SIP Plan for 10 Years

- Perfect for: Child’s education, first house, starting business

- Choose: Multi-Cap Funds, Index Funds

- Return expectation: 10%–13% per annum

Best SIP Plan for 20 Years

- Use for: retirement, wealth building, legacy planning

- Choose: Equity funds (Large & small cap, Nifty Next 50)

- Return expectation: 12%–15% per annum

📌 The longer you invest, the more compounding works like magic.

Best Monthly SIP Plans from SBI

If you trust government-backed funds, SBI Mutual Fund offers:

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) Since launch (%) SBI PSU Fund Growth ₹31.2562

↑ 0.01 ₹4,789 500 6.1 -0.8 4.3 30.6 31.3 23.5 8 SBI Magnum Tax Gain Fund Growth ₹419.616

↑ 2.47 ₹27,730 500 1.6 -3.5 9.9 24 29.5 27.7 12.4 SBI Infrastructure Fund Growth ₹47.8292

↓ -0.02 ₹4,681 500 0.5 -7.6 1.2 23.3 31.4 20.8 9.2 SBI Healthcare Opportunities Fund Growth ₹418.791

↑ 3.09 ₹3,611 500 1 2 23.1 23.3 25.4 42.2 15.6 SBI Contra Fund Growth ₹368.482

↑ 1.21 ₹42,220 500 1.3 -4.2 6.5 21.3 35.6 18.8 15 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 23 Apr 25

Pro Tips for First-Time SIP Investors

- Stay invested for at least 5 years – patience pays.

- Don’t panic if markets fall – SIP buys more when prices drop.

- Review annually, not monthly.

- Use Direct plans over regular – lower fees = more profit.

🚫 SIP Mistakes to Avoid (And What to Do Instead)

Even though SIPs are beginner-friendly, many investors still make mistakes that cost them long-term returns. Here's what to watch out for:

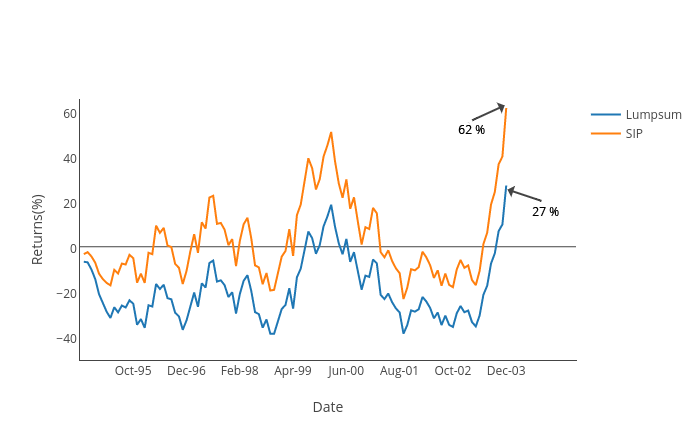

1. Stopping SIPs When the Market Falls

- When markets crash, SIPs buy more units at cheaper prices. That boosts long-term returns.

- Stay consistent — downturns are opportunities in disguise.

2. Investing Without a Goal

- You may withdraw early or get demotivated if you don’t have a target in mind.

- Link your SIP to a purpose — e.g., Europe trip in 5 years, child’s college in 10 years, retirement in 25.

3. Switching Funds Too Often

- Frequent changes interrupt compounding. Also, each fund has its cycle.

- Stick to well-performing funds and review annually — not monthly.

4. Choosing Regular Plans Instead of Direct

- Regular plans charge higher commissions (1–1.5%) which eat into returns.

- Use Direct plans via platforms like Fincash to save fees and earn more.

5. Ignoring Fund Reviews and Performance

- A fund can Underperform for years and erode your returns.

- Review once a year. Check consistency, fund manager changes, and compare with benchmarks.

How to Invest in SIP Mutual Funds Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

FAQs for First-Time SIP Investors

Q1. Is SIP safe for beginners?

A: Yes. SIP in Mutual Funds is managed by SEBI-regulated professionals.

Q2. Can I stop SIP anytime?

A: Yes. SIPs are flexible — stop, pause, or increase anytime.

Q3. What if markets crash?

A: You buy more units when prices are low. SIP works best during crashes!

Q4. Should I start with one fund or many?

A: One or two funds are enough initially. Diversify later.

A Real-Life SIP Story: From ₹1,000 to ₹9.8 Lakh

In 2008, Ramesh, a young IT professional, started a SIP of ₹1,000/month in an equity mutual fund. He didn’t track it daily. He simply continued the SIP while focusing on his career and family. In 2023, after 15 years, he checked his Portfolio — it was worth ₹9.8 lakhs. He hadn’t become a crorepati. But that amount helped him pay for his daughter’s education — without touching his fixed deposits or emergency savings.

👉 This is the power of consistent, disciplined investing. Start early, stay invested, and let time do the magic.

✨ Final Thought

“Start small. Stay consistent. SIP is not a get-rich-quick tool — it’s a build-wealth-slowly-and-surely plan.”

- Even if you’re starting with ₹500 or ₹1,000 a month — start.

- The best investors aren’t the ones who invested the most.

- They’re the ones who started early and stayed patient.

This blog is updated for 2025 with the latest insights and guidance on SIP investing for beginners.

By Rohini Hiremath

By Rohini Hiremath

Rohini Hiremath works as a Content Head at Fincash.com. Her passion is to deliver financial knowledge to the masses in simple language. She has a strong background in start-ups and diverse content. Rohini is also an SEO expert, coach and motivating team head!

You can connect with her at rohini.hiremath@fincash.com

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Very informative.