Table of Contents

Top 4 Best Student Debit Cards for 2025 - 2026

Cashless transactions are on a rise in today’s digital age. Children are no exception to the influence of the magic of a growing cashless society. In order to keep them at par with this growing inclusion, financial institutions are coming up with debit cards to meet their needs.

The idea is to keep the parents accountable for every transaction since the child can spend the amount in their account only. It’s a good option to transfer pocket money and keep a check on their expenditure, isn’t it?

Students can access educational loans and other benefits via these debit cards while also familiarising themselves with budgeting.

Best Debit Cards for Students in India

1) ICICI Bank@Campus

ICICI Bank offers cash Debit Card to students from selected educational institutes. This debit card provides ease of transactions along with security. It brings the Bank@Campus account to students. ICICI Bank also offers a debit card called young stars for children between the age group of 1-18 years.

Benefits for Students

- Free Internet Banking

- Free Phone Banking (in selected cities)

- Free ICICI Bank Ncash Debit Card

Benefits for Parents

- Parents can transfer funds from their ICICI Bank account to their child's account free of charge

- They can pay their children’s college fees, Tuition Fees, and living expenses

- Personalised cheque book and annual statement of the account

Eligibility

The child should be a student and be above 18 years of age. It is important to note that all the documents should furnish the personal details of the students during the opening of the account with the bank.

2) Axis Bank Youth Debit Card

The Youth Debit Card is designed for the age group of 18 to 25 years. Keep the youth's financial needs in mind, this debit card offers attractive benefits across premium brands along with higher limits for daily withdrawal.

Benefits

- Helps you to generate debit card PIN at the fingertips

- Offers attractive dining options

- Gives access to banking across the country

- Avail instant blocking options in emergency cases

Eligibility

- Students who are in the age group of 18-25 years.

- Documents that prove a child's identity, age and address are required while opening a youth account with Axis Bank.

Daily Withdrawal Limit and Insurance

There is a fee charged for the debit card. Axis Bank Youth Debit Card charges an issuance fee of Rs. 400 and annual fees of Rs. 400.

The table below gives an account of withdrawal limits and insurance cover.

| Features | Fees/Limits |

|---|---|

| Daily Cash Withdrawal Limit | Rs. 40,000 |

| Purchase limit per day | Rs. 1,00,000 |

| ATM withdrawal limit (per day) | Rs. 40,000 |

| POS Limit per day | Rs. 200,000 |

| Lost card liability | Rs. 50,000 |

| personal accident insurance cover | Nil |

| Airport Lounge access | No |

Get Best Debit Cards Online

3) HDFC Bank DigiSave Youth Account

HDFC Debit Card offers youth benefits like digital banking, loans, offers on food, travel, mobile recharge, movies, etc. DigiSave Youth account provides students with Millenia Debit card.

Features

- Get amazing offers every month on recharge, travel, movies, shopping via PayZapp

- Earn Special activation offer on the first transaction of Rs. 250 or more on PayZapp

- Get Rs. 250 off on Movies by maintaining the required balance & being active digitally every month on HDFC Bank platforms

- Get 5% cashback up to Rs.100 every month by setting “standing instructions” on your debit card for bill Payment

Eligibility

The following people can open DigiSave youth account.

- Resident Individuals (sole or joint account)

- Individual between the age of 18 years to 25 years

Average Monthly Balance (AMB) and Minimum Initial Deposit

The DigiSave account holders can be from metro/urban areas or rural areas. Therefore the minimum initial deposit and average monthly balance (AMB) varies.

The following table gives an account of the same.

| Parameters | Metro/Urban Branches | Semi-Urban/Rural Branches |

|---|---|---|

| Minimum initial Deposit | Rs. 5,000 | Rs. 2,500 |

| Average Monthly Balance | Rs. 5,000 | Rs. 2,500 |

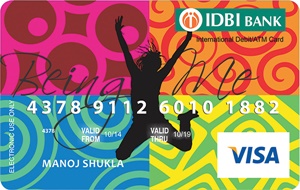

4) IDBI Bank Being Me Debit Card

This card is designed for students who are pursuing professional courses and for the first time working professionals, in the age group of 18-25 years. You can access the debit card across the world.

Features

- The Me Being Debit card is valid for 5 years

- It can be used for shopping, booking rail & air tickets, utility bill payments, etc.

- A surcharge of 2.5% of the transaction value will be levied if the card is used at Petrol pumps and railways

- Gain 2 points on every Rs. 100 spent on this card

Daily Withdrawal Limit

This student debit card can be used at any merchant establishments and ATMs for your convenience.

The daily cash withdrawal limit is mentioned in the table:

| Withdrawals | Limits |

|---|---|

| Daily cash withdrawal | Rs 25,000 |

| Daily purchases at Point of Sale (POS) | Rs. 25,000 |

Conclusion

Parents can opt for these student debit cards to open savings accounts for their children or help them access an educational loan. One of the major benefits is that parents can keep a track on their child’s spending habits while also teaching them to budget from a young age.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like