Table of Contents

- Top Union Bank of India Debit Cards current year

- 1. Rupay qSPARC Debit Card

- 2. Business Platinum Debit Card

- 3. Rupay/ Visa Classic Debit Card

- 4. Rupay/VISA Platinum Debit Card

- 5. VISA Contactless Debit Card

- 6. Signature Contactless Debit Card

- How to Apply for a Union Bank Debit Card?

- Union Bank of India Customer Care

Union Bank of India Debit Card- Make Hassle-free Transactions

Union Bank of India is the largest government-owned bank in India. On 1 April 2020, Corporation Bank and Andhra Bank amalgamated with the Union, which ranked the bank as the fourth largest in terms of the branch network. The Union Bank has 9500 branches and it is the fifth-largest bank in terms of business.

The Union Bank of India Debit card offers many unique features like contactless payment, rewards on shopping, airport lounge access, etc. The debit cards have flexible withdrawal options with 24x7 customer service and international acceptance of world-class security.

Top Union Bank of India Debit Cards current year

1. Rupay qSPARC Debit Card

This Debit Card offered by the Union Bank is in line with the Government initiative of National Common Mobility Card (NCMC). It is a single card, wherein you can make payments for toll plaza, parking, and other small purchases. So, now you don’t have to carry cards separately.

The debit card also works as a prepaid card, wherein you can recharge either by paying money or debiting from your account at NCMC POS terminals. You can recharge the card to pay for monthly passes like- bus pass, toll pass etc.

You can make transactions in both ways, i.e, - online and offline. You can make online transactions, where you swipe or dip the card. The transactions are compatible with NCMC POS terminals.

Withdrawals & Other Charges

With Rupay qSPARC Debit Card you can make five transactions on a daily Basis. You also get accidental insurance coverage in this card.

Check the usage limit and other charges given in the below table

| Particulars | Value |

|---|---|

| Daily ATM cash withdrawal limit | Rs. 25,000 |

| Daily POS shopping limit | Rs. 25,000 |

| Per transaction limit for contactless mode | Rs. 2,000 |

| Per day maximum limit for contactless mode | Rs. 5,000 |

| personal accident insurance | Primary cardholder- Rs. 2 lakh, Secondary cardholder- Rs. 1 lakh |

2. Business Platinum Debit Card

Business Platinum Debit Card on VISA platform is available for current account holders that include individuals, proprietorship, partnership and HUF (Karta). The card enables you to easily access your own funds anywhere.

It is given to the current account holders to maintain AQB (Average Quarterly Balance) of Rs.1 lakh and above. In case, you Fail to maintain, then a penalty of Rs, 50,000 + GST will be charged yearly.

Withdrawals & Other Charges

With a Business Platinum debit card you can get personal accidental coverage.

Check the card usage and other charges of the card mentioned below:

| Particulars | Value |

|---|---|

| AQB to be maintained | Rs. 1 lakh |

| Daily ATM cash withdrawal limit | Rs.50,000 |

| Daily online shopping limit | Rs. 2 lakh |

| Total daily limit | Rs. 2.5 lakh |

| Issuance fee | Rs. 2.5 lakh |

| Personal accident cover | Rs. 2 lakh cover for each partner issued |

Benefits of Business Debit Card by VISA

Lounge Access Program

VISA offer two complimentary airport lounge access per quarter

Commercial offers

You can avail various exciting offers on the categories like accommodation, business travel, car rental, office spaces etc. Also, you get a discount of 15% to 25% on these categories depending on the services availed.

Get Best Debit Cards Online

3. Rupay/ Visa Classic Debit Card

Classic Debit Card has an option of Rupay and Visa payment system. This Union Debit Card allows you to make hassle-free transactions.

The main idea behind Classic Debit Card is to give you a cashless journey, so that you can get the ease of payments anywhere, anytime.

Withdrawal & Other Charges

For Rupay/Visa Classic debit cards, you don't have to pay any issuance charges.

The card usage limit and other charges are mentioned below:

| Particulars | Value |

|---|---|

| Average Quarterly Balance (AQB) | Not applicable |

| Daily ATM withdrawal Limit | Rs. 25000 |

| Daily PoS shopping limit | Rs. 25000 |

| Total daily limit | Rs. 50000 |

| Accidental insurance covered | Rs. 2 lakh |

4. Rupay/VISA Platinum Debit Card

This debit card comes in Rupay and Visa payment system. With a spend of only Rs 2 with Rupay Platinum Debit Card, you can avail the Facility of Airport lounge twice a quarter. Both Rupay & Visa have different Average Quarterly Balance.

The Union Platinum Debit Card encourages you to do cashless transactions and become part of the Digital Economy.

Withdrawal & Charges

Under Rupay/Visa Platinum Debit Card, you can withdraw up to Rs. 40,000 daily.

The card charges and limits are as follows:

| Particulars | Value |

|---|---|

| Average quarterly balance, Average quarterly balance | For Rupay- Rs. 3000, For Visa- Rs. 1 lakh |

| Daily ATM cash withdrawal limit | Rs. 40,000 |

| Daily PoS shopping limit | Rs. 60,000 |

| Total daily limit | Rs. 1 lakh |

| Issuance Charges | NIL |

| Accidental insurance covered | Rs. 2 lakh |

5. VISA Contactless Debit Card

A VISA contactless debit card can help you save your time with quick transactions. In contactless, you don’t have to enter your PIN code for an amount upto Rs. 2,000.

The Union Bank of India has waived the average quarterly balance requirement on this card.

Withdrawal & Charges

With a VISA Contactless Debit Card, you can do a maximum of five transactions in a day.

The card usage fees and other charges are mentioned below-

| Particulars | Value |

|---|---|

| Average quarterly balance | Not applicable |

| Daily ATM cash withdrawal limit | Rs.25000 |

| Daily online shopping limit | Rs. 25000 |

| Total daily limit | Rs. 50000 |

| Per transaction limit | Rs. 2000 |

| Per day maximum limit | Rs. 5000 |

| Issuance charges | Rs. 150 + GST |

| Accidental insurance covered | Rs. 2 lakh |

6. Signature Contactless Debit Card

A Signature Contactless Debit Card is loaded with premium features and benefits. The bank helps you experience privileged banking at your convenience.

There are no annual maintenance charges applied on this card.

Withdrawal & Charges

With the help of the Signature Contactless Debit Card, you can do five transactions in a day.

Check the following table for usage and other charges related to the card-

| Particulars | Value |

|---|---|

| Daily ATM cash withdrawal limit | Rs. 1 lakh |

| Daily online shopping limit | Rs. 1 lakh |

| Total daily limit | Rs. 2 lakh |

| Average Quarterly Balance | Rs. 1 lakh |

| Per transaction limit for contactless mode | Rs. 2000 |

| Maximum per day limit for a Contactless Transaction | Rs. 5000 |

| Airport Lounge Access | Yes |

| Personal accidental insurance | Primary cardholder- Rs. 2 lakh, Secondary cardholder- Rs. 1 lakh |

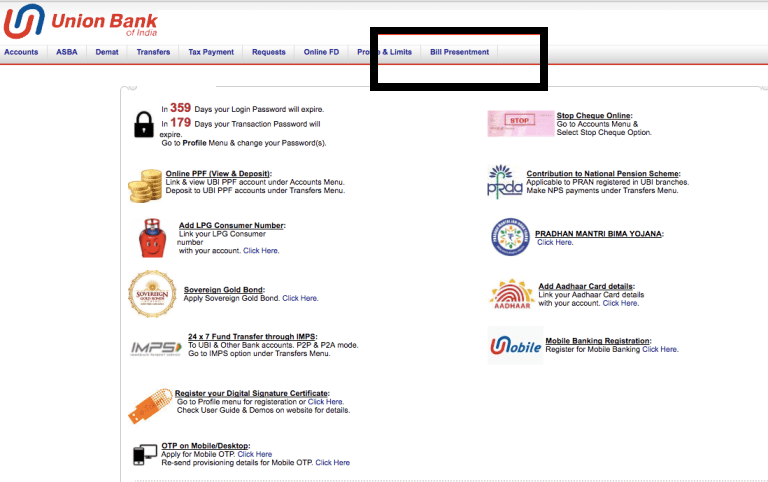

How to Apply for a Union Bank Debit Card?

Union Bank of India issues a debit card while you successfully open a Savings Account with the Bank. Existing account holders can visit the branch and fill the form to apply for a new debit card.

Union Bank of India Customer Care

You can contact Union Bank customer care if you have queries related to payments, transactions, PIN request, block credit or debit cards or any other queries. Following is the customer care number of Union Bank:

- Toll-free Number - 1800222244

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

You Might Also Like