Table of Contents

- What is a Stock Screener?

- The Benefits of Using a Stock Screener

- Types of Stock Screeners

- How to Use a Stock Screener Effectively

- Popular Stock Screeners: A Comparison

- The Role of Stock Screeners in Portfolio Diversification

- Stock Screeners and Risk Management

- Advanced Stock Screening Strategies

- Limitations of Stock Screeners

- The Future of Stock Screeners

- Conclusion

The Ultimate Guide to Stock Screeners: Your Key to Smarter Investing

Stock screeners are invaluable tools for investors and traders looking to identify profitable stocks quickly and efficiently. Whether you are a beginner or a seasoned professional, using a stock screener can save you time, reduce guesswork, and help you build a more strategic investment Portfolio. In this guide, we’ll dive deep into stock screeners, explain their importance, explore various types, and show you how to use them to enhance your Investing strategy.

What is a Stock Screener?

A stock screener is a tool that allows investors to filter and sort stocks based on specific criteria. These criteria can include fundamental metrics like price-to-Earnings (P/E) ratio, Earnings Per Share (EPS), and Dividend Yield, or technical indicators like moving averages and Relative Strength Index (RSI). By narrowing down the universe of thousands of publicly traded companies, stock screeners help investors identify the stocks that best align with their investing goals.

Stock screeners are often integrated into stock Market websites, Trading platforms, or standalone tools, giving users access to real-time data and customizable filters. Popular stock screeners include platforms like Ticker Tape, Chartink, TradingView, and many more.

The Benefits of Using a Stock Screener

Time Efficiency: One of the key benefits of stock screeners is their ability to save time. Instead of manually searching for stocks across multiple sources, a screener provides a fast, streamlined way to narrow down your choices. With just a few clicks, you can generate a list of stocks that meet your specific investment criteria.

Customizable Filters: Stock screeners offer a wide Range of filters to choose from. Whether you’re looking for stocks with high dividend yields, low P/E ratios, or stocks that have recently crossed certain technical thresholds, screeners allow you to set custom filters to match your investment strategy.

Risk Management Stock: Can also be used to identify stocks with lower Volatility or those that meet specific risk criteria. For example, by filtering for stocks with a low Beta, investors can minimize risk exposure. This helps you find stocks that align with your risk tolerance.

Diversification: A screener allows you to filter stocks across various sectors and industries. This makes it easier to build a diversified portfolio, which is a key principle of investing. For instance, you can filter stocks by sector (e.g., technology, healthcare, consumer goods) to ensure your portfolio isn’t overly concentrated in one area.

Talk to our investment specialist

Types of Stock Screeners

There are several types of stock screeners, each catering to different needs. Here are the main categories:

Basic Stock Screeners: These are great for beginners. They allow you to screen stocks based on basic criteria such as market cap, P/E ratio, dividend yield, and EPS. Some popular examples of basic stock screeners include Ticker Tape and Asian Paints Screener.

Intraday Stock Screeners: For active traders, intraday screeners provide real-time data on stocks that are showing significant price movement during market hours. These screeners often include filters like price change percentage, volume spikes, and RSI to identify stocks with momentum.

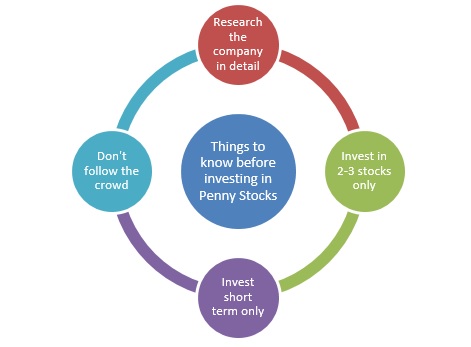

Penny Stock Screeners: penny stock screeners help investors find low-priced stocks (usually under $5) that have high potential for growth. These screeners filter stocks based on criteria like price, trading volume, and volatility, which are key metrics for penny stock investors.

Technical Stock Screeners: These screeners focus on stocks’ technical indicators, such as moving averages, RSI, and Bollinger Bands. They are ideal for technical traders looking to identify breakout stocks or trends.

How to Use a Stock Screener Effectively

To get the most out of your stock screener, follow these steps:

Set Your Investment Goals: Define your investment objectives. Are you looking for growth stocks, value stocks, or dividend-paying stocks? By clarifying your goals, you can set more relevant filters in your screener.

Select Key Filters: Choose filters that align with your strategy. For example, if you are looking for growth stocks, filter for companies with high earnings growth and a low P/E ratio. If you’re focusing on value, consider using filters like low price-to-book ratios and high dividend yields.

Refine Your Results: Start with broad criteria and narrow down the results by adding more specific filters. A good screener will allow you to refine your search until you get a list of stocks that fit your needs.

Research Your Results: Once you’ve narrowed down your list, don’t rely solely on the screener’s output. Conduct additional research on the companies, review their financial statements, and assess their market potential before making any investment decisions.

Popular Stock Screeners: A Comparison

Here’s a quick comparison of some of the most popular stock screeners:

| Screener Name | Key Features | Best For |

|---|---|---|

| Ticker Tape | Offers a wide range of filters and real-time data | Beginners and experienced investors |

| Chartink | Customizable charts and advanced technical filters | Technical traders |

| TradingView | Comprehensive charting tools and community insights | Technical Analysis and trading |

| ChartNexus | Focus on trend analysis and market indicators | Trend followers and swing traders |

| Zerodha Varsity | Educational content alongside stock screening tools | Beginners and learning traders |

Each platform offers unique features, so selecting the right one depends on your individual needs and trading style.

The Role of Stock Screeners in Portfolio Diversification

A balanced portfolio is crucial for mitigating risk and achieving consistent returns. Stock screeners help investors diversify by filtering for stocks across various sectors. For instance, you might choose to screen for stocks in the technology, healthcare, and consumer goods sectors to ensure that your portfolio isn't overly concentrated in one area.

Stock Screeners and Risk Management

Stock screeners can be particularly useful for investors who wish to manage risk. By screening for low-volatility stocks or those with low beta (a measure of stock volatility relative to the broader market), you can reduce your exposure to high-risk investments. Similarly, screeners can also help investors find dividend-paying stocks, which can provide a steady Income stream during market downturns.

Advanced Stock Screening Strategies

Growth Investing with Stock Screeners: If you’re a growth investor, stock screeners can help you find companies with strong earnings growth and high potential. Filter for stocks with increasing EPS, high sales growth, and a forward P/E ratio lower than the Industry average.

Value investing: For value investors, screeners can be used to identify undervalued stocks. Filters for low P/E ratios, low price-to-book ratios, and high dividend yields are essential for finding stocks that are trading below their Intrinsic Value.

Momentum Trading: Momentum traders use screeners to identify stocks that are trending upwards. Filters such as Moving Average crossovers, relative strength index (RSI) over 70, and increasing trading volume can help identify stocks with strong momentum.

Limitations of Stock Screeners

While stock screeners are powerful tools, they are not without limitations. They rely on specific data points, so if the input data is inaccurate or outdated, the results can be misleading. Additionally, stock screeners may not account for qualitative factors such as company leadership, market trends, or political influences, which can play a significant role in a stock’s performance.

The Future of Stock Screeners

With advancements in AI and machine learning, stock screeners are becoming more sophisticated. These technologies help improve the accuracy of stock predictions by analyzing historical data and identifying patterns that human investors might overlook. In the future, screeners will likely become even more integrated with robo-advisors, providing automated portfolio management based on predefined criteria.

Conclusion

Stock screeners are indispensable tools for both beginner and experienced investors. They provide a fast and efficient way to identify stocks that meet specific investment criteria. Whether you’re interested in growth stocks, dividend-paying stocks, or technical analysis, screeners can help you find the right opportunities. By integrating stock screeners into your investing strategy, you can make more informed decisions, manage risk effectively, and build a diversified portfolio that suits your Financial goals.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.