Table of Contents

Did The Government Make ITR Filing Online Mandatory?

Every individual whose minimum Income exceeds the exempted limit is obligated to file the ITR. Even if there are no tax dues and the salaried person gets a TDS every month, the filing becomes a necessary task. The best part is, the government had brought up the process of ITR filing online. While there are certain people for whom filing online is mandatory, the rest can choose the traditional method as well. So, who can file traditionally and who can choose ITR online? Let's find out here. Before that, let’s understand a handful of benefits that you can gain from this process.

Benefits of Filing

Some benefits come from e-filing of income tax are-

- Claiming Refunds: ITR needs to be filed if you have to claim TDS, and it also allows you to carry forward your losses

- Processing of documents: To apply for loans, visas, etc., you would have to show proof of income, and ITR form is preferred in the documentation process

- Establishing income proof in compensation cases: Similar to the processing of documents, it is preferred to show ITR as the proof of your income for all the compensation claims

ITR Filing Online

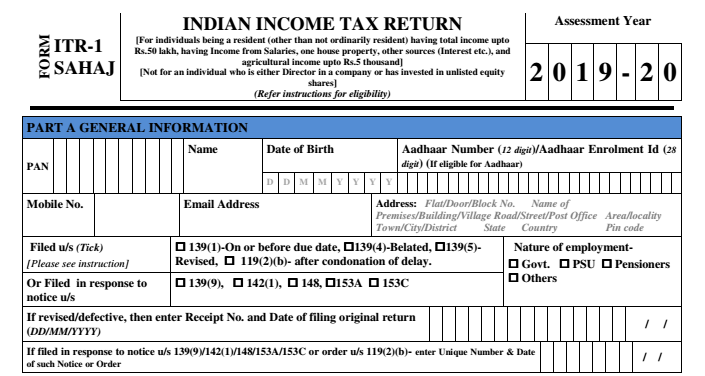

In case you fall under any of the below-mentioned categories, filing e return is quite mandatory for you:

- In case the total income is more than Rs. 5 lakhs

- If a refund is being claimed (keeping Super Senior Citizen Furnishing ITR1 or ITR2 as exceptions)

- If the accounts need to be audited under section 44AB

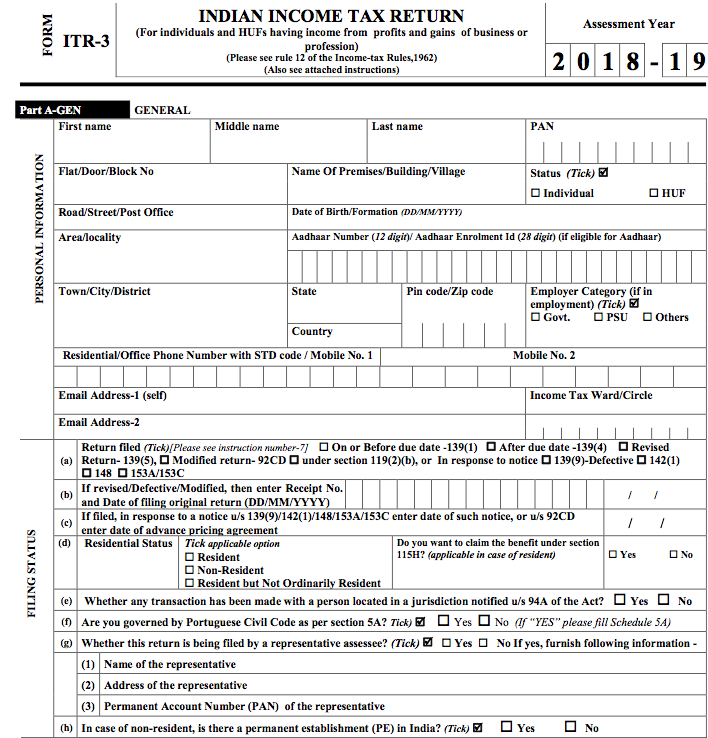

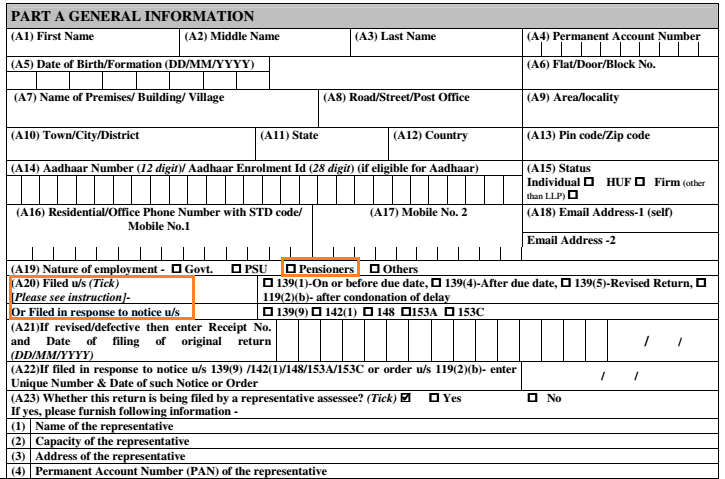

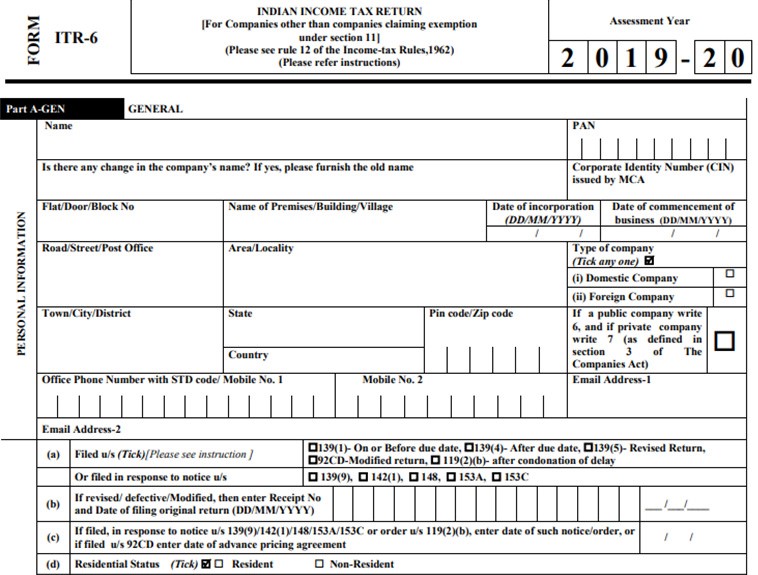

- If the return is furnishing in ITR3 or ITR4

Talk to our investment specialist

Who cannot choose E Filing of Income Tax?

Apart from the ones mentioned above, there is a specific type of people who are allowed to file the ITR offline rather than choosing e return filing. The list includes:

- Individuals with 80 years or more of the age

- Individuals who have an income of less than Rs. 5 lakhs

- Individuals who don’t have to claim any refund

Should you use the Government’s Website or Private Entities?

Although the government has introduced its portal for e Filing of Income Tax return, however, there are some private sites as well that allow the filing and are registered with the Income Tax Department. So, which method should you be using?

When you choose the government’s site, you can upload any ITR form, and the process will be done without costing you any money. Whereas, the private entities offer complex operations which may cost you some amount of money.

On the other hand, while the government’s site compels you to do everything on your own, the private ones provide adequate assistance, from filing to online ITR Verification.

Thus, when it comes to filing the Income Tax Returns online, you must choose the one cautiously.

The Method to ITR Filing Online

- Step 1: Visit the Income Tax India website

- Step 2: Select Income-tax under the e-file option

- Step 3: Select the Assessment year

- Step 4: Choose the ITR form accordingly

- Step 5: Go to the Submission Mode option and select Prepare and Submit Online

- Step 6: Choose return verification from the options

- Step 7: Fill all the details in the form

- Step 8: Save the form usingSave as Draft

- Step 9: To preview before submitting the return, choose Preview and Submit

- Step 10: Finally click onSubmit

- Step 11: Verify the return

- Step 12: Once the return is submitted an email will be sent as e-verification of Income Tax Return

Conclusion

Now that the importance of filing ITR online is clear, you must follow the proper guidance. In case you fall under the mandatory category of ITR filing online, choose that method only. After all, it is faster and quicker than the traditional.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.