ایس آئی پی میں رسک: ایس آئی پی انویسٹمنٹ میں رسک کا اندازہ

میں خطرہگھونٹ مختلف کے لیے مختلف ہوتی ہے۔میوچل فنڈز کی اقسام.میوچل فنڈز میں سرمایہ کاری ایس آئی پی کے ذریعے (سیسٹیمیٹکسرمایہ کاری کا منصوبہ) شامل ہے۔مارکیٹ منسلک خطرات، جو یقینی طور پر زیادہ ہیں۔ایکویٹی فنڈز قرض سے زیادہ اور متوازنباہمی چندہ. ایس آئی پی میں خطرہ سرمایہ کاری کے آپشن پر منحصر ہوتا ہے جسے غور کرتے ہوئے منتخب کیا جاتا ہے۔رسک پروفائل، خطرے کی بھوک اورلیکویڈیٹی. تاہم، SIP میں خطرے کو فنڈ مینیجرز اور فنڈ ہاؤس کے ذریعے منظم اور کم کیا جا سکتا ہے۔

SIP میں خطرے کا حساب لگانے کے لیے مختلف ٹولز دستیاب ہیں جیسےگھونٹ کیلکولیٹر (ایس آئی پی ریٹرن کیلکولیٹر کے نام سے بھی جانا جاتا ہے)۔

ایس آئی پی میں خطرہ: ایس آئی پی کے خطرات کا اندازہ

خطرہ 1: SIP کا منفی ریٹرن یا قیمت کا خطرہ

میوچل فنڈ کی سرمایہ کاری مارکیٹ کے خطرات سے مشروط ہوتی ہے، یہ عام طور پر سنی جانے والی اصطلاح ہے۔ اس کا مطلب یہ ہے کہ SIP میں آپ کی سرمایہ کاری کم ہو سکتی ہے اور مارکیٹ کے برتاؤ کے لحاظ سے آپ کی سرمایہ کاری سے کم قیمت ہو سکتی ہے۔

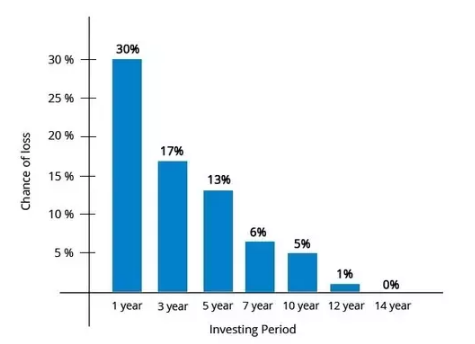

تاہم ایس آئی پی میں خطرہ انعقاد کی مدت سے متعلق ہے اور عام طور پر، انعقاد کی مدت جتنی لمبی ہوگی، خطرہ اتنا ہی کم ہوگا۔ زیادہ انعقاد کی مدت کے ساتھ منافع کمانے کا امکان بڑھ جاتا ہے۔ مثلاً ایکویٹی کے لیے ذیل میں ایک نظر ڈالیں، ایکویٹی کے لیے طویل انعقاد کی مدت کے نتیجے میں نقصان کا امکان کم ہوتا ہے۔ (ذیل میں 1979 سے 2016 تک بی ایس ای سینسیکس پر کیا گیا تجزیہ ہے)۔

خطرہ 2: آپ کے پیسے کو جلدی واپس حاصل کرنے کا خطرہ یا لیکویڈیٹی کا خطرہ

آپ کے پیسے کو جلدی سے واپس حاصل کرنے کی صلاحیت اس پر منحصر ہے۔زیرِ نظر سرمایہ کاری عام طور پر میوچل فنڈز کے ساتھ، یہ کوئی مسئلہ نہیں ہے، تاہم، ایسے ادوار آئے ہیں (جیسے 2008 میں)، جب سیکیورٹیز کی فروخت میں کوئی مسئلہ تھا(بانڈز) اور یہ کہ بعض میوچل فنڈز کو کچھ اسکیموں سے نکلوانے کو محدود کرنا پڑتا تھا۔ ایکویٹی مارکیٹ کافی مائع ہے (مطلب کہ خرید و فروخت میں کوئی مسئلہ نہیں ہے)۔ تاہم، اگر فروخت کی مقدار خریداروں کی تعداد سے بڑی رقم سے تجاوز کر جاتی ہے، تو اس کے نتیجے میں ایک مسئلہ پیدا ہو جائے گا، اس لیے بعد میں ادائیگیوں کو ایک مسئلہ بنا دیا جائے گا اور اس وجہ سے لیکویڈیٹی کا خطرہ ہے۔

رسک 3: سیکیورٹی یا کریڈٹ رسک کے نیچے گرنے کا خطرہ

جب کسی خاص کمپنی/اینٹی کے بانڈ کو کریڈٹ ریٹنگ ایجنسی کی طرف سے کمی کی جاتی ہے، تو اس کی قیمت گر جاتی ہے۔ اگر قیمت گرتی ہے تو اس سے پورٹ فولیو کی مجموعی قدر متاثر ہوتی ہے۔ اسے کریڈٹ رسک کہتے ہیں۔

Talk to our investment specialist

خطرہ 4: کمپنی کا بانڈ کے مالکان کو ان کا واجب یا طے شدہ خطرہ ادا نہ کرنے کا خطرہ

جب کوئی کمپنی بانڈ ہولڈرز کو اپنی ادائیگیوں میں ڈیفالٹ کرتی ہے، تو اسے کہا جاتا ہے۔پہلے سے موجود خطرہ.

کے ساتہسرمایہ کار ان کے پیسے واپس نہ ملنا، اس سے ان کے پورٹ فولیو پر منفی اثر پڑے گا۔

خطرہ 5: آپ کے لین دین کو درست طریقے سے پروسیس کرنے کا خطرہ یا ٹیکنالوجی کا خطرہ

آج تمام لین دین الیکٹرانک موڈ میں ہوتے ہیں۔ مختلف ٹچ پوائنٹس کے ساتھ، مختلف جگہوں پر، آر اینڈ ٹی ایجنٹ میں تکنیکی خرابی کا امکان ہے،بینک ڈیبٹ فنڈز وغیرہ

لین دین کی عدم پروسیسنگ بھی SIP میں ایک خطرہ ہے۔

خطرہ 6: پورٹ فولیو مینیجر کے ذریعہ اسکیم کی کارکردگی کا خطرہ یا فنڈ مینجمنٹ کا خطرہ

SIP میں ایک اور خطرہ یہ ہے کہ منتخب کردہ اسکیم توقعات کے مطابق نہیں ہوسکتی ہے، اور کارکردگی توقع سے بہت کم ہوسکتی ہے۔ فنڈ مینیجر کارکردگی پر کم ڈیلیور کر سکتا ہے، اور یہ اس پر کم منافع کا باعث بنے گا۔SIP سرمایہ کاری.

یہ ایک SIP میں بڑے خطرات ہیں، جبکہ ہم آگے بڑھ سکتے ہیں اور SIP میں مزید خطرات کی وضاحت کر سکتے ہیں جیسےمعیشت خطرہ وغیرہ، ان میں سے زیادہ تر خطرات مندرجہ بالا زمروں میں سے ایک یا زیادہ کے تحت آتے ہیں۔

اگرچہ SIP میں یقینی طور پر خطرہ ہے، لیکن کسی کو ہمیشہ یاد رکھنا چاہیے کہ SIP یا یکمشت، یہ صرف ایک سرمایہ کاری کا راستہ ہے نہ کہ بنیادی سرمایہ کاری۔ کسی کو بنیادی سرمایہ کاری، اس کے خطرات کو دیکھنے اور پھر حتمی فیصلہ کرنے کی ضرورت ہے۔

*نیچے درج ذیل کی فہرست ہے۔ٹاپ ایس آئی پیمیں سرمایہ کاری کرنے کا اندازہ لگا سکتا ہے۔ "The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of MLIIF - WGF. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or units of money market/liquid schemes of DSP Merrill Lynch Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized." Below is the key information for DSP World Gold Fund Returns up to 1 year are on The objective of the scheme would be to provide investors with opportunities for long-term growth in capital along with the liquidity of an open-ended scheme through an active management of investments in a diversified basket of equity stocks of domestic Public Sector Undertakings and in debt and money market instruments issued by PSUs AND others. Research Highlights for SBI PSU Fund Below is the key information for SBI PSU Fund Returns up to 1 year are on To generate capital appreciation by investing in Equity and Equity Related Instruments of companies where the Central / State Government(s) has majority shareholding or management control or has powers to appoint majority of directors. However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved. The Scheme does not assure or guarantee any returns. Research Highlights for Invesco India PSU Equity Fund Below is the key information for Invesco India PSU Equity Fund Returns up to 1 year are on The investment objective of Franklin India Opportunities Fund (FIOF) is to generate capital appreciation by capitalizing on the long-term growth opportunities in the Indian economy. Research Highlights for Franklin India Opportunities Fund Below is the key information for Franklin India Opportunities Fund Returns up to 1 year are on The investment objective of the scheme is to provide long term growth from a portfolio of equity / equity related instruments of companies engaged either directly or indirectly in the infrastructure sector. Research Highlights for LIC MF Infrastructure Fund Below is the key information for LIC MF Infrastructure Fund Returns up to 1 year are on 1. DSP World Gold Fund

DSP World Gold Fund

Growth Launch Date 14 Sep 07 NAV (12 Feb 26) ₹62.7255 ↓ -1.20 (-1.88 %) Net Assets (Cr) ₹1,756 on 31 Dec 25 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.41 Sharpe Ratio 3.42 Information Ratio -0.67 Alpha Ratio 1.32 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹8,807 31 Jan 23 ₹9,422 31 Jan 24 ₹8,517 31 Jan 25 ₹12,548 31 Jan 26 ₹33,170 Returns for DSP World Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 12 Feb 26 Duration Returns 1 Month 7.6% 3 Month 36% 6 Month 84.7% 1 Year 155.1% 3 Year 55.6% 5 Year 28.2% 10 Year 15 Year Since launch 10.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 167.1% 2023 15.9% 2022 7% 2021 -7.7% 2020 -9% 2019 31.4% 2018 35.1% 2017 -10.7% 2016 -4% 2015 52.7% Fund Manager information for DSP World Gold Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.85 Yr. Data below for DSP World Gold Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Basic Materials 94.95% Asset Allocation

Asset Class Value Cash 2.43% Equity 94.95% Debt 0.01% Other 2.6% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Gold I2

Investment Fund | -74% ₹1,294 Cr 1,219,254

↓ -59,731 VanEck Gold Miners ETF

- | GDX25% ₹442 Cr 573,719 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹28 Cr Net Receivables/Payables

Net Current Assets | -0% -₹8 Cr 2. SBI PSU Fund

SBI PSU Fund

Growth Launch Date 7 Jul 10 NAV (13 Feb 26) ₹35.8635 ↓ -0.43 (-1.19 %) Net Assets (Cr) ₹5,817 on 31 Dec 25 Category Equity - Sectoral AMC SBI Funds Management Private Limited Rating ☆☆ Risk High Expense Ratio 1.89 Sharpe Ratio 0.33 Information Ratio -0.47 Alpha Ratio -0.22 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹14,656 31 Jan 23 ₹17,067 31 Jan 24 ₹30,032 31 Jan 25 ₹32,242 31 Jan 26 ₹38,028 Returns for SBI PSU Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 12 Feb 26 Duration Returns 1 Month 5.7% 3 Month 5.9% 6 Month 14.5% 1 Year 28.8% 3 Year 33.7% 5 Year 28.5% 10 Year 15 Year Since launch 8.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 11.3% 2023 23.5% 2022 54% 2021 29% 2020 32.4% 2019 -10% 2018 6% 2017 -23.8% 2016 21.9% 2015 16.2% Fund Manager information for SBI PSU Fund

Name Since Tenure Rohit Shimpi 1 Jun 24 1.59 Yr. Data below for SBI PSU Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 35.24% Utility 29.32% Energy 13.87% Industrials 12% Basic Materials 6.69% Asset Allocation

Asset Class Value Cash 2.8% Equity 97.11% Debt 0.08% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 31 Jul 10 | SBIN17% ₹975 Cr 9,927,500 Bharat Electronics Ltd (Industrials)

Equity, Since 30 Jun 24 | BEL9% ₹518 Cr 12,975,000 NTPC Ltd (Utilities)

Equity, Since 31 Jul 10 | 5325559% ₹509 Cr 15,443,244

↑ 900,000 GAIL (India) Ltd (Utilities)

Equity, Since 31 May 24 | 5321559% ₹502 Cr 29,150,000

↑ 3,400,000 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 31 Jul 10 | 5328988% ₹467 Cr 17,635,554

↑ 1,100,000 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 31 Aug 24 | 5005476% ₹372 Cr 9,700,000 Bank of Baroda (Financial Services)

Equity, Since 31 Aug 24 | 5321346% ₹325 Cr 11,000,000 NMDC Ltd (Basic Materials)

Equity, Since 31 Oct 23 | 5263714% ₹232 Cr 27,900,000 Indian Bank (Financial Services)

Equity, Since 30 Jun 21 | 5328143% ₹203 Cr 2,427,235 Oil India Ltd (Energy)

Equity, Since 31 Mar 24 | OIL3% ₹163 Cr 3,850,000 3. Invesco India PSU Equity Fund

Invesco India PSU Equity Fund

Growth Launch Date 18 Nov 09 NAV (13 Feb 26) ₹67.17 ↓ -0.74 (-1.09 %) Net Assets (Cr) ₹1,449 on 31 Dec 25 Category Equity - Sectoral AMC Invesco Asset Management (India) Private Ltd Rating ☆☆☆ Risk High Expense Ratio 2.14 Sharpe Ratio 0.27 Information Ratio -0.37 Alpha Ratio -1.9 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹13,872 31 Jan 23 ₹15,622 31 Jan 24 ₹26,577 31 Jan 25 ₹29,948 31 Jan 26 ₹35,297 Returns for Invesco India PSU Equity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 12 Feb 26 Duration Returns 1 Month 1% 3 Month 1.2% 6 Month 7.9% 1 Year 26.1% 3 Year 31.5% 5 Year 26.4% 10 Year 15 Year Since launch 12.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 10.3% 2023 25.6% 2022 54.5% 2021 20.5% 2020 31.1% 2019 6.1% 2018 10.1% 2017 -16.9% 2016 24.3% 2015 17.9% Fund Manager information for Invesco India PSU Equity Fund

Name Since Tenure Hiten Jain 1 Jul 25 0.5 Yr. Sagar Gandhi 1 Jul 25 0.5 Yr. Data below for Invesco India PSU Equity Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 31.01% Financial Services 29.88% Utility 19.12% Energy 13.49% Basic Materials 3.52% Consumer Cyclical 1.22% Asset Allocation

Asset Class Value Cash 1.76% Equity 98.24% Top Securities Holdings / Portfolio

Name Holding Value Quantity State Bank of India (Financial Services)

Equity, Since 28 Feb 21 | SBIN9% ₹136 Cr 1,387,617

↓ -38,697 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Mar 17 | BEL8% ₹120 Cr 2,997,692 Bharat Petroleum Corp Ltd (Energy)

Equity, Since 30 Sep 18 | 5005477% ₹104 Cr 2,717,009

↓ -184,556 Indian Bank (Financial Services)

Equity, Since 30 Jun 21 | 5328147% ₹97 Cr 1,157,444

↑ 76,826 NTPC Green Energy Ltd (Utilities)

Equity, Since 30 Nov 24 | NTPCGREEN6% ₹86 Cr 9,129,820

↑ 339,034 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 31 May 22 | HAL6% ₹86 Cr 196,158 Bank of Baroda (Financial Services)

Equity, Since 30 Jun 21 | 5321345% ₹66 Cr 2,244,222

↑ 127,830 Bharat Dynamics Ltd Ordinary Shares (Industrials)

Equity, Since 31 May 22 | BDL5% ₹65 Cr 445,685

↑ 21,640 Dredging Corp of India Ltd (Industrials)

Equity, Since 31 Jul 25 | DREDGECORP4% ₹64 Cr 646,300 NTPC Ltd (Utilities)

Equity, Since 31 May 19 | 5325554% ₹59 Cr 1,801,543

↓ -223,420 4. Franklin India Opportunities Fund

Franklin India Opportunities Fund

Growth Launch Date 21 Feb 00 NAV (12 Feb 26) ₹259.69 ↓ -1.06 (-0.41 %) Net Assets (Cr) ₹8,380 on 31 Dec 25 Category Equity - Sectoral AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 1.83 Sharpe Ratio -0.1 Information Ratio 1.69 Alpha Ratio -4.27 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹12,618 31 Jan 23 ₹12,455 31 Jan 24 ₹20,675 31 Jan 25 ₹25,253 31 Jan 26 ₹26,952 Returns for Franklin India Opportunities Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 12 Feb 26 Duration Returns 1 Month 1.3% 3 Month -1% 6 Month 4.6% 1 Year 14.5% 3 Year 30% 5 Year 20.1% 10 Year 15 Year Since launch 13.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 3.1% 2023 37.3% 2022 53.6% 2021 -1.9% 2020 29.7% 2019 27.3% 2018 5.4% 2017 -10.1% 2016 35.6% 2015 4.2% Fund Manager information for Franklin India Opportunities Fund

Name Since Tenure Kiran Sebastian 7 Feb 22 3.9 Yr. R. Janakiraman 1 Apr 13 12.76 Yr. Sandeep Manam 18 Oct 21 4.21 Yr. Data below for Franklin India Opportunities Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Financial Services 23.16% Consumer Cyclical 15.36% Technology 15.21% Health Care 11.71% Industrials 9.45% Basic Materials 8.79% Communication Services 6.09% Energy 3.11% Utility 2.49% Real Estate 0.46% Asset Allocation

Asset Class Value Cash 4.14% Equity 95.84% Top Securities Holdings / Portfolio

Name Holding Value Quantity Axis Bank Ltd (Financial Services)

Equity, Since 30 Apr 25 | 5322156% ₹501 Cr 3,948,707 State Bank of India (Financial Services)

Equity, Since 31 Oct 25 | SBIN6% ₹489 Cr 4,981,006 Amphenol Corp Class A (Technology)

Equity, Since 31 Jul 25 | APH3% ₹285 Cr 234,384 Reliance Industries Ltd (Energy)

Equity, Since 30 Apr 22 | RELIANCE3% ₹261 Cr 1,661,519 APL Apollo Tubes Ltd (Basic Materials)

Equity, Since 31 Oct 24 | APLAPOLLO3% ₹247 Cr 1,289,735 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Jan 24 | BHARTIARTL3% ₹244 Cr 1,158,502 Mahindra & Mahindra Ltd (Consumer Cyclical)

Equity, Since 31 May 24 | M&M3% ₹237 Cr 637,966 Hindustan Aeronautics Ltd Ordinary Shares (Industrials)

Equity, Since 30 Nov 25 | HAL3% ₹233 Cr 531,519 Mphasis Ltd (Technology)

Equity, Since 30 Nov 24 | 5262993% ₹227 Cr 814,231 IDFC First Bank Ltd (Financial Services)

Equity, Since 30 Jun 25 | IDFCFIRSTB3% ₹222 Cr 25,878,858

↑ 5,038,869 5. LIC MF Infrastructure Fund

LIC MF Infrastructure Fund

Growth Launch Date 29 Feb 08 NAV (13 Feb 26) ₹50.2038 ↓ -0.39 (-0.77 %) Net Assets (Cr) ₹1,003 on 31 Dec 25 Category Equity - Sectoral AMC LIC Mutual Fund Asset Mgmt Co Ltd Rating Risk High Expense Ratio 2.21 Sharpe Ratio -0.21 Information Ratio 0.28 Alpha Ratio -18.43 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 21 ₹10,000 31 Jan 22 ₹15,011 31 Jan 23 ₹15,567 31 Jan 24 ₹24,683 31 Jan 25 ₹30,671 31 Jan 26 ₹31,739 Returns for LIC MF Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 12 Feb 26 Duration Returns 1 Month 4.5% 3 Month 0.1% 6 Month 3.5% 1 Year 18.4% 3 Year 28.9% 5 Year 23.5% 10 Year 15 Year Since launch 9.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 -3.7% 2023 47.8% 2022 44.4% 2021 7.9% 2020 46.6% 2019 -0.1% 2018 13.3% 2017 -14.6% 2016 42.2% 2015 -2.2% Fund Manager information for LIC MF Infrastructure Fund

Name Since Tenure Yogesh Patil 18 Sep 20 5.29 Yr. Mahesh Bendre 1 Jul 24 1.5 Yr. Data below for LIC MF Infrastructure Fund as on 31 Dec 25

Equity Sector Allocation

Sector Value Industrials 47.89% Consumer Cyclical 13.2% Basic Materials 9.06% Financial Services 6.21% Utility 5.93% Technology 3.68% Real Estate 3.55% Communication Services 3.18% Health Care 3.07% Asset Allocation

Asset Class Value Cash 4.22% Equity 95.78% Top Securities Holdings / Portfolio

Name Holding Value Quantity Shakti Pumps (India) Ltd (Industrials)

Equity, Since 31 Mar 24 | SHAKTIPUMP5% ₹50 Cr 686,379

↓ -7,478 Tata Motors Ltd (Consumer Cyclical)

Equity, Since 31 Oct 25 | TMCV5% ₹45 Cr 1,088,395

↓ -159,564 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Apr 09 | LT4% ₹44 Cr 108,403

↓ -1,181 REC Ltd (Financial Services)

Equity, Since 31 Jul 23 | 5329553% ₹32 Cr 901,191

↓ -9,818 Apollo Hospitals Enterprise Ltd (Healthcare)

Equity, Since 30 Jun 25 | APOLLOHOSP3% ₹31 Cr 43,674

↓ -475 Garware Hi-Tech Films Ltd (Basic Materials)

Equity, Since 31 Aug 23 | 5006553% ₹29 Cr 93,271

↓ -1,016 Mahindra Lifespace Developers Ltd (Real Estate)

Equity, Since 30 Jun 24 | MAHLIFE3% ₹26 Cr 659,065

↓ -7,180 Avalon Technologies Ltd (Technology)

Equity, Since 31 Jul 23 | AVALON3% ₹25 Cr 289,118

↑ 2,984 Cummins India Ltd (Industrials)

Equity, Since 31 May 21 | 5004803% ₹25 Cr 56,889

↓ -619 Bharat Bijlee Ltd (Industrials)

Equity, Since 31 Jul 22 | BBL2% ₹25 Cr 92,624

↓ -1,009

یہاں فراہم کردہ معلومات کے درست ہونے کو یقینی بنانے کے لیے تمام کوششیں کی گئی ہیں۔ تاہم، ڈیٹا کی درستگی کے حوالے سے کوئی ضمانت نہیں دی جاتی ہے۔ براہ کرم کوئی بھی سرمایہ کاری کرنے سے پہلے اسکیم کی معلومات کے دستاویز کے ساتھ تصدیق کریں۔

Research Highlights for DSP World Gold Fund