Table of Contents

- Best ETFs to Invest in 2025 India

- Top & Best Index ETFS 2025

- Top & Best Gold ETFs In India 2025

- Top & Best Sector ETFs 2025

- Top & Best Bond ETFs 2025

- Top & Best Global Index ETFs 2025

- Top & Best Currency ETFs 2025

- How to Choose Best ETFs in India

- Benefits of Investing in Exchange Traded Funds

- Why ETFs Matter?

- FAQs

- 1. What are the different types of ETFs?

- 2. Why is ETF important?

- 3. Which ETF should you invest in?

- 5. Do I need to get in touch with registered agents to invest in ETFs?

- 6. Are Gold ETFs better investments?

- 7. Do ETFs have adequate liquidity?

- 8. What is the main difference between the ETF and a mutual fund?

- 9. Is ETF tax efficient?

Best ETFs in India- Invest in Best Performing ETFs 2025

After the introduction of Mutual Funds, Exchange Traded Funds (ETFs) have become the most innovative and popular securities amongst investors in India.

ETF instruments have created a valuable space amongst investors who find difficulties to master the trick of the trade of analyzing and selecting stocks of their Portfolio. More importantly, due to ETF’s low cost and track record of returns, they have caught the eye of investors in a big way!

With more and more investors looking at exchange traded funds as a potential investment option, it is worthwhile to identify the top and best ETFs to invest in India.

Best ETFs to Invest in 2025 India

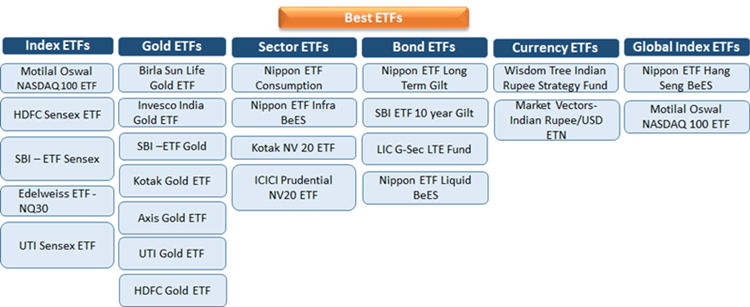

Exchange traded funds in India can be broadly segregated into six categories, they are – Index ETFs, Gold ETFs, Sector ETFs, Bond ETFs, Currency ETFs and Global Index ETFs.

Top & Best Index ETFS 2025

| Fund Name | 1Y Return (% p.a.) | 3Y Return (% p.a.) | 5Y Return (% p.a.) | Expense Ratio (%) | AUM (CR) |

|---|---|---|---|---|---|

| Motilal Oswal NASDAQ 100 ETF | 38.22 | 17.11 | 20.46 | 0.58 | 5,800 |

| HDFC S&P BSE Sensex ETF | 25.50 | 17.91 | 14.82 | 0.05 | 340 |

| SBI S&P BSE Sensex ETF | 25.49 | 17.89 | 14.83 | 0.07 | 85,200 |

| Edelweiss Nifty 100 Quality 30 Index Fund | 21.30 | - | - | 0.90 | 28 |

| UTI S&P BSE Sensex ETF | 25.47 | 17.58 | 14.66 | - | 27,450 |

April, 2025

Top & Best Gold ETFs In India 2025

| Fund Name | 1Y Return (% p.a.) | 3Y Return (% p.a.) | 5Y Return (% p.a.) | Expense Ratio (%) | AUM (CR) |

|---|---|---|---|---|---|

| Aditya Birla Sun Life gold ETF | 14.11 | 12.34 | 13.56 | 0.54 | 400.82 |

| Invesco India Gold ETF | 14.33 | 12.28 | 13.71 | 0.55 | 110 |

| SBI Gold ETF | 14.02 | 12.12 | 13.63 | 0.64 | 3,030 |

| Kotak Gold ETF | 13.97 | 12.06 | 13.57 | 0.55 | 2,700 |

| Axis Gold ETF | 13.83 | 11.90 | 13.47 | 0.53 | 820 |

| UTI Gold ETF | 13.76 | 11.89 | 13.26 | 1.13 | 650 |

| HDFC Gold Exchange Traded Fund | 13.71 | 11.91 | 13.29 | 0.59 | 3,600 |

As of April 2025

Talk to our investment specialist

Top & Best Sector ETFs 2025

| Fund Name | 1Y Return (% p.a.) | 3Y Return (% p.a.) | 5Y Return (% p.a.) | Expense Ratio (%) | AUM (CR) |

|---|---|---|---|---|---|

| Nippon ETF Consumption | 12.45 | 15.78 | 10.02 | 0.29 | 47.20 |

| Nippon India ETF Nifty Infrastructure BeES | 8.19 | 18.20 | 9.25 | 1.03 | 42.00 |

| Kotak NV 20 ETF | 15.23 | 22.30 | 17.12 | 0.14 | 44.50 |

| ICICI Prudential NV20 ETF | 15.19 | 22.35 | 17.06 | 0.12 | 68.10 |

As of April 2025

Top & Best Bond ETFs 2025

| Fund Name | 1Y Return (% p.a.) | 3Y Return (% p.a.) | 5Y Return (% p.a.) | Expense Ratio (%) | AUM (CR) |

|---|---|---|---|---|---|

| Nippon India ETF Nifty 8-13 yr G-Sec Long Term Gilt | 4.01 | 4.60 | 7.20 | 0.09 | 1300.5 |

| SBI-ETF 10Y Gilt | 3.87 | 3.42 | 6.02 | 0.14 | 2600.00 |

| lic mf Government Securities Fund (G) | 4.12 | 4.70 | 7.05 | 1.48 | 54.0 |

| Nippon India ETF Nifty 1D Rate Liquid BeES | 4.12 | 3.35 | 2.05 | 0.69 | 7300.00 |

As of April 2025

Top & Best Global Index ETFs 2025

| Fund Name | 1Y Return (% p.a.) | 3Y Return (% p.a.) | 5Y Return (% p.a.) | Expense Ratio (%) | AUM (CR) |

|---|---|---|---|---|---|

| Nippon ETF Hang Seng BeES | -1.25 | -0.52 | 0.89 | 0.93 | 180.45 |

| Motilal Oswal Nasdaq 100 ETF (MOSt Shares NASDAQ 100) | 38.22 | 17.11 | 20.46 | 0.58 | 5800.00 |

As of April 2025

Top & Best Currency ETFs 2025

| Fund Name | 1Y Return* (%) | 3Y Return* (%) | 5Y Return* (%) | Expense Ratio (%) | AUM ($) |

|---|---|---|---|---|---|

| WisdomTree Indian Earnings Fund (EPI) | 39.62 | 17.98 | 15.42 | 0.84 | $1,050,000.00 |

| Market Vectors- Indian Rupee/USD ETN | - | - | - | - | 0.55 |

(*): The average returns are based on Underlying index returns

How to Choose Best ETFs in India

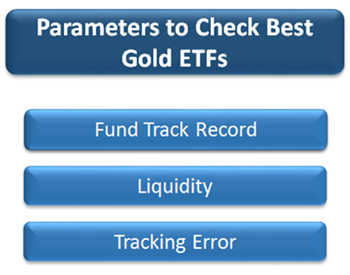

Following are the important parameters that investors have to look in a Fund in order to invest in the best ETFs in India.

1. Look at the Liquidity

The liquidity of the ETF is one of the parameters that will determine the profitability of your investment. Look for an ETF that provides adequate liquidity. There are two factors that play a role in the liquidity of the exchange traded fund–the liquidity of the shares that are being tracked and the liquidity of the fund itself. Monitoring the liquidity of an ETF is important, while an investment is made and it may be profitable, it is important to ensure that one is able to exit when they want to. In situations of the market, declines are when liquidity gets tested. ETFs work in a way that there are market makers available for buying & selling, these ensure that liquidity is available in an ETF all the time.

2. Know the Expense Ratio

An ETF’s expense ratio is often the deciding Factor when it comes to Investing in the best ETFs. A fund’s expense ratio is the measure of the cost to run the fund. The expense ratio can include various operational costs like Management Fee, compliance, distribution fee, etc., and these operating expenses are taken out of the ETF’s assets, hence, lowering the return for the investors. The lower the expense ratio, the lower is the cost of investing in the ETF.

3. Check for Tracking Error

The next thing to look in an ETF is the tracking error. In simple words, the tracking error is the amount by which a fund’s return, as indicated by its NAV (Net Asset Value), differs from the actual index return. Well, in India, most of the popular exchange traded funds do not completely track an index, instead, they invest part of the assets in the index, while the rest is used for investing in other financial instruments. This is done in order to increase returns so that you will find the tracking error to be high in most of the ETFs you invest in.

As an overview, low tracking error means a portfolio is closely following its benchmark, and high tracking errors mean the opposite. Thus, the lower the tracking error the better the index ETF.

Benefits of Investing in Exchange Traded Funds

Some of the benefits of investing in best ETFs or exchange traded funds are as follows-

a. Liquidity

Exchange traded funds can be sold and bought at any time throughout the trading period.

b. Low cost

ETFs make an affordable investment due to their lower expense ratios than a Mutual Fund.

c. Tax Advantage

Buying and selling of shares in the Open Market do not impact the exchange-traded fund’s tax Obligation.This is the reason exchange traded funds are tax efficient.

d. Transparency

There is a high level of transparency in ETFs as the investment holdings are published every day.

e. Exposure

Exchange traded funds provide diverse exposure to specific sectors as the case may be.

Why ETFs Matter?

India has a huge population. Trading and investing has been rising over the years. It has become a popular destination for investing as an emerging market. ETFs have been around the investment community for almost a decade. In India, ETFs started in 2001, with Nifty BEes being the first ETF to be launched. The asset is designed to track a pool of securities that are listed on the Indian stock exchanges. Underlying securities could include mutual funds, Bonds, stocks, etc. Over time, ETFs have become an easy and a preferred route for many investors to take exposure to the markets. It has created possibilities for investors to gain broad exposure to entire stock markets in different countries and specific sectors with ease.

By Rohini Hiremath

By Rohini Hiremath

Rohini Hiremath works as a Content Head at Fincash.com. Her passion is to deliver financial knowledge to the masses in simple language. She has a strong background in start-ups and diverse content. Rohini is also an SEO expert, coach and motivating team head!

You can connect with her at rohini.hiremath@fincash.com

FAQs

1. What are the different types of ETFs?

A: The different types of ETFs to invest are as follows:

- Index ETF

- Stock ETF

- Bond ETF

- Commodity ETF

- Currency ETF

- Actively managed ETF

- Inverse ETF

- Leveraged ETF

2. Why is ETF important?

A: ETF helps you diversify your portfolio of investments and increases the sources for earning passive Income. Additionally, they have lower expense ratios and known to produce good returns. As, ETFs are passively managed you do not have to worry about tracking your ETFs daily.

3. Which ETF should you invest in?

A: While investing in the ETF, you must first check the type of ETF you want to invest in. For instance, following are the Index Funds - Motilal Oswal NASDAQ 100 ETF, HDFC Sensex ETF, and SBI Sensex, Edelweiss ETF or UTI ETF, etc. Before picking one, you must check past 3-years return and the NAVs. Similarly, if you are thinking of investing in Sector ETFs, then you can select from Nippon ETF Consumption, Nippon ETF BeEs, Kortak NV 20ETF, or ICICI prudential ETF.

5. Do I need to get in touch with registered agents to invest in ETFs?

A: Yes, only registered agents can help you invest in ETFs. Moreover, they can advise you regarding the best performing ETF depending upon the returns and the type.

6. Are Gold ETFs better investments?

A: You can invest in gold ETFs offered by companies like Birla Sun Life Gold, SBI Gold, Axis Gold, UTI Gold, or Invesco India Gold. The Gold ETFs provide healthy returns as the price of gold rarely depreciates. It also acts as a buffer for your other investments and also works as a hedge against Inflation.

7. Do ETFs have adequate liquidity?

A: Yes, ETFs have better liquidity compared to other investments. You can exit the market whenever you want to, and you can trade the ETFs anytime throughout the trading period.

8. What is the main difference between the ETF and a mutual fund?

A: ETF and mutual fund's primary difference is that an ETF is traded actively during the trading hours. However, a mutual fund can be traded at the closing of the Net Asset Value. This means an ETF has more liquidity compared to a mutual fund.

9. Is ETF tax efficient?

A: Yes, ETFs are tax-efficient primarily because there are no Capital gains. When an ETF is sold in the open market, it behaves like a stock, and it is sold from one investor to another without any Capital Gains through the process. Hence, ETFs are more tax-efficient compared to other forms of investments that result in capital gains.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Excellent article about the state of affairs of the Indian ETF marketplace. Clear, concise, and thorough. But could have added more sectors, when they matter to many investors