+91-22-48913909

+91-22-48913909

Table of Contents

How to Create an Investment Plan?

“Save for a rainy day” is a practical truth. When you make an Investment plan, you not only save for bad times, but also secure your future.

Each of us has certain goals, dreams, aspiration & wish list, and making all these possible is achievable if you know the importance of an investment plan.

Basis this, we take you through a guideline, on how to create an investment plan in a systematic manner. But, before that let us understand the importance of Investing.

Why Should you Invest?

Many people today still Fail to understand the importance of investing. Well, the main idea behind investing or making an investment is to generate a regular Income or returns over a specified time period. Moreover, it makes you prepare for your future in an orderly way. But, people do invest their money for various reasons such as for retirement, to make a short term and long term investment (as per their goals), for the purchase of assets, for undertaking marriage, for starting a business or for going for a world tour etc.

Tips to Make Best Investment Plan

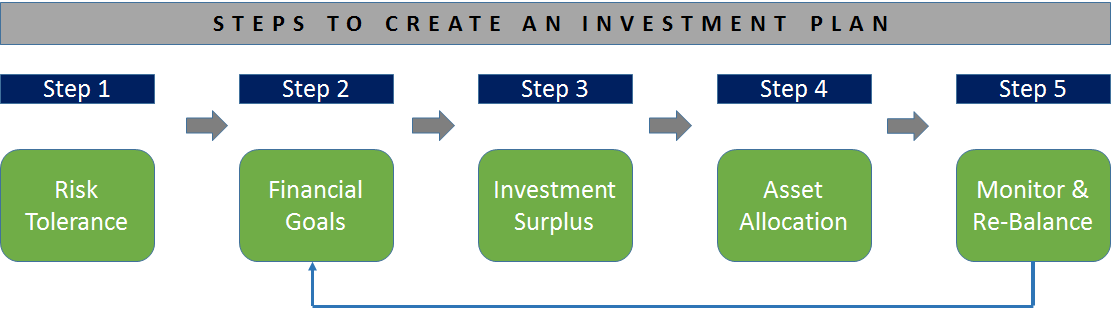

1. Determine Your Risk Tolerance

When making an investment plan, it's important to determine your risk tolerance. Every investing option has its own pros and cons. Some vehicles come with low risks, while some others have a high level of risks. In financial terms, a risk is defined as the Volatility or fluctuations of returns provided by an investment asset. While talking about the risk, the reward comes into the picture because risks and rewards go hand in hand. For example, the reward in Equity Funds is higher and so is the risk. However, having a diversified Portfolio of assets reduces the risks.

So, before investing in any instrument, know it’s both sides. Along with that determine your risk tolerance too. Few of the examples are mentioned below in the image.

Talk to our investment specialist

2. Set Financial Goals

The first thing you do while creating an investment plan is setting Financial goals! We all want to be financially stable and need a steady flow of income. But, many people underestimate their power of being financially stable, assuming that it's only for the rich ones. But hold on, being rich is not about how much you earn, but it’s about how much you save! One such way to reach is by making a Financial plan and setting financial goals.

One of the systematic ways to target your financial goals is by setting them into time frames, i.e., short-term, mid-term and long-term goals. This will not only give a very systematic solution to the journey of the desired financial goal but also achieve a realistic approach towards your financial goals. Whether you want to own a car, invest in Real Estate/gold or save for marriage - whatever be the financial goal; you can target them by categorising them foremost into the aforementioned time frames namely - short, medium and long-term. However, to make all these possible, you need to save first!

3. Decide Investment Surplus

While estimating the investment surplus, investors must clearly understand their current financial state which will give them an idea about both their Earnings and expenses. This analysis will guide you through your annual cost of living and indicate the savings or surplus money available for investment.

4. Decide Asset Allocation

Asset Allocation is simply deciding the mix of assets in a portfolio. It is important to realise the importance of having different asset classes in a portfolio. It is necessary to have sufficiently uncorrelated assets in a portfolio so that when an Asset Class doesn’t earn, the others to give the investor a positive return on the portfolio.

While there are many traditional ways of building assets like various schemes, fixed deposits, savings, etc., people need to also understand the importance of other unconventional ways of building assets faster. Moreover, investing in things which will appreciate in value and give you good returns for your money. For example, Mutual Funds, commodities, real estate are some options which will appreciate with time and it will help you in building a strong portfolio.

5. Monitor and Re-Balance

Investors should always review the portfolio at least once a quarter and rebalance at least once a year. One would need to see scheme performances and should make sure that a good performer exists in the portfolio. Else one would need to change their holdings and replace laggards with good performers.

Check Best Investment Options to Invest

What adds to the important side of investing in the right instruments! Many people think that keeping their money just in Bank accounts pay them a good interest. But there are many other options besides parking money in banks, wherein you can invest your money to gain better profits and returns. To mention some, there are various Types of Mutual Funds (Bonds, debt, equity), ELSS, ETFs, Money market funds, etc. So, choose the options well and make a Smart investment plan!

Your investment plan should hold the best performing investing instruments. So know some, we have listed off a few best options to invest money!

| Investment Options | Average Returns | Risk |

|---|---|---|

| Bank Accounts/Fixed Deposit | 3%-10% | Very Low to None |

| Money Market Funds | 4%-8% | Low |

| Liquid Funds | 5%-9% | Very Low to None |

| Equity Funds | 2%-20% | High to Moderate |

| Equity Linked Savings Scheme (ELSS) | 14%-20% | Moderate |

Best Money Market Funds to Invest

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2023 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Sub Cat. L&T Money Market Fund Growth ₹26.043

↑ 0.02 ₹2,457 2.3 4 7.7 6.7 7.5 7.52% 7M 7D 10M 20D Money Market Aditya Birla Sun Life Money Manager Fund Growth ₹364.993

↑ 0.30 ₹26,752 2.3 4.1 7.9 7.2 7.8 7.6% 6M 22D 6M 22D Money Market Kotak Money Market Scheme Growth ₹4,430.44

↑ 3.58 ₹27,943 2.3 4.1 7.9 7.1 7.7 7.57% 8M 8D 8M 8D Money Market ICICI Prudential Money Market Fund Growth ₹374.372

↑ 0.29 ₹25,882 2.3 4.1 7.9 7.1 7.7 7.48% 7M 6D 7M 23D Money Market UTI Money Market Fund Growth ₹3,041.92

↑ 2.44 ₹18,083 2.3 4.1 8 7.2 7.7 7.51% 6M 1D 6M 1D Money Market Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 15 Apr 25

Best Liquid Funds to Invest

Fund NAV Net Assets (Cr) 1 MO (%) 3 MO (%) 6 MO (%) 1 YR (%) 2023 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Sub Cat. Aditya Birla Sun Life Liquid Fund Growth ₹415.349

↑ 0.09 ₹57,091 0.8 1.9 3.6 7.3 7.3 7.33% 1M 13D 1M 13D Liquid Fund Nippon India Liquid Fund Growth ₹6,290.41

↑ 1.34 ₹33,917 0.8 1.9 3.6 7.3 7.3 7.32% 1M 17D 1M 21D Liquid Fund Principal Cash Management Fund Growth ₹2,274.07

↑ 0.46 ₹6,619 0.7 1.9 3.6 7.3 7.3 7.22% 1M 17D 1M 17D Liquid Fund Indiabulls Liquid Fund Growth ₹2,492.8

↑ 0.57 ₹158 0.8 1.9 3.7 7.3 7.4 7.02% 1M 2D 1M 2D Liquid Fund JM Liquid Fund Growth ₹70.3327

↑ 0.02 ₹3,341 0.8 1.8 3.6 7.2 7.2 7.13% 1M 10D 1M 13D Liquid Fund Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 15 Apr 25

Best Equity Funds to Invest

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) Sub Cat. DSP BlackRock Natural Resources and New Energy Fund Growth ₹79.731

↑ 2.28 ₹1,125 -4.8 -17.2 -8 9.9 28.2 13.9 Sectoral L&T Emerging Businesses Fund Growth ₹72.5522

↑ 2.26 ₹13,334 -11.7 -20.6 0.6 16 35 28.5 Small Cap IDFC Infrastructure Fund Growth ₹46.297

↑ 1.51 ₹1,400 -4.5 -15.9 3.3 24.1 35.6 39.3 Sectoral Aditya Birla Sun Life Banking And Financial Services Fund Growth ₹56.72

↑ 1.61 ₹3,011 7.5 -1 11.1 14.1 25.1 8.7 Sectoral Aditya Birla Sun Life Small Cap Fund Growth ₹76.2869

↑ 2.10 ₹4,054 -7 -18.3 2.1 12.7 28.6 21.5 Small Cap Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 11 Apr 25

Best ELSS Funds to Invest

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) Sub Cat. Tata India Tax Savings Fund Growth ₹40.7798

↑ 1.12 ₹4,053 -3.8 -11.2 7 12.8 23.2 19.5 ELSS IDFC Tax Advantage (ELSS) Fund Growth ₹140.649

↑ 3.49 ₹6,232 -0.9 -10.2 1.9 12.1 28.7 13.1 ELSS DSP BlackRock Tax Saver Fund Growth ₹130.855

↑ 2.99 ₹14,981 0.8 -7.9 13.7 17 27.3 23.9 ELSS L&T Tax Advantage Fund Growth ₹121.819

↑ 3.57 ₹3,604 -4.5 -12.7 9.2 15.4 23.8 33 ELSS Aditya Birla Sun Life Tax Relief '96 Growth ₹54.42

↑ 1.35 ₹13,629 -1.2 -10.8 5.6 10.2 16.1 16.4 ELSS Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 15 Apr 25

While creating an investment plan, look for different investing options, investors should also be aware of new schemes in the market. Most importantly, they should get into the habit of early investment by securing their hard earned money!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.