Table of Contents

Yield

What is Yield?

The term yield is used to describe the annual return on the investments as a percentage of your original investment. The yield of a particular security represents the current Market interest rate of the security. It is usually from dividend payments from a stock, Mutual Fund, Exchange Traded Fund or interest payments from a bond.

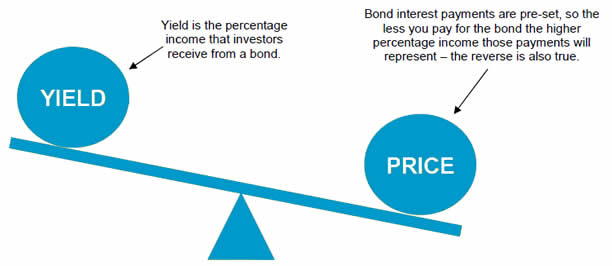

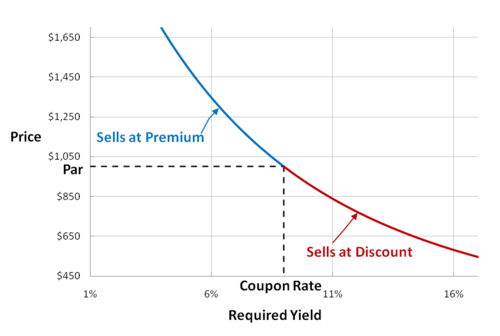

One should consider the yield of a security based on the current market price when evaluating and comparing to other fixed Income securities. The price of a fixed interest and the yield are inversely related so that when market interest rates rise, bond prices usually fall and vice versa.

Formula for Calculating Yield

Calculating the Yield of a Single-Period Investment:

(FV−PV)/PV∗100

Yields for Stock Investors

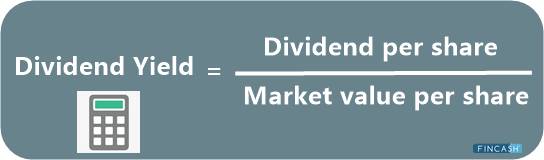

Dividend Yield

A Dividend Yield is calculated by dividing the indicated annual dividend by the closing price of the stock. It provides the historical annual dividend relative to the current market price. Dividend yield is expressed in the percentage form.

Talk to our investment specialist

Yields for Bond Investors

1. Current Yield

A bond's current yield is calculated by dividing the annual interest payment by the current market price of the bond. Current yield only captures the income generated by the investment. It avoids any changes in value from i.e., either gains or losses.

2. Coupon Yield

A bond's coupon yield is the simple interest paid by a bond annually as a percentage of maturity value. The coupon yield, also known as the coupon rate, is the annual interest rate established when the bond is issued.

3. Yield to Maturity (YTM)

The yield to maturity(ytm) of a bond indicates the running yield of the fund. When comparing Bonds on the Basis of YTM, one should also look at that fact that how is the extra yield being generated.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.