Table of Contents

- Shriram General Insurance Company Limited Product Portfolio

- Shriram Commercial Vehicle Insurance Plan

- Shriram Car Insurance Plan

- Shriram Two Wheeler Insurance Plan

- Shriram Home Insurance Plans

- Shriram Home Insurance Plans

- Shriram Personal Accident Insurance Plan

- Shriram Fire Insurance Plans

- Shriram Engineering Insurance Plans

- Shriram Marine Insurance Plans

- Shriram Liability Insurance Plans

- Shriram Cyber Suraksha Insurance

- Shriram Travel Insurance

- Conclusion

Shriram General Insurance Company Limited

Shriram general insurance Company Limited was founded to serve the largest number of common people in India. The company is a joint venture between the Indian Financial Sector major Shriram Capital and Sanlam Limited, one of the largest general Insurance companies in South Africa.

Founded in 1974, the Shriram Group has a customer base of over 9.5 million clients and more than 45,000 employees across 2,400 branches in India. The Sanlam Group, a conglomerate in financial services, has a Market capitalisation of more than $6 billion. They provide professional financial advice and financial products to corporates as well as individuals.

The company focuses on addressing customer needs and using a homegrown technology platform. Shriram General insurance brings innovative products and has focused on using information technology in the field of insurance. For two consecutive years (2011 & 2012), SGI has been bestowed with the “Excellence in Growth Award” at the Indian Insurance Awards. Primarily focused on Motor Insurance, Shriram General Insurance also offers products like fire, home, liability, engineering, and Marine Insurance.

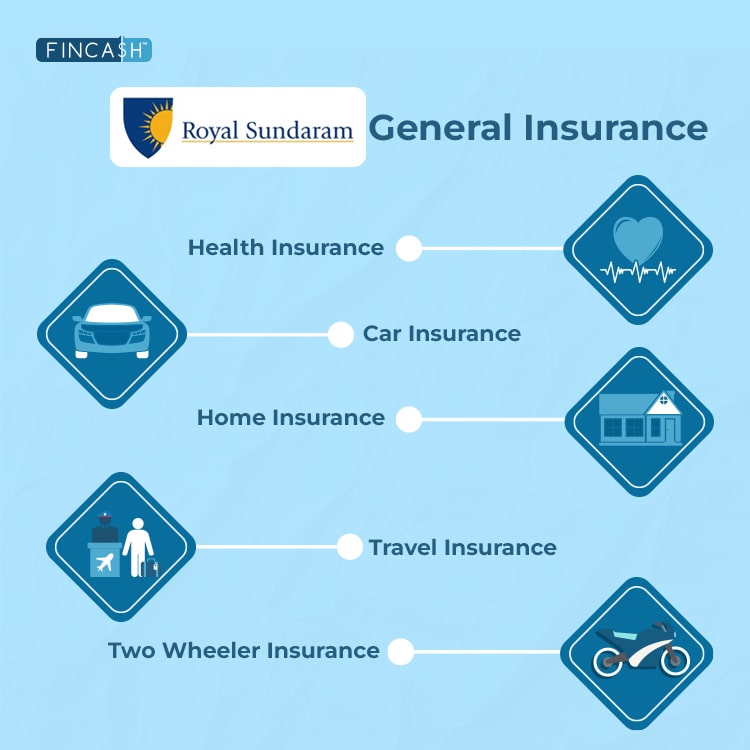

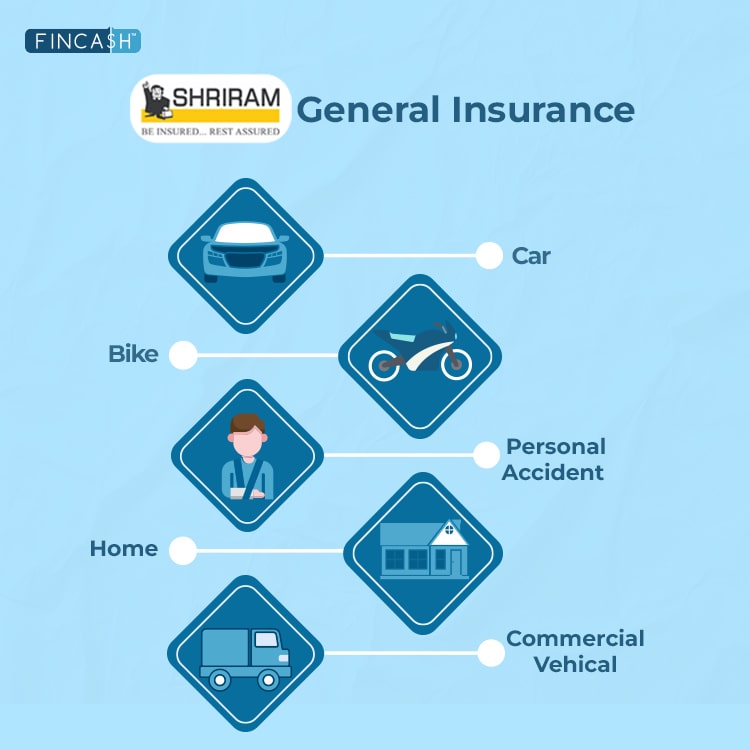

Shriram General Insurance Company Limited Product Portfolio

Jotted down below is the list of insurance plans that you can find in the Portfolio of Shriram General Insurance Company:

Shriram Commercial Vehicle Insurance Plan

Shriram Commercial Vehicle Insurance provides comprehensive coverage for commercial vehicles, ensuring protection against various risks such as accidents, theft, and natural calamities. The policy includes coverage for third-party liabilities, damages to the vehicle, and personal accident benefits for drivers.

Under this category, you can find the following plans:

- Shriram Commercial Goods Carrying Vehicle Insurance

- Shriram Commercial People Carrying Vehicle Insurance

Inclusions of Shriram Commercial Vehicle Insurance

Below mentioned is everything included in these plans:

- Coverage against any vehicle loss or damage due to natural and man-made calamities.

- Protection against damage from fire, explosion, self-ignition, lightning, typhoons, hurricanes, earthquakes, floods, storms, tempests, inundation, cyclones, hailstorms, frost, landslides, or rockslides.

- Coverage for damage from riots, strikes, malicious acts, terrorist activities, and other violent events.

- Coverage for burglary, theft, accidents by external means, and any damage during transit by road, rail, inland waterways, lifts, elevators, or air.

- Unlimited coverage for liabilities determined by court awards for accidental death or injuries caused by your vehicle to third parties.

Exclusions of Shriram Commercial Vehicle Insurance

Below mentioned is everything not included in these plans:

- Accidental loss or damage occurring while the insured or any authorised driver is under the influence of intoxicating liquor or drugs or due to willful negligence.

- Loss or liability when the vehicle is used beyond its defined limitations or driven by an unlicensed individual.

- Consequential losses, Depreciation, wear and tear, mechanical and electrical breakdowns or failures, and breakages are not covered.

- Losses related to nuclear or radioactive activity or due to war and related activities are excluded from the policy.

Talk to our investment specialist

Shriram Car Insurance Plan

A car insurance policy is a contract between the vehicle owner and the insurer designed to protect against third-party liabilities and own damages. In India, having a car insurance policy is mandatory under Section 146 of the Motor Vehicles Act, 1988. This policy safeguards vehicle owners against unforeseen events such as accidents, theft, and natural or man-made disasters, with the insurance company covering repair costs.

Under this category, you can find the following plans:

- Shriram Third-Party Car Insurance Policy

- Shriram Own Damage Car Insurance Policy

- Shriram Comprehensive Car Insurance Policy

- Shriram Electric Car Insurance Policy

Inclusions of Shriram Car Insurance

Below mentioned is everything included in these plans:

- Coverage against any loss or damage to the vehicle due to various natural and man-made calamities.

- Protection against damage from fire, explosions, self-ignition, lightning, earthquakes, floods, typhoons, hurricanes, storms, tempests, inundations, cyclones, hailstorms, frosts, landslides, and rockslides.

- Coverage for damage from riots, strikes, malicious acts, terrorist activities, and other violent events.

- Coverage for burglary, theft, accidents by external means, and any damage during transit by road, rail, inland waterways, lifts, elevators, or air.

- Unlimited coverage for liabilities determined by court awards for accidental death or injuries caused by your vehicle to third parties.

Exclusions of Shriram Car Insurance

Below mentioned is everything not included in these plans:

- Accidental loss or damage when the insured or any authorised driver is under the influence of intoxicating liquor or drugs or due to willful negligence.

- Loss or liability when the vehicle is used outside its defined limitations or driven by an unlicensed individual.

- Losses related to nuclear or radioactive activity or due to war and related activities are not covered.

- Consequential losses, depreciation, wear and tear, mechanical and electrical breakdowns, or failures and breakages are not covered.

- As per IRDAI regulations, a compulsory Deductible is the amount the insured must pay as part of their claim, which is not covered by the Shriram Car Insurance policy.

Shriram Two Wheeler Insurance Plan

A two-wheeler insurance policy protects bike owners against unforeseen expenses from accidents, theft, and natural or man-made disasters. This policy safeguards the vehicle and the owner against third-party liability, theft, natural disasters, and vandalism. Shriram's Two-Wheeler Insurance policy offers various online coverages, including Third-Party, Own Damage, and Comprehensive coverage.

Shriram Home Insurance Plans

- Shriram Householder Umbrella Insurance Policy

Under this category, you can find the following plans:

- Shriram Third-Party Two-Wheeler Insurance

- Shriram Standalone Own Damage Insurance

- Shriram Comprehensive Two-Wheeler Insurance

- Shriram Electric Bike Insurance

Inclusions of Shriram Two-Wheeler Insurance

Below mentioned is everything included in these plans:

- Covers any loss or damage to the vehicle due to various natural and man-made calamities.

- Protection against fire, explosion, self-ignition, lightning, earthquakes, floods, typhoons, hurricanes, storms, tempests, inundations, cyclones, hailstorms, frost, landslides, or rockslides.

- Coverage for damage resulting from riots, strikes, malicious acts, accidents by external means, terrorist activities, and other violent events.

- Coverage for burglary, theft, and any damage during transit by road, rail, inland waterways, lifts, elevators, or air.

- Unlimited liability coverage for accidental death or injuries caused by your vehicle to third-party individuals, as awarded by the court.

Exclusions of Shriram Two-Wheeler Insurance

Below mentioned is everything not included in these plans:

- Accidental loss or damage when the insured or any authorised driver is under the influence of intoxicating liquor or drugs or due to willful negligence.

- Loss or liability when the vehicle is used outside its defined limitations or driven by an unlicensed individual.

- Losses related to nuclear or radioactive activity or due to war and related activities are not covered.

- Consequential losses, depreciation, wear and tear, mechanical and electrical breakdowns, or failures and breakages are not covered.

Shriram Home Insurance Plans

Home insurance protects your house against man-made and natural disasters and other related threats through an agreement. Challenges such as unpredictable heavy rains, sudden floods, fire, and theft can cause significant damage to your home. Home insurance mitigates these risks by covering the house against such mishaps.

Under this category, you can find the following plans:

- Shriram Home Insurance Coverages

- Shriram Buildings & Contents Cover

- Shriram Contents Only Cover

Inclusions of Shriram Home Insurance

Below mentioned is everything included in these plans:

- Covers any loss or damage to the vehicle due to various natural and man-made calamities.

- Protection against fire, explosion, self-ignition, lightning, earthquakes, floods, typhoons, hurricanes, storms, tempests, inundations, cyclones, hailstorms, frost, landslides, or rockslides.

- Coverage for damage resulting from riots, strikes, malicious acts, accidents by external means, terrorist activities, and other violent events.

- Coverage for burglary, theft, and any damage during transit by road, rail, inland waterways, lifts, elevators, or air.

- Unlimited liability coverage for accidental death or injuries caused by your vehicle to third-party individuals, as awarded by the court.

Exclusions of Shriram Home Insurance

Below mentioned is everything not included in these plans:

- Conflict, invasion, operations by foreign enemies, or violent activities.

- Violation of the law with criminal intent.

- Exposure to radioactive, toxic, or explosive materials.

- Any form of intentional misconduct or negligence.

Shriram Personal Accident Insurance Plan

personal accident insurance provides crucial protection against unforeseen accidents, Offering financial security for the insured and their family. With this, you can cover accidental bodily injuries and partial or total disabilities (both permanent and temporary), along with so much more.

Under this category, you can find the following plans:

- Shriram Accidental Death & Disappearance Policy

- Shriram Transportation of Mortal Remains Policy

- Shriram Children’s Education Benefit Policy

- Shriram Permanent Total Disability Policy

- Shriram Permanent Partial Disability Policy

- Shriram Temporary Total Disability Policy

Inclusions of Shriram Personal Accident Insurance

Below mentioned is everything included in these plans:

- Coverage compensates the nominee in case of the insured's accidental death. If the insured disappears and is presumed dead after an accident, similar benefits apply.

- Expenses related to transporting the insured's mortal remains to their residence are covered.

- Financial support for the insured’s children's education in the event of the insured’s accidental death or permanent total disability.

- Compensation is provided if the insured suffers a permanent total disability due to an accident, making them unable to work for the rest of their life.

- Benefits cover permanent partial disabilities that limit but do not entirely stop the insured from working, such as losing a limb or sight in one eye.

- Coverage includes financial compensation for temporary total disabilities that completely but temporarily prevent the insured from working, ensuring they can cover daily expenses during the recovery period.

Exclusions of Shriram Personal Accident Insurance

Below mentioned is everything not included in these plans:

- Coverage does not extend to injuries resulting from suicide, attempted suicide, or any intentional self-inflicted wounds or illnesses.

- Injuries sustained while under the influence of alcohol, drugs, or other intoxicants are not covered.

- Injuries due to insanity, immoral acts, or committing any breach of law with criminal intent are excluded from coverage.

- Injuries from engaging in dangerous hobbies such as aviation (except as a passenger in a licensed aircraft) or ballooning are not covered.

- Injuries sustained while participating as a driver, co-driver, or passenger in motor racing or trial runs are excluded.

- Injuries arising from curative treatments or interventions the insured person undertakes or has performed on their body are not covered.

- Injuries due to participation in any naval, military, or air force operations, whether in military exercises, war games, or actual engagement with the enemy, are excluded.

- Any injury, disablement, or death arising directly or indirectly from or contributing to any pre-existing condition is not covered.

- Injuries or complications resulting from pregnancy, childbirth, miscarriage, or abortion are excluded from coverage.

Shriram Fire Insurance Plans

Regardless of the business size, every business owner must purchase Fire insurance. This additional safety measure ensures the business can withstand unexpected fire-related incidents without severe financial setbacks. The primary purpose of fire insurance is to provide coverage for the replacement, repair, or reconstruction of property or machinery damaged by fire. This ensures that businesses and property owners can recover financially from fire-related losses.

Under this category, you can find the following plans:

- Standard Fire and Special Perils Policy

- Industrial All-Risk Policy

- Fire Loss of Profit Policy

Inclusions of Shriram Fire Insurance

Below mentioned is everything included in these plans:

- Coverage includes damages caused by fire, lightning strikes, and explosions or implosions.

- Protection against damages caused by aircraft or other aerial devices and articles dropped from them.

- Includes losses due to riots, strikes, and malicious activities.

- Covers damages from storms, cyclones, floods, tempests, hurricanes, tornadoes, and inundations.

- Protection from damages due to impact, subsidence, landslides, and rockslides.

- Includes damages from the bursting or overflowing of water tanks, apparatus, and pipes.

- Covers damages resulting from missile testing operations.

- Coverage includes leakage from automatic sprinkler installations and bushfires.

Exclusions of Shriram Fire Insurance

Below mentioned is everything not included in these plans:

- Loss, destruction, or damage caused by war and invasion.

- Damages resulting from acts of foreign enemy hostilities or war-like operations (regardless of whether war is declared or not).

- Civil war, mutiny, or civil commotion.

- Military uprising, rebellion, revolution, insurrection, military, or usurped power.

- Damages due to faulty design, materials, inherent vice, latent defect, gradual deterioration, deformation, distortion, and wear and tear.

- Interruption of water supply, gas, electricity, fuel systems, or failure of effluent disposal systems to and from the premises.

Shriram Engineering Insurance Plans

Safeguarding your business against unforeseen risks and losses becomes imperative for ensuring the seamless operation of the organisation. Thus, engineering insurance covers third-party property damage and bodily injury.

Under this category, you can find the following plans:

- Contractors All Risk Insurance

- Policy Erection All Risk Insurance Policy

- Electronic Equipment Insurance Policy

- Machinery Breakdown Insurance Policy

- Contractor’s Plant and Machinery Insurance

- Boiler & Pressure Plant Insurance Policy

Inclusions of Shriram Engineering Insurance

Below mentioned is everything included in these plans:

- Material damage caused by accidental physical loss is covered.

- Protection against loss, damage, or destruction of property by any cause unless specifically excluded.

- Third-party liability coverage is provided for third-party property against loss, damage, destruction, and third-party personal injury.

- Any unforeseen and sudden physical loss or damage to electronic equipment from any cause, except for exclusions, is also included.

- The policy extends coverage to external data media and the expenses for reconstructing and re-recording information.

- In the event of increased work costs due to unforeseen and sudden physical damage or loss to machinery at work, rest, or during dismantling for cleaning or overhauling, the policy provides protection.

- Damage occurring during machine operations, shifting within the premises, or subsequent re-erection, as well as loss or damage to construction equipment due to malicious damage, earthquakes, floods, storms, etc., are covered.

- Work-related damage, including damage from work, rest, or maintenance on insured property, is included.

- Coverage is provided for damage to both fired and unfired equipment against losses due to explosion or collapse.

- Covers damage to surrounding property arising from the explosion or collapse of the Pressure Plant during its normal course of work, along with third-party legal liability arising from such incidents.

Exclusions of Shriram Engineering Insurance

Below mentioned is everything not included in these plans:

- Fire and related risks.

- War and nuclear hazards.

- Overload experiments/tests causing abnormal conditions.

- Gradually emerging defects that do not require cessation.

- Ordinary deterioration.

- Failure of individual tubes does not result in explosion or collapse.

- Loss or damage during inspections or tests conducted by regulatory bodies or otherwise, as well as willful acts or negligence.

- Pre-existing defects and faults.

- Consequential losses.

- Loss or damage attributable to the property's manufacturer, supplier, or repairer by law or contractual agreements.

Shriram Marine Insurance Plans

A marine cargo insurance policy extends coverage to third-party liability, encompassing damages incurred by the port, carrier, or road due to defective cargo. Shriram General Insurance offers a Range of Marine Cargo Insurance policies tailored to meet the needs of business owners, protecting against diverse cargo losses and damages.

Under this category, you can find the following plans:

- Shriram Specific Voyage (Inland/Import/Export)

- Shriram Open Policy (Inland)

- Shriram Open Cover (Import/Export)

- Shriram Sales Turnover Policy

Inclusions of Shriram Marine Insurance

Below mentioned is everything included in these plans:

- Coverage for loss or damage to cargo during transit by sea, air, road, or rail.

- Protection against various perils such as fire, theft, collision, sinking, and other fortuitous events.

- Third-party liability coverage, including damages caused to ports, carriers, or roads due to defective cargo.

- Optional additional coverage for war and strike risks.

- Flexibility to tailor the policy to specific cargo needs and requirements.

Exclusions of Shriram Marine Insurance

Below mentioned is everything not included in these plans:

- Loss or damage arising from willful misconduct or negligence.

- Loss or damage due to ordinary wear and tear.

- Loss or damage caused by inherent vice or nature of the cargo.

- Excluded perils such as war, nuclear risks, and acts of terrorism unless specifically covered.

- Loss or damage covered by other insurance policies.

- Consequential losses or indirect damages resulting from the loss or damage of cargo.

- Loss or damage caused by pre-existing defects or faults.

- Loss or damage for which the cargo's manufacturer, supplier, or repairer is legally responsible under contracts or laws.

Shriram Liability Insurance Plans

The insurance shields the insured from legal payouts and associated costs for which the policyholder is liable. However, liability insurance typically excludes coverage for intentional harm, deliberate criminal acts, and obligations arising from contracts.

Under this category, you can find the following plans:

- Professional indemnity – For Doctors and other than Doctors

- Commercial General Liability

- Error & Omissions – For Medical Establishments

- Product Liability

- Public Liability – Non-Industrial

- Public Liability – Workman Compensation Act Insurance

- Shri Suraksha Insurance

- Shopkeeper Umbrella Package Insurance

- Fidelity Guarantee Policy

- Burglary Insurance

- All Risk Insurance

- Business Protector Policy

Inclusions of Shriram Liability Insurance

Below mentioned is everything included in these plans:

- Coverage for legal payouts and associated costs incurred by the insured due to liability claims.

- Protection against bodily injury or property damage claims brought against the insured by third parties.

- Coverage for legal defence costs, including attorney fees and court expenses.

- Financial protection for liability arising from accidents or incidents covered under the policy.

- Optional additional coverage for specific liabilities tailored to the needs of the insured.

Exclusions of Shriram Liability Insurance

Below mentioned is everything not included in these plans:

- Intentional damage or harm caused by the insured.

- Wilful criminal activity or misconduct.

- Liabilities arising from contractual obligations unless specifically covered.

- Losses or damages covered by other insurance policies.

- Liabilities arise from professional services rendered by the insured unless specifically covered under a professional liability policy.

- Consequential losses or indirect damages resulting from covered liability incidents.

- Liabilities arising from pollution or environmental damage unless specifically covered.

- Losses or damages caused by acts of war, terrorism, or nuclear perils unless specifically covered.

Shriram Cyber Suraksha Insurance

A Cyber Insurance Policy is a specialised insurance product designed to cover a range of cyber risks and liabilities. This typically includes protection for data breaches, Identity Theft, network security liability, privacy breaches, and associated legal expenses. The policy might also encompass coverage for family members, as specified in the policy documentation. Furthermore, it may extend coverage to hardware components and incidents concerning personal devices.

Under this category, you can find the following plans:

- Shriram Theft of Funds Policy

- Shriram Identity Theft Policy

- Shriram Cyber Extortion Policy

- Shriram Network Security Liability Policy

Inclusions of Shriram Cyber Suraksha Insurance

Below mentioned is everything included in these plans:

- Provides coverage for financial losses resulting from unauthorised access to Bank accounts, credit/debit cards, or mobile wallets by a third party due to theft or phishing, including prosecution costs.

- Offers coverage for financial losses, lost wages, and expenses incurred for credit and identity monitoring due to identity theft.

- Reimburses expenses for data restoration and the decontamination of personal devices following a cyber incident.

- Covers costs associated with civil proceedings, reputation repair, psychological support, and potential relocation due to cyberbullying or stalking.

- Provides reimbursement for costs incurred to resolve cyber extortion and ransom payments with prior approval.

- Reimburses financial losses arising from fraudulent transactions conducted online.

- Provides reimbursement for financial losses resulting from selling goods online to dishonest buyers.

- Covers legal liabilities stemming from unintentional defamation or breaches of privacy rights in online media activities.

- Covers legal liabilities arising from cyber incidents on personal devices and reimburses associated legal expenses.

- Addresses legal liabilities arising from data breaches and reimburses related legal costs.

- Reimburses legal expenses for claims filed against a third party for data breaches.

- Reimburses expenses for decontamination and restoration of smart home devices following a cyber incident.

Exclusions of Shriram Cyber Suraksha Insurance

Below mentioned is everything not included in these plans:

- Pre-existing events known before the policy's commencement.

- Deliberate, malicious, or reckless actions or omissions.

- Business or professional activities.

- Acts of war, use of force, or hostile activities.

- Physical injury, mental distress, or fatalities.

- Theft, infringement, or misappropriation of patents, trademarks, and copyrights, except in social media and media liability cases.

- Claims made by one insured party against another.

- Costs for improving personal devices or smart home devices beyond their pre-event condition.

- Exclusion of cryptocurrencies, except in cases of cyber extortion for ransom payments.

- Participation in gambling activities.

- Failure or disruption of infrastructure or related services provided by specific third-party providers.

Shriram Travel Insurance

Travelling is an exhilarating experience filled with unexpected twists and turns. From flight cancellations to lost luggage or delays, mishaps can occur at any moment. Travel Insurance offers comprehensive coverage for your global adventures, safeguarding you against unforeseen incidents. Travel insurance provides peace of mind whether you're travelling domestically or abroad.

Under this category, you can find the following plans:

- Shriram Single-Trip Insurance Policy

- Shriram Annual Multi-Trip Insurance Policy

- Shriram family floater Insurance Policy

Inclusions of Shriram Travel Insurance

Below mentioned is everything included in these plans:

- Coverage for trip cancellations, interruptions, or delays due to unforeseen circumstances such as illness, accidents, or natural disasters.

- Protection against lost, stolen, or damaged luggage and personal belongings during travel.

- Medical coverage for emergencies, including hospitalisation, medical treatment, and evacuation expenses.

- Reimbursement for expenses incurred due to trip delays or missed connections.

- Assistance and coverage for lost or stolen passports, travel documents, and credit cards.

- Personal liability coverage for accidental damage or injury caused to third parties during travel.

- Additional coverage for adventure sports, pre-existing medical conditions, or high-value items is optional.

Exclusions of Shriram Travel Insurance

Below mentioned is everything not included in these plans:

- Pre-existing medical conditions not disclosed or covered under the policy.

- Travel to countries or regions with travel advisories or warnings issued by government authorities.

- Participation in high-risk activities or adventure sports not covered by the policy.

- Losses or damages caused by intentional acts, criminal activities, or under the influence of alcohol or drugs.

- Expenses related to non-emergency medical treatments or routine check-ups.

- Losses due to war, civil unrest, terrorism, nuclear events, or acts of God.

- Costs of travel or accommodation arrangements not authorised by the insurer.

- Claims arising from negligence or failure to take reasonable precautions to safeguard belongings or prevent accidents.

- Losses or damages covered by other insurance policies or compensation schemes.

- Any expenses incurred after the expiration or termination of the policy period.

Conclusion

Shriram General Insurance Company Limited offers online renewal of their policies. Customers can now buy, renew and find details about different policies offered by the company. So why wait? Buy now!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.