Table of Contents

Annualized Total Return

Basically, the formula for annualized Total Return gives an accurate estimate of the earning you could expect if the rate of return was compounded. It is important to note that the annualized total return is only used for getting a picture of the annual performance of your investment and it can’t be used to provide investors with an idea of the price fluctuations.

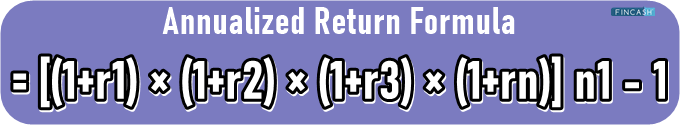

Annualized Total Return Formula

To understand the concept better, we are going to compare two Mutual Funds and their performances in the past 5 years.

A: 3%, 7%, 12%, 1%, and 5%

B: 4%, 5%, 6.7%, 6%, and 6%

Even though both funds have the same annualized rate of return, they happen to have varying Volatility. For example, A is comparatively more volatile than mutual funds B. The Standard Deviation of both stands at 4.2% and 1% respectively. No matter which investment instrument you select, you must analyze its annualized total return to get an idea of the risk statistics. Below we have mentioned the formula needed to calculate the annualized total return:

Annualized Return= ((1+r1) × (1+r2) × (1+r3) × (1+rn))n1−1

While it is mostly calculated on the annual returns, note that the annualized total returns could also be measured for a particular number of weeks or months. However, you may have to make slight changes to the formula. Let’s see how the annualized return is different from the Average Return.

Determining the annualized total return plays a vital role in making important decisions over the course of your investment period. It provides the answers in percentage – whether it’s profit or loss. The formula can be used for measuring the performance of almost all kinds of investment instruments, including but not limited to, mutual funds, stocks, Bonds, Real Estate, and small firms. The annualized total returns are especially important for investment managers that want to increase returns on investment or implement strategies that could control the risk associated with the certain investment.

Talk to our investment specialist

The formula is quite useful for the situation when you are aware of the returns in dollars, but you are supposed to calculate the exact percentage rate for the entire duration of the investment. In addition to that, the formula makes it easier for investment managers and professional investors to find out the rate of return they could expect from different types of investments in a specific period.

As mentioned above in the illustration, the annualized total return could be used to compare the financial and overall performance of different investment products. Note that the Average Annual Return is completely different from the annualized total return. Both have separate formulas and the results are also absolutely different. For example, the average annual return does not take the compounding interest into consideration, but that isn’t the case with the annualized total return.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.