Table of Contents

మ్యూచువల్ ఫండ్ vs FD (ఫిక్సెడ్ డిపాజిట్)

మ్యూచువల్ ఫండ్ vsఎఫ్ డి? డబ్బు ఆదా చేయడం గురించి ఆలోచిస్తున్నప్పుడు, చాలా మంది ప్రజలు చేసే మొదటి విషయంపెట్టుబడి పెడుతున్నారు ఫిక్స్డ్ డిపాజిట్లలో (FDలు). ఇది సాధారణంగా అర్థం చేసుకోవడం సులభం మరియు తరాల నుండి జరుగుతోంది. అయితే ఇది అత్యంత సరైన పెట్టుబడినా? మరియు ఇది ఉత్తమ రాబడిని అందజేస్తుందా? లేదా మ్యూచువల్ ఫండ్ పెట్టుబడులు ప్రయోజనాన్ని మెరుగ్గా అందిస్తాయా? ఈ ప్రశ్నలకు సమాధానాలు తెలుసుకోవడానికి, క్రింద చదవండి!

FD లేదా ఫిక్సెడ్ డిపాజిట్

ఫిక్సెడ్ డిపాజిట్, ఎఫ్డి అని కూడా పిలుస్తారుబ్యాంక్ దీర్ఘకాలిక మరియు స్వల్పకాలిక పెట్టుబడులకు తగిన పెట్టుబడి ఎంపిక. FD వడ్డీ రేటు భారత ప్రభుత్వం ముందుగా నిర్ణయించినందున FD రిటర్న్లు నిర్ణయించబడతాయి. ఫిక్స్డ్ డిపాజిట్లపై వడ్డీ రేటు స్థిరంగా ఉంది, దీని ప్రభావం ఉండదుద్రవ్యోల్బణం ఈ పెట్టుబడులపై.

అలాగే, FD రిటర్న్లు పెట్టుబడిదారుల చేతుల్లో పన్ను విధించబడతాయి. అయితే, FD పెట్టుబడులు కింద పన్ను మినహాయింపులకు బాధ్యత వహిస్తాయిసెక్షన్ 80C యొక్కఆదాయ పన్ను చట్టం

మ్యూచువల్ ఫండ్స్

మ్యూచువల్ ఫండ్ మూడు రకాలు, డెట్, ఈక్విటీ మరియు బ్యాలెన్స్డ్మ్యూచువల్ ఫండ్స్.డెట్ మ్యూచువల్ ఫండ్ ప్రభుత్వంలో చాలా ఆస్తులను పెట్టుబడి పెట్టేవిబాండ్లు, కార్పొరేట్ బాండ్లు మరియు మిగిలినవి ఈక్విటీ మార్కెట్లలో. దీనికి విరుద్ధంగా, ఈక్విటీ మ్యూచువల్ ఫండ్లు దాని ఆస్తులలో 65% కంటే ఎక్కువ ఈక్విటీ మార్కెట్లలో మరియు మిగిలిన మొత్తాన్ని ప్రభుత్వ బాండ్లు, కార్పొరేట్ బాండ్లు మరియు సెక్యూరిటీలలో పెట్టుబడి పెడతాయి. బ్యాలెన్స్డ్ మ్యూచువల్ ఫండ్స్ అంటే పాక్షికంగా అప్పులో మరియు పాక్షికంగా పెట్టుబడి పెట్టేవిఈక్విటీ ఫండ్స్. మ్యూచువల్ ఫండ్ అనేది ద్రవ్యోల్బణాన్ని అధిగమించే సాధనం, కాబట్టి ఇది మరింత పన్ను సమర్ధవంతంగా ఉంటుంది మరియు దీర్ఘకాలిక పెట్టుబడులపై మెరుగైన రాబడిని అందిస్తుందని భావిస్తున్నారు.

ఏది మంచి దీర్ఘకాలిక పెట్టుబడి?

మ్యూచువల్ ఫండ్స్ మరియు ఫిక్సెడ్ డిపాజిట్లు (FDలు) రెండూ అని ఇప్పుడు మనకు తెలుసుపన్ను ఆదా పెట్టుబడులు, తలెత్తే ప్రశ్న ఏమిటంటే - ఎక్కడ పెట్టుబడి పెట్టాలి? ఇది ఆత్మాశ్రయ ప్రశ్న అయినప్పటికీ, దానికి సమాధానం వ్యక్తికి వ్యక్తికి మారవచ్చు, మీరు ఉత్తమంగా ఎంచుకోవడానికి సహాయపడే వివిధ పారామితుల ఆధారంగా పేర్కొనబడిన పోలిక క్రింద ఉంది.

1. మ్యూచువల్ ఫండ్ రిటర్న్స్ & FD రిటర్న్స్

ఫిక్స్డ్ డిపాజిట్పై రాబడులు ముందుగా పేర్కొనబడ్డాయి మరియు పదవీకాలం అంతటా మారవు. మ్యూచువల్ ఫండ్స్, ఫైనాన్షియల్తో లింక్ చేయబడుతున్నాయిసంత, దీర్ఘకాలిక పెట్టుబడులపై మెరుగైన రాబడిని అందిస్తాయి.

2. FD వడ్డీ రేట్లు & మ్యూచువల్ ఫండ్ రిటర్న్స్

FDలపై వడ్డీ రేటు FD రకం లేదా FD వ్యవధిని బట్టి నిర్ణయించబడుతుంది, కాబట్టి ఫిక్స్డ్ డిపాజిట్లపై అధిక వడ్డీ రేట్లను ఆశించలేరు. మరోవైపు, వివిధ రకాల ఫండ్లు అస్థిరమైన రాబడిని అందిస్తాయి కాబట్టి మ్యూచువల్ ఫండ్లపై రాబడి మారుతూ ఉంటుంది. మార్కెట్ ఎక్కువగా ఉంటే రాబడులు పెరుగుతాయి మరియు దీనికి విరుద్ధంగా.

3. ప్రమాద కారకాలు

రాబడులు ముందుగా నిర్ణయించబడినందున ఫిక్స్డ్ డిపాజిట్లు ఎటువంటి ప్రమాదాన్ని కలిగి ఉండవు. అలాగే, బ్యాంక్ బస్ట్ చేయబడితే, అన్ని బ్యాంక్ ఖాతాలు INR 1 లక్ష వరకు బీమా చేయబడతాయి. మరోవైపు, మ్యూచువల్ ఫండ్లు తమ ఆస్తులను ఫైనాన్షియల్ మార్కెట్లో పెట్టుబడి పెట్టడం వల్ల ఎక్కువ రిస్క్ ఉంటుంది. ఈక్విటీ మ్యూచువల్ ఫండ్లు, ఈక్విటీ మార్కెట్లలో చాలా వరకు ఆస్తులు పెట్టుబడి పెట్టడం వల్ల చాలా ఎక్కువ రిస్క్ ఉంటుంది. డెట్ మ్యూచువల్ ఫండ్స్లో పెట్టుబడి పెట్టడం తక్కువ ప్రమాదకరం, ఎందుకంటే ఈ ఫండ్లలో చాలా తక్కువ భాగం స్టాక్ మార్కెట్లో పెట్టుబడి పెట్టబడుతుంది.

Talk to our investment specialist

4. ద్రవ్యోల్బణం ప్రభావం

వడ్డీ రేటు ముందుగా నిర్ణయించినందున, ఫిక్స్డ్ డిపాజిట్లపై ద్రవ్యోల్బణం ప్రభావం ఉండదు. అయితే, మ్యూచువల్ ఫండ్ల కోసం, రాబడులు ద్రవ్యోల్బణం-సర్దుబాటులో ఉంటాయి, ఇది మెరుగైన రాబడిని సంపాదించే సామర్థ్యాన్ని పెంచుతుంది.

5. మూలధన లాభాలు

లేవురాజధాని FDల విషయంలో లాభాలు సాధ్యమవుతాయి. మ్యూచువల్ ఫండ్స్ కోసం,మూలధన లాభాలు హోల్డింగ్ వ్యవధిపై ఆధారపడి ఉంటుంది. వివిధ మ్యూచువల్ ఫండ్లు విభిన్న మూలధన లాభాలను అందిస్తాయి.

6. లిక్విడిటీ

ఫిక్స్డ్ డిపాజిట్లు ఉంటాయిలిక్విడ్, పెట్టుబడి పెట్టిన మొత్తం కొంత సమయం వరకు లాక్ చేయబడి ఉంటుంది. ఆ వ్యవధిలోపు డబ్బును విత్డ్రా చేస్తే, కొంత పెనాల్టీ తీసివేయబడుతుంది. మ్యూచువల్ ఫండ్లు లిక్విడ్గా ఉంటాయి కాబట్టి అవి ఎక్కువ కారణం లేకుండా తక్కువ వ్యవధిలో విక్రయించబడతాయితరుగుదల ఫండ్ విలువలో. అయితే, కొన్ని మ్యూచువల్ ఫండ్లను విక్రయించేటప్పుడు వర్తించే ఎగ్జిట్ లోడ్లను తనిఖీ చేయడం ముఖ్యం.

7. పన్ను విధింపు

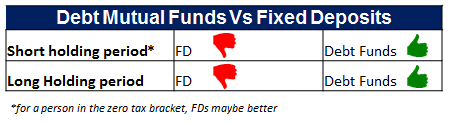

ఫిక్స్డ్ డిపాజిట్పై వడ్డీ వ్యక్తి యొక్క పన్ను స్లాబ్ ప్రకారం పన్ను విధించబడుతుంది. మరోవైపు,మ్యూచువల్ ఫండ్ పన్ను ప్రధానంగా హోల్డింగ్ వ్యవధిపై ఆధారపడి ఉంటుంది. షార్ట్ టర్మ్ క్యాపిటల్ గెయిన్స్ (STCG) మరియు లాంగ్ టర్మ్ క్యాపిటల్ గెయిన్స్ (LTCG) రెండూ వేర్వేరుగా పన్ను విధించబడతాయి.

8. పన్ను ఆదా FD యొక్క V/S ఈక్విటీ లింక్డ్ సేవింగ్ స్కీమ్లు (ELSS)

IT చట్టంలోని సెక్షన్ 80c కింద పన్ను ఆదా ప్రయోజనం కోసం FDలను పరిశీలిస్తున్న పెట్టుబడిదారుల కోసం. (5 సంవత్సరాల లాక్కిన్)ELSS మ్యూచువల్ ఫండ్లు 3 సంవత్సరాల లాక్-ఇన్ను కలిగి ఉన్నందున మంచి ప్రత్యామ్నాయం మరియు చారిత్రాత్మకంగా మెరుగైన రాబడిని అందిస్తున్నాయి.

ఏది బెటర్ ఇన్వెస్ట్మెంట్ ప్లాన్?

క్లుప్తంగా చూద్దాం:

| పరామితి | మ్యూచువల్ ఫండ్ | స్థిర నిధి |

|---|---|---|

| రాబడి రేటు | హామీ ఇవ్వబడిన రిటర్న్లు లేవు | స్థిర రిటర్న్స్ |

| ద్రవ్యోల్బణం సర్దుబాటు చేసిన రాబడులు | అధిక ద్రవ్యోల్బణం సర్దుబాటు చేసిన రాబడులకు సంభావ్యత | సాధారణంగా తక్కువ ద్రవ్యోల్బణం సర్దుబాటు చేసిన రాబడులు |

| ప్రమాదం | మీడియం నుండి హై రిస్క్ | తక్కువ ప్రమాదం |

| ద్రవ్యత | ద్రవం | ద్రవం |

| అకాల ఉపసంహరణ | ఎగ్జిట్ లోడ్/ లోడ్ లేకుండా అనుమతించబడుతుంది | పెనాల్టీతో అనుమతించబడింది |

| పెట్టుబడి ఖర్చు | నిర్వహణ ఖర్చు/వ్యయ నిష్పత్తి | ఖర్చు లేదు |

| పన్ను స్థితి | అనుకూలమైన పన్ను స్థితి | పన్ను స్లాబ్ ప్రకారం |

2022లో పెట్టుబడి పెట్టడానికి ఉత్తమ మ్యూచువల్ ఫండ్లు

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) Nippon India Small Cap Fund Growth ₹153.997

↑ 0.65 ₹50,826 -7 -14.8 5.4 20.1 38.3 26.1 ICICI Prudential Infrastructure Fund Growth ₹179.84

↑ 1.67 ₹6,886 -0.1 -8.3 6.6 27.4 37.4 27.4 Motilal Oswal Midcap 30 Fund Growth ₹90.8845

↑ 0.82 ₹23,704 -9.8 -15.7 13.6 24.6 35.1 57.1 IDFC Infrastructure Fund Growth ₹47.008

↑ 0.57 ₹1,400 -4.7 -13.8 4.3 24.7 35 39.3 Nippon India Power and Infra Fund Growth ₹322.789

↑ 3.27 ₹6,125 -3.3 -12 2.6 27.2 35 26.9 SBI Contra Fund Growth ₹363.109

↑ 3.77 ₹39,590 -1.1 -7.3 5.3 20.4 34.4 18.8 L&T Emerging Businesses Fund Growth ₹73.438

↑ 0.18 ₹13,334 -11.3 -18.5 1.6 16.5 34.3 28.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 17 Apr 25

* క్రింద 7 జాబితా ఉందిఉత్తమ మ్యూచువల్ ఫండ్స్ నికర ఆస్తులు/AUM కంటే ఎక్కువ The primary investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related instruments of small cap companies and the secondary objective is to generate consistent returns by investing in debt and money market securities. Nippon India Small Cap Fund is a Equity - Small Cap fund was launched on 16 Sep 10. It is a fund with Moderately High risk and has given a Below is the key information for Nippon India Small Cap Fund Returns up to 1 year are on To generate capital appreciation and income distribution to unit holders by investing predominantly in equity/equity related securities of the companies belonging to the infrastructure development and balance in debt securities and money market instruments. ICICI Prudential Infrastructure Fund is a Equity - Sectoral fund was launched on 31 Aug 05. It is a fund with High risk and has given a Below is the key information for ICICI Prudential Infrastructure Fund Returns up to 1 year are on (Erstwhile Motilal Oswal MOSt Focused Midcap 30 Fund) The investment objective of the Scheme is to achieve long term capital appreciation by investing in a maximum of 30 quality mid-cap companies having long-term competitive advantages and potential for growth. However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved. Motilal Oswal Midcap 30 Fund is a Equity - Mid Cap fund was launched on 24 Feb 14. It is a fund with Moderately High risk and has given a Below is the key information for Motilal Oswal Midcap 30 Fund Returns up to 1 year are on The investment objective of the scheme is to seek to generate long-term capital growth through an active diversified portfolio of predominantly equity and equity related instruments of companies that are participating in and benefiting from growth in Indian infrastructure and infrastructural related activities. However, there can be no assurance that the investment objective of the scheme will be realized. IDFC Infrastructure Fund is a Equity - Sectoral fund was launched on 8 Mar 11. It is a fund with High risk and has given a Below is the key information for IDFC Infrastructure Fund Returns up to 1 year are on (Erstwhile Reliance Diversified Power Sector Fund) The primary investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related securities of companies in the power sector. Nippon India Power and Infra Fund is a Equity - Sectoral fund was launched on 8 May 04. It is a fund with High risk and has given a Below is the key information for Nippon India Power and Infra Fund Returns up to 1 year are on To provide the investors maximum growth opportunity through equity

investments in stocks of growth oriented sectors of the economy. SBI Contra Fund is a Equity - Contra fund was launched on 6 May 05. It is a fund with Moderately High risk and has given a Below is the key information for SBI Contra Fund Returns up to 1 year are on To generate long-term capital appreciation from a diversified portfolio of predominantly equity and equity related securities, including equity derivatives, in the Indian markets with key theme focus being emerging companies (small cap stocks). The Scheme could also additionally invest in Foreign Securities. L&T Emerging Businesses Fund is a Equity - Small Cap fund was launched on 12 May 14. It is a fund with High risk and has given a Below is the key information for L&T Emerging Businesses Fund Returns up to 1 year are on 100 కోట్లు. 5 సంవత్సరాలలో క్రమబద్ధీకరించబడిందిCAGR/ వార్షికంగా తిరిగి వస్తుంది.1. Nippon India Small Cap Fund

CAGR/Annualized return of 20.6% since its launch. Ranked 6 in Small Cap category. Return for 2024 was 26.1% , 2023 was 48.9% and 2022 was 6.5% . Nippon India Small Cap Fund

Growth Launch Date 16 Sep 10 NAV (17 Apr 25) ₹153.997 ↑ 0.65 (0.42 %) Net Assets (Cr) ₹50,826 on 28 Feb 25 Category Equity - Small Cap AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.55 Sharpe Ratio -0.31 Information Ratio 0.66 Alpha Ratio 3.26 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹21,742 31 Mar 22 ₹31,334 31 Mar 23 ₹33,418 31 Mar 24 ₹51,907 31 Mar 25 ₹55,076 Returns for Nippon India Small Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 8.2% 3 Month -7% 6 Month -14.8% 1 Year 5.4% 3 Year 20.1% 5 Year 38.3% 10 Year 15 Year Since launch 20.6% Historical performance (Yearly) on absolute basis

Year Returns 2023 26.1% 2022 48.9% 2021 6.5% 2020 74.3% 2019 29.2% 2018 -2.5% 2017 -16.7% 2016 63% 2015 5.6% 2014 15.1% Fund Manager information for Nippon India Small Cap Fund

Name Since Tenure Samir Rachh 2 Jan 17 8.16 Yr. Kinjal Desai 25 May 18 6.77 Yr. Data below for Nippon India Small Cap Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 22.17% Consumer Cyclical 13.91% Financial Services 13.54% Basic Materials 12.14% Consumer Defensive 8.89% Technology 8.65% Health Care 8.16% Energy 2.03% Utility 1.98% Communication Services 1.54% Real Estate 0.54% Asset Allocation

Asset Class Value Cash 6.04% Equity 93.96% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Apr 22 | HDFCBANK2% ₹1,152 Cr 6,650,000 Multi Commodity Exchange of India Ltd (Financial Services)

Equity, Since 28 Feb 21 | MCX2% ₹924 Cr 1,851,010 Kirloskar Brothers Ltd (Industrials)

Equity, Since 31 Oct 12 | KIRLOSBROS1% ₹714 Cr 4,472,130 Dixon Technologies (India) Ltd (Technology)

Equity, Since 30 Nov 18 | DIXON1% ₹655 Cr 470,144 Karur Vysya Bank Ltd (Financial Services)

Equity, Since 28 Feb 17 | 5900031% ₹639 Cr 31,784,062 State Bank of India (Financial Services)

Equity, Since 31 Oct 19 | SBIN1% ₹627 Cr 9,100,000 Tube Investments of India Ltd Ordinary Shares (Industrials)

Equity, Since 30 Apr 18 | TIINDIA1% ₹615 Cr 2,499,222 NLC India Ltd (Utilities)

Equity, Since 31 Oct 22 | NLCINDIA1% ₹563 Cr 27,190,940 Adani Wilmar Ltd (Consumer Defensive)

Equity, Since 31 Jan 25 | 5434581% ₹553 Cr 22,483,343

↑ 183,343 Apar Industries Ltd (Industrials)

Equity, Since 31 Mar 17 | APARINDS1% ₹521 Cr 899,271 2. ICICI Prudential Infrastructure Fund

CAGR/Annualized return of 15.9% since its launch. Ranked 27 in Sectoral category. Return for 2024 was 27.4% , 2023 was 44.6% and 2022 was 28.8% . ICICI Prudential Infrastructure Fund

Growth Launch Date 31 Aug 05 NAV (17 Apr 25) ₹179.84 ↑ 1.67 (0.94 %) Net Assets (Cr) ₹6,886 on 28 Feb 25 Category Equity - Sectoral AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 2.22 Sharpe Ratio -0.25 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹18,670 31 Mar 22 ₹25,304 31 Mar 23 ₹30,899 31 Mar 24 ₹50,465 31 Mar 25 ₹54,540 Returns for ICICI Prudential Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 7.3% 3 Month -0.1% 6 Month -8.3% 1 Year 6.6% 3 Year 27.4% 5 Year 37.4% 10 Year 15 Year Since launch 15.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 27.4% 2022 44.6% 2021 28.8% 2020 50.1% 2019 3.6% 2018 2.6% 2017 -14% 2016 40.8% 2015 2% 2014 -3.4% Fund Manager information for ICICI Prudential Infrastructure Fund

Name Since Tenure Ihab Dalwai 3 Jun 17 7.75 Yr. Sharmila D’mello 30 Jun 22 2.67 Yr. Data below for ICICI Prudential Infrastructure Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 36.49% Basic Materials 21.39% Financial Services 16.91% Utility 8.65% Energy 7.09% Communication Services 1.63% Consumer Cyclical 0.89% Real Estate 0.35% Asset Allocation

Asset Class Value Cash 5.98% Equity 93.39% Debt 0.62% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 09 | LT9% ₹649 Cr 2,052,790

↑ 126,940 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 May 24 | ADANIPORTS4% ₹288 Cr 2,695,324 Shree Cement Ltd (Basic Materials)

Equity, Since 30 Apr 24 | 5003874% ₹268 Cr 98,408

↓ -10,339 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Dec 16 | ICICIBANK3% ₹240 Cr 1,990,000 NTPC Ltd (Utilities)

Equity, Since 29 Feb 16 | 5325553% ₹226 Cr 7,260,775 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 22 | HDFCBANK3% ₹212 Cr 1,225,000 NCC Ltd (Industrials)

Equity, Since 31 Aug 21 | NCC3% ₹210 Cr 12,006,117

↑ 1,500,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Jul 23 | RELIANCE3% ₹205 Cr 1,709,486

↑ 100,000 Vedanta Ltd (Basic Materials)

Equity, Since 31 Jul 24 | 5002953% ₹194 Cr 4,923,662

↑ 100,000 Cummins India Ltd (Industrials)

Equity, Since 31 May 17 | 5004803% ₹173 Cr 635,000 3. Motilal Oswal Midcap 30 Fund

CAGR/Annualized return of 21.9% since its launch. Ranked 27 in Mid Cap category. Return for 2024 was 57.1% , 2023 was 41.7% and 2022 was 10.7% . Motilal Oswal Midcap 30 Fund

Growth Launch Date 24 Feb 14 NAV (17 Apr 25) ₹90.8845 ↑ 0.82 (0.91 %) Net Assets (Cr) ₹23,704 on 28 Feb 25 Category Equity - Mid Cap AMC Motilal Oswal Asset Management Co. Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 0.66 Sharpe Ratio 0.43 Information Ratio 0.72 Alpha Ratio 16.87 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,888 31 Mar 22 ₹23,342 31 Mar 23 ₹25,677 31 Mar 24 ₹41,172 31 Mar 25 ₹48,151 Returns for Motilal Oswal Midcap 30 Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 2.1% 3 Month -9.8% 6 Month -15.7% 1 Year 13.6% 3 Year 24.6% 5 Year 35.1% 10 Year 15 Year Since launch 21.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 57.1% 2022 41.7% 2021 10.7% 2020 55.8% 2019 9.3% 2018 9.7% 2017 -12.7% 2016 30.8% 2015 5.2% 2014 16.5% Fund Manager information for Motilal Oswal Midcap 30 Fund

Name Since Tenure Ajay Khandelwal 1 Oct 24 0.41 Yr. Niket Shah 1 Jul 20 4.67 Yr. Rakesh Shetty 22 Nov 22 2.27 Yr. Sunil Sawant 1 Jul 24 0.67 Yr. Data below for Motilal Oswal Midcap 30 Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Technology 34.02% Consumer Cyclical 16.09% Industrials 11.09% Health Care 5% Communication Services 3.44% Real Estate 2.8% Basic Materials 2.32% Utility 2.06% Financial Services 0.09% Asset Allocation

Asset Class Value Cash 28.33% Equity 71.67% Top Securities Holdings / Portfolio

Name Holding Value Quantity Coforge Ltd (Technology)

Equity, Since 31 Mar 23 | COFORGE10% ₹2,349 Cr 3,190,000

↑ 340,000 Persistent Systems Ltd (Technology)

Equity, Since 31 Jan 23 | PERSISTENT10% ₹2,254 Cr 4,249,800

↑ 249,800 Kalyan Jewellers India Ltd (Consumer Cyclical)

Equity, Since 29 Feb 24 | KALYANKJIL7% ₹1,619 Cr 35,027,075

↑ 26,975 Dixon Technologies (India) Ltd (Technology)

Equity, Since 31 Mar 23 | DIXON7% ₹1,581 Cr 1,134,324

↑ 134,324 Max Healthcare Institute Ltd Ordinary Shares (Healthcare)

Equity, Since 31 Mar 24 | MAXHEALTH4% ₹975 Cr 9,969,361

↑ 1,913,231 One97 Communications Ltd (Technology)

Equity, Since 30 Sep 24 | 5433964% ₹934 Cr 13,066,359

↑ 3,065,359 Trent Ltd (Consumer Cyclical)

Equity, Since 30 Nov 24 | 5002514% ₹873 Cr 1,800,000

↓ -820,200 Polycab India Ltd (Industrials)

Equity, Since 30 Sep 23 | POLYCAB3% ₹825 Cr 1,750,000

↓ -100,000 Bharti Hexacom Ltd (Communication Services)

Equity, Since 31 Oct 24 | BHARTIHEXA3% ₹815 Cr 6,250,000

↑ 174,429 KEI Industries Ltd (Industrials)

Equity, Since 30 Nov 24 | KEI3% ₹768 Cr 2,500,000

↑ 1,250,000 4. IDFC Infrastructure Fund

CAGR/Annualized return of 11.6% since its launch. Ranked 1 in Sectoral category. Return for 2024 was 39.3% , 2023 was 50.3% and 2022 was 1.7% . IDFC Infrastructure Fund

Growth Launch Date 8 Mar 11 NAV (17 Apr 25) ₹47.008 ↑ 0.57 (1.23 %) Net Assets (Cr) ₹1,400 on 28 Feb 25 Category Equity - Sectoral AMC IDFC Asset Management Company Limited Rating ☆☆☆☆☆ Risk High Expense Ratio 2.33 Sharpe Ratio -0.3 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹20,153 31 Mar 22 ₹24,848 31 Mar 23 ₹27,324 31 Mar 24 ₹47,064 31 Mar 25 ₹50,038 Returns for IDFC Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 10.1% 3 Month -4.7% 6 Month -13.8% 1 Year 4.3% 3 Year 24.7% 5 Year 35% 10 Year 15 Year Since launch 11.6% Historical performance (Yearly) on absolute basis

Year Returns 2023 39.3% 2022 50.3% 2021 1.7% 2020 64.8% 2019 6.3% 2018 -5.3% 2017 -25.9% 2016 58.7% 2015 10.7% 2014 -0.2% Fund Manager information for IDFC Infrastructure Fund

Name Since Tenure Vishal Biraia 24 Jan 24 1.1 Yr. Ritika Behera 7 Oct 23 1.4 Yr. Gaurav Satra 7 Jun 24 0.73 Yr. Data below for IDFC Infrastructure Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 54.7% Utility 13.22% Basic Materials 10.84% Communication Services 4.49% Energy 3.88% Consumer Cyclical 3.46% Financial Services 2.99% Technology 2.07% Health Care 1.9% Asset Allocation

Asset Class Value Cash 2.43% Equity 97.57% Top Securities Holdings / Portfolio

Name Holding Value Quantity Kirloskar Brothers Ltd (Industrials)

Equity, Since 31 Dec 17 | KIRLOSBROS5% ₹71 Cr 443,385 Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 12 | LT4% ₹58 Cr 183,173

↑ 11,726 Reliance Industries Ltd (Energy)

Equity, Since 30 Jun 24 | RELIANCE4% ₹54 Cr 452,706 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 19 | BHARTIARTL4% ₹52 Cr 330,018

↑ 40,855 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Mar 14 | 5325384% ₹51 Cr 50,452

↑ 3,476 GPT Infraprojects Ltd (Industrials)

Equity, Since 30 Nov 17 | GPTINFRA3% ₹45 Cr 4,797,143 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 Dec 23 | ADANIPORTS3% ₹39 Cr 365,137

↓ -69,842 PTC India Financial Services Ltd (Financial Services)

Equity, Since 31 Dec 23 | PFS3% ₹39 Cr 12,400,122 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Oct 19 | BEL3% ₹35 Cr 1,431,700 KEC International Ltd (Industrials)

Equity, Since 30 Jun 24 | 5327143% ₹35 Cr 512,915 5. Nippon India Power and Infra Fund

CAGR/Annualized return of 18% since its launch. Ranked 13 in Sectoral category. Return for 2024 was 26.9% , 2023 was 58% and 2022 was 10.9% . Nippon India Power and Infra Fund

Growth Launch Date 8 May 04 NAV (17 Apr 25) ₹322.789 ↑ 3.27 (1.02 %) Net Assets (Cr) ₹6,125 on 28 Feb 25 Category Equity - Sectoral AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 2.05 Sharpe Ratio -0.55 Information Ratio 1.03 Alpha Ratio 1.38 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹18,563 31 Mar 22 ₹23,186 31 Mar 23 ₹26,891 31 Mar 24 ₹47,550 31 Mar 25 ₹48,861 Returns for Nippon India Power and Infra Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 8.8% 3 Month -3.3% 6 Month -12% 1 Year 2.6% 3 Year 27.2% 5 Year 35% 10 Year 15 Year Since launch 18% Historical performance (Yearly) on absolute basis

Year Returns 2023 26.9% 2022 58% 2021 10.9% 2020 48.9% 2019 10.8% 2018 -2.9% 2017 -21.1% 2016 61.7% 2015 0.1% 2014 0.3% Fund Manager information for Nippon India Power and Infra Fund

Name Since Tenure Kinjal Desai 25 May 18 6.77 Yr. Rahul Modi 19 Aug 24 0.53 Yr. Data below for Nippon India Power and Infra Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 40.77% Utility 19.49% Energy 9.09% Basic Materials 9.08% Communication Services 8.44% Real Estate 3.99% Technology 2.14% Health Care 2.08% Consumer Cyclical 1.96% Financial Services 1.78% Asset Allocation

Asset Class Value Cash 1.18% Equity 98.82% Top Securities Holdings / Portfolio

Name Holding Value Quantity Reliance Industries Ltd (Energy)

Equity, Since 30 Nov 18 | RELIANCE8% ₹480 Cr 4,000,000

↑ 250,000 NTPC Ltd (Utilities)

Equity, Since 31 May 09 | 5325558% ₹480 Cr 15,400,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 07 | LT8% ₹472 Cr 1,492,001 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 18 | BHARTIARTL7% ₹408 Cr 2,600,000 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Oct 19 | 5325384% ₹243 Cr 240,038 Tata Power Co Ltd (Utilities)

Equity, Since 30 Apr 23 | 5004004% ₹237 Cr 6,975,789

↑ 500,000 Kaynes Technology India Ltd (Industrials)

Equity, Since 30 Nov 22 | KAYNES3% ₹176 Cr 423,938 Siemens Ltd (Industrials)

Equity, Since 31 May 21 | 5005503% ₹162 Cr 350,000 CG Power & Industrial Solutions Ltd (Industrials)

Equity, Since 30 Sep 24 | 5000932% ₹151 Cr 2,632,923

↑ 80,000 Carborundum Universal Ltd (Industrials)

Equity, Since 30 Sep 23 | CARBORUNIV2% ₹150 Cr 1,800,000 6. SBI Contra Fund

CAGR/Annualized return of 14.9% since its launch. Ranked 48 in Contra category. Return for 2024 was 18.8% , 2023 was 38.2% and 2022 was 12.8% . SBI Contra Fund

Growth Launch Date 6 May 05 NAV (17 Apr 25) ₹363.109 ↑ 3.77 (1.05 %) Net Assets (Cr) ₹39,590 on 28 Feb 25 Category Equity - Contra AMC SBI Funds Management Private Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 1.7 Sharpe Ratio -0.24 Information Ratio 1.96 Alpha Ratio 0.91 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹20,310 31 Mar 22 ₹26,477 31 Mar 23 ₹29,993 31 Mar 24 ₹44,365 31 Mar 25 ₹47,483 Returns for SBI Contra Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 5.5% 3 Month -1.1% 6 Month -7.3% 1 Year 5.3% 3 Year 20.4% 5 Year 34.4% 10 Year 15 Year Since launch 14.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 18.8% 2022 38.2% 2021 12.8% 2020 49.9% 2019 30.6% 2018 -1% 2017 -14.3% 2016 40.2% 2015 2.4% 2014 -0.1% Fund Manager information for SBI Contra Fund

Name Since Tenure Dinesh Balachandran 7 May 18 6.82 Yr. Pradeep Kesavan 1 Dec 23 1.25 Yr. Data below for SBI Contra Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 22.65% Technology 8.84% Basic Materials 7.09% Health Care 7.08% Energy 6.82% Consumer Cyclical 5.38% Utility 5.12% Consumer Defensive 4.3% Industrials 4.21% Communication Services 3.01% Real Estate 0.52% Asset Allocation

Asset Class Value Cash 23.8% Equity 75.02% Debt 1.18% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Aug 16 | HDFCBANK8% ₹3,071 Cr 17,724,629

↑ 5,001,500 Reliance Industries Ltd (Energy)

Equity, Since 31 Mar 23 | RELIANCE4% ₹1,480 Cr 12,328,250 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Mar 24 | KOTAKBANK3% ₹1,219 Cr 6,405,768

↑ 1,277,600 Tech Mahindra Ltd (Technology)

Equity, Since 31 Mar 22 | 5327552% ₹861 Cr 5,786,409 GAIL (India) Ltd (Utilities)

Equity, Since 28 Feb 21 | 5321552% ₹811 Cr 51,993,788 Cognizant Technology Solutions Corp Class A (Technology)

Equity, Since 28 Feb 23 | CTSH2% ₹786 Cr 1,079,430 Torrent Power Ltd (Utilities)

Equity, Since 31 Oct 21 | 5327792% ₹778 Cr 6,163,300 Tata Steel Ltd (Basic Materials)

Equity, Since 31 Jul 22 | TATASTEEL2% ₹727 Cr 52,995,525 State Bank of India (Financial Services)

Equity, Since 31 Dec 10 | SBIN2% ₹706 Cr 10,254,269 91 Days Tbill Red 24-04-2025

Sovereign Bonds | -2% ₹693 Cr 70,000,000 7. L&T Emerging Businesses Fund

CAGR/Annualized return of 20% since its launch. Ranked 2 in Small Cap category. Return for 2024 was 28.5% , 2023 was 46.1% and 2022 was 1% . L&T Emerging Businesses Fund

Growth Launch Date 12 May 14 NAV (17 Apr 25) ₹73.438 ↑ 0.18 (0.25 %) Net Assets (Cr) ₹13,334 on 28 Feb 25 Category Equity - Small Cap AMC L&T Investment Management Ltd Rating ☆☆☆☆☆ Risk High Expense Ratio 1.73 Sharpe Ratio -0.4 Information Ratio -0.11 Alpha Ratio 1.44 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹20,010 31 Mar 22 ₹29,870 31 Mar 23 ₹31,289 31 Mar 24 ₹46,026 31 Mar 25 ₹48,026 Returns for L&T Emerging Businesses Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 17 Apr 25 Duration Returns 1 Month 7.3% 3 Month -11.3% 6 Month -18.5% 1 Year 1.6% 3 Year 16.5% 5 Year 34.3% 10 Year 15 Year Since launch 20% Historical performance (Yearly) on absolute basis

Year Returns 2023 28.5% 2022 46.1% 2021 1% 2020 77.4% 2019 15.5% 2018 -8.1% 2017 -13.7% 2016 66.5% 2015 10.2% 2014 12.3% Fund Manager information for L&T Emerging Businesses Fund

Name Since Tenure Venugopal Manghat 17 Dec 19 5.21 Yr. Cheenu Gupta 1 Oct 23 1.42 Yr. Sonal Gupta 1 Oct 23 1.42 Yr. Data below for L&T Emerging Businesses Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 24.78% Consumer Cyclical 15.58% Financial Services 14.01% Basic Materials 10.75% Technology 9.78% Health Care 5.55% Real Estate 4.98% Consumer Defensive 4.06% Energy 1.26% Asset Allocation

Asset Class Value Cash 6.91% Equity 93.09% Top Securities Holdings / Portfolio

Name Holding Value Quantity Neuland Laboratories Limited

Equity, Since 31 Jan 24 | -2% ₹310 Cr 292,479

↓ -6,521 Aditya Birla Real Estate Ltd (Basic Materials)

Equity, Since 30 Sep 22 | 5000402% ₹297 Cr 1,595,574 Suven Pharmaceuticals Ltd (Healthcare)

Equity, Since 31 Mar 20 | SUVENPHAR2% ₹279 Cr 2,298,085 K.P.R. Mill Ltd (Consumer Cyclical)

Equity, Since 28 Feb 15 | KPRMILL2% ₹263 Cr 3,286,897 BSE Ltd (Financial Services)

Equity, Since 29 Feb 24 | BSE2% ₹257 Cr 555,021

↓ -297,579 Time Technoplast Ltd (Consumer Cyclical)

Equity, Since 31 Jan 24 | TIMETECHNO2% ₹243 Cr 6,810,500 Karur Vysya Bank Ltd (Financial Services)

Equity, Since 31 Oct 22 | 5900032% ₹240 Cr 11,912,400 Brigade Enterprises Ltd (Real Estate)

Equity, Since 31 Jul 19 | 5329292% ₹237 Cr 2,499,622 The Federal Bank Ltd (Financial Services)

Equity, Since 30 Sep 22 | FEDERALBNK2% ₹236 Cr 13,286,579 Sumitomo Chemical India Ltd Ordinary Shares (Basic Materials)

Equity, Since 31 Oct 20 | SUMICHEM2% ₹215 Cr 4,672,221

ఆర్థిక ప్రణాళిక మీ నిర్వహణకు కీలకంఆదాయం మరియు ఖర్చులు. కాబట్టి, మీది ఏమిటిఆర్థిక లక్ష్యం? తెలివిగా విశ్లేషించి పెట్టుబడి పెట్టండి!

ఇక్కడ అందించిన సమాచారం ఖచ్చితమైనదని నిర్ధారించడానికి అన్ని ప్రయత్నాలు చేయబడ్డాయి. అయినప్పటికీ, డేటా యొక్క ఖచ్చితత్వానికి సంబంధించి ఎటువంటి హామీలు ఇవ్వబడవు. దయచేసి ఏదైనా పెట్టుబడి పెట్టే ముందు పథకం సమాచార పత్రంతో ధృవీకరించండి.

Great Read. Clarified my doubts.