Table of Contents

- Warren Buffett Investment Quotes

- Someone is sitting in the shade of a tree today because someone planted a tree a long time ago

- Risk comes from not knowing what you are doing

- The investor of today does not profit from yesterday’s growth

- It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price

- Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years

- We’re still in a Recession. We’re not gonna be out for a while, but we will get out

- Never invest in a business you cannot understand

- We don’t have to be smarter than the rest. We have to be more disciplined than the rest

- Never depend on a single Income. Make an investment to create a second source

- Don’t put all your eggs in basket

- Conclusion

10 Successful Investment Quotes from Warren Buffett

Who doesn’t know Warren Buffett! He is the world’s most renowned tycoon, investor and philanthropist, and the chairman & CEO of Berkshire Hathaway. To add more, he is also known as the “Oracle of Omaha”, “Sage of Omaha” and “Wizard of Omaha”.

When it comes to Investing, Warren Buffett has emerged as the most successful investor of all times. His Net worth of US$88.9 billion (as of December 2019) makes him the fourth richest person in the world.

After knowing his achievement, who doesn’t want to follow his piece of wisdom! Here are some interesting warren buffett quotes that will definitely inspire you to invest smartly & wisely.

Warren Buffett Investment Quotes

Someone is sitting in the shade of a tree today because someone planted a tree a long time ago

The above quote speaks a lot of aspects of life. For instance, you don’t have to do extraordinary exercise to improve your health. You just need to do it in the right way, in the right direction. Likewise, focus on the right investment to gain maximum benefits. Give time for your investment to grow and you will reap the benefits.

Many people delay investing and hesitate to invest due to the fear of loss. You don't have to stop investing due to fear. All you need to do is invest in the right way with adequate knowledge. Also, as the above quote of Warren Buffett interprets the maximum benefits of long-term investment- be patient and let the money grow!

Risk comes from not knowing what you are doing

Buffett spends hours of everyday reading, and he has done this for most of his life. The point is, the better you educate yourself on a topic, the better equipped you’ll be to make wise decisions and avoid unnecessary risks. Likewise, when it comes to investments, you should know everything about where you are investing your money.

Never invest in a company with high debt levels, choose a company with consistent and predictable Earnings. To add, Warren Buffett says “If you put a heavy weight on certainty the whole idea of a risk Factor doesn’t make any sense to me”. Therefore, risk comes from not knowing what you’re doing.“

Talk to our investment specialist

The investor of today does not profit from yesterday’s growth

Looking at the previous record before investing will not help you grow. Focus on future trends and it will give you good benefits. Pick up sectors that have the potential to perform in the long-run. Your investments won’t grow immediately, give it time, it will perform in the long-run.

It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price

If you know, Warren Buffett religiously follows principles of Value investing. This was taught to him by his mentor Benjamin Graham. He was taught to buy stocks that were trading way below their actual value (Intrinsic Value). So, when the Market corrects, the price will go up.

On the other hand, the “wonderful business” will continue to deliver more profits, compounding over the years. Such companies are able to consistently produce high returns on equity with little debt. One of the examples of Buffett is the investment in Coca Cola that delivers decades of steady returns.

Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years

This explains that you need to pick your investments wisely. If you invest in a company after understanding its business and the future potential it will likely perform well in the long-run and short-term price fluctuations will matter less to you.

You should assess the company’s strengths and weaknesses in the long-term and look at the unique advantages of the Industry that will successfully run the businesses for a long time.

For instance, if you invest in Equity Mutual Funds, you know you don’t have to worry about short market fluctuations because, in the long-run, you will get good returns.

We’re still in a Recession. We’re not gonna be out for a while, but we will get out

Most of the investors create chaos at the time of recession. Also, they hold a fear of loss and decide to sell. But, it isn’t the right step. Instead, you should be calm without thinking about the consequences.

As the above quote means, one or the other day the recession will come to end and you will get out. These are the temporary problems which need to be handled calmly.

Never invest in a business you cannot understand

This quote is very interesting as it shows how to invest your money in the safest manner. Warren says that investors should know where they are putting the money. Never put your money into a business, you do not understand. Take time to understand the company, analyse their financial, study the management team and know the company’s unique advantages.

Tip- If you think understanding a company or doing your research is not your cup of tea, then you can always take the help of an advisor. Else, invest in something where you don’t have to do much, for instance- Mutual Funds. Here, every fund is backed by a fund manager who manages the fund for you. Also, since MFs are not directly linked to the market, the risks are lesser than that of a stock.

We don’t have to be smarter than the rest. We have to be more disciplined than the rest

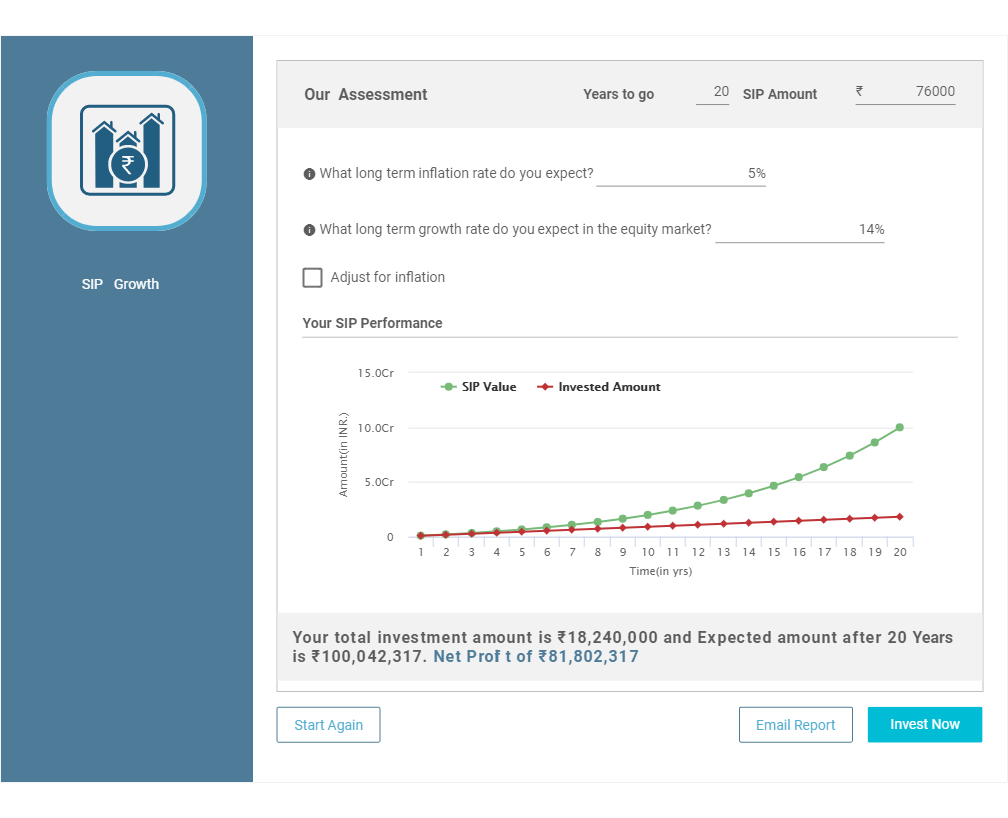

Most people think- investing in bulk will give higher returns. This isn't true! Returns depend on investment and the duration of the investment. For instance, if you invest for a long-term in equities, it will give you good long-term returns.

The best way to invest in equity mutual funds is by opting SIP (Systematic Invest Plan). SIP allows you to invest in a disciplined manner over a regular period of time.

Never depend on a single Income. Make an investment to create a second source

This is probably the most relatable advice. Even though you are in the best position and earning quite well, you need to think of the second source of income. Why?

The second source of income will help you avoid unseen financial troubles. So, even in a depressed economic environment, you have secondary income streams to supplement your primary income and grow wealth.

A good Investment plan can be a great source of income for you. Make smart plans for your future and invest money in such a way which will give you great returns in the future.

Don’t put all your eggs in basket

A similar advice from Warren is "Diversification is a protection against ignorance. It makes very little sense for those who know what they are doing.'

This simply means diversify! Invest a little, but spread across various assets. So, even if one asset fails to perform, the other will balance the returns. In this way, you are always on the green side.

Conclusion

Warren Buffett's investment approach are rooted to common sense. By embracing some of his investment advice – looking for stable & constant growth company, focusing on the longer term, diversifying – can help you create a good investment Portfolio. So keep your investments approach simple and in a disciplined manner.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

learn a lot thank you

Good and informative.