Table of Contents

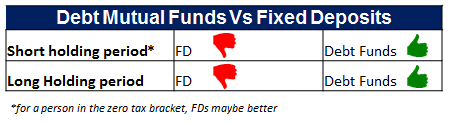

ایف ڈی بمقابلہ ڈیبٹ میوچل فنڈ

ایف ڈی بمقابلہقرض فنڈ? سوچناکہاں سرمایہ کاری کرنا ہے اچھا منافع کمانے کے لیے آپ کی بچت۔ عام طور پر لوگ غور کرتے ہیں۔سرمایہ کاری فکسڈ ڈپازٹ یا FD میں سب سے آسان آپشن ہے کیونکہ یہ محفوظ ہے اور فکسڈ ریٹرن پیش کرتا ہے۔ لیکن کیا یہ بہترین طریقہ ہے؟ اگرچہ فکسڈ ڈپازٹ سب کے لیے سرمایہ کاری کا ایک آسان آپشن ہے، تاہم، قابل ٹیکس ہونے والے فکسڈ ڈپازٹ کے منافع ڈیبٹ فنڈ کے مقابلے بہت کم ہیں۔ مزید برآں، جب طویل مدت کے لیے منعقد کیا جاتا ہے، قرضباہمی چندہ اچھا منافع پیش کرتے ہیں. ڈیٹ میوچل فنڈز یا فکسڈ ڈپازٹ میں سرمایہ کاری کرنے کا حتمی فیصلہ کرنے سے پہلے، ان سرمایہ کاری کے تفصیلی موازنہ کو دیکھیں۔

خلاصہ:

ڈیبٹ میوچل فنڈز (ڈیبٹ فنڈ) بمقابلہ فکسڈ ڈپازٹس (ایف ڈی)

ہمیں خطرہ مول لینے کی صلاحیت اور اس کے انعقاد کی مطلوبہ مدت کے ذریعے اسے توڑنا ہوگا۔سرمایہ کار سوال میں.

مختصر انعقاد کی مدت (1 سال یا اس سے کم)

یہاں قرض فنڈ کے اختیارات محدود ہوں گے۔مائع فنڈزالٹرامختصر مدت کے فنڈز اور مختصر مدتآمدنی فنڈز اگرچہ ریٹرن یا پیداوار عام طور پر مائع سے الٹرا شارٹ سے شارٹ ٹرم فنڈ تک زیادہ ہوتی ہے، لیکن ان ڈیٹ فنڈز اور فکسڈ ڈپازٹ کے درمیان پیداوار کے فرق کا تعین ان کے پچھلے ایک سال کے ریٹرن کو دیکھتے ہوئے کیا جا سکتا ہے۔

ڈیبٹ میوچل فنڈ (زمرہ اوسط واپسی)

| قرض میوچل فنڈ کی قسم | گزشتہ 1 سال واپسی (%) |

|---|---|

| مائع فنڈ | 7.36 |

| الٹرا شارٹ ٹرم ڈیبٹ فنڈز | 9.18 |

| قلیل مدتی قرض فنڈز | 9.78 |

| ڈائنامک ڈیبٹ فنڈز | 13.89 |

| طویل مدتی قرض فنڈز | 13.19 |

| گلٹ قلیل مدتی فنڈز | 11.76 |

| گلٹ طویل مدتی فنڈز | 15.06 |

| 20 فروری 2017 تک کا ڈیٹا |

فکسڈ ڈپازٹ یا ایف ڈی کی اوسط واپسی کی شرح

فکسڈ ڈپازٹس کی اوسط واپسی کی شرح 8-8.5% p.a کے درمیان ہے۔ سال 2016 میں (تاکہ کوئی بھی ٹیبل میں مذکورہ بالا منافع کا موازنہ کر سکے)۔ تاہم، پچھلے ایک سال میں، واپسی کی شرح 6.6-7.5% p.a تک گر گئی ہے۔

مندرجہ بالا مثال کے ساتھ، یہ واضح ہے کہ ڈیبٹ فنڈز کی واپسی کی اوسط شرح فکسڈ ڈپازٹس سے بہتر ہے۔

Talk to our investment specialist

طویل مدتی انعقاد کی مدت

طویل مدتی انعقاد کے ساتھ، قرض فنڈز FDs سے بہتر ثابت ہو سکتے ہیں۔

یہاں سرمایہ کاری کے اختیارات یہ ہوں گے:

- طویل مدتی آمدنی کے فنڈز

- طویل مدتی گلٹ،

- کارپوریٹبانڈ فنڈز (زیادہ پیداوار کے فنڈز)، اوپر بیان کردہ مائع کے اختیارات کے علاوہ، الٹرا شارٹ اور شارٹ ٹرم فنڈز بھی استعمال کیے جا سکتے ہیں۔

یہ دیکھتے ہوئے کہ انعقاد کی مدت 3 سال یا اس سے زیادہ ہوسکتی ہے، ہم درج ذیل کہہ سکتے ہیں:

- کے ساتھسرمایہ اشاریہ سازی کے فوائد کے ساتھ 20% پر ٹیکس حاصل کرتا ہے، خالص ٹیکس کے واقعات کم سے کم ہوں گے (تاہم کسی کو ٹیکس کے واقعات کا حساب لگانا چاہیے ٹیکس کے سال کے حساب سے)

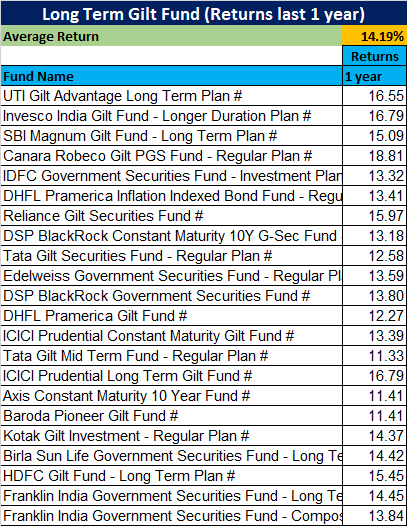

- طویل مدتی آمدنی کے فنڈز/گلٹ فنڈز اعلی پیداوار کے ساتھ اور اس کے علاوہ، اگر سود کی شرحیں نیچے جائیں تو بہت زیادہ منافع ملے گا۔

- کوئی بھی ان قرض فنڈز کے ساتھ اعلی دوہرے ہندسے کی واپسی کے ساتھ ختم ہوسکتا ہے۔

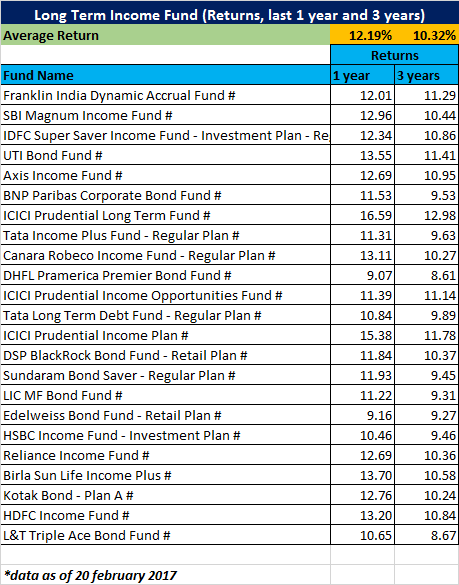

لانگ ٹرم انکم فنڈز پر ریٹرن کی ذیل کی مثال لیں، زمرہ کے لیے اوسط آخری 1 سال کا منافع 12.19% ہے اور پچھلے 3 سالوں میں 10.32% p.a. اس مدت میں کوئی بھی ایف ڈی اس جیسی واپسی نہیں دے سکتا تھا۔ گلٹ فنڈ کے منافع اور بھی زیادہ ہیں۔ اسی مدت میں، پچھلے سال FD کی شرح زیادہ تر بینکوں میں 8-8.5% سالانہ کے قریب ہوتی، (اگرچہ آج شرحیں مزید گر کر 6.5 - 7.5% ہو گئی ہیں)

لہذا ایک سرمایہ کار کے ساتھ طویل مدتی ہولڈنگ اور سود کی شرحیں گرنے کے ساتھ، ایک قرض فنڈ (طویل مدتی آمدنی یا گلٹ) FD کے مقابلے میں زیادہ بہتر منافع دے گا۔ یہاں تک کہ شرح سود میں کمی نہ ہونے کی صورت میں بھی، زیادہ پیداوار والے کارپوریٹ بانڈ فنڈز اسی مدت میں ایف ڈی کو مات دے گا۔

قرض میوچل فنڈز اور فکسڈ ڈپازٹس پر ٹیکس

ٹیکسیشن ڈیٹ فنڈز اور فکسڈ ڈپازٹس کے ریٹرن کا تعین کرنے میں بھی اہم کردار ادا کرتا ہے۔ عام طور پر، فکسڈ ڈپازٹس پر ٹیکس 33% (ٹیکس کی معمولی شرح) ہے جب کہ ڈیبٹ فنڈز پر اگر کوئی 3 سال سے کم نظریہ کے ساتھ سرمایہ کاری کرتا ہے تو ڈی ڈی ٹی (ڈیویڈنڈ ڈسٹری بیوشن ٹیکس) کاٹنا بہتر آپشن ہوگا۔ تقریباً 25% پر (+سرچارج وغیرہ)۔ اس سے ظاہر ہوتا ہے کہ ڈیٹ میوچل فنڈز پر ٹیکس فکسڈ ڈپازٹ کے مقابلے نسبتاً کم ہے۔

قرض فنڈز کے ساتھ آنے والے اضافی فوائد یہ ہیں:

- لیکویڈیٹی: رقم 1-2 دنوں کے اندر دستیاب ہو گی۔رہائی

- پیشہ ورانہ انتظام: حکمت عملی کو متحرک طور پر تبدیل کرنے اور بازاروں سے فائدہ اٹھانے کی صلاحیت

- قبل از وقت واپسی کا کوئی جرمانہ نہیں۔

خلاصہ:

| پیرامیٹرز | باہمی چندہ | فکسڈ ڈپازٹس |

|---|---|---|

| واپسی کی شرح | کوئی یقینی واپسی نہیں۔ | فکسڈ ریٹرن |

| مہنگائی ایڈجسٹ ریٹرن | اعلی افراط زر کی ایڈجسٹ شدہ واپسیوں کا امکان | عام طور پر کم افراط زر کی ایڈجسٹ شدہ واپسی |

| خطرہ | کم سے زیادہ خطرہ (فنڈ پر منحصر ہے۔ | کم خطرہ |

| لیکویڈیٹی | مائع | مائع |

| قبل از وقت واپسی | ایگزٹ لوڈ/نو لوڈ کے ساتھ اجازت ہے۔ | جرمانے کے ساتھ اجازت ہے۔ |

| سرمایہ کاری کی لاگت | انتظامی لاگت/خرچ کا تناسب | کوی قیمت نہیں |

سرفہرست 8 بہترین کارکردگی والے قرض فنڈز 2022

مندرجہ بالا خالص اثاثوں/اے یو ایم والے قرض فنڈز کی فہرست ذیل میں ہے۔1000 کروڑ اور 3 سال کے مرکب پر ترتیب دیا گیا (سی اے جی آر) واپسی

The primary investment objective of the Scheme is to generate regular income through investments in debt & money market instruments in order to make regular dividend payments to unit holders & secondary objective is growth of capital. Aditya Birla Sun Life Medium Term Plan is a Debt - Medium term Bond fund was launched on 25 Mar 09. It is a fund with Moderate risk and has given a Below is the key information for Aditya Birla Sun Life Medium Term Plan Returns up to 1 year are on An Open-ended income scheme with the objective to generate optimal returns with high liquidity through active management of the portfolio by investing in high quality debt and money market instruments. Aditya Birla Sun Life Dynamic Bond Fund is a Debt - Dynamic Bond fund was launched on 27 Sep 04. It is a fund with Moderate risk and has given a Below is the key information for Aditya Birla Sun Life Dynamic Bond Fund Returns up to 1 year are on The Scheme aims to provide reasonable returns by investing in portfolio of Government Securities with average maturity of around 10 years. However, there can be no assurance that the investment objective of the

Scheme will be realized. ICICI Prudential Constant Maturity Gilt Fund is a Debt - 10 Yr Govt Bond fund was launched on 12 Sep 14. It is a fund with Moderate risk and has given a Below is the key information for ICICI Prudential Constant Maturity Gilt Fund Returns up to 1 year are on (Erstwhile SBI Magnum Gilt Fund Short Term) To provide the investors with the returns generated through investments in government securities issued by the Central Govt. and State Govt. SBI Magnum Constant Maturity Fund is a Debt - 10 Yr Govt Bond fund was launched on 30 Dec 00. It is a fund with Moderately Low risk and has given a Below is the key information for SBI Magnum Constant Maturity Fund Returns up to 1 year are on (Erstwhile SBI Magnum Gilt Fund - Long Term Plan) To provide the investors with returns generated through investments in government securities issued by the Central Government and / or a State Government SBI Magnum Gilt Fund is a Debt - Government Bond fund was launched on 30 Dec 00. It is a fund with Moderate risk and has given a Below is the key information for SBI Magnum Gilt Fund Returns up to 1 year are on (Erstwhile ICICI Prudential Income Plan) To generate income through investments in a range of debt and money market instruments of various maturities with a view to maximising income while maintaining the optimum balance of yield, safety and liquidity. ICICI Prudential Long Term Bond Fund is a Debt - Longterm Bond fund was launched on 9 Jul 98. It is a fund with Moderate risk and has given a Below is the key information for ICICI Prudential Long Term Bond Fund Returns up to 1 year are on (Erstwhile ICICI Prudential Long Term Gilt Fund) To generate income through investment in Gilts of various maturities. ICICI Prudential Gilt Fund is a Debt - Government Bond fund was launched on 19 Aug 99. It is a fund with Moderate risk and has given a Below is the key information for ICICI Prudential Gilt Fund Returns up to 1 year are on The Scheme aims to generate returns through investments in Central Govt Securities. DSP BlackRock Government Securities Fund is a Debt - Government Bond fund was launched on 30 Sep 99. It is a fund with Moderate risk and has given a Below is the key information for DSP BlackRock Government Securities Fund Returns up to 1 year are on 1. Aditya Birla Sun Life Medium Term Plan

CAGR/Annualized return of 8.9% since its launch. Ranked 6 in Medium term Bond category. Return for 2024 was 10.5% , 2023 was 6.9% and 2022 was 24.8% . Aditya Birla Sun Life Medium Term Plan

Growth Launch Date 25 Mar 09 NAV (21 Apr 25) ₹39.3243 ↑ 0.07 (0.17 %) Net Assets (Cr) ₹2,206 on 31 Mar 25 Category Debt - Medium term Bond AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆☆ Risk Moderate Expense Ratio 1.55 Sharpe Ratio 2.48 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 1,000 Exit Load 0-365 Days (1%),365 Days and above(NIL) Yield to Maturity 7.89% Effective Maturity 4 Years 10 Months 24 Days Modified Duration 3 Years 7 Months 17 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,987 31 Mar 22 ₹12,025 31 Mar 23 ₹14,567 31 Mar 24 ₹15,635 31 Mar 25 ₹17,673 Returns for Aditya Birla Sun Life Medium Term Plan

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 21 Apr 25 Duration Returns 1 Month 1.9% 3 Month 5.2% 6 Month 6.9% 1 Year 14.4% 3 Year 14.3% 5 Year 12.6% 10 Year 15 Year Since launch 8.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 10.5% 2022 6.9% 2021 24.8% 2020 7.1% 2019 8.1% 2018 -4.4% 2017 5.6% 2016 7% 2015 10.9% 2014 9.5% Fund Manager information for Aditya Birla Sun Life Medium Term Plan

Name Since Tenure Sunaina Cunha 1 Sep 14 10.59 Yr. Mohit Sharma 6 Aug 20 4.65 Yr. Data below for Aditya Birla Sun Life Medium Term Plan as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 3.74% Equity 4.08% Debt 91.93% Other 0.25% Debt Sector Allocation

Sector Value Corporate 51.47% Government 39.97% Cash Equivalent 3.74% Securitized 0.5% Credit Quality

Rating Value A 3.53% AA 30.9% AAA 63.02% BBB 2.54% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.18% Govt Stock 2033

Sovereign Bonds | -22% ₹483 Cr 47,000,000

↓ -1,500,000 National Bank For Agriculture And Rural Development

Debentures | -5% ₹100 Cr 10,000

↑ 10,000 Nuvama Wealth Finance Ltd

Debentures | -4% ₹95 Cr 9,500

↑ 1,500 7.1% Govt Stock 2034

Sovereign Bonds | -4% ₹94 Cr 9,196,700

↑ 500,000 360 One Prime Ltd. 9.4%

Debentures | -3% ₹65 Cr 6,500

↑ 6,500 Narayana Hrudayalaya Limited

Debentures | -3% ₹60 Cr 6,000 Vedanta Limited

Debentures | -3% ₹60 Cr 6,000 7.23% Government Of India (15/04/2039)

Sovereign Bonds | -2% ₹52 Cr 5,000,000 LIC Housing Finance Limited

Debentures | -2% ₹50 Cr 5,000 Creditaccess Grameen Limited

Debentures | -2% ₹50 Cr 500,000 2. Aditya Birla Sun Life Dynamic Bond Fund

CAGR/Annualized return of 7.7% since its launch. Ranked 16 in Dynamic Bond category. Return for 2024 was 8.8% , 2023 was 6.9% and 2022 was 6% . Aditya Birla Sun Life Dynamic Bond Fund

Growth Launch Date 27 Sep 04 NAV (21 Apr 25) ₹46.2806 ↑ 0.16 (0.35 %) Net Assets (Cr) ₹1,767 on 31 Mar 25 Category Debt - Dynamic Bond AMC Birla Sun Life Asset Management Co Ltd Rating ☆☆☆ Risk Moderate Expense Ratio 1.21 Sharpe Ratio 0.81 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 1,000 Exit Load 0-90 Days (0.5%),90 Days and above(NIL) Yield to Maturity 7.33% Effective Maturity 14 Years 7 Months 20 Days Modified Duration 7 Years 7 Months 2 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,824 31 Mar 22 ₹11,337 31 Mar 23 ₹12,141 31 Mar 24 ₹13,078 31 Mar 25 ₹14,280 Returns for Aditya Birla Sun Life Dynamic Bond Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 21 Apr 25 Duration Returns 1 Month 2.8% 3 Month 4.1% 6 Month 5.1% 1 Year 11.4% 3 Year 8.7% 5 Year 7.7% 10 Year 15 Year Since launch 7.7% Historical performance (Yearly) on absolute basis

Year Returns 2023 8.8% 2022 6.9% 2021 6% 2020 4.9% 2019 9.7% 2018 -0.9% 2017 5.7% 2016 2.2% 2015 14% 2014 7.4% Fund Manager information for Aditya Birla Sun Life Dynamic Bond Fund

Name Since Tenure Mohit Sharma 22 Mar 21 3.94 Yr. Bhupesh Bameta 6 Aug 20 4.57 Yr. Data below for Aditya Birla Sun Life Dynamic Bond Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 2.72% Debt 97% Other 0.28% Debt Sector Allocation

Sector Value Government 65.45% Corporate 31.54% Cash Equivalent 2.72% Credit Quality

Rating Value A 2.48% AA 7.71% AAA 89.82% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.23% Government Of India (15/04/2039)

Sovereign Bonds | -20% ₹347 Cr 33,577,900 7.18% Govt Stock 2037

Sovereign Bonds | -16% ₹277 Cr 27,000,000 7.1% Govt Stock 2034

Sovereign Bonds | -10% ₹170 Cr 16,590,200 Power Finance Corporation Limited

Debentures | -7% ₹124 Cr 12,500 7.34% Govt Stock 2064

Sovereign Bonds | -7% ₹124 Cr 11,914,000 Cholamandalam Investment And Finance Company Limited

Debentures | -5% ₹80 Cr 8,000 Bharti Telecom Limited

Debentures | -4% ₹76 Cr 7,500 State Bank Of India

Debentures | -4% ₹74 Cr 75 7.25% Govt Stock 2063

Sovereign Bonds | -3% ₹51 Cr 5,000,000 LIC Housing Finance Limited

Debentures | -3% ₹50 Cr 5,000 3. ICICI Prudential Constant Maturity Gilt Fund

CAGR/Annualized return of 8.9% since its launch. Ranked 6 in 10 Yr Govt Bond category. Return for 2024 was 9.3% , 2023 was 7.7% and 2022 was 1.2% . ICICI Prudential Constant Maturity Gilt Fund

Growth Launch Date 12 Sep 14 NAV (21 Apr 25) ₹24.6949 ↑ 0.10 (0.42 %) Net Assets (Cr) ₹2,537 on 31 Mar 25 Category Debt - 10 Yr Govt Bond AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk Moderate Expense Ratio 0.39 Sharpe Ratio 1.14 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-7 Days (0.25%),7 Days and above(NIL) Yield to Maturity 9.83% Effective Maturity 9 Years 9 Months 29 Days Modified Duration 6 Years 10 Months 13 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,799 31 Mar 22 ₹11,205 31 Mar 23 ₹11,591 31 Mar 24 ₹12,568 31 Mar 25 ₹13,796 Returns for ICICI Prudential Constant Maturity Gilt Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 21 Apr 25 Duration Returns 1 Month 3.1% 3 Month 4.7% 6 Month 6.1% 1 Year 12.5% 3 Year 8.6% 5 Year 7% 10 Year 15 Year Since launch 8.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 9.3% 2022 7.7% 2021 1.2% 2020 2.8% 2019 13.6% 2018 12.8% 2017 9.7% 2016 2.4% 2015 16.2% 2014 6.9% Fund Manager information for ICICI Prudential Constant Maturity Gilt Fund

Name Since Tenure Manish Banthia 22 Jan 24 1.11 Yr. Raunak Surana 22 Jan 24 1.11 Yr. Data below for ICICI Prudential Constant Maturity Gilt Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 3.14% Debt 96.86% Debt Sector Allocation

Sector Value Government 96.86% Cash Equivalent 3.14% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.1% Govt Stock 2034

Sovereign Bonds | -44% ₹1,121 Cr 109,556,400

↓ -62,500,000 6.64% Govt Stock 2035

Sovereign Bonds | -39% ₹988 Cr 100,000,000

↑ 70,000,000 7.18% Govt Stock 2037

Sovereign Bonds | -8% ₹200 Cr 19,500,000 6.19% Govt Stock 2034

Sovereign Bonds | -2% ₹48 Cr 5,000,000 6.92% Govt Stock 2039

Sovereign Bonds | -1% ₹35 Cr 3,500,000

↓ -2,500,000 7.23% Government Of India (15/04/2039)

Sovereign Bonds | -1% ₹31 Cr 3,000,000 6.67% Govt Stock 2035

Sovereign Bonds | -1% ₹25 Cr 2,500,000 6.79% Government Of India (07/10/2034)

Sovereign Bonds | -0% ₹6 Cr 549,300

↓ -3,000,000 7.18% Govt Stock 2033

Sovereign Bonds | -0% ₹1 Cr 72,600 Net Current Assets

Net Current Assets | -2% ₹56 Cr 4. SBI Magnum Constant Maturity Fund

CAGR/Annualized return of 7.9% since its launch. Ranked 1 in 10 Yr Govt Bond category. Return for 2024 was 9.1% , 2023 was 7.5% and 2022 was 1.3% . SBI Magnum Constant Maturity Fund

Growth Launch Date 30 Dec 00 NAV (21 Apr 25) ₹63.8448 ↑ 0.30 (0.47 %) Net Assets (Cr) ₹1,831 on 31 Mar 25 Category Debt - 10 Yr Govt Bond AMC SBI Funds Management Private Limited Rating ☆☆☆☆ Risk Moderately Low Expense Ratio 0.64 Sharpe Ratio 1 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 6.74% Effective Maturity 9 Years 9 Months 29 Days Modified Duration 6 Years 9 Months 22 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,595 31 Mar 22 ₹10,971 31 Mar 23 ₹11,385 31 Mar 24 ₹12,324 31 Mar 25 ₹13,484 Returns for SBI Magnum Constant Maturity Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 21 Apr 25 Duration Returns 1 Month 2.9% 3 Month 4.4% 6 Month 5.8% 1 Year 12% 3 Year 8.6% 5 Year 6.5% 10 Year 15 Year Since launch 7.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 9.1% 2022 7.5% 2021 1.3% 2020 2.4% 2019 11.6% 2018 11.9% 2017 9.9% 2016 6.2% 2015 12.8% 2014 9.1% Fund Manager information for SBI Magnum Constant Maturity Fund

Name Since Tenure Rajeev Radhakrishnan 1 Nov 23 1.33 Yr. Tejas Soman 1 Dec 23 1.25 Yr. Data below for SBI Magnum Constant Maturity Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 3.09% Debt 96.91% Debt Sector Allocation

Sector Value Government 96.91% Cash Equivalent 3.09% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.1% Govt Stock 2034

Sovereign Bonds | -72% ₹1,320 Cr 129,000,000 7.18% Govt Stock 2037

Sovereign Bonds | -25% ₹467 Cr 45,500,000 Net Receivable / Payable

CBLO | -2% ₹42 Cr Treps

CBLO/Reverse Repo | -1% ₹15 Cr 5. SBI Magnum Gilt Fund

CAGR/Annualized return of 8.1% since its launch. Ranked 3 in Government Bond category. Return for 2024 was 8.9% , 2023 was 7.6% and 2022 was 4.2% . SBI Magnum Gilt Fund

Growth Launch Date 30 Dec 00 NAV (21 Apr 25) ₹66.6098 ↑ 0.35 (0.52 %) Net Assets (Cr) ₹11,489 on 31 Mar 25 Category Debt - Government Bond AMC SBI Funds Management Private Limited Rating ☆☆☆☆ Risk Moderate Expense Ratio 0.94 Sharpe Ratio 0.61 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 6.97% Effective Maturity 24 Years 14 Days Modified Duration 10 Years 2 Months 1 Day Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,724 31 Mar 22 ₹11,112 31 Mar 23 ₹11,744 31 Mar 24 ₹12,773 31 Mar 25 ₹13,915 Returns for SBI Magnum Gilt Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 21 Apr 25 Duration Returns 1 Month 2.9% 3 Month 4.5% 6 Month 5% 1 Year 11.4% 3 Year 8.5% 5 Year 7.2% 10 Year 15 Year Since launch 8.1% Historical performance (Yearly) on absolute basis

Year Returns 2023 8.9% 2022 7.6% 2021 4.2% 2020 3% 2019 11.7% 2018 13.1% 2017 5.1% 2016 3.9% 2015 16.3% 2014 7.3% Fund Manager information for SBI Magnum Gilt Fund

Name Since Tenure Rajeev Radhakrishnan 1 Nov 23 1.33 Yr. Tejas Soman 1 Dec 23 1.25 Yr. Data below for SBI Magnum Gilt Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 10.5% Debt 89.5% Debt Sector Allocation

Sector Value Government 89.5% Cash Equivalent 10.5% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.34% Govt Stock 2064

Sovereign Bonds | -37% ₹4,219 Cr 406,500,000

↓ -7,500,000 6.79% Government Of India (07/10/2034)

Sovereign Bonds | -36% ₹4,009 Cr 398,326,400

↑ 27,000,000 7.3% Govt Stock 2053

Sovereign Bonds | -10% ₹1,096 Cr 106,000,000

↓ -5,500,000 7.22% State Government Of Haryana 2038

Sovereign Bonds | -4% ₹402 Cr 40,000,000 7.13% State Government Of Karnataka 2041

Sovereign Bonds | -2% ₹249 Cr 25,048,600

↑ 4,500,000 7.16% State Government Of Madhya Pradesh 2037

Sovereign Bonds | -1% ₹100 Cr 10,000,000 Treps

CBLO/Reverse Repo | -5% ₹608 Cr Net Receivable / Payable

CBLO | -5% ₹574 Cr 8.83% Govt Stock 2041

Sovereign Bonds | -₹0 Cr 00

↓ -80,000,000 7.93% Govt Stock 2033

Sovereign Bonds | -₹0 Cr 00

↓ -6,000,000 6. ICICI Prudential Long Term Bond Fund

CAGR/Annualized return of 8.6% since its launch. Ranked 12 in Longterm Bond category. Return for 2024 was 10.1% , 2023 was 6.8% and 2022 was 1.3% . ICICI Prudential Long Term Bond Fund

Growth Launch Date 9 Jul 98 NAV (21 Apr 25) ₹90.3862 ↑ 0.45 (0.50 %) Net Assets (Cr) ₹1,078 on 31 Mar 25 Category Debt - Longterm Bond AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆☆ Risk Moderate Expense Ratio 1.97 Sharpe Ratio 1.03 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load NIL Yield to Maturity 7.09% Effective Maturity 23 Years 1 Month 6 Days Modified Duration 9 Years 6 Months 7 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,493 31 Mar 22 ₹10,688 31 Mar 23 ₹11,063 31 Mar 24 ₹12,017 31 Mar 25 ₹13,198 Returns for ICICI Prudential Long Term Bond Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 21 Apr 25 Duration Returns 1 Month 2.7% 3 Month 4.4% 6 Month 5.7% 1 Year 11.8% 3 Year 8.5% 5 Year 6.1% 10 Year 15 Year Since launch 8.6% Historical performance (Yearly) on absolute basis

Year Returns 2023 10.1% 2022 6.8% 2021 1.3% 2020 0.4% 2019 11% 2018 12.1% 2017 6.8% 2016 4.1% 2015 15.7% 2014 5.1% Fund Manager information for ICICI Prudential Long Term Bond Fund

Name Since Tenure Manish Banthia 22 Jan 24 1.11 Yr. Raunak Surana 22 Jan 24 1.11 Yr. Data below for ICICI Prudential Long Term Bond Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 5.41% Debt 94.36% Other 0.23% Debt Sector Allocation

Sector Value Government 77.89% Corporate 16.47% Cash Equivalent 5.41% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.34% Govt Stock 2064

Sovereign Bonds | -32% ₹391 Cr 37,701,500

↑ 2,500,000 7.18% Govt Stock 2037

Sovereign Bonds | -18% ₹222 Cr 21,603,830 6.92% Govt Stock 2039

Sovereign Bonds | -8% ₹101 Cr 10,063,500

↓ -8,000,000 7.23% Government Of India (15/04/2039)

Sovereign Bonds | -6% ₹72 Cr 7,000,000 The Great Eastern Shipping Company Limited

Debentures | -4% ₹53 Cr 536 HDFC Bank Limited

Debentures | -4% ₹51 Cr 5,000

↓ -2,500 LIC Housing Finance Limited

Debentures | -4% ₹50 Cr 500 7.12% Maharashtra SDL 2038

Sovereign Bonds | -4% ₹49 Cr 4,960,700

↑ 4,960,700 7.14% Maharashtra SDL 2039

Sovereign Bonds | -3% ₹40 Cr 4,000,000

↑ 4,000,000 7.09% Govt Stock 2054

Sovereign Bonds | -3% ₹35 Cr 3,500,000 7. ICICI Prudential Gilt Fund

CAGR/Annualized return of 9.5% since its launch. Ranked 5 in Government Bond category. Return for 2024 was 8.2% , 2023 was 8.3% and 2022 was 3.7% . ICICI Prudential Gilt Fund

Growth Launch Date 19 Aug 99 NAV (21 Apr 25) ₹102.612 ↑ 0.37 (0.36 %) Net Assets (Cr) ₹7,133 on 31 Mar 25 Category Debt - Government Bond AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆☆ Risk Moderate Expense Ratio 1.12 Sharpe Ratio 0.87 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load NIL Yield to Maturity 6.94% Effective Maturity 15 Years 9 Months 14 Days Modified Duration 7 Years 22 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,828 31 Mar 22 ₹11,265 31 Mar 23 ₹11,915 31 Mar 24 ₹12,953 31 Mar 25 ₹14,074 Returns for ICICI Prudential Gilt Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 21 Apr 25 Duration Returns 1 Month 2.5% 3 Month 3.9% 6 Month 5.5% 1 Year 10.8% 3 Year 8.4% 5 Year 7.4% 10 Year 15 Year Since launch 9.5% Historical performance (Yearly) on absolute basis

Year Returns 2023 8.2% 2022 8.3% 2021 3.7% 2020 3.8% 2019 12.6% 2018 10.8% 2017 6.8% 2016 2.1% 2015 18.2% 2014 5.5% Fund Manager information for ICICI Prudential Gilt Fund

Name Since Tenure Manish Banthia 22 Jan 24 1.11 Yr. Raunak Surana 22 Jan 24 1.11 Yr. Data below for ICICI Prudential Gilt Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 9.99% Debt 90.01% Debt Sector Allocation

Sector Value Government 90.01% Cash Equivalent 9.99% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.1% Govt Stock 2034

Sovereign Bonds | -33% ₹2,109 Cr 206,066,000

↓ -30,000,000 7.34% Govt Stock 2064

Sovereign Bonds | -21% ₹1,360 Cr 131,038,200

↑ 25,000,000 7.93% Govt Stock 2033

Sovereign Bonds | -15% ₹968 Cr 94,096,700 7.3% Govt Stock 2028

Sovereign Bonds | -7% ₹427 Cr 42,500,000 7.12% Maharashtra SDL 2038

Sovereign Bonds | -3% ₹214 Cr 21,496,400

↑ 21,496,400 91 Days Tbill Red 24-04-2025

Sovereign Bonds | -3% ₹189 Cr 19,000,000 7.14% Maharashtra SDL 2039

Sovereign Bonds | -3% ₹180 Cr 18,000,000

↑ 18,000,000 91 DTB 17042025

Sovereign Bonds | -3% ₹174 Cr 17,500,000

↓ -10,000,000 7.09% Govt Stock 2054

Sovereign Bonds | -2% ₹151 Cr 15,000,000 7.18% Govt Stock 2033

Sovereign Bonds | -2% ₹109 Cr 10,567,890

↓ -262,500 8. DSP BlackRock Government Securities Fund

CAGR/Annualized return of 9.3% since its launch. Ranked 9 in Government Bond category. Return for 2024 was 10.1% , 2023 was 7.1% and 2022 was 2.7% . DSP BlackRock Government Securities Fund

Growth Launch Date 30 Sep 99 NAV (21 Apr 25) ₹96.6442 ↑ 0.55 (0.57 %) Net Assets (Cr) ₹1,566 on 31 Mar 25 Category Debt - Government Bond AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk Moderate Expense Ratio 1.1 Sharpe Ratio 0.52 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-7 Days (0.1%),7 Days and above(NIL) Yield to Maturity 7.04% Effective Maturity 29 Years 2 Months 26 Days Modified Duration 11 Years 6 Months Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,730 31 Mar 22 ₹11,166 31 Mar 23 ₹11,651 31 Mar 24 ₹12,744 31 Mar 25 ₹13,899 Returns for DSP BlackRock Government Securities Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 21 Apr 25 Duration Returns 1 Month 2.8% 3 Month 4.3% 6 Month 4.5% 1 Year 11.6% 3 Year 8.2% 5 Year 7.1% 10 Year 15 Year Since launch 9.3% Historical performance (Yearly) on absolute basis

Year Returns 2023 10.1% 2022 7.1% 2021 2.7% 2020 3.1% 2019 13.1% 2018 12.5% 2017 7.4% 2016 1.4% 2015 15.3% 2014 6.2% Fund Manager information for DSP BlackRock Government Securities Fund

Name Since Tenure Sandeep Yadav 1 Aug 24 0.58 Yr. Shantanu Godambe 1 Jun 23 1.75 Yr. Data below for DSP BlackRock Government Securities Fund as on 31 Mar 25

Asset Allocation

Asset Class Value Cash 3.77% Debt 96.23% Debt Sector Allocation

Sector Value Government 96.23% Cash Equivalent 3.77% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity 7.34% Govt Stock 2064

Sovereign Bonds | -34% ₹555 Cr 52,000,000

↓ -3,500,000 7.3% Govt Stock 2053

Sovereign Bonds | -29% ₹473 Cr 45,000,000

↓ -3,000,000 7.09% Govt Stock 2054

Sovereign Bonds | -7% ₹112 Cr 11,000,000

↓ -4,000,000 7.14% Madhya Pradesh SDL 2043

Sovereign Bonds | -6% ₹103 Cr 10,000,000 7.26% Maharashtra SDL 2050

Sovereign Bonds | -6% ₹101 Cr 10,000,000 7.1% Govt Stock 2034

Sovereign Bonds | -5% ₹90 Cr 8,500,000

↑ 8,500,000 8.17% Govt Stock 2044

Sovereign Bonds | -4% ₹58 Cr 5,000,000 7.14% Maharashtra SDL 2039

Sovereign Bonds | -3% ₹50 Cr 5,000,000 7.85% MP Sdl 2032

Sovereign Bonds | -2% ₹27 Cr 2,500,000 7.22% Maharashtra SDL 2049

Sovereign Bonds | -1% ₹15 Cr 1,500,000

یہاں فراہم کردہ معلومات کے درست ہونے کو یقینی بنانے کے لیے تمام کوششیں کی گئی ہیں۔ تاہم، ڈیٹا کی درستگی کے حوالے سے کوئی ضمانت نہیں دی جاتی ہے۔ براہ کرم کوئی بھی سرمایہ کاری کرنے سے پہلے اسکیم کی معلومات کے دستاویز کے ساتھ تصدیق کریں۔