Table of Contents

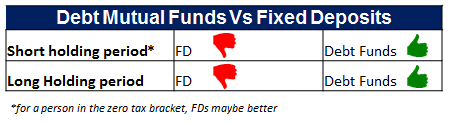

میوچل فنڈ بمقابلہ ایف ڈی (فکسڈ ڈپازٹ)

میوچل فنڈ بمقابلہایف ڈی? پیسہ بچانے کے بارے میں سوچتے وقت، سب سے پہلی چیز جس پر زیادہ تر لوگ غور کرتے ہیں وہ ہے۔سرمایہ کاری فکسڈ ڈپازٹس (FDs) میں۔ یہ عام طور پر اس وجہ سے ہے کہ اسے سمجھنا آسان ہے اور نسلوں سے کیا جا رہا ہے۔ لیکن کیا یہ سب سے مناسب سرمایہ کاری ہے؟ اور کیا یہ بہترین منافع فراہم کرتا ہے؟ یا میوچل فنڈ کی سرمایہ کاری اس مقصد کو بہتر طریقے سے پورا کر سکتی ہے؟ ان سوالات کے جوابات جاننے کے لیے ذیل میں پڑھیں!

ایف ڈی یا فکسڈ ڈپازٹ

فکسڈ ڈپازٹ، جسے FD بھی کہا جاتا ہے ایک مقبول ہے۔بینک سرمایہ کاری کا اختیار طویل مدتی اور قلیل مدتی سرمایہ کاری دونوں کے لیے موزوں ہے۔ FD ریٹرن مقرر ہیں کیونکہ FD سود کی شرح حکومت ہند کے ذریعہ پہلے سے طے شدہ ہے۔ فکسڈ ڈپازٹس پر جو شرح سود طے کی جا رہی ہے، اس کا کوئی اثر نہیں ہے۔مہنگائی ان سرمایہ کاری پر.

نیز، FD ریٹرن سرمایہ کاروں کے ہاتھ میں قابل ٹیکس ہیں۔ تاہم، ایف ڈی سرمایہ کاری کے تحت ٹیکس کٹوتیوں کے لیے ذمہ دار ہیں۔سیکشن 80 سی کیانکم ٹیکس ایکٹ

باہمی چندہ

میوچل فنڈ تین طرح کا ہوتا ہے، قرض، ایکویٹی اور متوازنباہمی چندہ.قرض باہمی فنڈ وہ ہیں جو حکومت میں زیادہ تر اثاثے لگاتے ہیں۔بانڈز، کارپوریٹ بانڈز اور باقی ایکویٹی مارکیٹوں میں۔ اس کے برعکس، ایکویٹی میوچل فنڈز اپنے اثاثوں کا 65% سے زیادہ ایکویٹی مارکیٹوں میں اور باقی سرکاری بانڈز، کارپوریٹ بانڈز اور سیکیورٹیز میں لگاتا ہے۔ جبکہ بیلنسڈ میوچل فنڈز وہ ہیں جو جزوی طور پر قرض میں اور جزوی طور پر سرمایہ کاری کرتے ہیں۔ایکویٹی فنڈز. میوچل فنڈ افراط زر کو شکست دینے والا ایک آلہ ہے، اس لیے یہ زیادہ ٹیکس موثر ہے اور اس سے طویل مدتی سرمایہ کاری پر بہتر منافع کی پیشکش کی جاتی ہے۔

کون سی بہتر طویل مدتی سرمایہ کاری ہے؟

اب جب کہ ہم جانتے ہیں کہ میوچل فنڈز اور فکسڈ ڈپازٹ (FDs) دونوں ہیں۔ٹیکس کی بچت کی سرمایہ کاریسوال یہ پیدا ہوتا ہے کہ سرمایہ کاری کہاں کرنی چاہیے؟ اگرچہ یہ ایک موضوعی سوال ہے اور اس کا جواب ہر شخص سے مختلف ہو سکتا ہے، ذیل میں مختلف پیرامیٹرز کی بنیاد پر ایک موازنہ دیا گیا ہے جو آپ کو بہتر انتخاب کرنے میں مدد کر سکتا ہے۔

1. میوچل فنڈ ریٹرن اور ایف ڈی ریٹرن

فکسڈ ڈپازٹ پر واپسی پہلے سے متعین ہے اور پوری مدت میں تبدیل نہیں ہوتی ہے۔ جبکہ میوچل فنڈز، مالیاتی سے منسلک ہیں۔مارکیٹطویل مدتی سرمایہ کاری پر بہتر منافع پیش کرتے ہیں۔

2. ایف ڈی کی شرح سود اور میوچل فنڈ ریٹرن

FDs پر سود کی شرح FD کی قسم یا FD کی مدت کے لحاظ سے طے کی جاتی ہے، لہذا کوئی بھی فکسڈ ڈپازٹ پر زیادہ شرح سود کی توقع نہیں کر سکتا۔ دوسری طرف، میوچل فنڈز پر منافع مختلف ہوتا ہے کیونکہ مختلف قسم کے فنڈز غیر مستحکم منافع پیش کرتے ہیں۔ اگر مارکیٹ زیادہ جاتی ہے تو منافع میں اضافہ ہوتا ہے اور اس کے برعکس۔

3. خطرے کے عوامل

فکسڈ ڈپازٹس کو شاید ہی کوئی خطرہ لاحق ہوتا ہے کیونکہ ریٹرن پہلے سے طے شدہ ہوتے ہیں۔ نیز، اگر بینک کا پردہ فاش ہو جاتا ہے تو تمام بینک کھاتوں کا INR 1 لاکھ تک بیمہ کیا جاتا ہے۔ دوسری طرف، میوچل فنڈز زیادہ خطرہ رکھتے ہیں کیونکہ وہ اپنے اثاثوں کو مالیاتی منڈی میں لگاتے ہیں۔ ایکویٹی میوچل فنڈز، جس کے زیادہ تر اثاثے ایکویٹی مارکیٹوں میں لگائے گئے ہیں، بہت زیادہ خطرہ رکھتے ہیں۔ جبکہ ڈیبٹ میوچل فنڈز میں سرمایہ کاری کم خطرہ ہے، کیونکہ ان فنڈز کا بہت کم حصہ اسٹاک مارکیٹ میں لگایا جاتا ہے۔

Talk to our investment specialist

4. افراط زر کا اثر

سود کی شرح پہلے سے طے شدہ ہے، فکسڈ ڈپازٹس پر افراط زر کا کوئی اثر نہیں ہے۔ جبکہ، میوچل فنڈز کے لیے، ریٹرن افراط زر کے مطابق ہوتے ہیں جو بہتر منافع کمانے کی صلاحیت کو بڑھاتے ہیں۔

5. کیپٹل گینز

نہیں ہیںسرمایہ ایف ڈی کی صورت میں فائدہ ممکن ہے۔ میوچل فنڈز کے لیے،کیپٹل گینز انعقاد کی مدت پر منحصر ہے. مختلف میوچل فنڈز مختلف کیپیٹل گینز پیش کرتے ہیں۔

6. لیکویڈیٹی

فکسڈ ڈپازٹس ہیں۔غیر قانونیکیونکہ سرمایہ کاری کی گئی رقم ایک خاص وقت کے لیے مقفل ہے۔ اگر اس مدت سے پہلے رقم نکال لی جائے تو ایک مخصوص جرمانہ کاٹا جاتا ہے۔ جبکہ میوچل فنڈز مائع ہوتے ہیں کیونکہ وہ بہت کم وقت میں فروخت کیے جاسکتے ہیں۔فرسودگی فنڈ کی قیمت میں. تاہم، چند میوچل فنڈز کی فروخت پر لاگو ہونے والے ایگزٹ بوجھ کو چیک کرنا ضروری ہے۔

7. ٹیکس لگانا

فکسڈ ڈپازٹ پر سود پر فرد کے ٹیکس سلیب کے مطابق ٹیکس لگایا جاتا ہے۔ دوسری جانب،میوچل فنڈ ٹیکسیشن زیادہ تر انعقاد کی مدت پر منحصر ہے۔ شارٹ ٹرم کیپیٹل گینز (STCG) اور لانگ ٹرم کیپیٹل گینز (LTCG) دونوں پر مختلف ٹیکس لگایا جاتا ہے۔

8. ٹیکس سیونگ ایف ڈی کی V/S ایکویٹی لنکڈ سیونگ سکیمز (ELSS)

ان سرمایہ کاروں کے لیے جو IT ایکٹ کے سیکشن 80c کے تحت ٹیکس بچانے کے مقصد کے لیے ایف ڈی پر غور کر رہے ہیں۔ (5 سالہ لاکن)ای ایل ایس ایس میوچل فنڈز ایک اچھا متبادل ہیں کیونکہ ان کا 3 سال کا لاک ان ہے اور تاریخی طور پر بہتر منافع کی پیشکش کی ہے۔

کون سا بہتر سرمایہ کاری منصوبہ ہے؟

آئیے مختصراً دیکھتے ہیں:

| پیرامیٹر | مشترکہ فنڈ | معیاد مقررہ تک جمع |

|---|---|---|

| واپسی کی شرح | کوئی یقینی واپسی نہیں۔ | فکسڈ ریٹرن |

| انفلیشن ایڈجسٹ ریٹرن | اعلی افراط زر کی ایڈجسٹ شدہ واپسیوں کا امکان | عام طور پر کم افراط زر کی ایڈجسٹ شدہ واپسی |

| خطرہ | درمیانے درجے سے زیادہ خطرہ | کم خطرہ |

| لیکویڈیٹی | مائع | مائع |

| قبل از وقت واپسی | ایگزٹ لوڈ/کوئی لوڈ کے ساتھ اجازت ہے۔ | جرمانے کے ساتھ اجازت ہے۔ |

| سرمایہ کاری کی لاگت | انتظامی لاگت/خرچ کا تناسب | کوی قیمت نہیں |

| ٹیکس کی حیثیت | سازگار ٹیکس کی حیثیت | ٹیکس سلیب کے مطابق |

2022 میں سرمایہ کاری کے لیے بہترین میوچل فنڈز

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Nippon India Small Cap Fund Growth ₹158.379

↑ 0.48 ₹55,491 -2.4 -9.2 5.6 21.7 39 26.1 ICICI Prudential Infrastructure Fund Growth ₹182.77

↑ 0.55 ₹7,214 2.6 -3.8 7.1 28.1 38.9 27.4 Motilal Oswal Midcap 30 Fund Growth ₹94.5278

↑ 1.44 ₹26,028 -4.3 -10.9 14.9 27 36.9 57.1 IDFC Infrastructure Fund Growth ₹48.045

↑ 0.19 ₹1,563 0.9 -6.6 5.3 25.9 36.1 39.3 L&T Emerging Businesses Fund Growth ₹75.9538

↑ 0.35 ₹13,334 -5.3 -12.2 3.3 18.4 35.7 28.5 Nippon India Power and Infra Fund Growth ₹329.752

↑ 2.52 ₹6,849 1.3 -6 2.9 28.2 35.7 26.9 SBI Contra Fund Growth ₹368.482

↑ 1.21 ₹42,220 1.3 -4.2 6.5 21.3 35.6 18.8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 23 Apr 25

*نیچے 7 کی فہرست ہے۔بہترین باہمی فنڈز خالص اثاثے/AUM سے زیادہ ہونا The primary investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related instruments of small cap companies and the secondary objective is to generate consistent returns by investing in debt and money market securities. Nippon India Small Cap Fund is a Equity - Small Cap fund was launched on 16 Sep 10. It is a fund with Moderately High risk and has given a Below is the key information for Nippon India Small Cap Fund Returns up to 1 year are on To generate capital appreciation and income distribution to unit holders by investing predominantly in equity/equity related securities of the companies belonging to the infrastructure development and balance in debt securities and money market instruments. ICICI Prudential Infrastructure Fund is a Equity - Sectoral fund was launched on 31 Aug 05. It is a fund with High risk and has given a Below is the key information for ICICI Prudential Infrastructure Fund Returns up to 1 year are on (Erstwhile Motilal Oswal MOSt Focused Midcap 30 Fund) The investment objective of the Scheme is to achieve long term capital appreciation by investing in a maximum of 30 quality mid-cap companies having long-term competitive advantages and potential for growth. However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved. Motilal Oswal Midcap 30 Fund is a Equity - Mid Cap fund was launched on 24 Feb 14. It is a fund with Moderately High risk and has given a Below is the key information for Motilal Oswal Midcap 30 Fund Returns up to 1 year are on The investment objective of the scheme is to seek to generate long-term capital growth through an active diversified portfolio of predominantly equity and equity related instruments of companies that are participating in and benefiting from growth in Indian infrastructure and infrastructural related activities. However, there can be no assurance that the investment objective of the scheme will be realized. IDFC Infrastructure Fund is a Equity - Sectoral fund was launched on 8 Mar 11. It is a fund with High risk and has given a Below is the key information for IDFC Infrastructure Fund Returns up to 1 year are on To generate long-term capital appreciation from a diversified portfolio of predominantly equity and equity related securities, including equity derivatives, in the Indian markets with key theme focus being emerging companies (small cap stocks). The Scheme could also additionally invest in Foreign Securities. L&T Emerging Businesses Fund is a Equity - Small Cap fund was launched on 12 May 14. It is a fund with High risk and has given a Below is the key information for L&T Emerging Businesses Fund Returns up to 1 year are on (Erstwhile Reliance Diversified Power Sector Fund) The primary investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related securities of companies in the power sector. Nippon India Power and Infra Fund is a Equity - Sectoral fund was launched on 8 May 04. It is a fund with High risk and has given a Below is the key information for Nippon India Power and Infra Fund Returns up to 1 year are on To provide the investors maximum growth opportunity through equity

investments in stocks of growth oriented sectors of the economy. SBI Contra Fund is a Equity - Contra fund was launched on 6 May 05. It is a fund with Moderately High risk and has given a Below is the key information for SBI Contra Fund Returns up to 1 year are on 100 کروڑ. 5 سال پر ترتیب دیا گیا۔سی اے جی آر/سالانہ واپسی1. Nippon India Small Cap Fund

CAGR/Annualized return of 20.8% since its launch. Ranked 6 in Small Cap category. Return for 2024 was 26.1% , 2023 was 48.9% and 2022 was 6.5% . Nippon India Small Cap Fund

Growth Launch Date 16 Sep 10 NAV (23 Apr 25) ₹158.379 ↑ 0.48 (0.30 %) Net Assets (Cr) ₹55,491 on 31 Mar 25 Category Equity - Small Cap AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.55 Sharpe Ratio 0.07 Information Ratio 0.53 Alpha Ratio -0.23 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹21,742 31 Mar 22 ₹31,334 31 Mar 23 ₹33,418 31 Mar 24 ₹51,907 31 Mar 25 ₹55,076 Returns for Nippon India Small Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 4.4% 3 Month -2.4% 6 Month -9.2% 1 Year 5.6% 3 Year 21.7% 5 Year 39% 10 Year 15 Year Since launch 20.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 26.1% 2023 48.9% 2022 6.5% 2021 74.3% 2020 29.2% 2019 -2.5% 2018 -16.7% 2017 63% 2016 5.6% 2015 15.1% Fund Manager information for Nippon India Small Cap Fund

Name Since Tenure Samir Rachh 2 Jan 17 8.16 Yr. Kinjal Desai 25 May 18 6.77 Yr. Data below for Nippon India Small Cap Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Industrials 22.17% Consumer Cyclical 13.91% Financial Services 13.54% Basic Materials 12.14% Consumer Defensive 8.89% Technology 8.65% Health Care 8.16% Energy 2.03% Utility 1.98% Communication Services 1.54% Real Estate 0.54% Asset Allocation

Asset Class Value Cash 6.04% Equity 93.96% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Apr 22 | HDFCBANK2% ₹1,152 Cr 6,650,000 Multi Commodity Exchange of India Ltd (Financial Services)

Equity, Since 28 Feb 21 | MCX2% ₹924 Cr 1,851,010 Kirloskar Brothers Ltd (Industrials)

Equity, Since 31 Oct 12 | KIRLOSBROS1% ₹714 Cr 4,472,130 Dixon Technologies (India) Ltd (Technology)

Equity, Since 30 Nov 18 | DIXON1% ₹655 Cr 470,144 Karur Vysya Bank Ltd (Financial Services)

Equity, Since 28 Feb 17 | 5900031% ₹639 Cr 31,784,062 State Bank of India (Financial Services)

Equity, Since 31 Oct 19 | SBIN1% ₹627 Cr 9,100,000 Tube Investments of India Ltd Ordinary Shares (Industrials)

Equity, Since 30 Apr 18 | TIINDIA1% ₹615 Cr 2,499,222 NLC India Ltd (Utilities)

Equity, Since 31 Oct 22 | NLCINDIA1% ₹563 Cr 27,190,940 Adani Wilmar Ltd (Consumer Defensive)

Equity, Since 31 Jan 25 | 5434581% ₹553 Cr 22,483,343

↑ 183,343 Apar Industries Ltd (Industrials)

Equity, Since 31 Mar 17 | APARINDS1% ₹521 Cr 899,271 2. ICICI Prudential Infrastructure Fund

CAGR/Annualized return of 15.9% since its launch. Ranked 27 in Sectoral category. Return for 2024 was 27.4% , 2023 was 44.6% and 2022 was 28.8% . ICICI Prudential Infrastructure Fund

Growth Launch Date 31 Aug 05 NAV (23 Apr 25) ₹182.77 ↑ 0.55 (0.30 %) Net Assets (Cr) ₹7,214 on 31 Mar 25 Category Equity - Sectoral AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 2.22 Sharpe Ratio 0.14 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹18,670 31 Mar 22 ₹25,304 31 Mar 23 ₹30,899 31 Mar 24 ₹50,465 31 Mar 25 ₹54,540 Returns for ICICI Prudential Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 3.1% 3 Month 2.6% 6 Month -3.8% 1 Year 7.1% 3 Year 28.1% 5 Year 38.9% 10 Year 15 Year Since launch 15.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 27.4% 2023 44.6% 2022 28.8% 2021 50.1% 2020 3.6% 2019 2.6% 2018 -14% 2017 40.8% 2016 2% 2015 -3.4% Fund Manager information for ICICI Prudential Infrastructure Fund

Name Since Tenure Ihab Dalwai 3 Jun 17 7.75 Yr. Sharmila D’mello 30 Jun 22 2.67 Yr. Data below for ICICI Prudential Infrastructure Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Industrials 36.49% Basic Materials 21.39% Financial Services 16.91% Utility 8.65% Energy 7.09% Communication Services 1.63% Consumer Cyclical 0.89% Real Estate 0.35% Asset Allocation

Asset Class Value Cash 5.98% Equity 93.39% Debt 0.62% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 09 | LT9% ₹649 Cr 2,052,790

↑ 126,940 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 May 24 | ADANIPORTS4% ₹288 Cr 2,695,324 Shree Cement Ltd (Basic Materials)

Equity, Since 30 Apr 24 | 5003874% ₹268 Cr 98,408

↓ -10,339 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Dec 16 | ICICIBANK3% ₹240 Cr 1,990,000 NTPC Ltd (Utilities)

Equity, Since 29 Feb 16 | 5325553% ₹226 Cr 7,260,775 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 22 | HDFCBANK3% ₹212 Cr 1,225,000 NCC Ltd (Industrials)

Equity, Since 31 Aug 21 | NCC3% ₹210 Cr 12,006,117

↑ 1,500,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Jul 23 | RELIANCE3% ₹205 Cr 1,709,486

↑ 100,000 Vedanta Ltd (Basic Materials)

Equity, Since 31 Jul 24 | 5002953% ₹194 Cr 4,923,662

↑ 100,000 Cummins India Ltd (Industrials)

Equity, Since 31 May 17 | 5004803% ₹173 Cr 635,000 3. Motilal Oswal Midcap 30 Fund

CAGR/Annualized return of 22.3% since its launch. Ranked 27 in Mid Cap category. Return for 2024 was 57.1% , 2023 was 41.7% and 2022 was 10.7% . Motilal Oswal Midcap 30 Fund

Growth Launch Date 24 Feb 14 NAV (23 Apr 25) ₹94.5278 ↑ 1.44 (1.55 %) Net Assets (Cr) ₹26,028 on 31 Mar 25 Category Equity - Mid Cap AMC Motilal Oswal Asset Management Co. Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 0.66 Sharpe Ratio 0.47 Information Ratio 0.63 Alpha Ratio 8.9 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,888 31 Mar 22 ₹23,342 31 Mar 23 ₹25,677 31 Mar 24 ₹41,172 31 Mar 25 ₹48,151 Returns for Motilal Oswal Midcap 30 Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 2.9% 3 Month -4.3% 6 Month -10.9% 1 Year 14.9% 3 Year 27% 5 Year 36.9% 10 Year 15 Year Since launch 22.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 57.1% 2023 41.7% 2022 10.7% 2021 55.8% 2020 9.3% 2019 9.7% 2018 -12.7% 2017 30.8% 2016 5.2% 2015 16.5% Fund Manager information for Motilal Oswal Midcap 30 Fund

Name Since Tenure Ajay Khandelwal 1 Oct 24 0.41 Yr. Niket Shah 1 Jul 20 4.67 Yr. Rakesh Shetty 22 Nov 22 2.27 Yr. Sunil Sawant 1 Jul 24 0.67 Yr. Data below for Motilal Oswal Midcap 30 Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Technology 34.02% Consumer Cyclical 16.09% Industrials 11.09% Health Care 5% Communication Services 3.44% Real Estate 2.8% Basic Materials 2.32% Utility 2.06% Financial Services 0.09% Asset Allocation

Asset Class Value Cash 28.33% Equity 71.67% Top Securities Holdings / Portfolio

Name Holding Value Quantity Coforge Ltd (Technology)

Equity, Since 31 Mar 23 | COFORGE10% ₹2,349 Cr 3,190,000

↑ 340,000 Persistent Systems Ltd (Technology)

Equity, Since 31 Jan 23 | PERSISTENT10% ₹2,254 Cr 4,249,800

↑ 249,800 Kalyan Jewellers India Ltd (Consumer Cyclical)

Equity, Since 29 Feb 24 | KALYANKJIL7% ₹1,619 Cr 35,027,075

↑ 26,975 Dixon Technologies (India) Ltd (Technology)

Equity, Since 31 Mar 23 | DIXON7% ₹1,581 Cr 1,134,324

↑ 134,324 Max Healthcare Institute Ltd Ordinary Shares (Healthcare)

Equity, Since 31 Mar 24 | MAXHEALTH4% ₹975 Cr 9,969,361

↑ 1,913,231 One97 Communications Ltd (Technology)

Equity, Since 30 Sep 24 | 5433964% ₹934 Cr 13,066,359

↑ 3,065,359 Trent Ltd (Consumer Cyclical)

Equity, Since 30 Nov 24 | 5002514% ₹873 Cr 1,800,000

↓ -820,200 Polycab India Ltd (Industrials)

Equity, Since 30 Sep 23 | POLYCAB3% ₹825 Cr 1,750,000

↓ -100,000 Bharti Hexacom Ltd (Communication Services)

Equity, Since 31 Oct 24 | BHARTIHEXA3% ₹815 Cr 6,250,000

↑ 174,429 KEI Industries Ltd (Industrials)

Equity, Since 30 Nov 24 | KEI3% ₹768 Cr 2,500,000

↑ 1,250,000 4. IDFC Infrastructure Fund

CAGR/Annualized return of 11.8% since its launch. Ranked 1 in Sectoral category. Return for 2024 was 39.3% , 2023 was 50.3% and 2022 was 1.7% . IDFC Infrastructure Fund

Growth Launch Date 8 Mar 11 NAV (23 Apr 25) ₹48.045 ↑ 0.19 (0.41 %) Net Assets (Cr) ₹1,563 on 31 Mar 25 Category Equity - Sectoral AMC IDFC Asset Management Company Limited Rating ☆☆☆☆☆ Risk High Expense Ratio 2.33 Sharpe Ratio 0.11 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹20,153 31 Mar 22 ₹24,848 31 Mar 23 ₹27,324 31 Mar 24 ₹47,064 31 Mar 25 ₹50,038 Returns for IDFC Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 4.9% 3 Month 0.9% 6 Month -6.6% 1 Year 5.3% 3 Year 25.9% 5 Year 36.1% 10 Year 15 Year Since launch 11.8% Historical performance (Yearly) on absolute basis

Year Returns 2024 39.3% 2023 50.3% 2022 1.7% 2021 64.8% 2020 6.3% 2019 -5.3% 2018 -25.9% 2017 58.7% 2016 10.7% 2015 -0.2% Fund Manager information for IDFC Infrastructure Fund

Name Since Tenure Vishal Biraia 24 Jan 24 1.1 Yr. Ritika Behera 7 Oct 23 1.4 Yr. Gaurav Satra 7 Jun 24 0.73 Yr. Data below for IDFC Infrastructure Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Industrials 54.7% Utility 13.22% Basic Materials 10.84% Communication Services 4.49% Energy 3.88% Consumer Cyclical 3.46% Financial Services 2.99% Technology 2.07% Health Care 1.9% Asset Allocation

Asset Class Value Cash 2.43% Equity 97.57% Top Securities Holdings / Portfolio

Name Holding Value Quantity Kirloskar Brothers Ltd (Industrials)

Equity, Since 31 Dec 17 | KIRLOSBROS5% ₹71 Cr 443,385 Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 12 | LT4% ₹58 Cr 183,173

↑ 11,726 Reliance Industries Ltd (Energy)

Equity, Since 30 Jun 24 | RELIANCE4% ₹54 Cr 452,706 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 19 | BHARTIARTL4% ₹52 Cr 330,018

↑ 40,855 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Mar 14 | 5325384% ₹51 Cr 50,452

↑ 3,476 GPT Infraprojects Ltd (Industrials)

Equity, Since 30 Nov 17 | GPTINFRA3% ₹45 Cr 4,797,143 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 Dec 23 | ADANIPORTS3% ₹39 Cr 365,137

↓ -69,842 PTC India Financial Services Ltd (Financial Services)

Equity, Since 31 Dec 23 | PFS3% ₹39 Cr 12,400,122 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Oct 19 | BEL3% ₹35 Cr 1,431,700 KEC International Ltd (Industrials)

Equity, Since 30 Jun 24 | 5327143% ₹35 Cr 512,915 5. L&T Emerging Businesses Fund

CAGR/Annualized return of 20.3% since its launch. Ranked 2 in Small Cap category. Return for 2024 was 28.5% , 2023 was 46.1% and 2022 was 1% . L&T Emerging Businesses Fund

Growth Launch Date 12 May 14 NAV (23 Apr 25) ₹75.9538 ↑ 0.35 (0.47 %) Net Assets (Cr) ₹13,334 on 28 Feb 25 Category Equity - Small Cap AMC L&T Investment Management Ltd Rating ☆☆☆☆☆ Risk High Expense Ratio 1.73 Sharpe Ratio -0.4 Information Ratio -0.11 Alpha Ratio 1.44 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹20,010 31 Mar 22 ₹29,870 31 Mar 23 ₹31,289 31 Mar 24 ₹46,026 31 Mar 25 ₹48,026 Returns for L&T Emerging Businesses Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 3.5% 3 Month -5.3% 6 Month -12.2% 1 Year 3.3% 3 Year 18.4% 5 Year 35.7% 10 Year 15 Year Since launch 20.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 28.5% 2023 46.1% 2022 1% 2021 77.4% 2020 15.5% 2019 -8.1% 2018 -13.7% 2017 66.5% 2016 10.2% 2015 12.3% Fund Manager information for L&T Emerging Businesses Fund

Name Since Tenure Venugopal Manghat 17 Dec 19 5.21 Yr. Cheenu Gupta 1 Oct 23 1.42 Yr. Sonal Gupta 1 Oct 23 1.42 Yr. Data below for L&T Emerging Businesses Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 24.78% Consumer Cyclical 15.58% Financial Services 14.01% Basic Materials 10.75% Technology 9.78% Health Care 5.55% Real Estate 4.98% Consumer Defensive 4.06% Energy 1.26% Asset Allocation

Asset Class Value Cash 6.91% Equity 93.09% Top Securities Holdings / Portfolio

Name Holding Value Quantity Neuland Laboratories Limited

Equity, Since 31 Jan 24 | -2% ₹310 Cr 292,479

↓ -6,521 Aditya Birla Real Estate Ltd (Basic Materials)

Equity, Since 30 Sep 22 | 5000402% ₹297 Cr 1,595,574 Suven Pharmaceuticals Ltd (Healthcare)

Equity, Since 31 Mar 20 | SUVENPHAR2% ₹279 Cr 2,298,085 K.P.R. Mill Ltd (Consumer Cyclical)

Equity, Since 28 Feb 15 | KPRMILL2% ₹263 Cr 3,286,897 BSE Ltd (Financial Services)

Equity, Since 29 Feb 24 | BSE2% ₹257 Cr 555,021

↓ -297,579 Time Technoplast Ltd (Consumer Cyclical)

Equity, Since 31 Jan 24 | TIMETECHNO2% ₹243 Cr 6,810,500 Karur Vysya Bank Ltd (Financial Services)

Equity, Since 31 Oct 22 | 5900032% ₹240 Cr 11,912,400 Brigade Enterprises Ltd (Real Estate)

Equity, Since 31 Jul 19 | 5329292% ₹237 Cr 2,499,622 The Federal Bank Ltd (Financial Services)

Equity, Since 30 Sep 22 | FEDERALBNK2% ₹236 Cr 13,286,579 Sumitomo Chemical India Ltd Ordinary Shares (Basic Materials)

Equity, Since 31 Oct 20 | SUMICHEM2% ₹215 Cr 4,672,221 6. Nippon India Power and Infra Fund

CAGR/Annualized return of 18.2% since its launch. Ranked 13 in Sectoral category. Return for 2024 was 26.9% , 2023 was 58% and 2022 was 10.9% . Nippon India Power and Infra Fund

Growth Launch Date 8 May 04 NAV (23 Apr 25) ₹329.752 ↑ 2.52 (0.77 %) Net Assets (Cr) ₹6,849 on 31 Mar 25 Category Equity - Sectoral AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 2.05 Sharpe Ratio -0.05 Information Ratio 1.15 Alpha Ratio 2.34 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹18,563 31 Mar 22 ₹23,186 31 Mar 23 ₹26,891 31 Mar 24 ₹47,550 31 Mar 25 ₹48,861 Returns for Nippon India Power and Infra Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 4.4% 3 Month 1.3% 6 Month -6% 1 Year 2.9% 3 Year 28.2% 5 Year 35.7% 10 Year 15 Year Since launch 18.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 26.9% 2023 58% 2022 10.9% 2021 48.9% 2020 10.8% 2019 -2.9% 2018 -21.1% 2017 61.7% 2016 0.1% 2015 0.3% Fund Manager information for Nippon India Power and Infra Fund

Name Since Tenure Kinjal Desai 25 May 18 6.77 Yr. Rahul Modi 19 Aug 24 0.53 Yr. Data below for Nippon India Power and Infra Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Industrials 40.77% Utility 19.49% Energy 9.09% Basic Materials 9.08% Communication Services 8.44% Real Estate 3.99% Technology 2.14% Health Care 2.08% Consumer Cyclical 1.96% Financial Services 1.78% Asset Allocation

Asset Class Value Cash 1.18% Equity 98.82% Top Securities Holdings / Portfolio

Name Holding Value Quantity Reliance Industries Ltd (Energy)

Equity, Since 30 Nov 18 | RELIANCE8% ₹480 Cr 4,000,000

↑ 250,000 NTPC Ltd (Utilities)

Equity, Since 31 May 09 | 5325558% ₹480 Cr 15,400,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 07 | LT8% ₹472 Cr 1,492,001 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 18 | BHARTIARTL7% ₹408 Cr 2,600,000 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Oct 19 | 5325384% ₹243 Cr 240,038 Tata Power Co Ltd (Utilities)

Equity, Since 30 Apr 23 | 5004004% ₹237 Cr 6,975,789

↑ 500,000 Kaynes Technology India Ltd (Industrials)

Equity, Since 30 Nov 22 | KAYNES3% ₹176 Cr 423,938 Siemens Ltd (Industrials)

Equity, Since 31 May 21 | 5005503% ₹162 Cr 350,000 CG Power & Industrial Solutions Ltd (Industrials)

Equity, Since 30 Sep 24 | 5000932% ₹151 Cr 2,632,923

↑ 80,000 Carborundum Universal Ltd (Industrials)

Equity, Since 30 Sep 23 | CARBORUNIV2% ₹150 Cr 1,800,000 7. SBI Contra Fund

CAGR/Annualized return of 15% since its launch. Ranked 48 in Contra category. Return for 2024 was 18.8% , 2023 was 38.2% and 2022 was 12.8% . SBI Contra Fund

Growth Launch Date 6 May 05 NAV (22 Apr 25) ₹368.482 ↑ 1.21 (0.33 %) Net Assets (Cr) ₹42,220 on 31 Mar 25 Category Equity - Contra AMC SBI Funds Management Private Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 1.7 Sharpe Ratio 0.07 Information Ratio 1.73 Alpha Ratio 0.22 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹20,310 31 Mar 22 ₹26,477 31 Mar 23 ₹29,993 31 Mar 24 ₹44,365 31 Mar 25 ₹47,483 Returns for SBI Contra Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 23 Apr 25 Duration Returns 1 Month 3.2% 3 Month 1.3% 6 Month -4.2% 1 Year 6.5% 3 Year 21.3% 5 Year 35.6% 10 Year 15 Year Since launch 15% Historical performance (Yearly) on absolute basis

Year Returns 2024 18.8% 2023 38.2% 2022 12.8% 2021 49.9% 2020 30.6% 2019 -1% 2018 -14.3% 2017 40.2% 2016 2.4% 2015 -0.1% Fund Manager information for SBI Contra Fund

Name Since Tenure Dinesh Balachandran 7 May 18 6.82 Yr. Pradeep Kesavan 1 Dec 23 1.25 Yr. Data below for SBI Contra Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Financial Services 22.65% Technology 8.84% Basic Materials 7.09% Health Care 7.08% Energy 6.82% Consumer Cyclical 5.38% Utility 5.12% Consumer Defensive 4.3% Industrials 4.21% Communication Services 3.01% Real Estate 0.52% Asset Allocation

Asset Class Value Cash 23.8% Equity 75.02% Debt 1.18% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Aug 16 | HDFCBANK8% ₹3,071 Cr 17,724,629

↑ 5,001,500 Reliance Industries Ltd (Energy)

Equity, Since 31 Mar 23 | RELIANCE4% ₹1,480 Cr 12,328,250 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Mar 24 | KOTAKBANK3% ₹1,219 Cr 6,405,768

↑ 1,277,600 Tech Mahindra Ltd (Technology)

Equity, Since 31 Mar 22 | 5327552% ₹861 Cr 5,786,409 GAIL (India) Ltd (Utilities)

Equity, Since 28 Feb 21 | 5321552% ₹811 Cr 51,993,788 Cognizant Technology Solutions Corp Class A (Technology)

Equity, Since 28 Feb 23 | CTSH2% ₹786 Cr 1,079,430 Torrent Power Ltd (Utilities)

Equity, Since 31 Oct 21 | 5327792% ₹778 Cr 6,163,300 Tata Steel Ltd (Basic Materials)

Equity, Since 31 Jul 22 | TATASTEEL2% ₹727 Cr 52,995,525 State Bank of India (Financial Services)

Equity, Since 31 Dec 10 | SBIN2% ₹706 Cr 10,254,269 91 Days Tbill Red 24-04-2025

Sovereign Bonds | -2% ₹693 Cr 70,000,000

معاشی منصوبہ بندی آپ کے انتظام کی کلید ہے۔آمدنی اور اخراجات. تو، آپ کا کیا ہےمالی مقصد? تجزیہ کریں اور سمجھداری سے سرمایہ کاری کریں!

یہاں فراہم کردہ معلومات کے درست ہونے کو یقینی بنانے کے لیے تمام کوششیں کی گئی ہیں۔ تاہم، ڈیٹا کی درستگی کے حوالے سے کوئی ضمانت نہیں دی جاتی ہے۔ براہ کرم کوئی بھی سرمایہ کاری کرنے سے پہلے اسکیم کی معلومات کے دستاویز کے ساتھ تصدیق کریں۔

Great Read. Clarified my doubts.