Mutual Fund: Dividend Option Or Growth Option

Don’t you feel good when you receive mutual fund dividend? Yes, you do. Mutual fund dividend is distributed by a mutual fund scheme among its unitholders. Mutual Funds distribute dividends against their realized profits and not on their book profits or paper profits. Realized profit means the profits earned by the mutual fund scheme against the sale of underlying assets in the Portfolio. There are certain myths associated with the concept of mutual fund dividend although it sounds luring. So, let us understand the various aspects of mutual fund dividend like mutual fund investment in mutual fund dividend plans, how to invest in SIP mutual fund, myth behind the mutual fund dividends some of the mutual fund companies offering best dividend plans, taxation aspects of dividend plans and so on.

Talk to our investment specialist

Mutual Fund Dividend: Meaning

Mutual fund dividend, in simple words, is a share in the actually earned profits which a mutual fund scheme distributes to its unitholders. Realized profits as discussed in the earlier paragraphs refer to, the actual profits earned by the mutual fund scheme through income generated from the sale of its underlying assets in the portfolio. One should not confuse between realized profits and book profits. It is because book profits consider the increase in the Net Asset Value or NAV of the underlying assets also. Increase in the NAV forms part of unrealized profits.

The mutual fund dividend is distributed only among the unitholders of a particular scheme. The fund manager distributes dividend among the unitholders. Distribution of mutual fund dividend results into a reduction in the NAV. In addition, it is the responsibility of the fund managers to declare the dividends. With respect to taxation on the mutual fund dividends, individuals should note that dividend distribution on equity mutual fund does not attract dividend distribution tax as per current income tax laws. Contrarily, dividend distribution on a debt fund is liable for dividend distribution tax. The various dividend options that a mutual fund dividend plan offers include annual dividends, half-early dividends, weekly dividends, and daily dividends.

Mutual Funds: Various Options in Mutual Fund Schemes

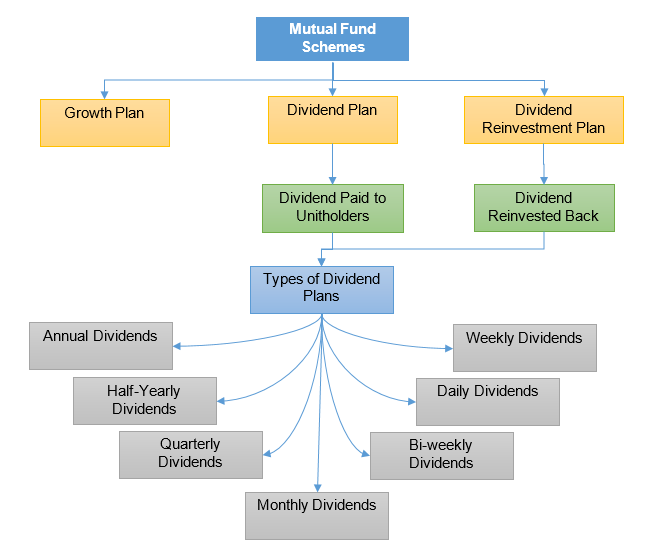

A mutual fund is an investment vehicle that pools money from various individuals sharing a common objective of Investing in shares and Bonds. Most of the mutual fund schemes offer various options like growth plan, dividend plan, and dividend reinvestment plan. So, let us look at these plans in detail.

Growth plan in a mutual fund implies that the profits earned by the scheme gets reinvested in the scheme. Without any prior intimation, the profit is reinvested in the scheme. Increase in NAV of a mutual fund growth plan reflects its profits earned. Individuals opting for growth plan do not get any interim cash inflows till redemption. However, growth plans enjoy compounding benefits. Investing in growth plans also helps individuals to enjoy taxation benefits on Capital Gains. If the mutual fund investment is held for more than one year, individuals need not pay long-term capital gain tax. Contrarily, if the investment is redeemed within one year from the date of purchase then, individuals need to pay short-term capital gains.

Dividend plan refers to the plan offered by a mutual fund scheme where the dividend is distributed to the unitholders of the mutual fund scheme. This dividend is given from the separated portion of actual profits earned by the fund scheme to their unitholders. Individuals looking out for regular income on their investment opt for the mutual fund dividend plan. However, while choosing the dividend plan, individuals need to understand that whenever a mutual fund scheme declares a dividend, NAV of the fund reduces. It is because the dividends are declared from the NAV.

Dividend reinvestment plan is similar to dividend plan, where a mutual fund distributes dividend among individuals. However, instead of giving money to individuals, the dividend amount is ploughed back into the mutual fund scheme for purchasing further units.

Mutual Fund Dividend: Duration of Dividends

The duration for the declaration of dividends on mutual fund schemes differs from plan to plans. However, the sole discretion of dividend distribution lies in the hands of the fund manager. The various options of dividend declaration are as follows.

Annual Dividend Mutual Funds

In this option, the mutual fund schemes declare dividends annually. All types of mutual fund schemes like Equity Funds, debt funds, etc., offer this plan.

Half-Yearly Dividend Mutual Funds

In half-yearly option, individuals get dividends once in six months. The fund house based on the performance of the fund scheme declares dividends to its unitholders.

Quarterly Dividend Mutual Funds

By resorting to this option, individuals can receive dividends once in three months depending on the mutual fund scheme’s performance.

Monthly Dividend Mutual Funds

Individuals who are expecting steady returns every month opt for monthly dividend option. By resorting to this scheme, an individual can expect dividends on a monthly basis.

BI-Weekly Dividend Mutual Funds

This option helps the unitholders to enjoy the dividends on fortnightly basis.

Weekly Dividend Mutual Funds

The weekly option gives the unitholders to avail dividend benefits every week. Mutual fund schemes such as ultra-short-term funds and Liquid Funds offer weekly dividend option.

Daily Dividend Mutual Funds

In this option, individuals receive dividends on a daily basis. Liquid funds and other debt funds are some of the mutual fund schemes that can offer daily dividends.

Taxation Applicability on Mutual Funds Dividends

For the purpose of taxation, mutual funds are classified into two categories, namely, equity funds and non-equity funds. For tax purposes, equity mutual fund is a mutual fund scheme having more than 65% of its total investment in equity shares. Dividends of equity mutual funds are exempt from income tax. Capital gains as per income tax are classified into long-term capital gain and short-term capital gain. Long-term capital gain (LTCG) means any investment in equity mutual fund held for a period of more than 12 months. Long-term capital gain in equity funds is not applicable to tax. Short-term capital gain (STCG), where the investment in equity funds are held for a period of less than 12 months is applicable to tax at a flat rate of 15%.

What about debt funds? For taxation purposes, debt funds or non-equity mutual funds is a mutual fund scheme having less than 65% investment in equity shares. Dividends on non-equity mutual funds are liable for Dividend Distribution Tax (DDT). The unitholders need not pay DDT instead, the fund house deducts the tax from the scheme’s NAV and pays the same. The percentage of DDT levied on mutual fund dividend is 28.84% (25% +surcharge etc.). Therefore, the dividend plan is suitable for individuals falling under highest tax slab and planning to invest in debt mutual fund compared to the growth plan. This is explained as follows :

LTCG on a debt fund is applicable if the investment period is more than 36 months. The tax rate applicable on LTCG for debt funds along with indexation benefit is 20%. Contrarily, STCG on a debt fund applies when the investment period is less than 36 months. Tax on STCG is applied as per the individual’s tax bracket. So, if an individual falls under the highest tax slab of 33.33% then, he/she would end up paying a tax of 33.33%. Therefore, such individuals can opt for dividend plans where they end up paying only 28.84 percent as DDT instead of 33.33% of income tax.

Mutual Fund Investment: Myths Behind Mutual Fund Dividends

Many individuals feel that mutual fund dividends are similar to dividends declared by companies to their shareholders which is a misnomer. Mutual fund dividends and dividends offered by companies both are different. Companies offer a dividend to their shareholders out of their profits. Similarly, individuals carry a notion that by investing in mutual fund schemes they will be able to earn additional income along with the increase in the fund's NAV. However, it is a wrong notion. However, it is issued from the investment itself resulting in an impact in the NAV. This can be explained with an example.

Assume you have 10,000 rupees’ worth of mutual fund units whose NAV is 50 rupees. It means you hold 200 units in the mutual fund scheme. Now, assume that the fund house has declared a dividend of 15 rupees per unit. Therefore, the dividend amount you will receive is 3,000 rupees. As a consequence, the net worth of the NAV will be 7,000 rupees. Due to dividend distribution, the NAV has to reduce and its revised value will be 35 (50-15) rupees.

Mutual Fund Companies Offering Mutual Fund Dividend Schemes

Currently, most of the Asset Management Companies (AMCs) or mutual fund companies are offering mutual fund schemes dividend schemes. Individuals who expect regular returns on their mutual fund investment opt for mutual fund dividend plans. However, individuals should remember that the fund manager has the sole discretion to declare dividends. The fund manager can decide on the amount of dividend and the timing of dividend declaration.

How to Invest in Mutual Fund Dividend Schemes?

Individuals can invest in Mutual Fund dividend schemes through various investment channels like directly from the AMC or through brokers, mutual fund distributors, and online portals. However, if individuals invest in mutual fund dividend schemes through the AMC then they can purchase schemes only of one fund house. In contrast, by going through brokers or mutual fund distributors, individuals get the choice to invest in schemes of various fund houses. The additional advantage that online portals offer is that, apart from choosing schemes of various fund houses, they can invest in such schemes from anywhere and at any time.

SIP Mutual Funds Offering Dividend Plans

SIP or Systematic Investment plan refers to an investment in mutual fund schemes in small amounts at regular intervals. The primary advantage of SIP is that individuals can invest in small amounts. As a result, it does not pinch their pockets. The minimum amount of SIP investment can be as low as 500 rupees (some even smaller). The Mutual fund company rolls out dividend plans in various types of mutual fund schemes like debt funds, equity funds, and Hybrid Fund.

Fund Selection Methodology used to find 5 funds

Best Dividend Mutual Funds for SIP Equities

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Franklin Asian Equity Fund Normal Dividend, Payout ₹18.1401

↑ 0.36 ₹315 6.7 21.1 33 11.3 2.2 23.7 DSP US Flexible Equity Fund Normal Dividend, Payout ₹38.0895

↓ -0.24 ₹1,068 7.4 23.3 31.5 22.5 17.8 33.8 DSP Natural Resources and New Energy Fund Normal Dividend, Payout ₹33.263

↓ -0.63 ₹1,573 7.1 19.3 25.4 21.1 22 17.5 Aditya Birla Sun Life Banking And Financial Services Fund Normal Dividend, Payout ₹23.44

↑ 0.66 ₹3,694 1.4 7.2 20.7 16.8 13.3 16.8 Kotak Standard Multicap Fund Normal Dividend, Payout ₹53.157

↑ 1.32 ₹56,460 1 5.5 15.5 17.6 14.6 9.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 3 Feb 26 Research Highlights & Commentary of 5 Funds showcased

Commentary Franklin Asian Equity Fund DSP US Flexible Equity Fund DSP Natural Resources and New Energy Fund Aditya Birla Sun Life Banking And Financial Services Fund Kotak Standard Multicap Fund Point 1 Bottom quartile AUM (₹315 Cr). Bottom quartile AUM (₹1,068 Cr). Lower mid AUM (₹1,573 Cr). Upper mid AUM (₹3,694 Cr). Highest AUM (₹56,460 Cr). Point 2 Oldest track record among peers (18 yrs). Established history (13+ yrs). Established history (17+ yrs). Established history (12+ yrs). Established history (16+ yrs). Point 3 Top rated. Rating: 5★ (upper mid). Rating: 5★ (lower mid). Rating: 5★ (bottom quartile). Rating: 5★ (bottom quartile). Point 4 Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: High. Risk profile: Moderately High. Point 5 5Y return: 2.19% (bottom quartile). 5Y return: 17.75% (upper mid). 5Y return: 22.01% (top quartile). 5Y return: 13.30% (bottom quartile). 5Y return: 14.59% (lower mid). Point 6 3Y return: 11.26% (bottom quartile). 3Y return: 22.47% (top quartile). 3Y return: 21.12% (upper mid). 3Y return: 16.81% (bottom quartile). 3Y return: 17.61% (lower mid). Point 7 1Y return: 33.05% (top quartile). 1Y return: 31.47% (upper mid). 1Y return: 25.36% (lower mid). 1Y return: 20.65% (bottom quartile). 1Y return: 15.45% (bottom quartile). Point 8 Alpha: 0.00 (lower mid). Alpha: 2.48 (top quartile). Alpha: 0.00 (bottom quartile). Alpha: -2.05 (bottom quartile). Alpha: 1.61 (upper mid). Point 9 Sharpe: 1.54 (top quartile). Sharpe: 1.20 (upper mid). Sharpe: 0.74 (bottom quartile). Sharpe: 0.79 (lower mid). Sharpe: 0.28 (bottom quartile). Point 10 Information ratio: 0.00 (upper mid). Information ratio: -0.29 (bottom quartile). Information ratio: 0.00 (lower mid). Information ratio: 0.15 (top quartile). Information ratio: -0.04 (bottom quartile). Franklin Asian Equity Fund

DSP US Flexible Equity Fund

DSP Natural Resources and New Energy Fund

Aditya Birla Sun Life Banking And Financial Services Fund

Kotak Standard Multicap Fund

Thus, it can be concluded that individuals who expect a steady income flow over a period of time can opt for mutual fund dividend plans.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.