Table of Contents

SIP or Systematic Investment Plan

SIP or a Systematic Investment plan is one of the best ways of Investing your money. SIP’s start the process of wealth creation where a small amount of money is invested over regular intervals of time and this investment being invested in the stock Market generates returns over time.SIP’s are usually considered to be a good way to invest money since the investment is spread out over time, unlike a lump sum investment which takes place all at once.The amount required for starting a SIP is as low as INR 500, thus making SIP’s a great tool for smart investments, where one can start investing small amount from a young age. SIP’s are very widely used for investing and for meeting Financial goals for individuals over time. Generally, people have the following goals in life

- Buying a car

- Buying a house

- Save for an international trip

- Marriage

- Child’s education

- retirement

- Medical emergencies etc.

SIP plans help you save money and achieve all these goals in a systematic manner. How? Read the below section to know.

Types of Systematic Investment Plan (SIP)

Below are the types of Systematic Investment Plans:

Top-up SIP

This SIP allows you to increase your investment amount periodically giving you the flexibility to invest higher when you have a higher Income or available amount to be invested. This also helps in making the most out of the investments by investing in the best and high performing funds at regular intervals

Flexible SIP

As the name suggests this SIP plan carries flexibility of amount you want to invest. An investor can increase or decrease the amount to be invested as per his own cash flow needs or preferences.

Perpetual SIP

This SIP Plan allows you to carry on the investments without an end to the mandate date. Generally, an SIP carries an end date after 1 Year, 3Years or 5 years of investment. The investor can hence, withdraw the amount invested whenever he wishes or as per his financial goals.

Why Should you Invest in SIP or Systematic Investment Plan?

Some of the benefits of investing in Systematic Investment Plan are:

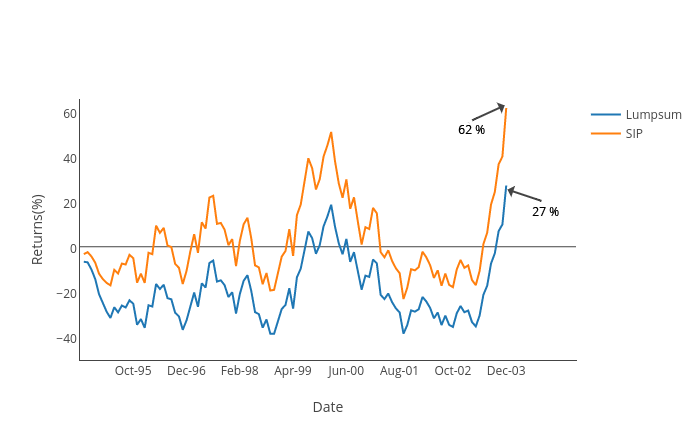

Rupee Cost Averaging

The biggest benefit that a systematic investment plan offers is Rupee Cost Averaging which helps an individual to average out the cost of an asset purchase. While making a lump sum investment in a mutual fund a certain number of units are purchased by the investor all at once, in the case of a SIP the purchase of units is done over a long period and these are spread out equally over monthly intervals (usually). Due to the investment being spread out over time, the investment is made into the stock market at different price points giving the investor the benefit of averaging cost, hence the term rupee cost averaging.

Power of Compounding

Systematic Investment Plans also offer the benefit of the Power of Compounding. Simple interest is when you gain interest on only the principal. In the case of compound interest, the interest amount is added to the principal, and interest is calculated on the new principal (old principal plus gains). This process continues every time. Since the Mutual Funds in the SIP are in instalments, they are compounded, which adds more to the initially invested sum.

Habit of Saving

Apart from this Systematic Investment plans are a simple means to save money and what is an initially low investment over time would add to a large sum later on in life.

Talk to our investment specialist

Affordability

SIPs are a very affordable option for the masses to start savings since the minimum amount required for each instalment (that too monthly!) can be as low as INR 500. Some Mutual Fund companies even offer something called a “MicroSIP” where the ticket size is as low as INR 100.

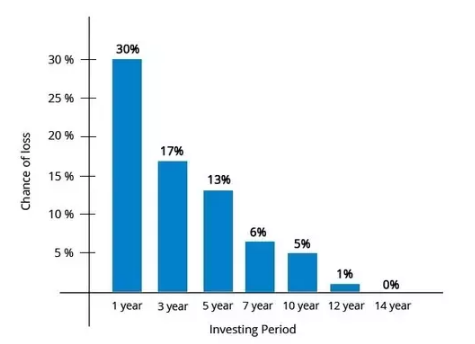

Risk Reduction

Given that a systematic investment plan is spread over a long period of time, one catches all periods of the stock market, the ups and more importantly the downturns. In downturns, when fear catches most investors, SIP instalments continue ensuring the investors buy “low”.

Best SIP Plans or Best Mutual Funds For SIP

Before you invest in SIP, it is important to know the Top SIP plans, so that you choose a right plan. These SIP plans are chosen Basis various factors like returns, AUM (Assets Under Management) etc. Best SIP Plans include-

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) SBI PSU Fund Growth ₹30.2151

↑ 0.36 ₹4,149 500 2 -8.6 1.7 28.9 30.2 23.5 HDFC Infrastructure Fund Growth ₹44.125

↑ 0.23 ₹2,105 300 -0.9 -9.9 4 27.8 34.7 23 Invesco India PSU Equity Fund Growth ₹58.38

↑ 0.78 ₹1,047 500 1.7 -11.2 1.9 27.6 28.4 25.6 ICICI Prudential Infrastructure Fund Growth ₹178.17

↑ 0.82 ₹6,886 100 -0.8 -10.1 5.6 27 37.8 27.4 Franklin India Opportunities Fund Growth ₹231.448

↑ 1.61 ₹5,517 500 -4 -9.6 12.1 26.9 32.4 37.3 Nippon India Power and Infra Fund Growth ₹319.52

↑ 1.87 ₹6,125 100 -3.4 -14.3 1.5 26.8 35.3 26.9 Franklin Build India Fund Growth ₹129.62

↑ 0.90 ₹2,406 500 -2.4 -11.1 4.5 26.1 34.1 27.8 DSP BlackRock India T.I.G.E.R Fund Growth ₹286.618

↑ 1.41 ₹4,465 500 -5.4 -17.6 3.1 24.4 34.4 32.4 IDFC Infrastructure Fund Growth ₹46.435

↑ 0.14 ₹1,400 100 -5.8 -15.8 3 24.2 35.2 39.3 Motilal Oswal Midcap 30 Fund Growth ₹90.068

↑ 0.45 ₹23,704 500 -11.2 -17.5 12.6 24.2 35.7 57.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 16 Apr 25 SIP funds having AUM/Net Assets above 300 Crore. Sorted on Last 3 Year Return.

How to Invest in SIP?

Investing money is an art, it can work wonders if done correctly. Now that you know the best SIP plans you must know how to invest in SIP as well. We have mentioned the steps to invest in SIP below. Take a look!

1. Analyse your financial goals

Choose a SIP investment suiting your financial goals. For example, if your goal is short-term (buying a car in 2 years), you should invest in debt mutual fund and if your goal is long-term (retirement in 5-10 years), you should invest in Equity Mutual Funds.

2. Choose a timeline of investment

This will ensure that you invest a right amount of money for a right period of time.

3. Decide the amount you wish to invest monthly

As SIP is a monthly investment, you should choose an amount that you will be able to invest monthly without Fail. You can also calculate the suitable amount as per your goal using sip calculator or SIP return calculator.

4. Select the best SIP plan

Make a wise investment choice by consulting a financial advisor or by choosing best SIP plans offered by various online investment platforms.

How does SIP Investment Grow?

Want to know how your SIP investment will grow if you invest a certain amount monthly for a specific period of time? We will explain you with an example.

SIP Calculator or SIP Return Calculator

SIP calculators usually take inputs such as the SIP investment amount(goal) one seeks to invest, the number of years of investing required, expected Inflation rates (one needs to account for this!) and expected returns. Hence, one can calculate the SIP returns required to achieve a goal!

Let’s suppose, if you invest INR 10,000 for 10 years, see how your SIP investment grows-

Monthly Investment: INR 10,000

Investment Period: 10 years

Total Amount Invested: INR 12,00,000

Long-term Growth Rate (approx.): 15%

Expected Returns as per SIP calculator: INR 27,86,573

Net Profit:

INR 15,86,573(Absolute Return= 132.2%)

The above calculations show that if you invest INR 10,000 monthly for 10 years (a total of INR 12,00,000) you will earn INR 27,86,573, which means the net profit you make is INR 15,86,573. Isn’t it great!

You can do more slicing and dicing by using our SIP Calculator below

Know Your SIP Returns

SIP Investment for Mutual Funds

SIP investment in Mutual Funds is the most convenient way to inculcate the habit of saving. Too often the youngest generation of earning people do not save much. To have a Systematic Investment Plan one does not require a massive amount of investing as the starting amount is as low as Rs 500. From an early age, one can get into the habit of making their savings as a form of investment. SIP, thereby sets aside a fixed amount to be saved during each month. Systematic Investment Plans are therefore one of the most important tools of smart investing.

SIP’s help you prepare for your financial goals in a hassle-free manner. Having a SIP is extremely convenient as the Mutual Funds require the paperwork to be done only one time after which the monthly amounts are debited from the Bank account directly without intervention. As a result, SIP’s do not require the efforts required by other investments & savings options.

How to Invest in SIP Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

Plan your goal using mutual funds, use SIPs to reach them!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Right answer