Table of Contents

Par Yield Curve

A Par Yield Curve is referred to the geographical representation of the hypothetical Treasury securities’ yields with prices at par. On this yield curve, the coupon rate equals the Yield to Maturity (ytm) of the security, which is the reason that the treasury bond trades at Par.

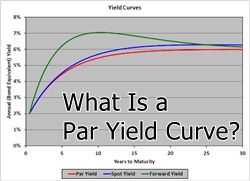

Basically, the par yield curve can be compared with the forward yield curve and the spot yield curve for Treasuries.

Explaining Par Yield Curves

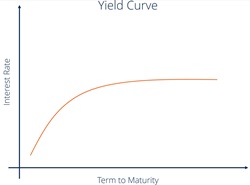

In simple words, the yield curve is a graph that represents the relationship between bond yields and interest rates of several maturities that Range from mere 3-months treasury bills up to 30-years treasury Bonds.

This y-axis of the graph depicts the interest rates, and the x-axis shows the increasing time durations. Considering that short-term bonds generally come with lower yields in comparison to long-term bonds, the curve goes upwards toward the right.

When the yield curve, specifically the spot yield curve is spoken of, it is for the risk-free bonds. But there are certain situations where another yield curve type is referred to as the par yield curve. Also, the par yield curve graphs the Yield to Maturity (YTM) of coupon-paying bonds of varying maturity dates.

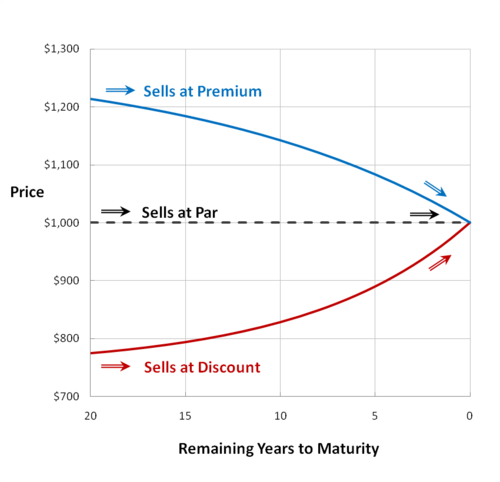

The YTM is the return that a bond investor is anticipating to make, presuming that the bond will be held until it matures. Further, a bond that gets issued at par has a YTM equal to the coupon rate. With the fluctuations in the interest rate over time, either the YTM increases or decreases to signify the current environment of the interest rate.

For instance, if interest rates, after the bond issue, are decreasing, the bond’s value will rise, provided that the coupon rate, which is fixed to the bond, is higher than the interest rate. In this scenario, the coupon rate will go higher than the YTM.

Talk to our investment specialist

Simply, a par yield is such a coupon rate at which the bond prices turn zero. A par yield curve signifies bonds that trade at par. In simple words, the par yield curve is known as the yield plot that matures against term to maturity for a bonds’ group that is priced at par.

It is generally used to comprehend the coupon rate that a new bond, with the provided maturity, will be paying to sell at par.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.