+91-22-48913909

+91-22-48913909

Fincash » Mutual Funds » DHFL Pramerica/PGIM India Mutual Fund

Table of Contents

- PGIM India

- Important Information about DHFL Mutual Fund

- Types of Funds Offered by PGIM India/DHFL Pramerica Mutual Fund

- List of Name Change in Schemes of DHFL Pramerica Mutual Fund

- PGIM India Mutual Fund Calculator

- DHFL Pramerica Mutual Fund Statement

- How to Invest in PGIM India Mutual Fund Online?

- DHFL Pramerica/PGIM India Mutual Fund NAV

- Why Opt for PGIM India/DHFL Pramerica Mutual Fund?

- Corporate Address

- Sponsors

Top 4 Funds

PGIM India Mutual Fund (Formerly DHFL Pramerica Mutual Fund)

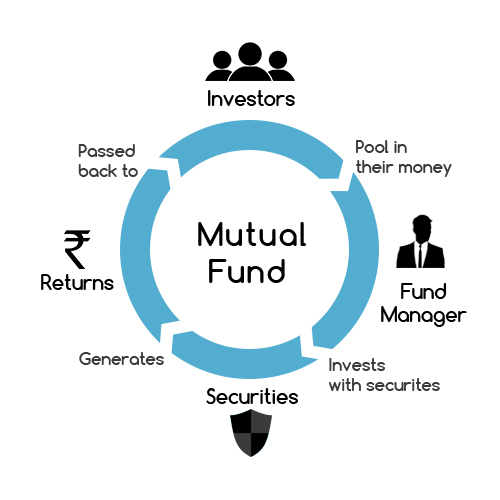

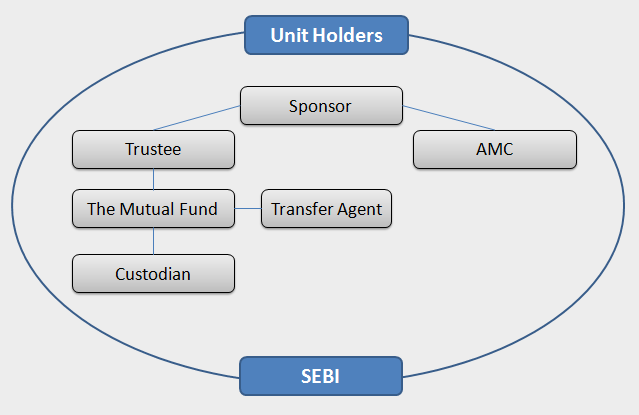

DHFL Pramerica Mutual Fund, renamed as PGIM India Mutual Fund is one of the biggest financial services provider in the country. Today PGIM is a global investment management business of PFI (Prudential Financial, Inc) and is one of the topmost investment managers with an asset of over USD 1.2 trillion. It offers a wide Range of actively managed asset classes and investment styles including Equities, Fixed Income and Real Estate. PGIM is present across 15 countries and has 37 offices with over 1,200+ investment professionals.

PGIM India

| AMC | PGIM India Mutual Fund (Formerly DHFL Pramerica Mutual Fund) |

|---|---|

| Date of Setup | May 13, 2010 |

| AUM | INR 4264.14 (Quarterly) |

| Managing Director & CEO | Mr. Ajit Menon |

| CIO | Mr. Srinivas Rao Ravuri |

| Compliance Officer | Mr. Sandeep Kamath |

| investor Service Officer | Mr. Murali Ramasubramanian |

| Headquarters | Mumbai |

| Customer Care Number | 1800-266-7446 |

| Fax | 022 - 61593100 |

| Telephone | 9930738128 |

| Website | https://www.pgimindiamf.com/ |

| care@pgimindia.co.in |

Important Information about DHFL Mutual Fund

From July 2019, DHFL Mutual Fund has been renamed as PGIM India Mutual Fund. PGIM India has acquired 100% stakes in DHFL- PGIM Asset Management.

Today, it is India's one of the leading mortgage finance institutions. The primary vision of PGIM India/DHFL throughout its span has been Financial Inclusion. Its network along with understanding about the local customer needs has helped the company to reach out to even in India's smallest towns.

PGIM India Mutual Fund is a business owned by PGIM, the global investment management business of the US based Prudential Financial, Inc. (PFI). With operations in the United States, Asia, Europe and Latin America, PFI has provided its customers with a wide range of products and services, including Life Insurance, annuities, retirement-related services, Mutual Funds and investment management.

The PFI has a diverse and talented team of employees who are committed to help all its customers individual as well as institutional to grow and protect their wealth.

Talk to our investment specialist

Types of Funds Offered by PGIM India/DHFL Pramerica Mutual Fund

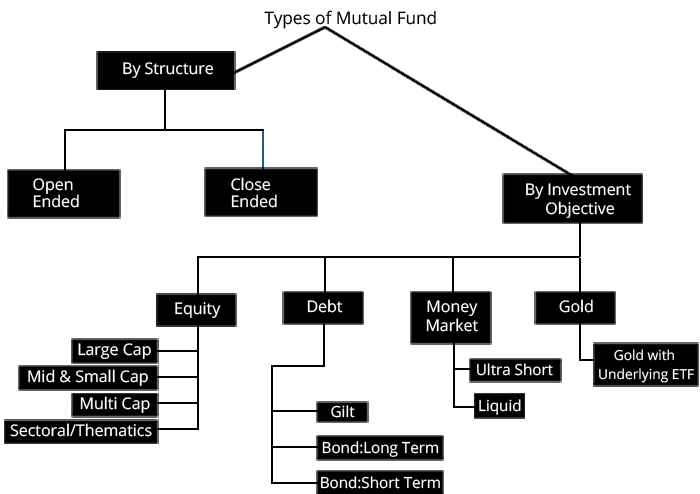

PGIM India Mutual Fund offers a wide range of schemes under different categories to cater the varied requirements of the individuals. Some of these categories of Mutual Fund along with the best schemes in them are as follows.

DHFL Pramerica/PGIM India Equity Funds

Equity Funds are the Mutual Fund schemes that invest their fund money in equity and equity-related instruments of various companies. These schemes are a good investment option in the long-term. PGIM India offers numerous schemes under equity category. Some of the best schemes are as follows.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) PGIM India Large Cap Fund Growth ₹309.77

↑ 4.50 ₹531 -3.1 -8.9 -0.9 8.9 17.6 9.4 PGIM India Midcap Opportunities Fund Growth ₹56.83

↑ 1.06 ₹9,600 -7.7 -13.4 2.1 9.3 29.6 21 PGIM India Tax Savings Fund Growth ₹31.73

↑ 0.59 ₹698 -6 -8.2 3 9 22.9 15.6 PGIM India Diversified Equity Fund Growth ₹32.51

↑ 0.55 ₹5,595 -5 -10.4 0.7 7.3 23.8 15.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 11 Apr 25

PGIM India Debt Funds

The accumulated fund money of debt funds is invested in Fixed Income and money market instruments that vary on maturity periods. The risk-appetite of debt funds is less as compared to equity funds. Debt Funds are a good option for short and medium-term investments. Some of the Best Debt Funds of DHFL Pramerica are tabulated as follows.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity PGIM India Credit Risk Fund Growth ₹15.5876

↑ 0.00 ₹39 0.6 4.4 8.4 3 5.01% 6M 14D 7M 2D PGIM India Insta Cash Fund Growth ₹335.329

↑ 0.06 ₹391 1.9 3.7 7.3 6.8 7.3 7.17% 1M 21D 1M 24D PGIM India Low Duration Fund Growth ₹26.0337

↑ 0.01 ₹104 1.5 3.3 6.3 4.5 7.34% 6M 11D 7M 17D PGIM India Short Maturity Fund Growth ₹39.3202

↓ 0.00 ₹28 1.2 3.1 6.1 4.2 7.18% 1Y 7M 28D 1Y 11M 1D PGIM India Gilt Fund Growth ₹30.1653

↑ 0.02 ₹114 3.6 4.3 10.1 7.2 8.9 6.95% 7Y 2M 26D 12Y 9M 22D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 21 Jan 22

DHFL Pramerica/PGIM India Hybrid Funds

Hybrid Fund invest their corpus in a pre-determined proportion in equity and fixed income instruments. These schemes are suitable for investors seeking for long-term Capital gains along with regular income. The best schemes under hybrid category are as follows.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) PGIM India Equity Savings Fund Growth ₹47.8746

↑ 0.11 ₹68 0.9 1.3 5.6 6.1 9.7 7.3 PGIM India Arbitrage Fund Growth ₹18.1432

↑ 0.01 ₹89 1.8 3.5 7 6.3 5.1 7.1 PGIM India Hybrid Equity Fund Growth ₹118.44

↑ 0.49 ₹198 -5.3 -5.8 3.3 8.4 15.6 14.3 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 11 Apr 25

"The primary objective of the Scheme is to generate long-term capital appreciation by predominantly investing in equity & equity related instruments and to enable eligible investors to

avail deduction from total income, as permitted under the Income Tax Act, 1961 as amended from time to time. However, there is no assurance that the investment objective

shall be realize" PGIM India Tax Savings Fund is a Equity - ELSS fund was launched on 11 Dec 15. It is a fund with Moderately High risk and has given a Below is the key information for PGIM India Tax Savings Fund Returns up to 1 year are on (Erstwhile DHFL Pramerica Credit Opportunities Fund) The investment objective of the Scheme is to generate income and capital appreciation by investing predominantly in corporate debt. There can be no assurance that the investment objective of the Scheme will be realized. PGIM India Credit Risk Fund is a Debt - Credit Risk fund was launched on 29 Sep 14. It is a fund with Moderate risk and has given a Below is the key information for PGIM India Credit Risk Fund Returns up to 1 year are on The objective of the Scheme is to generate income through investment primarily in low duration debt & money market securities. There is no assurance or guarantee that the investment objective of the scheme will be achieved. PGIM India Low Duration Fund is a Debt - Low Duration fund was launched on 22 Jun 07. It is a fund with Moderate risk and has given a Below is the key information for PGIM India Low Duration Fund Returns up to 1 year are on (Erstwhile DHFL Pramerica Insta Cash Plus Fund) To generate steady returns along with high liquidity by investing in a portfolio of short-term, high quality money market and debt instruments. PGIM India Insta Cash Fund is a Debt - Liquid Fund fund was launched on 5 Sep 07. It is a fund with Low risk and has given a Below is the key information for PGIM India Insta Cash Fund Returns up to 1 year are on 1. PGIM India Tax Savings Fund

CAGR/Annualized return of 13.2% since its launch. Return for 2024 was 15.6% , 2023 was 19.5% and 2022 was 4.7% . PGIM India Tax Savings Fund

Growth Launch Date 11 Dec 15 NAV (11 Apr 25) ₹31.73 ↑ 0.59 (1.89 %) Net Assets (Cr) ₹698 on 28 Feb 25 Category Equity - ELSS AMC Pramerica Asset Managers Private Limited Rating Risk Moderately High Expense Ratio 2.32 Sharpe Ratio -0.14 Information Ratio -0.55 Alpha Ratio 3.42 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,533 31 Mar 22 ₹22,571 31 Mar 23 ₹22,684 31 Mar 24 ₹28,136 31 Mar 25 ₹30,631 Returns for PGIM India Tax Savings Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 11 Apr 25 Duration Returns 1 Month 2.6% 3 Month -6% 6 Month -8.2% 1 Year 3% 3 Year 9% 5 Year 22.9% 10 Year 15 Year Since launch 13.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 15.6% 2023 19.5% 2022 4.7% 2021 37.5% 2020 17.9% 2019 8.2% 2018 -6.4% 2017 39.3% 2016 1.7% 2015 Fund Manager information for PGIM India Tax Savings Fund

Name Since Tenure Bhupesh Kalyani 1 Apr 23 2 Yr. Vinay Paharia 1 Apr 23 2 Yr. Utsav Mehta 15 Apr 24 0.96 Yr. Vivek Sharma 15 Apr 24 0.96 Yr. Data below for PGIM India Tax Savings Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 28.63% Industrials 11.16% Health Care 10.91% Consumer Cyclical 10.85% Technology 10.83% Basic Materials 6.53% Energy 6.08% Consumer Defensive 5.77% Communication Services 3.81% Real Estate 0.47% Asset Allocation

Asset Class Value Cash 4.18% Equity 95.68% Debt 0.14% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Dec 15 | HDFCBANK9% ₹62 Cr 355,514 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Jan 16 | ICICIBANK8% ₹57 Cr 469,764 Reliance Industries Ltd (Energy)

Equity, Since 31 Aug 17 | RELIANCE6% ₹42 Cr 353,591 Bharti Airtel Ltd (Communication Services)

Equity, Since 28 Feb 19 | BHARTIARTL3% ₹23 Cr 148,605 Infosys Ltd (Technology)

Equity, Since 30 Jun 24 | INFY3% ₹21 Cr 122,500 Tata Consultancy Services Ltd (Technology)

Equity, Since 30 Apr 24 | TCS3% ₹19 Cr 53,406 Dixon Technologies (India) Ltd (Technology)

Equity, Since 30 Apr 23 | DIXON2% ₹17 Cr 12,000 ICICI Lombard General Insurance Co Ltd (Financial Services)

Equity, Since 31 Jul 23 | ICICIGI2% ₹17 Cr 98,882 Persistent Systems Ltd (Technology)

Equity, Since 29 Feb 24 | PERSISTENT2% ₹16 Cr 30,992 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 30 Jun 23 | KOTAKBANK2% ₹16 Cr 84,000 2. PGIM India Credit Risk Fund

CAGR/Annualized return of 6.3% since its launch. Ranked 2 in Credit Risk category. . PGIM India Credit Risk Fund

Growth Launch Date 29 Sep 14 NAV (21 Jan 22) ₹15.5876 ↑ 0.00 (0.01 %) Net Assets (Cr) ₹39 on 31 Dec 21 Category Debt - Credit Risk AMC Pramerica Asset Managers Private Limited Rating ☆☆☆☆☆ Risk Moderate Expense Ratio 1.85 Sharpe Ratio 1.73 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Yield to Maturity 5.01% Effective Maturity 7 Months 2 Days Modified Duration 6 Months 14 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,565 Returns for PGIM India Credit Risk Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 11 Apr 25 Duration Returns 1 Month 0.3% 3 Month 0.6% 6 Month 4.4% 1 Year 8.4% 3 Year 3% 5 Year 4.2% 10 Year 15 Year Since launch 6.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for PGIM India Credit Risk Fund

Name Since Tenure Data below for PGIM India Credit Risk Fund as on 31 Dec 21

Asset Allocation

Asset Class Value Debt Sector Allocation

Sector Value Credit Quality

Rating Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 3. PGIM India Low Duration Fund

CAGR/Annualized return of 6.1% since its launch. Ranked 7 in Low Duration category. . PGIM India Low Duration Fund

Growth Launch Date 22 Jun 07 NAV (29 Sep 23) ₹26.0337 ↑ 0.01 (0.06 %) Net Assets (Cr) ₹104 on 31 Aug 23 Category Debt - Low Duration AMC Pramerica Asset Managers Private Limited Rating ☆☆☆☆☆ Risk Moderate Expense Ratio 1.18 Sharpe Ratio -1.66 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load NIL Yield to Maturity 7.34% Effective Maturity 7 Months 17 Days Modified Duration 6 Months 11 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,164 31 Mar 22 ₹10,496 31 Mar 23 ₹10,991 Returns for PGIM India Low Duration Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 11 Apr 25 Duration Returns 1 Month 0.5% 3 Month 1.5% 6 Month 3.3% 1 Year 6.3% 3 Year 4.5% 5 Year 1.3% 10 Year 15 Year Since launch 6.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 Fund Manager information for PGIM India Low Duration Fund

Name Since Tenure Data below for PGIM India Low Duration Fund as on 31 Aug 23

Asset Allocation

Asset Class Value Debt Sector Allocation

Sector Value Credit Quality

Rating Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 4. PGIM India Insta Cash Fund

CAGR/Annualized return of 7.1% since its launch. Ranked 4 in Liquid Fund category. Return for 2024 was 7.3% , 2023 was 7% and 2022 was 4.8% . PGIM India Insta Cash Fund

Growth Launch Date 5 Sep 07 NAV (11 Apr 25) ₹335.329 ↑ 0.06 (0.02 %) Net Assets (Cr) ₹391 on 28 Feb 25 Category Debt - Liquid Fund AMC Pramerica Asset Managers Private Limited Rating ☆☆☆☆☆ Risk Low Expense Ratio 0.27 Sharpe Ratio 3.89 Information Ratio -2.6 Alpha Ratio -0.04 Min Investment 5,000 Min SIP Investment 1,000 Exit Load NIL Yield to Maturity 7.17% Effective Maturity 1 Month 24 Days Modified Duration 1 Month 21 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,360 31 Mar 22 ₹10,711 31 Mar 23 ₹11,314 31 Mar 24 ₹12,123 31 Mar 25 ₹13,011 Returns for PGIM India Insta Cash Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 11 Apr 25 Duration Returns 1 Month 0.8% 3 Month 1.9% 6 Month 3.7% 1 Year 7.3% 3 Year 6.8% 5 Year 5.4% 10 Year 15 Year Since launch 7.1% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.3% 2023 7% 2022 4.8% 2021 3.3% 2020 4.2% 2019 6.7% 2018 7.4% 2017 6.7% 2016 7.7% 2015 8.4% Fund Manager information for PGIM India Insta Cash Fund

Name Since Tenure Bhupesh Kalyani 13 Sep 22 2.55 Yr. Puneet Pal 16 Jul 22 2.71 Yr. Data below for PGIM India Insta Cash Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 99.4% Other 0.6% Debt Sector Allocation

Sector Value Cash Equivalent 73.71% Corporate 20.53% Government 5.16% Credit Quality

Rating Value AAA 100% Top Securities Holdings / Portfolio

Name Holding Value Quantity Clearing Corporation Of India Ltd.

CBLO/Reverse Repo | -12% ₹43 Cr Indian Bank

Certificate of Deposit | -7% ₹25 Cr 2,500,000 Union Bank Of India

Certificate of Deposit | -7% ₹25 Cr 2,500,000 Infina Finance Private Limited

Commercial Paper | -7% ₹25 Cr 2,500,000 Export-Import Bank Of India

Commercial Paper | -7% ₹25 Cr 2,500,000 Canara Bank

Certificate of Deposit | -7% ₹25 Cr 2,500,000 Bank of Baroda

Debentures | -7% ₹25 Cr 2,500,000

↑ 2,500,000 Axis Bank Limited

Certificate of Deposit | -7% ₹25 Cr 2,500,000

↑ 2,500,000 Aditya Birla Money Ltd.

Commercial Paper | -7% ₹25 Cr 2,500,000

↑ 2,500,000 HDFC Bank Ltd.

Debentures | -7% ₹25 Cr 2,500,000

↑ 2,500,000

List of Name Change in Schemes of DHFL Pramerica Mutual Fund

After SEBI's (Securities and Exchange Board of India) circulation on re-categorisation and rationalisation of open-ended mutual funds, many Mutual Fund Houses are incorporating changes in their scheme names and categories. SEBI introduced new and broad categories in Mutual Funds in order to bring uniformity in similar schemes launched by the different Mutual Funds. This is to aim and ensure that investors can find it easier to compare the products and evaluate the different options available before Investing in a scheme.

Here is a list of DHFL schemes that got new names:

| Old Scheme Name | New Scheme Name |

|---|---|

| DHFL Pramerica Insta Cash Fund | PGIM India Insta Cash Fund |

| DHFL Pramerica Euro Equity Fund | PGIM India Euro Equity Fund |

| DHFL Pramerica Floating Rate Fund | PGIM India Floating Rate Fund |

| DHFL Pramerica Hybrid Debt fund | PGIM India Hybrid Debt Fund |

| DHFL Pramerica Hybrid Equity Fund | PGIM India Hybrid Equity Fund |

| DHFL Pramerica Medium Term Fund | PGIM India Medium Term Fund |

| DHFL Pramerica Strategic Debt Fund | PGIM India Strategic Debt Fund |

| DHFL Pramerica Credit Risk Fund | PGIM India Credit Risk Fund |

| DHFL Pramerica Equity Savings Fund | PGIM India Equity Savings Fund |

*Note-The list will be updated as and when we get an insight about the changes in the scheme names.

PGIM India Mutual Fund Calculator

Like every Mutual Fund company, DHFL/PGIM India too has a mutual fund calculator that helps investors to calculate the amount they need to save to fulfil their objectives. Also known as sip calculator, it shows how the investment grows over a period of time. In addition, Mutual Fund calculator helps people to decide which type of scheme they need to choose to accomplish their objectives. Some of the input data that needs to be entered in the Mutual Fund calculator include income, monthly expenses, monthly savings amount, and other related parameters.

Know Your Monthly SIP Amount

DHFL Pramerica Mutual Fund Statement

You can generate your DHFL Pramerica/PGIM India Mutual Fund account statement from their website by entering your registered email-id.

How to Invest in PGIM India Mutual Fund Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

DHFL Pramerica/PGIM India Mutual Fund NAV

PGIM India Mutual Fund NAV can be found on the AMFI website. The latest NAV can also be found on the asset management company's website. You can also check for the historical NAV of the Fund on the AMFI website.

Why Opt for PGIM India/DHFL Pramerica Mutual Fund?

1. Excellent Market Judgement

The schemes are designed with precise Market judgment. These schemes are ahead of the market and give out better returns. Also, there is a capital appreciation actively managed for long-term The offered schemes invest in companies with strong and proven track record.

2. A variety of Choice

Investors can choose from a large range of schemes. It offers large-cap focused diversified equity, dynamic Asset Allocation, Liquid Fund, alternate maturity plan, and credit opportunity debt fund.

3. Risk Profiling and Management

Each of the above-mentioned schemes has a detailed risk profile. PGIM India excellent Risk assessment with respect to the investor profile. Equity funds are supported by strong risk management while credit opportunities debt funds offer moderate risk.

4. Investor Centric

The AMC prides itself on giving innovative investor-centric solutions.

Corporate Address

Nirlon House, 2nd Floor, Dr Annie Besant Road, Worli, Mumbai - 400 030

Sponsors

Prudential Financial, Inc. (PFI)

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.