Celebrate Raksha Bandhan in a Unique Way. Gift Best Financial Products to your Sister for Secure Future!

Raksha Bandhan is a significant occasion in India because it has a deep and meaningful meaning for people. Sisters' blessings are regarded as a divine seal of protection for their brothers, capable of saving them from harm or injury. Sisters have been tying "Rakhis," a sanctified thread that symbolizes a precious link between a brother and sister, since ancient times.

Raksha Bandhan is also a wonderful occasion when a brother lavishes presents on his sister. This year, you can take it a step further and invest in a financial gift to assure her a successful future. Accessories, jewellery, smartphones, cosmetic kits, clothes, boxes of sweets or dry fruits, and so on are common gift examples.

But the best present a brother can offer his sister, though, is financial independence. What better day than Raksha Bandhan to begin or expand her financial independence? On the festive holiday of brother and sister, here is a list of the finest financial goods that you can consider gifting your sister. You can select the product that is most appropriate for you and your sister.

Top Financial Gifts for your Sister this Raksha Bandhan

1. Create a SIP

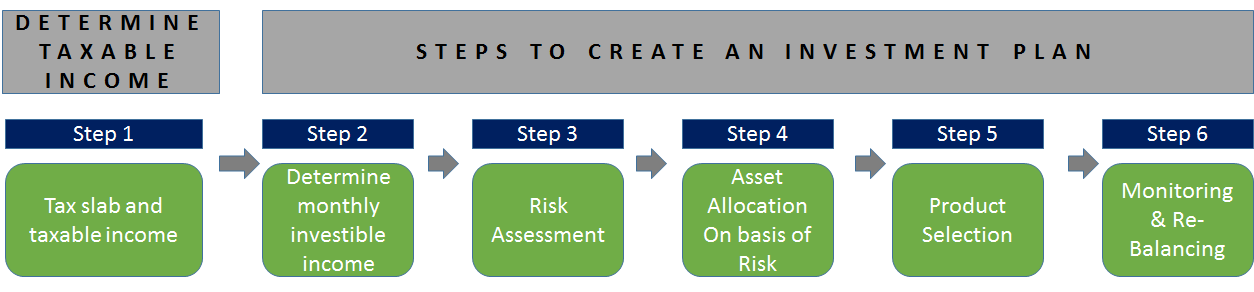

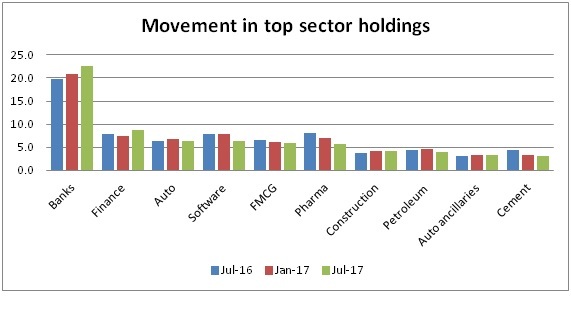

A mutual fund scheme called a Systematic Investment plan (SIP) can be an efficient way to fulfil your sister's ambitions, be it travelling to an exotic location or beginning her own business. And, SIPs are a systematic technique for you to assist her in building that corpus.

SIP is a modern and efficient way to invest in Mutual Funds that can be done with only one click online. It allows you to invest a set amount of money regularly, such as monthly or quarterly, rather than all at once, enabling you to plan for multiple Financial goals at the same time.

And who says you have to do something monumental? With the ‘Step-up SIP service,' you can start with a monthly SIP of Rs. 500 and gradually increase the amount. However, picking the correct mutual fund(s) for SIP is critical. Choose one with a track record of providing consistent returns over a long Range of periods and Market cycles. Ensure that the fund house's investment methods and systems are sound.

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) DSP World Gold Fund Growth ₹48.9817

↑ 0.25 ₹1,498 500 23.4 58.7 122.4 44.8 20.9 15.9 Franklin India Opportunities Fund Growth ₹256.661

↑ 1.95 ₹8,189 500 -0.6 2.4 0 27.6 23.5 37.3 Invesco India PSU Equity Fund Growth ₹63.68

↓ -0.25 ₹1,466 500 3.2 -2.7 -1.9 26.2 26.7 25.6 SBI PSU Fund Growth ₹32.6683

↓ -0.05 ₹5,714 500 4.6 0.1 -0.7 25.9 28.6 23.5 Invesco India Mid Cap Fund Growth ₹181.59

↓ -1.69 ₹9,320 500 -0.1 2.3 3.9 25.6 24.7 43.1 LIC MF Infrastructure Fund Growth ₹47.8882

↓ -0.31 ₹1,054 1,000 -2.9 -5.2 -9.3 24.8 26.4 47.8 HDFC Mid-Cap Opportunities Fund Growth ₹200.3

↓ -1.28 ₹89,383 300 2.7 3.4 3 24.4 25.6 28.6 Franklin India Feeder - Franklin U S Opportunities Fund Growth ₹81.708

↓ -0.04 ₹4,520 500 1.7 11.2 9.1 24.3 11.1 27.1 UTI Transportation & Logistics Fund Growth ₹290.223

↓ -0.83 ₹4,008 500 -0.5 12 12.9 24.1 22.8 18.7 Franklin Build India Fund Growth ₹139.954

↓ -0.68 ₹3,088 500 -0.2 -1.6 -3.9 23.7 26.8 27.8 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 9 Dec 25 Research Highlights & Commentary of 10 Funds showcased

Commentary DSP World Gold Fund Franklin India Opportunities Fund Invesco India PSU Equity Fund SBI PSU Fund Invesco India Mid Cap Fund LIC MF Infrastructure Fund HDFC Mid-Cap Opportunities Fund Franklin India Feeder - Franklin U S Opportunities Fund UTI Transportation & Logistics Fund Franklin Build India Fund Point 1 Bottom quartile AUM (₹1,498 Cr). Upper mid AUM (₹8,189 Cr). Bottom quartile AUM (₹1,466 Cr). Upper mid AUM (₹5,714 Cr). Top quartile AUM (₹9,320 Cr). Bottom quartile AUM (₹1,054 Cr). Highest AUM (₹89,383 Cr). Upper mid AUM (₹4,520 Cr). Lower mid AUM (₹4,008 Cr). Lower mid AUM (₹3,088 Cr). Point 2 Established history (18+ yrs). Oldest track record among peers (25 yrs). Established history (16+ yrs). Established history (15+ yrs). Established history (18+ yrs). Established history (17+ yrs). Established history (18+ yrs). Established history (13+ yrs). Established history (21+ yrs). Established history (16+ yrs). Point 3 Rating: 3★ (upper mid). Rating: 3★ (upper mid). Rating: 3★ (upper mid). Rating: 2★ (bottom quartile). Rating: 2★ (bottom quartile). Not Rated. Rating: 3★ (lower mid). Rating: 4★ (top quartile). Rating: 3★ (lower mid). Top rated. Point 4 Risk profile: High. Risk profile: Moderately High. Risk profile: High. Risk profile: High. Risk profile: Moderately High. Risk profile: High. Risk profile: Moderately High. Risk profile: High. Risk profile: High. Risk profile: High. Point 5 5Y return: 20.86% (bottom quartile). 5Y return: 23.47% (lower mid). 5Y return: 26.69% (upper mid). 5Y return: 28.59% (top quartile). 5Y return: 24.71% (lower mid). 5Y return: 26.42% (upper mid). 5Y return: 25.64% (upper mid). 5Y return: 11.11% (bottom quartile). 5Y return: 22.80% (bottom quartile). 5Y return: 26.84% (top quartile). Point 6 3Y return: 44.77% (top quartile). 3Y return: 27.57% (top quartile). 3Y return: 26.16% (upper mid). 3Y return: 25.92% (upper mid). 3Y return: 25.60% (upper mid). 3Y return: 24.77% (lower mid). 3Y return: 24.39% (lower mid). 3Y return: 24.29% (bottom quartile). 3Y return: 24.15% (bottom quartile). 3Y return: 23.73% (bottom quartile). Point 7 1Y return: 122.42% (top quartile). 1Y return: 0.04% (lower mid). 1Y return: -1.94% (bottom quartile). 1Y return: -0.71% (lower mid). 1Y return: 3.88% (upper mid). 1Y return: -9.32% (bottom quartile). 1Y return: 3.05% (upper mid). 1Y return: 9.08% (upper mid). 1Y return: 12.89% (top quartile). 1Y return: -3.94% (bottom quartile). Point 8 Alpha: -4.16 (bottom quartile). Alpha: 0.68 (top quartile). Alpha: -0.54 (lower mid). Alpha: -0.58 (lower mid). Alpha: 0.00 (upper mid). Alpha: -6.32 (bottom quartile). Alpha: 1.17 (top quartile). Alpha: -13.31 (bottom quartile). Alpha: 0.00 (upper mid). Alpha: 0.00 (upper mid). Point 9 Sharpe: 1.83 (top quartile). Sharpe: 0.06 (bottom quartile). Sharpe: 0.09 (lower mid). Sharpe: 0.09 (lower mid). Sharpe: 0.43 (upper mid). Sharpe: -0.04 (bottom quartile). Sharpe: 0.15 (upper mid). Sharpe: 0.69 (top quartile). Sharpe: 0.60 (upper mid). Sharpe: -0.11 (bottom quartile). Point 10 Information ratio: -1.04 (bottom quartile). Information ratio: 1.78 (top quartile). Information ratio: -0.60 (bottom quartile). Information ratio: -0.57 (lower mid). Information ratio: 0.00 (upper mid). Information ratio: 0.40 (upper mid). Information ratio: 0.61 (top quartile). Information ratio: -1.95 (bottom quartile). Information ratio: 0.00 (upper mid). Information ratio: 0.00 (lower mid). DSP World Gold Fund

Franklin India Opportunities Fund

Invesco India PSU Equity Fund

SBI PSU Fund

Invesco India Mid Cap Fund

LIC MF Infrastructure Fund

HDFC Mid-Cap Opportunities Fund

Franklin India Feeder - Franklin U S Opportunities Fund

UTI Transportation & Logistics Fund

Franklin Build India Fund

SIP funds having AUM/Net Assets above 300 Crore. Sorted on Last 3 Year Return.

2. Get a Medical Insurance Policy in Her Name

Enrolling your sibling in a comprehensive health insurance plan is one of the finest ways to ensure that their life is not spoiled by health issues. With rising hospitalization costs that can quickly deplete savings and investment returns, a health insurance plan would help to mitigate the financial effect of health-related concerns at the very least.

So, obtaining a complete health plan with at least Rs. 5 lakh of coverage and cashless treatment would come to your sibling's rescue if they ever encounter a health difficulty. Moreover, initiating the policy when they are young can also help acquire a big coverage amount at a lower price. However, make sure to look for vital extras like critical illness protection, pre-and post-hospitalization coverage, and evaluate all of your alternatives before choosing the insurance that best meets your sibling's needs.

Talk to our investment specialist

3. Create a Savings Bank Account or Demat Account in Her Name

Create an account in her name if she doesn't already have one. You can start the account by paying the minimum amount required. Certain banks now provide 'women's accounts,' which come with added benefits. However, you will need your sister's KYC documents for the Bank requirements, and she must be present if you are opening the account offline.

If she already has one, you can assist her in putting money into a Fixed Deposit (FD). Your sister's money will be safe in a bank account or a fixed deposit, both of which pay interest. Make sure, however, that she does not leave her money in her bank account uninvested. An FD is also designed for conservative investors, so if your sister is young, ensure that she invests it in a product that will help her grow her money.

4. Give Her a Gift Card

Gift cards are prepaid cards issued by banks that are frequently accepted at retail stores and online shopping portals nowadays. It is entirely up to you whether or not to add a specific amount. Due to the validity of a gift card, your sister will be able to choose her present within one year of the date of issue.

Cash withdrawals, on the other hand, are not permitted. You won't have to worry about the money's security because each gift comes with its PIN, and it's also easier to manage than cash.

5. Consider Purchasing Paper Gold

Gold, as an Asset Class, exemplifies the character of being in a safe place, as it acts as a saviour in times of economic uncertainty. This will help to ensure your sister's financial security in the long run, and it is a well-deserved Rakhsha Bandhan gift. However, avoid giving actual gold as much as possible because it has a high holding cost. Instead, try Investing on her behalf in gold ETFs or gold savings accounts.

Gold Exchange-Traded Funds (ETFs) and gold Mutual Funds (MFs) are two smart and effective ways to invest in gold.

6. Assist Her in Paying Off Her Debts

To whatever extent you can, help her pay off the debts (if any). This can prove to be an outstanding gift and a tremendous relief for your loving sister. Help her reorganize her debts, and if you lack the expertise, refer her to a credit counsellor or a financial guardian. Pay the professional cost, and then chart a route for your sister to follow in the long run for her financial well-being.

7. Invest in Green FD

When you become an adult, you must Handle both your Income and your expenses on your own, which necessitates the ability to manage money. Setting financial objectives and investing in a savings plan that helps you reach them, while difficult at first, is the best way to proceed. Green FDs are a sort of fixed deposit that allows you to invest in accordance with long-term financial objectives.

8. Get Recurring Deposits

recurring deposits are a sort of term deposits in which you can deposit a set amount regularly for a specific period. Your sister can earn interest income by making frequent deposits, thus, increasing her pool of wealth for the future.

9. Credit Card Add-on

This Raksha Bandhan, if your credit card allows for add-on cards, you can get one in your sibling's name. An Add-on card will not only make your sibling's purchases easier, but it will also allow her to maximize the value of their card spends with enticing perks, such as reward points, cashback, complimentary Travel Insurance, quick discounts, and so on, depending on the card variation. More importantly, because your sister will use a card linked to your credit card account, it will teach her about financial discipline and intelligent money management.

If your sister is new to the world of credit cards, try to educate her about how credit cards work, why it's important to pay off the balance in full during the interest-free period, what interest charges and other penalties will be assessed for late payments, why paying only the "Minimum Amount Due" is insufficient, why it should never be used to withdraw cash from an ATM, and so on.

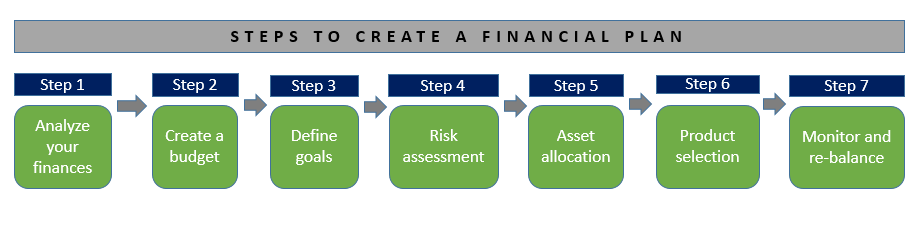

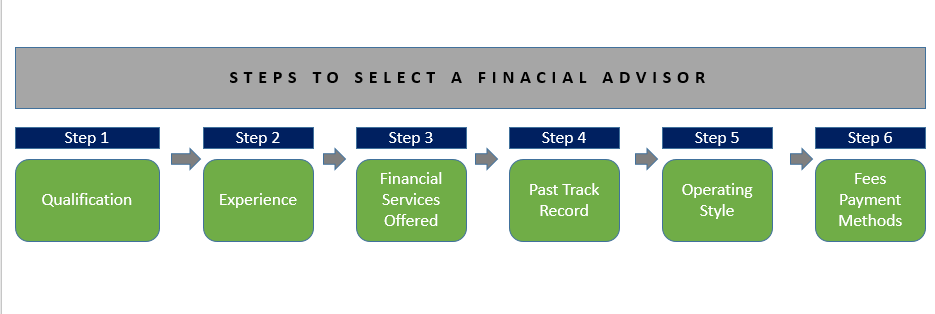

10. Advice On Finances

These are the types of gifts you can acquire for your sister now. You can also assist her in making the best investing decisions possible. Giving your sister financial advice will help her learn about money planning. Inform her about financial journals to which she can subscribe; most of them are also available online. This can help her become financially smarter and more financially self-sufficient.

Finally, make sure she gets her fair share of the family property and Inheritance and that she is treated equally in your parents' will.

Conclusion

These thoughtful financial presents for your sister will not only be treasured, but they will also increase her financial security and freedom. Whether you're buying health insurance, a Paper Gold, or any other asset, make sure you do your homework and choose the best option. Raksha Bandhan is an appropriate occasion to give your sister financial security and freedom. All of the following alternatives are available via various prominent financial institutions to make your Raksha Bandhan extra special.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.