Table of Contents

- Key Highlights of Axis Flexi-Cap Fund

- Investment Objective

- Portfolio Composition & Asset Allocation

- Benefits of Axis Flexi-Cap Funds

- Axis Flexi-Cap Fund Returns

- Axis Flexi-Cap Fund: Current NAV, AUM, PE and PB Ratio

- Top Sector-Wise Investments of Axis Flexi-Cap Fund

- Axis Flexi-Cap Fund's Top Stock Holdings

- Suitability of Axis Flexi-Cap Fund

- Axis Flexi-Cap Fund's Earning Taxability for Capital Gains

- Axis Flexi-Cap Fund's Earning Taxability for Dividend

- Conclusion

Axis Flexi-Cap Fund - Fund Overview

Axis Flexi-Cap Fund is an Axis Mutual Fund scheme that was established on November 20, 2017. The Nifty 500 Total Return Index is used as a benchmark for this scheme. Axis Flexi-Cap Fund Direct-Growth is a medium-sized fund in the Axis Fund category.

The fund has a 0.57% cost ratio, which is lower than most other multi-cap funds. Axis Flexi-Cap Fund Direct has a 1-year growth rate of 22.22%. This open-ended fund has returned an average of 16.59% per year since its inception.

Every three years, the fund has doubled the amount invested. If you're thinking of Investing in this fund, the post covers all of the essential details, including the key highlights and benefits of this fund.

Key Highlights of Axis Flexi-Cap Fund

- The ability of the Axis Flexi-Cap Fund Direct-Growth plan to provide consistent returns can be compared to that of most funds coming in the same category. It also has an above-average capacity for controlling losses in a sinking Market

- Bajaj Finance Ltd., ICICI Bank Ltd., Infosys Ltd., Avenue Supermarts Ltd., and HDFC Bank Ltd. are the fund's top five holdings

- The minimum investment is Rs. 5000, with an extra investment of Rs. 100. SIP investments start at Rs. 500

Investment Objective

According to the fund's investment objective, the scheme aims to generate long-term Capital growth by investing in diversified holdings of equity and other equity-related tools across market capitalisation by targeting underpriced businesses that provide superior capital appreciation from a medium-to-long-term perspective.

Talk to our investment specialist

Portfolio Composition & Asset Allocation

- The fund's Asset Allocation is roughly 94.29% equities, 5.96% Bonds, and -0.25% cash and Cash Equivalents

- The top 10 equity holdings account for roughly 55.8% of total assets, while the top three sectors account for around 62.0%

- The fund invests in various market capitalisations, with roughly 81.95% in gigantic and big-cap firms, 14.79% in mid-sized companies, and 3.26% in small cap companies

Benefits of Axis Flexi-Cap Funds

Here are the top benefits associated with Axis Flexi-Cap funds:

- A diversified Equity Fund invests in a wide Range of firms based on their market capitalisation

- This flexi-cap Mutual Fund strives to provide investors with an appropriate combination of assets to produce long-term returns while reducing market Volatility concerns

- High-quality firms provide risk-adjusted returns to investors who are consistently seeking high-growth investments

- When compared to a pure mid-cap or small-cap fund, investing in a flexi-cap fund is less hazardous since the fund manager has the freedom to take advantage of the greatest available possibilities in the market at the time

- Equity as an Asset Class can outperform Inflation and build long-term wealth

- Long-term goals such as a child's education and future, retirement, or other long-term growth necessitate a wealth-generation strategy

Axis Flexi-Cap Fund Returns

The Axis Flexi-Cap Fund is a four-and-a-half-year-old fund with an average yearly return of 16.6% since its inception.

| 1-Year | 3-Year | Since Inception |

|---|---|---|

| 21.68% | 19.05% | 16.6% |

Axis Flexi-Cap Fund: Current NAV, AUM, PE and PB Ratio

Net Asset Value (NAV) is the mutual fund's per-unit price. The mutual fund's NAV fluctuates daily. It is computed by subtracting the expenses from the current value of the fund's holdings at the end of the day and dividing the amount by the units issued to date. Axis Flexi-Cap Fund's NAV on April 13, 2022, is Rs. 19.64. The fund has an AUM of Rs. 10,848 crores.

Axis Flexi-Cap Fund Direct Growth's PE ratio is calculated by dividing the market price by Earnings Per Share. In contrast, its PB ratio is calculated by dividing the stock price per share by its Book Value Per Share (BVPS).

Top Sector-Wise Investments of Axis Flexi-Cap Fund

The sectors in which the fund has predominantly invested are as follows:

| Sector | Percentage of Portfolio |

|---|---|

| Financial | 32.72% |

| Technology | 18.97% |

| Services | 8.96% |

| Healthcare | 8.28% |

| Chemicals | 5.8% |

| Materials | 5% |

| Automobile | 4.77% |

| Consumer Discretionary | 2.24% |

| Construction | 1.82% |

| Communication | 1.61% |

Axis Flexi-Cap Fund's Top Stock Holdings

The majority of the money in the Axis Flexi-Cap Fund is invested in the equities of the following companies:

| Company | Percentage of Portfolio |

|---|---|

| Bajaj Finance Ltd. | 9.5% |

| Infosys Ltd. | 8.47% |

| ICICI Bank Ltd. | 8.06% |

| Avenue Supermarts Ltd. | 6.81% |

| HDFC Bank Ltd. | 5.71% |

| Tata Consultancy Services Ltd. | 5.43% |

| Kotak Mahindra Bank Ltd. | 3.23% |

| Divi's Laboratories Ltd. | 2.65% |

| Ultratech Cement Ltd. | 2.32% |

| Sona BLW Precision Forgings Ltd. | 2.29% |

Suitability of Axis Flexi-Cap Fund

If you invest for five years or longer, you can expect gains that can easily outperform inflation along with the returns from fixed-Income choices. However, be prepared for ups and downs in the value of your investment along the road.

This is a flexi-cap fund, meaning that the fund management team can invest in firms of varying sizes based on where it expects to make the most money. Flexi-cap funds are perfectly suited for equities fund investors because the responsibility of stock selection is entirely in the hands of the fund management, which is the whole point of investing in a mutual fund.

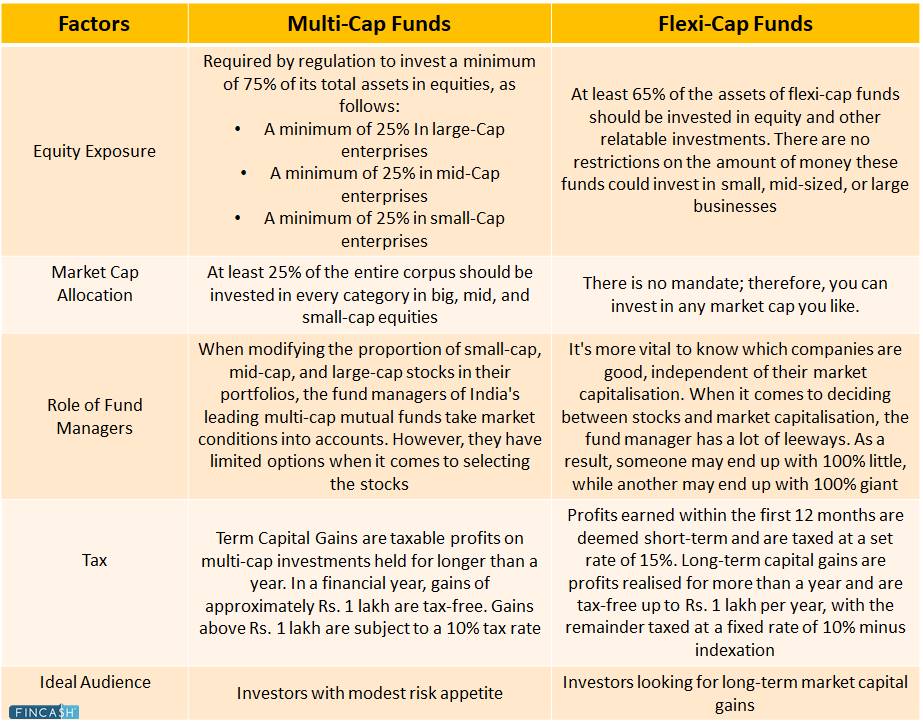

Axis Flexi-Cap Fund's Earning Taxability for Capital Gains

Here are the details regarding the taxability of Earnings for the fund:

- Gains up to Rs. 1 lakh in any financial year are tax-free if mutual fund units are sold after one year from the investment date. Gains of more than Rs 1 lakh are taxed at a 10% rate

- If mutual fund units get sold within one year of when they were purchased, the entire gain is taxed at 15% of the rate

- As long as you keep the units, you won't have to pay any Taxes

Axis Flexi-Cap Fund's Earning Taxability for Dividend

Dividends are added to an investor's income and taxed according to their tax brackets. In addition, if an investor's dividend income exceeds Rs. 5,000 in a calendar year, the fund house deducts a 10% TDS before releasing the dividend.

Conclusion

The Financial, Services, Technology, Healthcare, and Chemicals sectors account for most of the fund's holdings. Compared to the several other funds in the category, it has less exposure to the Financial and Technology industries. The Axis Flexi-Cap Fund Rank is 7th out of 31, and the consistency grade is 3. However, you may also investigate other funds in the same category.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.