Table of Contents

Mutual Funds Sahi Hai

UPDATES - The latest ‘Mutual Fund Sahi Hai’ campaign, featuring two cricket icons -

Sachin TendulkarandM S Dhoni, encourages people to start Investing in Mutual Funds through the monthly Systematic Investment plan (SIP) route, for their long-term financial goal, like children’s future and retirement.

AMFI has started an Ad campaign in March 2017 as an initiative for investor awareness towards Mutual Funds. Mutual Funds set aside 2 bps of the management fees towards investor awareness. This money is now being utilised towards creating awareness via the "Sahi Hai" campaign. The objective of the campaign is to communicate to investors that mutual funds are the right choice for investors. The campaign is targetted towards the common public and aims to generate interest amongst retail investors.

Mutual Funds Sahi Hai is the recently launched campaign by Association of Mutual Funds in India (AMFI) to create awareness about Mutual Funds in the investor community. With this campaign, AMFI chooses to address various investor questions such as Mutual funds meaning, Mutual Fund companies, best mutual funds to invest into, how to make a Mutual Fund investment and how investing in Mutual Funds makes sense. It truly is trying to get into the minds of Indian investor with the tagline "Mutual Funds Sahi Hai".

Role of AMFI in Mutual Funds Sahi Hai

AMFI is an Association of Mutual Funds in India. AMFI is not a regulatory body, but an association that sets best practices for the Mutual Fund Industry. It also undertakes investor awareness, education, code of conduct and maintains ethical & professional standards in the industry.

Mutual Funds Sahi Hai Spends

In the 2018-19 financial year, AMFI will spend Rs 150-175 crore to promote mutual funds investments. In the last fiscal (FY 17-18), it had spent Rs 200 crore for the purpose.

Impact of Mutual Funds Sahi Hai

Mutual funds industry has added 32 lakh new investors over the last one year mainly due to a spirited promotion campaign by the industry, as per Association of Mutual Funds in India (Amfi) officials in April 2018.

Way forward for Mutual Funds Sahi Hai

The Association of Mutual Funds of India (AMFI) is all set to come out with its next campaign that will focus on the benefits of investing in Debt fund, following the popular 'Mutual Funds Sahi Hai' drive.

We are now planning the second phase of mutual funds campaign on debt investment benefits. It is expected to be aired from the third week of September 2018," AMFI Chief Executive N S Venkatesh told PTI.

Talk to our investment specialist

What are Mutual Funds?

Mutual Funds are a collective pool of funds with a common objective. Mutual Funds are regulated by Securities & Exchange Board of India (SEBI). SEBI ensures that there are clear policies and guidelines that each Mutual Funds scheme follows. Each scheme is managed professionally by a qualified person called a Fund Manager or Portfolio Manager. These are experts in their field and know how to select securities (equity or debt) and ensure that the investor generates returns over time.

Mutual Funds in Hindi

While there is no real Hindi term for Mutual Funds, however, what has happened over the years is that Mutual funds have launched specific campaigns in Hindi/vernacular to ensure there is deeper penetration built-in. In fact, a tax saving fund called "Kar Bachat Yojana", a Balanced Fund called "Bal Vikas Yojana", and a balanced scheme targetted at saving for children’s future come up in the early years. Along with these, there are also schemes like "Bachat Yojana" and "Nivesh Lakshya" which are also there. Many years ago SBI Mutual Fund, launched "SBI Chota SIP" a micro-SIP with minimum investment amounts at INR 500.

Share Market Vs Mutual Funds

A lot of people also try to invest directly into the share market (or stock market). This becomes dangerous when those people have inadequate knowledge about the stock market, how to select stocks, how to evaluate them, what factors to look for and most importantly how to monitor them & exit. Investing directly into the stock market is for experts. Mutual Funds are managed by professionals called fund managers, who have the professional qualifications, experience & expertise in all the above. Depending on the scheme, fund houses charge a management fee which could be as low at 0.2% per annum ( for Liquid Funds) to as high as 2.5% p.a. for Equity Funds. Paying a professional for their services and ensuring in the long run that you benefit is a good thing to do.It's a smarter way to invest! So for retail investors, against investing directly in the stock market, Mutual Funds Sahi Hai!

Mutual Fund Kya Hai Campaign

The campaign is not only in English but also in Hindi and other vernacular languages. Hence today many inquisitive investors ask the question "Mutual Fund kya hai ?", while there is no real definition in Hindi, one can explain the concept that it is a pool of funds with a common goal. The very words of the campaign literally mean that Mutual Funds are the right choice! Mutual Funds Sahi Hai!

Investing in Mutual Funds, Good or Bad?

Today, the Mutual Funds industry has expanded over time, just to share some of the statistics:

- Over INR 20 lakh crores of investor money is in Mutual Funds

- There are over 5 crores investments made in Mutual Funds

- There are 42 Mutual Fund companies regulated by SEBI offering Mutual Funds

- There are over 10,000 schemes that investors can choose from

So Mutual Funds Sahi Hai!

How to Invest in Best Mutual Funds?

There are various routes to make an investment into Mutual Funds. One can use a broker, a distributor, a Bank, an online platform or even through an Independent Financial Agent (IFA). All routes will help you make an investment into a mutual fund.

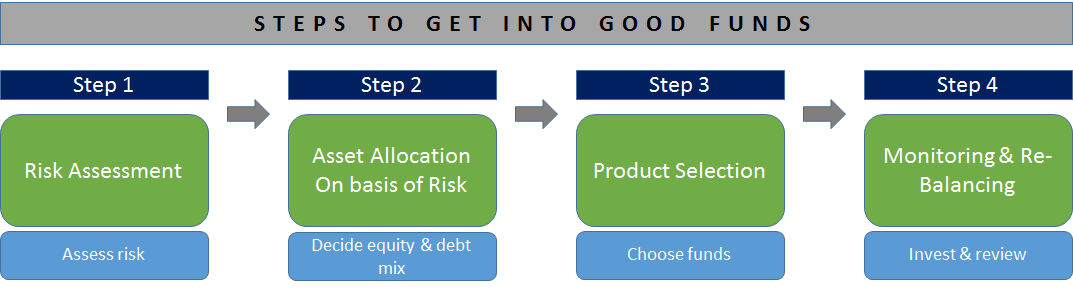

It is not about getting the best Mutual Fund to invest into. Firstly, investors need to understand their risk appetite. Secondly, they need to match their risk capacity and holding period with the type of investment to be made, this is essentially getting the mix of equity and debt right and matching this with the risk capacity of the investor.Thirdly, selecting the best mutual fund is a tedious task, one needs to look at various parameters such as performance ratings, expense ratios, fund manager track record etc. Lastly, but not least, one needs to monitor performance over time and ensure that they are in a good fund. Bad performers need to be replaced.

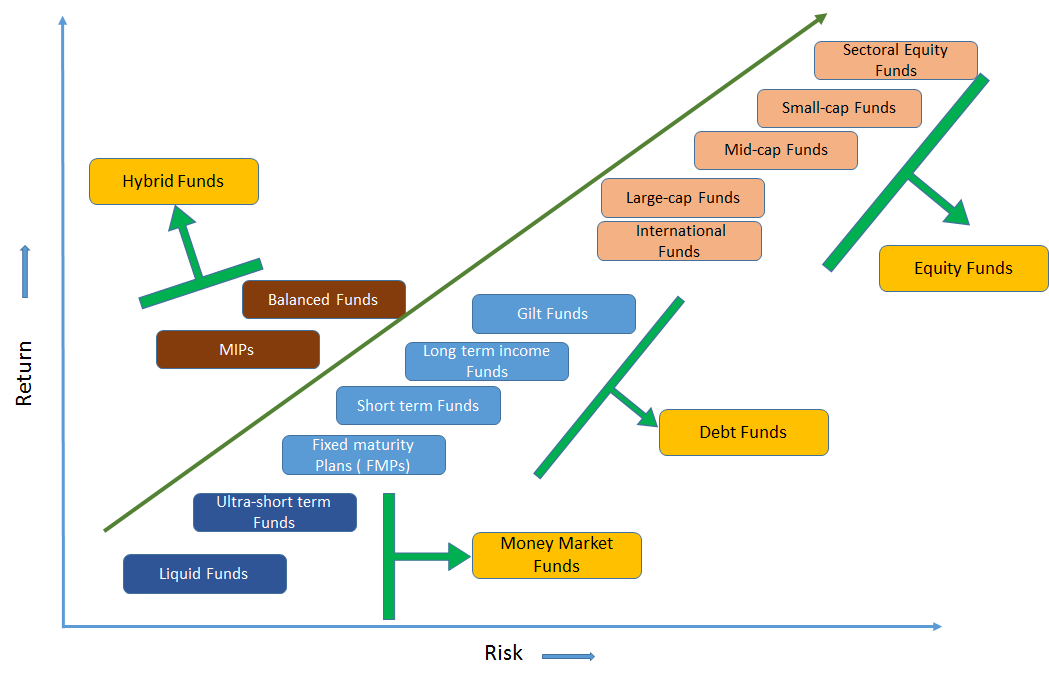

Another thing is that the investor needs to match their holding period with the type of investment to be made. Mutual funds are available for every tenor. If one wants to invest money for even 1 day, there are liquid funds, for a couple of weeks there are ultra short-term funds, and for long tenors, say at least more than 3-5 years there are equity funds. So Mutual Funds exist for every possible tenor. The below chart gives an indicator of the type of fund and the tenor one should have.

Mutual Funds For Short Term

There is a common belief that Mutual Funds are only for long-term investors and that too for people with loads of money. Both these are not true. One can invest for an amount as low as INR 500 (even INR 50 at times). Also, there are Mutual Funds for every tenor. In fact, if one goes to find mutual funds for short term, then a whole list of funds will come up. Those investors looking to invest for a day or even couple of days can invest in liquid funds, those looking to invest for a couple of weeks or a month can look at ultra short term funds.Those looking to invest for a year and up to 2 years can look at short term funds. So there are mutual funds for short term, in fact, mutual funds exist for every term! Mutual Funds Sahi Hai!

Best Short Term Mutual Funds

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2023 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Franklin India Ultra Short Bond Fund - Super Institutional Plan Growth ₹34.9131

↑ 0.04 ₹297 1.3 5.9 13.7 8.8 0% 1Y 15D Sundaram Short Term Debt Fund Growth ₹36.3802

↑ 0.01 ₹362 0.8 11.4 12.8 5.3 4.52% 1Y 2M 13D 1Y 7M 3D HDFC Short Term Debt Fund Growth ₹31.5245

↑ 0.03 ₹14,391 2.8 4.3 9 7.2 8.3 2.96% 2Y 9M 18D 4Y 23D IDFC Bond Fund Short Term Plan Growth ₹56.2875

↑ 0.08 ₹9,570 2.9 4.4 8.9 6.7 7.8 7.38% 2Y 10M 17D 3Y 8M 16D Axis Short Term Fund Growth ₹30.4232

↑ 0.03 ₹8,825 2.9 4.6 8.9 7 8 7.57% 2Y 9M 14D 3Y 7M 10D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 7 Aug 22

Best Mutual Fund Investment to Make in 2025

The best mutual fund investment to make in 2025 is the one after one does after a bit of research. First, one needs to know what category of funds one wants to invest in. After that one can choose the category of funds, be it large-cap equity, mid-cap equity or even debt.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) DSP BlackRock Natural Resources and New Energy Fund Growth ₹77.453

↓ -0.97 ₹1,125 -8.5 -18.5 -9.5 9 27.5 13.9 DSP BlackRock Equity Opportunities Fund Growth ₹561.493

↑ 9.20 ₹12,598 -3.9 -10.8 7.3 16.8 25.6 23.9 DSP BlackRock US Flexible Equity Fund Growth ₹48.5287

↓ -2.19 ₹876 -16.2 -12.1 -8.1 5.5 13.7 17.8 L&T Emerging Businesses Fund Growth ₹70.2958

↑ 1.97 ₹13,334 -16 -21.4 -3.7 14.2 34.5 28.5 L&T India Value Fund Growth ₹96.3499

↑ 2.03 ₹11,580 -6.1 -12.8 1.4 17.7 29.5 25.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 9 Apr 25

SIP Investment in Mutual Funds

A Systematic Investment Plan (SIP) is a unique invention of the Mutual Funds industry. The SIP is built for the retail investor and is a great tool to build savings for any individual. A systematic investment plan essentially allows an investor to invest very small amounts of money at set periodicity (say monthly) into Mutual Funds. One can invest with an amount as low as INR 500! A one-time setup is enough to ensure even a SIP through a generation (even 20 years), hence this makes it very convenient for an investor who wants to invest small amounts. The paperwork, setup or even if done online is only one-time!

Best SIP Mutual Funds

Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) SBI PSU Fund Growth ₹29.2899

↑ 0.57 ₹4,149 500 0.4 -11.2 -3 27.2 29.9 23.5 HDFC Infrastructure Fund Growth ₹42.756

↑ 0.81 ₹2,105 300 -3.4 -11.9 -1.1 26 35.5 23 ICICI Prudential Infrastructure Fund Growth ₹173.11

↑ 3.09 ₹6,886 100 -3.3 -11.8 0.4 25.5 38 27.4 Franklin India Opportunities Fund Growth ₹224.029

↑ 4.86 ₹5,517 500 -7.6 -12 7.6 24.9 31.8 37.3 Nippon India Power and Infra Fund Growth ₹307.974

↑ 6.25 ₹6,125 100 -6.6 -16.5 -3.2 24.9 35.6 26.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 11 Apr 25

How to Invest in Mutual Funds Online?

✅ 1. Open Free Investment Account for Lifetime at Fincash.com

✅ 2. Complete your Registration and KYC Process

✅ 3. Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

Mutual Funds History in India

The mutual fund industry in India started in 1963 with the formation of Unit Trust of India, at the initiative of the Government of India and Reserve Bank of India. The History of Mutual Funds in India can be broadly divided into four distinct phases

First Phase - 1964-1987

Unit Trust of India (UTI) was established in 1963 by an Act of Parliament. It was set up by the Reserve Bank of India and functioned under the Regulatory and administrative control of the Reserve Bank of India. In 1978 UTI was de-linked from the RBI and the Industrial Development Bank of India (IDBI) took over the regulatory and administrative control in place of RBI. The first scheme launched by UTI was Unit Scheme 1964. At the end of 1988 UTI had Rs. 6,700 crores of assets under management.

Second Phase - 1987-1993 (Entry of Public Sector Funds)

1987 marked the entry of non-UTI, public sector mutual funds set up by public sector banks and Life Insurance Corporation of India (LIC) and general insurance Corporation of India (GIC). SBI Mutual Fund was the first non-UTI Mutual Fund established in June 1987 followed by Canbank Mutual Fund (Dec 87), Punjab National Bank Mutual Fund (Aug 89), Indian Bank Mutual Fund (Nov 89), Bank of India (Jun 90), Bank of Baroda Mutual Fund (Oct 92). LIC established its mutual fund in June 1989 while GIC had set up its mutual fund in December 1990.

At the end of 1993, the mutual fund industry had assets under management of Rs. 47,004 crores.

Third Phase - 1993-2003 (Entry of Private Sector Funds)

With the entry of private sector funds in 1993, a new era started in the Indian mutual fund industry, giving the Indian investors a wider choice of fund families. Also, 1993 was the year in which the first Mutual Fund Regulations came into being, under which all mutual funds, except UTI were to be registered and governed. The erstwhile Kothari Pioneer (now merged with Franklin Templeton) was the first private sector mutual fund registered in July 1993.

The 1993 SEBI (Mutual Fund) Regulations were substituted by a more comprehensive and revised Mutual Fund Regulations in 1996. The industry now functions under the SEBI (Mutual Fund) Regulations 1996. The number of Mutual Fund Houses went on increasing, with many foreign mutual funds setting up funds in India and also the industry has witnessed several mergers and acquisitions. As at the end of January 2003, there were 33 mutual funds with total assets of Rs. 1,21,805 crores. The Unit Trust of India with Rs. 44,541 crores of assets under management was way ahead of other mutual funds.

Fourth Phase - since February 2003

In February 2003, following the repeal of the Unit Trust of India Act 1963 UTI was bifurcated into two separate entities. One is the Specified Undertaking of the Unit Trust of India with assets under management of Rs. 29,835 crores as at the end of January 2003, representing broadly, the assets of US 64 scheme, assured return and certain other schemes. The Specified Undertaking of Unit Trust of India, functioning under an administrator and under the rules framed by Government of India and does not come under the purview of the Mutual Fund Regulations.

The second is the UTI Mutual Fund, sponsored by SBI, PNB, BOB and LIC. It is registered with SEBI and functions under the Mutual Fund Regulations. With the bifurcation of the erstwhile UTI which had in March 2000 more than Rs. 76,000 crores of assets under management and with the setting up of a UTI Mutual Fund, conforming to the SEBI Mutual Fund Regulations, and with recent mergers taking place among different private sector funds, the mutual fund industry has entered its current phase of consolidation and growth.

The graph indicates the growth of assets over the years. upto 2015.

Mutual Fund Companies

Mutual Fund Companies or Asset Management Companies are the entities that provide mutual funds to investors. Today, there are over 40 AMCs in India. The industry opened up in the early 90's and since then it has expanded rapidly.Today, there are various types of AMCs that exist, there are PSU bank sponsored AMCs like SBI Mutual Fund to foreign-owned (partly) AMCs such as Franklin Templeton Mutual Fund. Investors can choose schemes across AMCs.

Mutual Fund Information

There are various websites available that provide a lot of information with regards to Mutual Funds. AMFI website provides various information like daily NAVs, funds houses, schemes etc. Then there are various providers that give performance ratings of Mutual Funds like MorningStar, ICRA, CRISIL etc. One can get a lot of information about Mutual Funds from various places, however, at any point in time, one should see the source, its credibility & reputation.

Given that there are over 5 crores investments (volume) made in Mutual Funds, over 19 lakh crores of funds and the fact that the industry has been around for decade gives us a lot of confidence. AMFIs "Mutual Funds Sahi Hai" campaign is another step in the right direction to educate investors and to ensure that more & more investors get their savings into Mutual Funds.

So #Mutualfundsahihai! invest in Mutual Funds!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.

Pretty good content