Table of Contents

میوچل فنڈ کیلکولیٹر

میوچل فنڈ کیا ہے؟

میوچل فنڈ ایک پیشہ ورانہ طور پر منظم سرمایہ کاری کی اسکیم ہے۔ یہ ایک اثاثہ جات کی انتظامی کمپنی چلاتی ہے (اے ایم سی) جو خوردہ سرمایہ کاروں کے لیے ثالث کی طرح کام کرتا ہے۔ AMC بڑی تعداد میں سرمایہ کاروں سے رقم جمع کرتا ہے اور اسے ایکویٹی شیئرز میں لگاتا ہے،بانڈز,کرنسی مارکیٹ آلات اور سیکیورٹیز کی دیگر اقسام۔ میوچل فنڈ خریدنا ایک بڑے پیزا کا چھوٹا ٹکڑا خریدنے کے مترادف ہے۔ ہر ایکسرمایہ کار، بدلے میں، فنڈ میں اس کی سرمایہ کاری کی رقم کے تناسب سے یونٹس کی ایک مخصوص تعداد تفویض کی جاتی ہے۔ سرمایہ کار کو یونٹ ہولڈر کے نام سے جانا جاتا ہے۔ یونٹ ہولڈر فوائد، نقصانات،آمدنی اور فنڈ میں اس کی سرمایہ کاری کے تناسب سے فنڈ کے اخراجات۔

میوچل فنڈ کیلکولیٹر کیا ہے؟

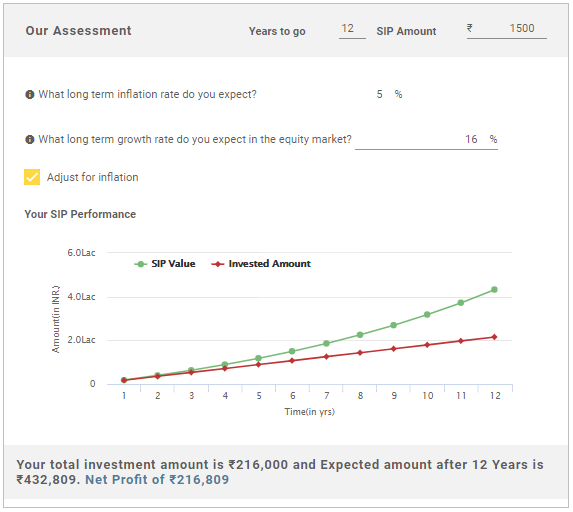

میوچل فنڈ کیلکولیٹر ہماری سود کی واپسی کا حساب لگانے میں ہماری مدد کرتا ہے۔گھونٹ ذیل میں Fincash میوچل فنڈ کیلکولیٹر کی مدد سے سرمایہ کاری یا یکمشت سرمایہ کاری۔

میوچل فنڈ کیلکولیٹر کیسے کام کرتا ہے؟

کیا آپ کی میوچل فنڈ اسکیم آپ کی توقع کے مطابق منافع پیدا کر رہی ہے؟ کیا آپ سوچ رہے ہیں کہ SIP کی کتنی رقم آپ کو ذاتی مقصد کی تکمیل میں مدد دے گی؟ ہمارے میوچل فنڈ کیلکولیٹر کا استعمال کرکے اپنے جوابات حاصل کریں! میوچل فنڈ کیلکولیٹر آپ کے سرمایہ کاری کے افق کے مطابق فنڈ ریٹرن کا حساب لگا کر میچورٹی پر آپ کو سرمایہ کاری کی قیمت دے گا۔ آپ کیلکولیٹر کے متغیرات کو ایڈجسٹ کر سکتے ہیں جیسے SIP/ یکمشت، سرمایہ کاری کی رقم، SIP کی فریکوئنسی، واپسی کی متوقع شرح اور SIP کی مدت

سرمایہ کاری کی نوعیت ( SIP / Lumpsum )

بنیادی طور پر دو طریقے ہیں۔سرمایہ کاری آپ کے پسندیدہ میں پیسےباہمی چندہ. آپ SIP یا یکمشت راستے سے جا سکتے ہیں۔

1. یکمشت سرمایہ کاری

یکمشت رقم کے تحت، آپ اپنے فنڈز کا ایک بڑا حصہ اپنی پسند کی میوچل فنڈ اسکیم میں لگاتے ہیں۔ یہ عام طور پر اس وقت ہوتا ہے جب آپ کو کسی اثاثے کی فروخت سے بھاری رقم ملتی ہے۔ریٹائرمنٹ فوائد لیکن یکمشت سرمایہ کاری میں زیادہ خطرہ ہوتا ہے۔ اس لیے ہمیشہ SIP روٹ سے جانے کی سفارش کی جاتی ہے۔

2. منظم سرمایہ کاری کا منصوبہ (SIP)

ایک ایس آئی پی کے تحت، آپ ہدایت دیتے ہیں۔بینک ایک کٹوتی کرنے کے لئے؟ آپ کی طرف سے مقررہ رقمبچت اکاونٹ ہر ماہ اور اسے مذکورہ میوچل فنڈ اسکیم میں سرمایہ کاری کریں۔ اس طرح، آپ داخل ہونے کے صحیح وقت کی فکر کیے بغیر مسلسل یونٹ خرید سکتے ہیں۔مارکیٹ. آپ کو روپے کی اوسط لاگت کا فائدہ ملتا ہے اور اس سے لطف اندوز ہوتے ہیں۔کمپاؤنڈنگ کی طاقت

Talk to our investment specialist

کیلکولیٹرز کی اقسام

Lumpsum کیلکولیٹر

ایس آئی پی کیلکولیٹر

Know Your SIP Returns

2022 کے لیے سرفہرست فنڈز

*1 سال کی کارکردگی کی بنیاد پر بہترین فنڈز۔

"The primary investment objective of the Scheme is to seek capital appreciation by investing predominantly in units of MLIIF - WGF. The Scheme may, at the discretion of the Investment Manager, also invest in the units of other similar overseas mutual fund schemes, which may constitute a significant part of its corpus. The Scheme may also invest a certain portion of its corpus in money market securities and/or units of money market/liquid schemes of DSP Merrill Lynch Mutual Fund, in order to meet liquidity requirements from time to time. However, there is no assurance that the investment objective of the Scheme will be realized." DSP BlackRock World Gold Fund is a Equity - Global fund was launched on 14 Sep 07. It is a fund with High risk and has given a Below is the key information for DSP BlackRock World Gold Fund Returns up to 1 year are on The primary objective of the Scheme is to achieve long-term capital appreciation by investing in equity & equity related instruments of mid cap & small cap companies. Principal Emerging Bluechip Fund is a Equity - Large & Mid Cap fund was launched on 12 Nov 08. It is a fund with Moderately High risk and has given a Below is the key information for Principal Emerging Bluechip Fund Returns up to 1 year are on To generate long term capital appreciation from a portfolio that is predominantly in equity and equity related instruments HDFC Long Term Advantage Fund is a Equity - ELSS fund was launched on 2 Jan 01. It is a fund with Moderately High risk and has given a Below is the key information for HDFC Long Term Advantage Fund Returns up to 1 year are on 1. DSP BlackRock World Gold Fund

CAGR/Annualized return of 6.1% since its launch. Ranked 11 in Global category. Return for 2024 was 15.9% , 2023 was 7% and 2022 was -7.7% . DSP BlackRock World Gold Fund

Growth Launch Date 14 Sep 07 NAV (24 Apr 25) ₹28.4033 ↑ 0.45 (1.62 %) Net Assets (Cr) ₹1,146 on 31 Mar 25 Category Equity - Global AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆ Risk High Expense Ratio 1.35 Sharpe Ratio 1.49 Information Ratio -0.12 Alpha Ratio 0.84 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹13,604 31 Mar 22 ₹15,152 31 Mar 23 ₹14,266 31 Mar 24 ₹13,920 31 Mar 25 ₹20,792 Returns for DSP BlackRock World Gold Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 25 Duration Returns 1 Month 10.5% 3 Month 27.4% 6 Month 18.4% 1 Year 56% 3 Year 14.8% 5 Year 9.8% 10 Year 15 Year Since launch 6.1% Historical performance (Yearly) on absolute basis

Year Returns 2023 15.9% 2022 7% 2021 -7.7% 2020 -9% 2019 31.4% 2018 35.1% 2017 -10.7% 2016 -4% 2015 52.7% 2014 -18.5% Fund Manager information for DSP BlackRock World Gold Fund

Name Since Tenure Jay Kothari 1 Mar 13 12.01 Yr. Data below for DSP BlackRock World Gold Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Basic Materials 92.86% Asset Allocation

Asset Class Value Cash 3.12% Equity 93.16% Debt 0.02% Other 3.7% Top Securities Holdings / Portfolio

Name Holding Value Quantity BGF World Gold I2

Investment Fund | -80% ₹844 Cr 1,880,211

↓ -73,489 VanEck Gold Miners ETF

- | GDX19% ₹199 Cr 573,719 Treps / Reverse Repo Investments

CBLO/Reverse Repo | -2% ₹19 Cr Net Receivables/Payables

CBLO | -0% -₹4 Cr 2. Principal Emerging Bluechip Fund

CAGR/Annualized return of 24.8% since its launch. Ranked 1 in Large & Mid Cap category. . Principal Emerging Bluechip Fund

Growth Launch Date 12 Nov 08 NAV (31 Dec 21) ₹183.316 ↑ 2.03 (1.12 %) Net Assets (Cr) ₹3,124 on 30 Nov 21 Category Equity - Large & Mid Cap AMC Principal Pnb Asset Mgmt. Co. Priv. Ltd. Rating ☆☆☆☆☆ Risk Moderately High Expense Ratio 2.08 Sharpe Ratio 2.74 Information Ratio 0.22 Alpha Ratio 2.18 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,552 Returns for Principal Emerging Bluechip Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 25 Duration Returns 1 Month 2.9% 3 Month 2.9% 6 Month 13.6% 1 Year 38.9% 3 Year 21.9% 5 Year 19.2% 10 Year 15 Year Since launch 24.8% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for Principal Emerging Bluechip Fund

Name Since Tenure Data below for Principal Emerging Bluechip Fund as on 30 Nov 21

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 3. HDFC Long Term Advantage Fund

CAGR/Annualized return of 21.4% since its launch. Ranked 23 in ELSS category. . HDFC Long Term Advantage Fund

Growth Launch Date 2 Jan 01 NAV (14 Jan 22) ₹595.168 ↑ 0.28 (0.05 %) Net Assets (Cr) ₹1,318 on 30 Nov 21 Category Equity - ELSS AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.25 Sharpe Ratio 2.27 Information Ratio -0.15 Alpha Ratio 1.75 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,787

Purchase not allowed Returns for HDFC Long Term Advantage Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 24 Apr 25 Duration Returns 1 Month 4.4% 3 Month 1.2% 6 Month 15.4% 1 Year 35.5% 3 Year 20.6% 5 Year 17.4% 10 Year 15 Year Since launch 21.4% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for HDFC Long Term Advantage Fund

Name Since Tenure Data below for HDFC Long Term Advantage Fund as on 30 Nov 21

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity

یہاں فراہم کردہ معلومات کے درست ہونے کو یقینی بنانے کے لیے تمام کوششیں کی گئی ہیں۔ تاہم، ڈیٹا کی درستگی کے حوالے سے کوئی ضمانت نہیں دی جاتی ہے۔ براہ کرم کوئی بھی سرمایہ کاری کرنے سے پہلے اسکیم کی معلومات کے دستاویز کے ساتھ تصدیق کریں۔