Table of Contents

Overview of Cholamandalam MS General Insurance Company

An Indian assurance company, Cholamandalam MS general insurance Company Limited is a joint association between the Murugappa Group and the Mitsui Sumitomo insurance Group (MSIG). Murugappa group is one of the largest industrial houses, having 29 companies that operate in 13 states in India. the various business portfolios of Murugappa Group include engineering, finance, fertilisers and bio-products. Some of the companies owned by this group include BSA, Ajax, Ballmaster, Gromor, Paramfos, etc. Meanwhile, Mitsui Sumitomo Insurance Group, an expert in general insurance, is Japan's third-largest property assurance company. Cholamandalam General Insurance Company offers various products, including Cholamandalam health insurance, Cholamandalam car insurance, Cholamandalam Travel Insurance, Cholamandalam Home insurance, etc.

In 2011-2012, the Cholamandalam Insurance Company was named the best insurance company in India for “In time Claims Settlement for the year 2011 – 12”. IndusInd Bank has associated with Chola MS to offer corporate and individual customers insurance. Moreover, the company has won the Financial Insights Innovation Award for its mobile enablement innovation.

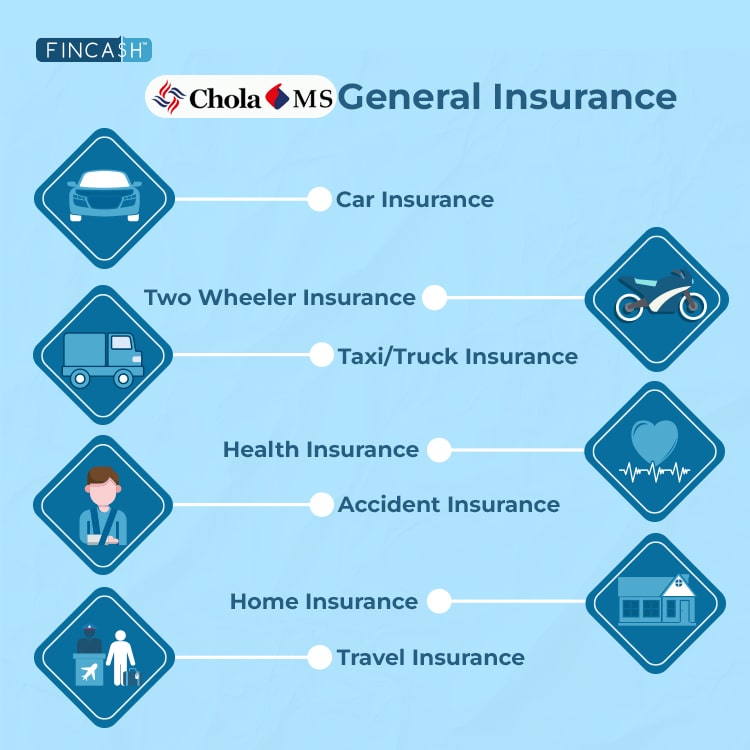

The company's product Portfolio is mentioned below. Take a look!

Insurance Plans by Cholamandalam MS General Insurance Company

Here is the list of insurance plans offered by Cholamandalam MS General Insurance Company:

Health Insurance Plans

Health insurance is a financial safety net against unexpected medical expenses, especially given today's lifestyle changes and health challenges. Cholamandalam MS health insurance plan provide financial assistance for medical treatments and hospitalisations, reimbursing the actual costs up to the sum insured. You can access their extensive healthcare benefits at over 11,000 cashless network hospitals.

Here is the list of plans that you can get under this category:

- Chola MS Flexi Supreme Health Insurance

- Chola MS Flexi Health Insurance

- Chola MS Arogya Sanjeevani Policy

- Chola MS Healthline

- Chola MS Critical Healthline

- Chola MS Super Top-Up Insurance

- Chola MS Hospital Cash Healthline

- Chola MS Sarva Shakti

- Chola MS Accident Protection

Talk to our investment specialist

Inclusions of Cholamandalam MS Health Insurance Plans

Here is the list of everything included in these plans:

Daycare Expenses: Treatments requiring less than 24 hours are covered under Chola MS health insurance, providing financial aid for daycare treatments

Hospitalisation Coverage: Comprehensive coverage includes surgeries, doctor consultation fees, room rent, ICU expenses for injury or illness, ambulance services, and more. Cashless treatment is available at network facilities upon meeting claim authorisation criteria

Pre-Hospitalisation Expenses: Costs of therapies and consultation fees up to 30 days (extendable to 60 days) before hospitalisation due to the same injury or illness are covered

Post-Hospitalisation Expenses: Expenses for therapies and consultation fees up to 60 days (extendable to 90 days) after hospitalisation due to the same injury or illness are covered

AYUSH Treatment: Expenses for ayurvedic, Unani, Siddha, or homoeopathic treatments from recognised institutes or authorised doctors are included, covering surgical and therapeutic procedures

Extended Hospitalisation: Chola MS policies offer extended and child hospitalisation benefits under the Healthline cover

Organ Donor Expenses: The health insurance policy covers the expenses of organ donation and transplant surgeries

Recovery Benefit: Financial support is provided for unexpected extended hospital stays, assisting with miscellaneous recovery expenses for you and your family

Exclusions of Cholamandalam MS Health Insurance Plans

Here is the list of everything excluded from these plans:

Vaccinations: Vaccinations are generally not covered unless they are part of specific treatment protocols, such as post-bite treatment for rabies

Sports Injuries: Injuries sustained during sports activities or related adventures are typically excluded from coverage

War: Health insurance plans do not cover injuries or illnesses resulting from acts of war, whether internal or external, including revolutions, mutiny, or martial law

Injuries Due to Immoral Acts: Injuries incurred while breaking the law or engaging in immoral acts are not covered under health insurance policies

Self-Inflicted Injuries: Deliberate self-harm is not covered by insurance policies, as it is illegal

Assisting in Defence Operations: Injuries sustained while participating in defence operations, such as those of the Air Force, Army, or Navy, are not covered

Venereal or Sexually Transmitted Diseases (STDs): Chola MS health insurance policies do not cover venereal or sexually transmitted diseases

Cosmetic or Obesity Surgery Expenses: Recreational surgeries like cosmetic or obesity surgeries are typically not covered. Plastic surgery may be considered if it is necessitated by an accident

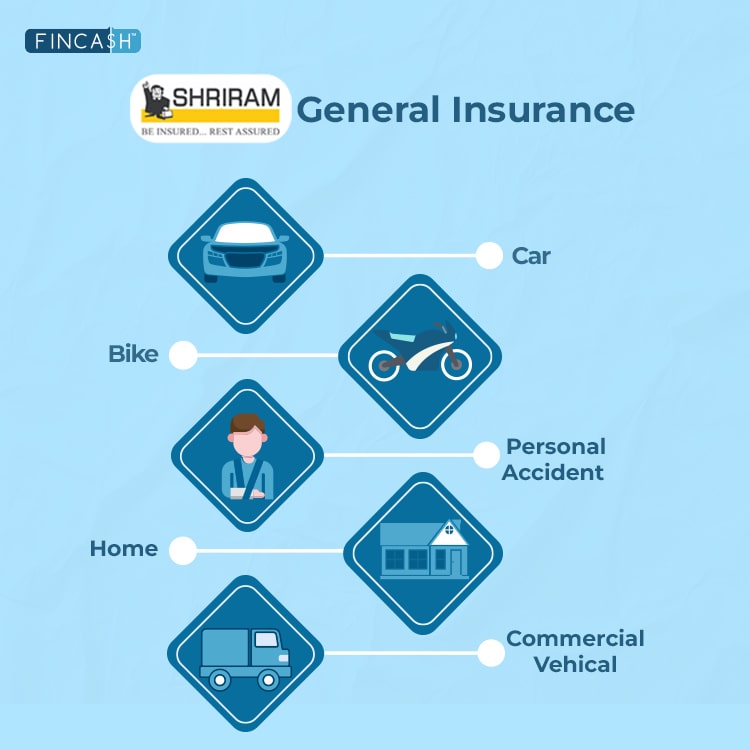

Motor Insurance

Vehicle insurance protects your vehicles—whether two-wheelers, four-wheelers, or commercial vehicles—against financial liabilities arising from accidents or physical damage. Motor Insurance is essential for every vehicle owner as it minimises financial liability in the event of vehicle damage or loss. Additionally, opting for Personal Accident cover under motor insurance provides crucial support if the driver-owner or occupants sustain injuries during an accident.

Under this category, you can find the following plans:

- Chola MS Private Car Insurance

- Chola MS Two-Wheeler Insurance

- Chola MS Commercial Vehicle Insurance

Inclusions of Cholamandalam MS Motor Insurance Plans

Here is the list of everything included in these plans:

Own Damage Coverage: Protection against loss due to fire, ignition, burglary, theft, natural disasters (landslides, floods, earthquakes, storms, typhoons, cyclones, hurricanes), riots, strikes, terrorist activities, malicious acts, accidental damages, and transit damages via road, rail, air, inland waterway, or lift

Third-Party Coverage: Third-Party Property Damage is also covered with caps of ₹ 7,50,000 for private cars, ₹ 1,00,000 for two-wheelers, and Rs.₹ 7,50,000 for all other classes of vehicles

Compulsory Personal Accident Cover for Owner Driver: Covers the owner-driver while driving the vehicle, with a maximum limit of ₹ 15,00,000

Personal Accident to Unnamed Passengers: Covers any person other than the insured/owner-driver/paid-driver/cleaner/employed person by the insured. The minimum insured sum is ₹ 10,000, while the maximum is ₹ 2,00,000

Exclusions of Cholamandalam MS Motor Insurance Plans

Here is the list of everything excluded from these plans:

Wear and Tear Loss: The insurance company does not compensate for vehicle loss resulting from natural wear and tear. Claims for damages due to normal wear and tear are not eligible

Damages Inflicted When Driving Under the Influence: The insurance does not cover damages if the driver is under the influence of alcohol or other intoxicants at the time of the incident

Intentional Injury or Damage to the Insured Vehicle: No reimbursement is provided if the insured intentionally causes damage to the vehicle

Injury or Damage During War: The insurance does not cover damages caused during war, bio-chemical attacks, fires due to nuclear explosions, or related events

Damage Caused Due to Racing: The insurance company does not cover damages or injuries from racing activities

Travel Insurance Plans

If you love to travel and seek adventure, purchasing travel insurance can prove highly beneficial, especially during unexpected circumstances. Travel insurance offers protection against unforeseen situations and should be an essential part of every travel checklist, whether for business or leisure. It covers various scenarios, including flight delays, lost baggage, passport loss, and medical emergencies. Buying travel insurance online is a convenient and straightforward process.

Here is the list of plans that you can explore under this category:

- Chola MS Comprehensive Travel Insurance Plan

- Chola MS Student Travel Protection Plan

- Chola MS Business/Leisure Travel Protection Policy

Inclusions of Cholamandalam MS Travel Insurance Plans

Here is the list of everything included in these plans:

Medical Expenses: Provides coverage for unforeseen medical expenses during emergencies

Delay in Checked-in Baggage: Compensation for expenses incurred to purchase replacement items like toiletries due to delayed checked-in baggage

Bail bond: Covers the bail amount if detained or arrested by authorities abroad for a bailable offence

Dental Treatment: Additional benefit for dental treatment expenses beyond the medical expenses limit

Loss of International Driving License: Coverage for expenses related to replacing a lost international driving license during overseas travel

Total Loss of Checked-in Baggage: Compensation in case of permanent loss of all luggage while under the airline's custody

Loss of Passport: Compensation for reasonable expenses incurred to obtain a duplicate passport

2-Way Compassionate Visit: If hospitalised for more than seven consecutive days or visiting a hospitalised family member in India, coverage includes round trip Economy class airfare and accommodation charges for the visiting family member abroad

Exclusions of Cholamandalam MS Travel Insurance Plans

Here is the list of everything excluded from these plans:

Overseas Medical Expenses: Exclusions include treatment for pre-existing conditions and expenses related to vaccinations or inoculations

Total Loss of Checked-in Baggage and Hand Baggage: Exclusions include any electronic, electrical, visual, or audiovisual equipment, items, or aids, as well as losses due to complete or partial damage of checked-in or hand baggage

Home Insurance Plan

Investing in a home is a significant life decision, often requiring us to save diligently to acquire our dream residence. A home insurance policy is essential for safeguarding your tranquil abode against such unforeseen threats. A comprehensive Property Insurance plan not only shields the structure of your home but also covers your assets and valuables. You are fully prepared to Handle any crisis with the right home insurance.

Here are the types of plans you can find under this category:

- Chola Home Package - Griha Raksha Policy

- Chola MS Bharat Griha Raksha Policy

Inclusions of Cholamandalam MS Home Insurance Plans

Here is the list of everything included in these plans:

Burglary and Housebreaking: Coverage for loss or damage to contents within the insured premises due to burglary or housebreaking

Personal Baggage: Protection against loss or damage to personal baggage of the insured or family members anywhere in India due to accident or misfortune

Home Utility Appliances: Coverage for sudden physical damage caused by mechanical electrical breakdown or accidental damage to home utility appliances

Home Appliances: Protection against total or substantial loss caused by mechanical breakdown of specified home appliances within the insured property

Plate Glass: Coverage for accidental damage to fixed plate glass specified in the schedule within the insured property

Jewellery and Other Precious Items (optional): Protection against loss or damage to jewellery by accident or misfortune anywhere in India

Garden: Compensation for total loss or destruction of the insured garden due to specified perils like storms, cyclones, floods, subsidence, etc

Tenant Liability: Liability coverage for perils affecting the rented private residence occupied by the insured

Cost of Conducting Death Ceremonies: Coverage for expenses related to conducting death ceremonies after the insured's demise

Talk to our investment specialist

Exclusions of Cholamandalam MS Home Insurance Plans

Here is the list of everything excluded from these plans:

Deliberate Acts or Omissions: Exclusion for loss or damage resulting from deliberate, willful, or intentional acts or omissions by the insured or anyone acting on their behalf with connivance

War and War-like Operations: Exclusion for loss or damage caused by war, invasion, civil war, rebellion, revolution, or nuclear fuel-related incidents

Lonising Radiation or Contamination: Exclusion for loss or damage caused by ionising radiation, radioactive contamination, or hazardous properties of nuclear assemblies

Pollution or Contamination: Exclusion for loss or damage resulting from pollution or contamination unless directly caused by an insured event

Electrical or Electronic Damage: Exclusion for loss or damage to electrical or electronic items due to specific causes like over-running, short-circuiting, or self-heating

Excluded Items: Exclusion for loss of bullion, precious stones, documents, vehicles, and other specified items unless expressly covered by the policy

Missing or Mislaid Property: Exclusion for loss of property that is missing, mislaid, or cannot be linked to a specific identifiable event

Property Removed from Home: Exclusion for loss or damage to property removed from the insured's home to any other location

Consequential or Indirect Loss: Exclusion for loss of Earnings, Market value, or any other consequential or indirect loss or damage

Market Value Reduction: Exclusion for any reduction in market value of insured property after repair or reinstatement

Structural Alterations: Exclusion for structural additions or alterations exceeding 10% of the carpet area without additional premium and endorsement

Claim Preparation Costs: Exclusion for costs, fees, or expenses associated with preparing any claim under the policy

Conclusion

Cholamandalam MS General Insurance Company has proven to be a reliable partner in providing Comprehensive Insurance solutions. With a strong focus on customer needs and risk management, Chola MS offers a Range of insurance products tailored to individual and business requirements. Their commitment to prompt claim settlement and customer satisfaction underscores their reputation as a trusted insurer. Whether it's motor, health, travel, or home insurance, Chola MS ensures peace of mind by safeguarding against unforeseen risks and financial liabilities. With innovative policies and a customer-centric approach, Chola MS General Insurance Company stands out as a leader in the insurance Industry, Offering protection that customers can rely on.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.