+91-22-48913909

+91-22-48913909Table of Contents

- About JM Financial Mutual Fund

- Best Mutual Funds by JM Financial Mutual Fund

- List of Name Change in Schemes of JM Financial Mutual Fund

- JM Financial SIP Mutual Fund

- JM Financial Mutual Fund Calculator

- How to Invest in JM Financial Mutual Fund Online?

- JM Financial Mutual Fund NAV

- JM Financial Mutual Fund Account Statement

- Corporate Address

- Sponsors

Top 4 Funds

JM Financial Mutual Fund

JM Financial Mutual Fund is India’s one of the first private sector mutual fund company. This mutual fund company is a part of JM Financial Group. JM Financial Mutual Fund offers a bunch of mutual fund schemes across various types of funds to cater the diverse needs of both institutional as well as retail investors. JM Financial Group has a strong foundation in the financial services sector and has its presence for a period of more than four decades.

The objective of JM Financial Mutual Fund is to help investors in achieving their goals through prudent investment, proper fund management, and strong systems of managing risk scientifically.

| AMC | JM Financial Mutual Fund |

|---|---|

| Date of Setup | September 15, 1994 |

| AUM | INR 12072.94 crore (Jun-30-2018) |

| Chairman | Mr. V. P. Shetty |

| CEO/MD | Mr. Bhanu Katoch |

| CIO | N.A |

| Compliance Officer | Ms. Diana D'sa |

| investor Service Officer | Mr. Harish Kukreja |

| Fax | 22876297/98 |

| Tel | 022-61987777 |

| Website | www.jmfinancialmf.com |

| investor[AT]jmfl.com |

Talk to our investment specialist

About JM Financial Mutual Fund

JM mutual fund is one of the first private sector mutual fund companies that has its presence over two decades. The company commenced its operations in December 1994, with three mutual fund schemes, namely, JM Liquid Fund (presently JM Income Fund), JM Equity Fund, and JM Balanced Fund. The Asset Management Company or AMC that runs the JM Mutual Fund is JM Financial Asset Management Ltd. This AMC is a part of JM Financial Limited. JM Financial Limited has spread its wings in various areas of investment banking, private equity, asset reconstruction, investment advisory, and so on. JM Financial Group was founded in the year 1973 and registered under the name as JM Financial & Investment Consultancy Services.

Best Mutual Funds by JM Financial Mutual Fund

JM Financial Mutual Fund offers various mutual fund schemes under the following mutual fund categories.

Equity Funds

A mutual fund scheme whose funds are predominantly invested in equity shares of companies is known as an equity fund. Equity fund does not offer fixed returns. Some of the equity fund schemes offered by JM Financial Mutual Fund include JM Balanced Fund, JM Equity Fund, JM Basic Fund, and so on. These funds have various options like dividend option, growth option, etc., which investors can choose depending on their preference.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) JM Multicap Fund Growth ₹91.7219

↑ 2.32 ₹4,899 -7.2 -14.8 5.5 21.2 27.8 33.3 JM Core 11 Fund Growth ₹18.4943

↑ 0.49 ₹217 -4.1 -12.1 3.1 16.9 21.9 24.3 JM Value Fund Growth ₹89.4191

↑ 2.23 ₹937 -6.2 -16.6 2.5 20.5 28.8 25.1 JM Tax Gain Fund Growth ₹44.413

↑ 1.06 ₹167 -4.9 -14.1 8.4 16.4 26.5 29 JM Large Cap Fund Growth ₹142.557

↑ 3.33 ₹458 -2.9 -12.6 -0.7 13.3 18.5 15.1 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 15 Apr 25

Debt Funds

Debt fund is a category or mutual fund scheme that invests its predominant stake in Fixed Income securities. The Underlying securities forming part of the debt funds include Bonds, government securities, and money market instruments. The aim of these funds is to provide a regular and steady returns to the investors by Investing in debt instruments. Some of the mutual fund schemes offered by JM Financial Mutual Fund under the debt fund category include JM Floater Long Term Fund, JM G-Sec Fund, JM Income Fund, JM Money Manager Fund, and JM Short Term Fund.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity JM Liquid Fund Growth ₹70.3327

↑ 0.02 ₹3,341 1.8 3.6 7.2 6.7 7.2 7.13% 1M 10D 1M 13D JM Dynamic Debt Fund Growth ₹41.3416

↑ 0.09 ₹44 4.4 5.1 10.6 7.3 8 6.87% 6Y 10M 22D 10Y 5M 7D JM Ultra Short Duration Fund Growth ₹26.7173

↑ 0.00 ₹35 4.5 6.4 5.3 4.3 3.37% 4M 7D 4M 13D Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 15 Apr 25

Hybrid Funds

Hybrid funds or Balanced funds refer to the mutual fund scheme that invests its accumulated funds in a combination of equity and debt instruments. These funds are good option for people seeking Capital appreciation along with regular inflow of income. JM Financial Mutual Fund offers JM Balanced Fund under the balanced category. This scheme was launched on April 01, 1995. The risk appetite of JM Balanced Fund is moderately high. The performance of JM Balanced Fund is tabulated as follows.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) JM Arbitrage Fund Growth ₹32.2399

↑ 0.03 ₹212 1.6 3.3 6.7 6.3 4.8 7.2 JM Equity Hybrid Fund Growth ₹114.107

↑ 2.09 ₹729 -2.9 -11.2 6 19.1 27.9 27 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 15 Apr 25

(Erstwhile JM High Liquidity Fund) To provide income by way of dividend (dividend plans) and capital gains (growth plan) through investing in debt and money market instruments. JM Liquid Fund is a Debt - Liquid Fund fund was launched on 31 Dec 97. It is a fund with Low risk and has given a Below is the key information for JM Liquid Fund Returns up to 1 year are on (Erstwhile JM Equity Fund) The scheme seeks to provide optimum capital growth and appreciation. JM Large Cap Fund is a Equity - Large Cap fund was launched on 1 Apr 95. It is a fund with Moderately High risk and has given a Below is the key information for JM Large Cap Fund Returns up to 1 year are on (Erstwhile JM Multi Strategy Fund) The investment objective of the Scheme is to provide capital appreciation by investing in equity and equity related securities using a combination of strategies. JM Multicap Fund is a Equity - Multi Cap fund was launched on 23 Sep 08. It is a fund with Moderately High risk and has given a Below is the key information for JM Multicap Fund Returns up to 1 year are on (Erstwhile JM Balanced Fund) To provide steady current income as well as long term growth of capital. JM Equity Hybrid Fund is a Hybrid - Hybrid Equity fund was launched on 1 Apr 95. It is a fund with Moderately High risk and has given a Below is the key information for JM Equity Hybrid Fund Returns up to 1 year are on 1. JM Liquid Fund

CAGR/Annualized return of 7.4% since its launch. Ranked 3 in Liquid Fund category. Return for 2024 was 7.2% , 2023 was 7% and 2022 was 4.8% . JM Liquid Fund

Growth Launch Date 31 Dec 97 NAV (15 Apr 25) ₹70.3327 ↑ 0.02 (0.02 %) Net Assets (Cr) ₹3,341 on 28 Feb 25 Category Debt - Liquid Fund AMC JM Financial Asset Management Limited Rating ☆☆☆☆☆ Risk Low Expense Ratio 0.25 Sharpe Ratio 2.98 Information Ratio -4.38 Alpha Ratio -0.13 Min Investment 5,000 Min SIP Investment 500 Exit Load NIL Yield to Maturity 7.13% Effective Maturity 1 Month 13 Days Modified Duration 1 Month 10 Days Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹10,343 31 Mar 22 ₹10,695 31 Mar 23 ₹11,296 31 Mar 24 ₹12,104 31 Mar 25 ₹12,974 Returns for JM Liquid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 15 Apr 25 Duration Returns 1 Month 0.8% 3 Month 1.8% 6 Month 3.6% 1 Year 7.2% 3 Year 6.7% 5 Year 5.4% 10 Year 15 Year Since launch 7.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 7.2% 2023 7% 2022 4.8% 2021 3.3% 2020 4% 2019 6.6% 2018 7.4% 2017 6.7% 2016 7.7% 2015 8.4% Fund Manager information for JM Liquid Fund

Name Since Tenure Killol Pandya 5 Nov 24 0.4 Yr. Naghma Khoja 21 Oct 21 3.44 Yr. Ruchi Fozdar 3 Apr 24 0.99 Yr. Data below for JM Liquid Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 99.78% Other 0.22% Debt Sector Allocation

Sector Value Cash Equivalent 72.2% Corporate 23.25% Government 4.32% Credit Quality

Rating Value AA 0.16% AAA 99.84% Top Securities Holdings / Portfolio

Name Holding Value Quantity Ccil

CBLO/Reverse Repo | -4% ₹128 Cr 127,856

↓ -99,547 Indian Bank

Certificate of Deposit | -3% ₹100 Cr 10,000,000

↑ 10,000,000 Punjab National Bank

Certificate of Deposit | -3% ₹100 Cr 10,000,000 91 DTB 28032025

Sovereign Bonds | -3% ₹100 Cr 10,000,000 Union Bank Of India

Certificate of Deposit | -3% ₹100 Cr 10,000,000 91 DTB 30052025

Sovereign Bonds | -3% ₹99 Cr 10,000,000 182 DTB 05062025

Sovereign Bonds | -3% ₹99 Cr 10,000,000

↑ 10,000,000 Punjab National Bank

Certificate of Deposit | -3% ₹99 Cr 10,000,000 HDFC Bank Limited

Certificate of Deposit | -3% ₹98 Cr 10,000,000 Small Industries Development Bank Of India

Commercial Paper | -2% ₹75 Cr 7,500,000

↑ 7,500,000 2. JM Large Cap Fund

CAGR/Annualized return of 9.2% since its launch. Ranked 73 in Large Cap category. Return for 2024 was 15.1% , 2023 was 29.6% and 2022 was 3.4% . JM Large Cap Fund

Growth Launch Date 1 Apr 95 NAV (15 Apr 25) ₹142.557 ↑ 3.33 (2.39 %) Net Assets (Cr) ₹458 on 28 Feb 25 Category Equity - Large Cap AMC JM Financial Asset Management Limited Rating ☆☆ Risk Moderately High Expense Ratio 2.46 Sharpe Ratio -0.8 Information Ratio 0.16 Alpha Ratio -7.4 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-60 Days (1%),60 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹13,783 31 Mar 22 ₹16,352 31 Mar 23 ₹16,416 31 Mar 24 ₹23,869 31 Mar 25 ₹23,803 Returns for JM Large Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 15 Apr 25 Duration Returns 1 Month 4.8% 3 Month -2.9% 6 Month -12.6% 1 Year -0.7% 3 Year 13.3% 5 Year 18.5% 10 Year 15 Year Since launch 9.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 15.1% 2023 29.6% 2022 3.4% 2021 23.2% 2020 18.1% 2019 4.9% 2018 0.8% 2017 20.9% 2016 1.8% 2015 -1.3% Fund Manager information for JM Large Cap Fund

Name Since Tenure Satish Ramanathan 20 Aug 21 3.53 Yr. Asit Bhandarkar 5 Oct 17 7.41 Yr. Ruchi Fozdar 4 Oct 24 0.41 Yr. Deepak Gupta 27 Jan 25 0.09 Yr. Data below for JM Large Cap Fund as on 28 Feb 25

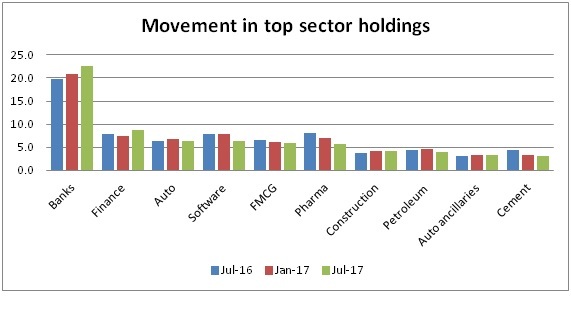

Equity Sector Allocation

Sector Value Financial Services 35.75% Consumer Cyclical 11.17% Technology 10.43% Consumer Defensive 9.3% Industrials 8.88% Communication Services 6.48% Health Care 6.21% Basic Materials 5.57% Utility 1.52% Energy 0.96% Asset Allocation

Asset Class Value Cash 3.72% Equity 96.28% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Jan 11 | ICICIBANK7% ₹32 Cr 269,087

↓ -20,000 Cholamandalam Investment and Finance Co Ltd (Financial Services)

Equity, Since 31 Jan 25 | CHOLAFIN5% ₹25 Cr 176,639

↓ -25,000 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Sep 12 | HDFCBANK5% ₹24 Cr 138,472

↑ 40,000 Infosys Ltd (Technology)

Equity, Since 30 Apr 15 | INFY5% ₹24 Cr 140,898 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 30 Sep 24 | MARUTI4% ₹19 Cr 16,317 State Bank of India (Financial Services)

Equity, Since 31 Oct 11 | SBIN4% ₹18 Cr 258,397 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Mar 24 | BHARTIARTL4% ₹17 Cr 110,000 Bajaj Finserv Ltd (Financial Services)

Equity, Since 31 Jan 25 | 5329783% ₹16 Cr 85,000 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Jan 25 | KOTAKBANK3% ₹14 Cr 75,000

↑ 25,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 28 Feb 25 | LT3% ₹14 Cr 44,000

↑ 44,000 3. JM Multicap Fund

CAGR/Annualized return of 14.3% since its launch. Ranked 16 in Multi Cap category. Return for 2024 was 33.3% , 2023 was 40% and 2022 was 7.8% . JM Multicap Fund

Growth Launch Date 23 Sep 08 NAV (15 Apr 25) ₹91.7219 ↑ 2.32 (2.60 %) Net Assets (Cr) ₹4,899 on 28 Feb 25 Category Equity - Multi Cap AMC JM Financial Asset Management Limited Rating ☆☆☆☆ Risk Moderately High Expense Ratio 2.17 Sharpe Ratio -0.18 Information Ratio 1.18 Alpha Ratio 3.84 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-60 Days (1%),60 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,364 31 Mar 22 ₹19,803 31 Mar 23 ₹20,797 31 Mar 24 ₹32,659 31 Mar 25 ₹35,051 Returns for JM Multicap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 15 Apr 25 Duration Returns 1 Month 5.2% 3 Month -7.2% 6 Month -14.8% 1 Year 5.5% 3 Year 21.2% 5 Year 27.8% 10 Year 15 Year Since launch 14.3% Historical performance (Yearly) on absolute basis

Year Returns 2024 33.3% 2023 40% 2022 7.8% 2021 32.9% 2020 11.4% 2019 16.6% 2018 -5.4% 2017 39.5% 2016 10.5% 2015 -2.8% Fund Manager information for JM Multicap Fund

Name Since Tenure Satish Ramanathan 20 Aug 21 3.53 Yr. Asit Bhandarkar 1 Oct 24 0.41 Yr. Chaitanya Choksi 31 Dec 21 3.17 Yr. Ruchi Fozdar 4 Oct 24 0.41 Yr. Data below for JM Multicap Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 31.39% Consumer Cyclical 18.95% Health Care 8.86% Industrials 8.8% Technology 8.31% Consumer Defensive 7.29% Basic Materials 5.01% Communication Services 2.66% Utility 2.19% Asset Allocation

Asset Class Value Cash 6.55% Equity 93.45% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 30 Nov 23 | HDFCBANK6% ₹302 Cr 1,745,500

↓ -150,000 ICICI Bank Ltd (Financial Services)

Equity, Since 30 Nov 21 | ICICIBANK6% ₹292 Cr 2,425,800

↑ 350,000 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 31 Jan 25 | MARUTI4% ₹200 Cr 167,679

↑ 20,000 Infosys Ltd (Technology)

Equity, Since 30 Nov 20 | INFY4% ₹176 Cr 1,042,750

↓ -280,000 Bajaj Auto Ltd (Consumer Cyclical)

Equity, Since 30 Sep 24 | 5329773% ₹165 Cr 208,165

↑ 40,000 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Jan 25 | KOTAKBANK3% ₹162 Cr 850,000

↑ 330,000 State Bank of India (Financial Services)

Equity, Since 30 Nov 20 | SBIN3% ₹160 Cr 2,325,000

↓ -375,000 Tech Mahindra Ltd (Technology)

Equity, Since 31 Jul 24 | 5327553% ₹158 Cr 1,063,515

↑ 144,215 Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 31 Oct 24 | SUNPHARMA3% ₹153 Cr 960,000

↑ 550,811 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 10 | LT3% ₹139 Cr 438,247

↑ 72,225 4. JM Equity Hybrid Fund

CAGR/Annualized return of 12.5% since its launch. Ranked 35 in Hybrid Equity category. Return for 2024 was 27% , 2023 was 33.8% and 2022 was 8.1% . JM Equity Hybrid Fund

Growth Launch Date 1 Apr 95 NAV (15 Apr 25) ₹114.107 ↑ 2.09 (1.86 %) Net Assets (Cr) ₹729 on 28 Feb 25 Category Hybrid - Hybrid Equity AMC JM Financial Asset Management Limited Rating ☆ Risk Moderately High Expense Ratio 2.36 Sharpe Ratio -0.28 Information Ratio 1.09 Alpha Ratio -0.16 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-60 Days (1%),60 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,786 31 Mar 22 ₹20,451 31 Mar 23 ₹21,645 31 Mar 24 ₹32,246 31 Mar 25 ₹34,502 Returns for JM Equity Hybrid Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 15 Apr 25 Duration Returns 1 Month 4.7% 3 Month -2.9% 6 Month -11.2% 1 Year 6% 3 Year 19.1% 5 Year 27.9% 10 Year 15 Year Since launch 12.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 27% 2023 33.8% 2022 8.1% 2021 22.9% 2020 30.5% 2019 -8.1% 2018 1.7% 2017 18.5% 2016 3% 2015 -0.2% Fund Manager information for JM Equity Hybrid Fund

Name Since Tenure Satish Ramanathan 1 Oct 24 0.41 Yr. Asit Bhandarkar 31 Dec 21 3.17 Yr. Chaitanya Choksi 20 Aug 21 3.53 Yr. Ruchi Fozdar 4 Oct 24 0.41 Yr. Data below for JM Equity Hybrid Fund as on 28 Feb 25

Asset Allocation

Asset Class Value Cash 12.53% Equity 69.26% Debt 18.22% Equity Sector Allocation

Sector Value Financial Services 22.12% Consumer Cyclical 11.89% Technology 9.76% Health Care 8.86% Consumer Defensive 4.28% Basic Materials 4.23% Communication Services 3.55% Industrials 3.18% Debt Sector Allocation

Sector Value Cash Equivalent 11.24% Government 10.52% Corporate 8.99% Credit Quality

Rating Value AA 0.7% AAA 99.3% Top Securities Holdings / Portfolio

Name Holding Value Quantity Bajaj Finance Ltd (Financial Services)

Equity, Since 31 Jan 25 | 5000346% ₹43 Cr 50,004

↑ 7,000 Infosys Ltd (Technology)

Equity, Since 30 Nov 20 | INFY5% ₹34 Cr 200,000 HDFC Bank Ltd (Financial Services)

Equity, Since 30 Jun 24 | HDFCBANK4% ₹29 Cr 167,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 21 | ICICIBANK4% ₹29 Cr 240,114

↑ 40,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 24 | BHARTIARTL4% ₹26 Cr 165,000 6.92% Govt Stock 2039

Sovereign Bonds | -4% ₹26 Cr 2,550,000

↑ 1,000,000 Bajaj Auto Ltd (Consumer Cyclical)

Equity, Since 31 Oct 23 | 5329773% ₹25 Cr 31,280 Kotak Mahindra Bank Ltd (Financial Services)

Equity, Since 31 Jan 25 | KOTAKBANK3% ₹23 Cr 120,000

↑ 60,000 Voltas Ltd (Consumer Cyclical)

Equity, Since 31 Oct 23 | VOLTAS3% ₹20 Cr 150,000

↑ 75,000 Jubilant Foodworks Ltd (Consumer Cyclical)

Equity, Since 30 Nov 24 | JUBLFOOD2% ₹18 Cr 285,000

↓ -15,000

List of Name Change in Schemes of JM Financial Mutual Fund

After SEBI's (Securities and Exchange Board of India) circulation on re-categorisation and rationalisation of open-ended Mutual Funds, many Mutual Fund Houses are incorporating changes in their scheme names and categories. SEBI introduced new and broad categories in Mutual Funds in order to bring uniformity in similar schemes launched by the different Mutual Funds. This is to aim and ensure that investors can find it easier to compare the products and evaluate the different options available before investing in a scheme.

Here is a list of JM Financial schemes that got new names:

| Existing Scheme Name | New Scheme Name |

|---|---|

| JM Arbitrage Advantage Fund | JM Arbitrage Fund |

| JM Floater Long Term Fund | JM Dynamic Debt Fund |

| JM Balanced Fund | JM Equity Hybrid Fund |

| JM Equity Fund | JM Large cap fund |

| JM High liquidity Fund | JM Liquid Fund |

| JM Multi Strategy Fund | JM Multicap Fund |

| JM Money Manager Fund | JM Ultra Short Duration Fund |

| JM Basic Fund | JM value fund |

*Note-The list will be updated as and when we get an insight about the changes in the scheme names.

JM Financial SIP Mutual Fund

SIP or Systematic Investment plan is an investment mode in a mutual fund scheme where individuals deposit money in small amounts at regular intervals in the fund scheme. One of the advantages of SIP is that since individuals need to invest in small amounts, it does not pinch their pockets. JM Financial Mutual Fund offers SIP option in most of the fund schemes offered. SIP investing has a lot of benefits which include compounding, instilling a habit of disciplined savings, and much more.

JM Financial Mutual Fund Calculator

Most of the mutual fund companies have a mutual fund calculator or sip calculator that helps individuals to determine their present investment amount(the SIP amount) for accomplishing a future objective (buying a house, car, education of a child etc). The SIP calculator considers an individual’s age, income, financial commitments and other parameters to determine the present savings amount. In addition, numerous independent portals that deal in mutual fund distribution also have a mutual fund calculator to help their customers to calculate the SIP amount required to achieve a goal.

Know Your Monthly SIP Amount

How to Invest in JM Financial Mutual Fund Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

JM Financial Mutual Fund NAV

JM Financial Mutual Fund’s NAV or Net Asset Value is available on the AMFI website. In addition, one can find the latest NAV on the Asset Management Company’s or AMC’s website. You can also check for the historical NAV of the JM Financial Mutual Fund on the AMFI website.

JM Financial Mutual Fund Account Statement

Mutual fund account statement is a statement that shows the mutual fund investment transactions performed by an individual. Individuals who have invested in JM Financial Mutual Fund directly through the company can log in to the AMC’s website to view their Account Statement. Instead, individuals who have invested in mutual funds through independent portals need to login on the respective portals and check their mutual fund account statement.

Corporate Address

Office B, 8th Floor, Cnergy, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025.

Sponsors

JM Financial Limited

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.