+91-22-48913909

+91-22-48913909

Table of Contents

- എന്തുകൊണ്ട് മികച്ച 11 SIP ഫണ്ടുകളിൽ നിക്ഷേപിക്കണം?

- എസ്ഐപിയിൽ എങ്ങനെ നിക്ഷേപിക്കാം?

- ഇന്ത്യയിലെ ഏറ്റവും മികച്ച 11 SIP മ്യൂച്വൽ ഫണ്ടുകൾ FY 22 - 23

- മികച്ച ചിട്ടയായ നിക്ഷേപ പദ്ധതികളിൽ നിക്ഷേപിക്കുമ്പോൾ പരിഗണിക്കേണ്ട പാരാമീറ്ററുകൾ

- SIP MF ഓൺലൈനിൽ എങ്ങനെ നിക്ഷേപിക്കാം?

- പതിവുചോദ്യങ്ങൾ

- 1. മ്യൂച്വൽ ഫണ്ടുകൾ എന്തൊക്കെയാണ്?

- 2. മ്യൂച്വൽ ഫണ്ടുകളുടെ വ്യത്യസ്ത തരം ഏതൊക്കെയാണ്?

- 3. വളർച്ചാ ഇക്വിറ്റി ഫണ്ടുകൾ എന്തൊക്കെയാണ്?

- 4. എന്തുകൊണ്ടാണ് നിങ്ങൾ ഒരു ഡെറ്റ് ഫണ്ടിൽ നിക്ഷേപിക്കേണ്ടത്?

- 5. നിങ്ങൾ എന്തിന് SIP-കളിൽ നിക്ഷേപിക്കണം?

- 6. നികുതി ലാഭിക്കുന്ന മ്യൂച്വൽ ഫണ്ടിൽ നിക്ഷേപിക്കുന്നത് എന്തുകൊണ്ട്?

- 7. മ്യൂച്വൽ ഫണ്ടുകളിൽ നിക്ഷേപിക്കാൻ എനിക്ക് ഒരു ബ്രോക്കറെ ആവശ്യമുണ്ടോ?

Top 11 Funds

- ICICI Prudential Infrastructure Fund

- ICICI Prudential Technology Fund

- SBI Healthcare Opportunities Fund

- L&T Emerging Businesses Fund

- TATA Digital India Fund

- BOI AXA Manufacturing and Infrastructure Fund

- IDFC Infrastructure Fund

- Nippon India Power and Infra Fund

- Franklin India Smaller Companies Fund

- DSP BlackRock Small Cap Fund

- Kotak Small Cap Fund

SIP 2022-നുള്ള 11 മികച്ച മ്യൂച്വൽ ഫണ്ടുകൾ

എസ്.ഐ.പി മ്യൂച്വൽ ഫണ്ടുകൾ (അല്ലെങ്കിൽ മികച്ച 11 എസ്ഐപി മ്യൂച്വൽ ഫണ്ടുകൾ) സ്റ്റോക്ക് മാർക്കറ്റിന്റെ അനിവാര്യമായ ഉയർച്ച താഴ്ചകളിൽ നാഡീ വിൽപന ഒഴിവാക്കാൻ ആനുകാലിക നിക്ഷേപത്തിന്റെ ലളിതമായ സൂത്രവാക്യം പാലിക്കുന്ന ഫണ്ടുകളാണ്.

സാധാരണ, SIP അല്ലെങ്കിൽ സിസ്റ്റമാറ്റിക്നിക്ഷേപ പദ്ധതി മ്യൂച്വൽ ഫണ്ടുകളിൽ പണം നിക്ഷേപിക്കുന്നതിനുള്ള ഒരു മോഡാണ്.നിക്ഷേപിക്കുന്നു മികച്ച 11 എസ്ഐപി മ്യൂച്വൽ ഫണ്ടുകളിൽ നിങ്ങളുടെ നിക്ഷേപത്തിന് ചിട്ടയായതും അച്ചടക്കമുള്ളതുമായ ഒരു സമീപനം നൽകുന്നു. ദിവസേനയുള്ള നിങ്ങളുടെ നിക്ഷേപം നിയന്ത്രിക്കാനുള്ള നിങ്ങളുടെ ശ്രമത്തെ ഇത് കുറയ്ക്കുന്നുഅടിസ്ഥാനം. മാത്രമല്ല, ഇത് ലിവറേജ് വാഗ്ദാനം ചെയ്യുന്നുസംയുക്തത്തിന്റെ ശക്തി കാലക്രമേണ ആവശ്യമുള്ള വരുമാനത്തിലേക്ക് നയിക്കുന്നു.

വ്യത്യസ്തങ്ങളുണ്ട്മ്യൂച്വൽ ഫണ്ടുകളുടെ തരങ്ങൾ ഇക്വിറ്റി, ഡെറ്റ്, ബാലൻസ്ഡ്, അൾട്രാ- എന്നിവ ഉൾപ്പെടുന്ന എസ്ഐപിക്ക്ഹ്രസ്വകാല ഫണ്ടുകൾ, മുതലായവ. എന്നിരുന്നാലും, ഒരു SIP വഴി നിക്ഷേപിക്കുമ്പോൾ ഇക്വിറ്റി മ്യൂച്വൽ ഫണ്ടുകൾ പരമാവധി വരുമാനം വാഗ്ദാനം ചെയ്യുന്നു. നിക്ഷേപകർ നിക്ഷേപം നടത്തണമെന്ന് സാമ്പത്തിക ഉപദേഷ്ടാക്കൾ നിർദ്ദേശിക്കുന്നുമികച്ച മ്യൂച്വൽ ഫണ്ടുകൾ എസ്ഐപിയുടെ അടിസ്ഥാനത്തിൽ അവരുടെ നിക്ഷേപ ലക്ഷ്യങ്ങളും കാലയളവുംSIP നിക്ഷേപം.

എന്തുകൊണ്ട് മികച്ച 11 SIP ഫണ്ടുകളിൽ നിക്ഷേപിക്കണം?

മ്യൂച്വൽ ഫണ്ടുകളിൽ നിക്ഷേപിക്കുന്നതിന് എസ്ഐപികൾ അച്ചടക്കമുള്ള സമീപനം നൽകുന്നു

ചിട്ടയായ നിക്ഷേപം ഭാവി സ്വപ്നത്തിനും റിട്ടയർമെന്റ്, കുട്ടിയുടെ കരിയർ, വീട്, കാർ അല്ലെങ്കിൽ മറ്റേതെങ്കിലും ആസ്തികൾ വാങ്ങൽ തുടങ്ങിയ പ്രധാന ലക്ഷ്യങ്ങൾക്കും ധനസഹായം നൽകുന്നു.

എസ്ഐപികൾ കോമ്പൗണ്ടിംഗ് പരമാവധി പ്രയോജനപ്പെടുത്താൻ സഹായിക്കുന്നു, മാത്രമല്ല യുവ നിക്ഷേപകർക്ക് അനുയോജ്യവുമാണ്

വ്യവസ്ഥാപിത നിക്ഷേപ പദ്ധതികൾ ഇക്വിറ്റി ഏറ്റക്കുറച്ചിലുകളുടെ അപകടസാധ്യത കുറയ്ക്കുന്നു

എസ്ഐപിയിൽ എങ്ങനെ നിക്ഷേപിക്കാം?

പണം നിക്ഷേപിക്കുന്നത് ഒരു കലയാണ്, അത് ശരിയായി ചെയ്താൽ അത് അത്ഭുതങ്ങൾ സൃഷ്ടിക്കും. ഇപ്പോൾ നിങ്ങൾക്കറിയാംടോപ്പ് SIP അതിൽ എങ്ങനെ നിക്ഷേപിക്കണമെന്ന് നിങ്ങൾ അറിഞ്ഞിരിക്കേണ്ട പദ്ധതികൾ. എസ്ഐപിയിൽ നിക്ഷേപിക്കുന്നതിനുള്ള ഘട്ടങ്ങൾ ഞങ്ങൾ ചുവടെ സൂചിപ്പിച്ചിട്ടുണ്ട്.

1. നിങ്ങളുടെ സാമ്പത്തിക ലക്ഷ്യങ്ങൾ വിശകലനം ചെയ്യുക

നിങ്ങൾക്ക് അനുയോജ്യമായ ഒരു SIP നിക്ഷേപം തിരഞ്ഞെടുക്കുകസാമ്പത്തിക ലക്ഷ്യങ്ങൾ. ഉദാഹരണത്തിന്, നിങ്ങളുടെ ലക്ഷ്യം ഹ്രസ്വകാലമാണെങ്കിൽ (അടുത്ത 2 വർഷത്തിനുള്ളിൽ ഒരു കാർ വാങ്ങണമെങ്കിൽ), നിങ്ങൾ ഡെറ്റ് മ്യൂച്വൽ ഫണ്ടുകളിൽ നിക്ഷേപിക്കണം. കൂടാതെ, നിങ്ങളുടെ ലക്ഷ്യം ദീർഘകാലമാണെങ്കിൽ (ഇത് പോലെവിരമിക്കൽ ആസൂത്രണം) തുടർന്ന് ഇക്വിറ്റി മ്യൂച്വൽ ഫണ്ടുകളിൽ നിക്ഷേപിക്കാൻ മുൻഗണന നൽകുക.

2. നിക്ഷേപത്തിന്റെ ഒരു ടൈംലൈൻ തിരഞ്ഞെടുക്കുക

ഒരു നിശ്ചിത സമയത്തേക്ക് നിങ്ങൾ ശരിയായ തുക നിക്ഷേപിക്കുന്നുവെന്ന് ഇത് ഉറപ്പാക്കും.

3. നിങ്ങൾ പ്രതിമാസം നിക്ഷേപിക്കാൻ ആഗ്രഹിക്കുന്ന തുക തീരുമാനിക്കുക

എസ്ഐപി പ്രതിമാസ നിക്ഷേപമായതിനാൽ, പ്രതിമാസം നിക്ഷേപിക്കാൻ കഴിയുന്ന തുക നിങ്ങൾ തിരഞ്ഞെടുക്കണംപരാജയപ്പെടുക. നിങ്ങളുടെ ലക്ഷ്യം അനുസരിച്ച് നിങ്ങൾക്ക് അനുയോജ്യമായ തുക കണക്കാക്കാനും കഴിയുംസിപ്പ് കാൽക്കുലേറ്റർ അല്ലെങ്കിൽ SIP റിട്ടേൺ കാൽക്കുലേറ്റർ.

4. മികച്ച SIP പ്ലാൻ തിരഞ്ഞെടുക്കുക

കൺസൾട്ട് ചെയ്തുകൊണ്ട് ബുദ്ധിപരമായ നിക്ഷേപ തിരഞ്ഞെടുപ്പ് നടത്തുക aസാമ്പത്തിക ഉപദേഷ്ടാവ് അല്ലെങ്കിൽ തിരഞ്ഞെടുക്കുന്നതിലൂടെമികച്ച SIP പ്ലാനുകൾ വിവിധ ഓൺലൈൻ നിക്ഷേപ പ്ലാറ്റ്ഫോമുകൾ വാഗ്ദാനം ചെയ്യുന്നു.

Talk to our investment specialist

ഇന്ത്യയിലെ ഏറ്റവും മികച്ച 11 SIP മ്യൂച്വൽ ഫണ്ടുകൾ FY 22 - 23

To generate capital appreciation and income distribution to unit holders by investing predominantly in equity/equity related securities of the companies belonging to the infrastructure development and balance in debt securities and money market instruments. ICICI Prudential Infrastructure Fund is a Equity - Sectoral fund was launched on 31 Aug 05. It is a fund with High risk and has given a Below is the key information for ICICI Prudential Infrastructure Fund Returns up to 1 year are on To generate long-term capital appreciation for you from a portfolio made up predominantly of equity and equity-related securities of technology intensive companies. ICICI Prudential Technology Fund is a Equity - Sectoral fund was launched on 3 Mar 00. It is a fund with High risk and has given a Below is the key information for ICICI Prudential Technology Fund Returns up to 1 year are on (Erstwhile SBI Pharma Fund) To provide the investors maximum growth opportunity through equity

investments in stocks of growth oriented sectors of the economy. SBI Healthcare Opportunities Fund is a Equity - Sectoral fund was launched on 31 Dec 04. It is a fund with High risk and has given a Below is the key information for SBI Healthcare Opportunities Fund Returns up to 1 year are on To generate long-term capital appreciation from a diversified portfolio of predominantly equity and equity related securities, including equity derivatives, in the Indian markets with key theme focus being emerging companies (small cap stocks). The Scheme could also additionally invest in Foreign Securities. L&T Emerging Businesses Fund is a Equity - Small Cap fund was launched on 12 May 14. It is a fund with High risk and has given a Below is the key information for L&T Emerging Businesses Fund Returns up to 1 year are on The investment objective of the scheme is to seek long term capital appreciation by investing atleast 80% of its net assets in equity/equity related instruments of the companies in Information Technology Sector in India.However, there is no assurance or guarantee that the investment objective of the Scheme will be achieved.The Scheme does not assure or guarantee any returns. TATA Digital India Fund is a Equity - Sectoral fund was launched on 28 Dec 15. It is a fund with High risk and has given a Below is the key information for TATA Digital India Fund Returns up to 1 year are on The Scheme seeks to generate long term capital appreciation through a portfolio of predominantly equity and equity related securities of companies engaged in manufacturing and infrastructure and related sectors. Further, there can be no assurance that the investment objectives of the scheme will be realized. The Scheme is not providing any assured or guaranteed returns BOI AXA Manufacturing and Infrastructure Fund is a Equity - Sectoral fund was launched on 5 Mar 10. It is a fund with High risk and has given a Below is the key information for BOI AXA Manufacturing and Infrastructure Fund Returns up to 1 year are on The investment objective of the scheme is to seek to generate long-term capital growth through an active diversified portfolio of predominantly equity and equity related instruments of companies that are participating in and benefiting from growth in Indian infrastructure and infrastructural related activities. However, there can be no assurance that the investment objective of the scheme will be realized. IDFC Infrastructure Fund is a Equity - Sectoral fund was launched on 8 Mar 11. It is a fund with High risk and has given a Below is the key information for IDFC Infrastructure Fund Returns up to 1 year are on (Erstwhile Reliance Diversified Power Sector Fund) The primary investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related securities of companies in the power sector. Nippon India Power and Infra Fund is a Equity - Sectoral fund was launched on 8 May 04. It is a fund with High risk and has given a Below is the key information for Nippon India Power and Infra Fund Returns up to 1 year are on The Fund seeks to provide long-term capital appreciation by investing in mid and small cap companies. Franklin India Smaller Companies Fund is a Equity - Small Cap fund was launched on 13 Jan 06. It is a fund with Moderately High risk and has given a Below is the key information for Franklin India Smaller Companies Fund Returns up to 1 year are on (Erstwhile DSP BlackRock Micro Cap Fund) The primary investment objective is to seek to generate long term capital appreciation from a portfolio that is substantially constituted of equity and equity related securities of small cap companies. From time to time, the fund manager will also seek participation in other equity and equity related securities to achieve optimal portfolio construction. There is no assurance that the investment objective of the Scheme will be realized DSP BlackRock Small Cap Fund is a Equity - Small Cap fund was launched on 14 Jun 07. It is a fund with Moderately High risk and has given a Below is the key information for DSP BlackRock Small Cap Fund Returns up to 1 year are on (Erstwhile Kotak Midcap Scheme) The investment objective of the Scheme is to generate capital appreciation from a diversified portfolio of equity and equity related securities. Kotak Small Cap Fund is a Equity - Small Cap fund was launched on 24 Feb 05. It is a fund with Moderately High risk and has given a Below is the key information for Kotak Small Cap Fund Returns up to 1 year are on Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) ICICI Prudential Infrastructure Fund Growth ₹177.05

↓ -1.12 ₹6,911 100 -7.8 -5.3 11.3 28.4 28.5 27.4 ICICI Prudential Technology Fund Growth ₹212.05

↓ -0.30 ₹14,275 100 1 9.3 15.9 10.3 28.3 25.4 SBI Healthcare Opportunities Fund Growth ₹426.614

↓ -0.19 ₹3,628 500 -0.4 12.6 27.2 24 27.6 42.2 L&T Emerging Businesses Fund Growth ₹78.6906

↓ -0.69 ₹17,386 500 -10.1 -3.6 9.1 19.1 27.5 28.5 TATA Digital India Fund Growth ₹51.8432

↓ -0.06 ₹12,963 150 -1.1 8.7 17.3 11.7 27 30.6 BOI AXA Manufacturing and Infrastructure Fund Growth ₹52.61

↓ -0.22 ₹537 1,000 -7.7 -8.3 11.7 21.3 26.7 25.7 IDFC Infrastructure Fund Growth ₹46.519

↓ -0.15 ₹1,791 100 -12.3 -15.8 12.5 23.7 26.4 39.3 Nippon India Power and Infra Fund Growth ₹314.666

↓ -0.26 ₹7,453 100 -11.9 -12.7 6.1 26.2 26.1 26.9 Franklin India Smaller Companies Fund Growth ₹164.163

↓ -1.32 ₹14,069 500 -8.8 -6.3 9.6 21.2 26 23.2 DSP BlackRock Small Cap Fund Growth ₹181.667

↓ -1.05 ₹16,634 500 -9.1 -3.2 11 16.9 26 25.6 Kotak Small Cap Fund Growth ₹252.677

↓ -1.01 ₹17,778 1,000 -10.1 -3.9 13.4 14.9 25.9 25.5 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 7 Feb 25 200 കോടി മ്യൂച്വൽ ഫണ്ടുകളുടെ ഇക്വിറ്റി വിഭാഗത്തിൽ 5 വർഷത്തെ കലണ്ടർ വർഷ റിട്ടേണുകളെ അടിസ്ഥാനമാക്കി ഓർഡർ ചെയ്യുന്നു.1. ICICI Prudential Infrastructure Fund

CAGR/Annualized return of 16% since its launch. Ranked 27 in Sectoral category. Return for 2024 was 27.4% , 2023 was 44.6% and 2022 was 28.8% . ICICI Prudential Infrastructure Fund

Growth Launch Date 31 Aug 05 NAV (07 Feb 25) ₹177.05 ↓ -1.12 (-0.63 %) Net Assets (Cr) ₹6,911 on 31 Dec 24 Category Equity - Sectoral AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 2.22 Sharpe Ratio 1.41 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹10,385 31 Jan 22 ₹16,659 31 Jan 23 ₹19,888 31 Jan 24 ₹30,973 31 Jan 25 ₹35,717 Returns for ICICI Prudential Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 7 Feb 25 Duration Returns 1 Month -2.6% 3 Month -7.8% 6 Month -5.3% 1 Year 11.3% 3 Year 28.4% 5 Year 28.5% 10 Year 15 Year Since launch 16% Historical performance (Yearly) on absolute basis

Year Returns 2023 27.4% 2022 44.6% 2021 28.8% 2020 50.1% 2019 3.6% 2018 2.6% 2017 -14% 2016 40.8% 2015 2% 2014 -3.4% Fund Manager information for ICICI Prudential Infrastructure Fund

Name Since Tenure Ihab Dalwai 3 Jun 17 7.67 Yr. Sharmila D’mello 30 Jun 22 2.59 Yr. Data below for ICICI Prudential Infrastructure Fund as on 31 Dec 24

Equity Sector Allocation

Sector Value Industrials 36.99% Basic Materials 18.93% Financial Services 16.99% Utility 10.73% Energy 7.04% Communication Services 1.26% Consumer Cyclical 1.11% Real Estate 0.75% Asset Allocation

Asset Class Value Cash 5.59% Equity 93.78% Debt 0.63% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 09 | LT9% ₹615 Cr 1,704,683 NTPC Ltd (Utilities)

Equity, Since 29 Feb 16 | 5325554% ₹257 Cr 7,710,775 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Dec 16 | ICICIBANK4% ₹255 Cr 1,990,000 Shree Cement Ltd (Basic Materials)

Equity, Since 30 Apr 24 | 5003874% ₹246 Cr 95,657 JM Financial Ltd (Financial Services)

Equity, Since 31 Oct 21 | JMFINANCIL3% ₹231 Cr 17,763,241

↑ 400,000 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 May 24 | ADANIPORTS3% ₹214 Cr 1,740,091 InterGlobe Aviation Ltd (Industrials)

Equity, Since 28 Feb 23 | INDIGO3% ₹208 Cr 457,106

↓ -30,684 NCC Ltd (Industrials)

Equity, Since 31 Aug 21 | NCC3% ₹207 Cr 7,547,700 Kalpataru Projects International Ltd (Industrials)

Equity, Since 30 Sep 06 | KPIL3% ₹202 Cr 1,558,301 Reliance Industries Ltd (Energy)

Equity, Since 31 Jul 23 | RELIANCE3% ₹196 Cr 1,609,486 2. ICICI Prudential Technology Fund

CAGR/Annualized return of 13% since its launch. Ranked 37 in Sectoral category. Return for 2024 was 25.4% , 2023 was 27.5% and 2022 was -23.2% . ICICI Prudential Technology Fund

Growth Launch Date 3 Mar 00 NAV (06 Feb 25) ₹212.05 ↓ -0.30 (-0.14 %) Net Assets (Cr) ₹14,275 on 31 Dec 24 Category Equity - Sectoral AMC ICICI Prudential Asset Management Company Limited Rating ☆☆ Risk High Expense Ratio 1.96 Sharpe Ratio 0.97 Information Ratio -0.12 Alpha Ratio 1.16 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹16,325 31 Jan 22 ₹25,971 31 Jan 23 ₹22,408 31 Jan 24 ₹29,166 31 Jan 25 ₹34,454 Returns for ICICI Prudential Technology Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 7 Feb 25 Duration Returns 1 Month -1.1% 3 Month 1% 6 Month 9.3% 1 Year 15.9% 3 Year 10.3% 5 Year 28.3% 10 Year 15 Year Since launch 13% Historical performance (Yearly) on absolute basis

Year Returns 2023 25.4% 2022 27.5% 2021 -23.2% 2020 75.7% 2019 70.6% 2018 2.3% 2017 19.1% 2016 19.8% 2015 -4% 2014 3.9% Fund Manager information for ICICI Prudential Technology Fund

Name Since Tenure Vaibhav Dusad 2 May 20 4.76 Yr. Sharmila D’mello 30 Jun 22 2.59 Yr. Data below for ICICI Prudential Technology Fund as on 31 Dec 24

Equity Sector Allocation

Sector Value Technology 71.4% Communication Services 16.22% Consumer Cyclical 4.97% Industrials 2.81% Health Care 0.69% Financial Services 0.5% Consumer Defensive 0.2% Asset Allocation

Asset Class Value Cash 2.98% Equity 97.02% Top Securities Holdings / Portfolio

Name Holding Value Quantity Infosys Ltd (Technology)

Equity, Since 30 Apr 08 | INFY22% ₹3,152 Cr 16,768,086 Tata Consultancy Services Ltd (Technology)

Equity, Since 30 Sep 19 | TCS12% ₹1,742 Cr 4,254,724

↑ 270,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 May 20 | BHARTIARTL8% ₹1,167 Cr 7,348,806

↑ 200,000 LTIMindtree Ltd (Technology)

Equity, Since 31 Jul 16 | LTIM6% ₹847 Cr 1,515,919

↑ 207,126 HCL Technologies Ltd (Technology)

Equity, Since 30 Sep 20 | HCLTECH5% ₹721 Cr 3,758,139

↑ 108,689 Tech Mahindra Ltd (Technology)

Equity, Since 31 Oct 16 | 5327555% ₹713 Cr 4,176,250

↑ 391,032 Bharti Airtel Ltd (Partly Paid Rs.1.25) (Communication Services)

Equity, Since 31 Oct 21 | 8901574% ₹547 Cr 4,645,340 Wipro Ltd (Technology)

Equity, Since 30 Sep 19 | 5076853% ₹452 Cr 14,965,117

↑ 242,399 Zomato Ltd (Consumer Cyclical)

Equity, Since 31 Aug 22 | 5433203% ₹402 Cr 14,473,026

↓ -1,085,383 Persistent Systems Ltd (Technology)

Equity, Since 31 May 20 | PERSISTENT2% ₹344 Cr 532,687

↓ -17,707 3. SBI Healthcare Opportunities Fund

CAGR/Annualized return of 15.9% since its launch. Ranked 34 in Sectoral category. Return for 2024 was 42.2% , 2023 was 38.2% and 2022 was -6% . SBI Healthcare Opportunities Fund

Growth Launch Date 31 Dec 04 NAV (06 Feb 25) ₹426.614 ↓ -0.19 (-0.04 %) Net Assets (Cr) ₹3,628 on 31 Dec 24 Category Equity - Sectoral AMC SBI Funds Management Private Limited Rating ☆☆ Risk High Expense Ratio 2.09 Sharpe Ratio 2.76 Information Ratio 0.52 Alpha Ratio 4.09 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-15 Days (0.5%),15 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹15,535 31 Jan 22 ₹17,594 31 Jan 23 ₹17,709 31 Jan 24 ₹26,160 31 Jan 25 ₹33,176 Returns for SBI Healthcare Opportunities Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 7 Feb 25 Duration Returns 1 Month -2.4% 3 Month -0.4% 6 Month 12.6% 1 Year 27.2% 3 Year 24% 5 Year 27.6% 10 Year 15 Year Since launch 15.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 42.2% 2022 38.2% 2021 -6% 2020 20.1% 2019 65.8% 2018 -0.5% 2017 -9.9% 2016 2.1% 2015 -14% 2014 27.1% Fund Manager information for SBI Healthcare Opportunities Fund

Name Since Tenure Tanmaya Desai 1 Jun 11 13.68 Yr. Pradeep Kesavan 31 Dec 23 1.09 Yr. Data below for SBI Healthcare Opportunities Fund as on 31 Dec 24

Equity Sector Allocation

Sector Value Health Care 90.04% Basic Materials 6.53% Asset Allocation

Asset Class Value Cash 3.35% Equity 96.57% Debt 0.08% Top Securities Holdings / Portfolio

Name Holding Value Quantity Sun Pharmaceuticals Industries Ltd (Healthcare)

Equity, Since 31 Dec 17 | SUNPHARMA13% ₹472 Cr 2,500,000 Max Healthcare Institute Ltd Ordinary Shares (Healthcare)

Equity, Since 31 Mar 21 | MAXHEALTH6% ₹226 Cr 2,000,000 Divi's Laboratories Ltd (Healthcare)

Equity, Since 31 Mar 12 | DIVISLAB6% ₹220 Cr 360,000 Cipla Ltd (Healthcare)

Equity, Since 31 Aug 16 | 5000876% ₹214 Cr 1,400,000

↑ 120,000 Lupin Ltd (Healthcare)

Equity, Since 31 Aug 23 | 5002575% ₹188 Cr 800,000 Lonza Group Ltd ADR (Healthcare)

Equity, Since 31 Jan 24 | LZAGY4% ₹151 Cr 300,000 Mankind Pharma Ltd (Healthcare)

Equity, Since 30 Apr 23 | MANKIND4% ₹151 Cr 523,016

↑ 123,016 Poly Medicure Ltd (Healthcare)

Equity, Since 31 Aug 24 | POLYMED4% ₹131 Cr 500,000 Krishna Institute of Medical Sciences Ltd (Healthcare)

Equity, Since 30 Nov 22 | 5433083% ₹126 Cr 2,100,000

↓ -100,000 Jupiter Life Line Hospitals Ltd (Healthcare)

Equity, Since 31 Aug 23 | JLHL3% ₹125 Cr 800,000

↓ -32,871 4. L&T Emerging Businesses Fund

CAGR/Annualized return of 21.3% since its launch. Ranked 2 in Small Cap category. Return for 2024 was 28.5% , 2023 was 46.1% and 2022 was 1% . L&T Emerging Businesses Fund

Growth Launch Date 12 May 14 NAV (07 Feb 25) ₹78.6906 ↓ -0.69 (-0.87 %) Net Assets (Cr) ₹17,386 on 31 Dec 24 Category Equity - Small Cap AMC L&T Investment Management Ltd Rating ☆☆☆☆☆ Risk High Expense Ratio 1.73 Sharpe Ratio 1.32 Information Ratio 0.19 Alpha Ratio 3.87 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹11,113 31 Jan 22 ₹19,683 31 Jan 23 ₹19,960 31 Jan 24 ₹30,763 31 Jan 25 ₹33,089 Returns for L&T Emerging Businesses Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 7 Feb 25 Duration Returns 1 Month -8.8% 3 Month -10.1% 6 Month -3.6% 1 Year 9.1% 3 Year 19.1% 5 Year 27.5% 10 Year 15 Year Since launch 21.3% Historical performance (Yearly) on absolute basis

Year Returns 2023 28.5% 2022 46.1% 2021 1% 2020 77.4% 2019 15.5% 2018 -8.1% 2017 -13.7% 2016 66.5% 2015 10.2% 2014 12.3% Fund Manager information for L&T Emerging Businesses Fund

Name Since Tenure Venugopal Manghat 17 Dec 19 5.13 Yr. Cheenu Gupta 1 Oct 23 1.34 Yr. Sonal Gupta 1 Oct 23 1.34 Yr. Data below for L&T Emerging Businesses Fund as on 31 Dec 24

Equity Sector Allocation

Sector Value Industrials 30.48% Consumer Cyclical 16.51% Financial Services 14.26% Technology 10.64% Basic Materials 10.36% Real Estate 5.3% Health Care 4.2% Consumer Defensive 3.21% Energy 1.5% Asset Allocation

Asset Class Value Cash 1.16% Equity 98.84% Top Securities Holdings / Portfolio

Name Holding Value Quantity Apar Industries Ltd (Industrials)

Equity, Since 31 Mar 17 | APARINDS3% ₹470 Cr 455,400 BSE Ltd (Financial Services)

Equity, Since 29 Feb 24 | BSE3% ₹454 Cr 852,600

↓ -31,900 Dixon Technologies (India) Ltd (Technology)

Equity, Since 31 Jul 20 | DIXON2% ₹427 Cr 238,273 Neuland Laboratories Limited

Equity, Since 31 Jan 24 | -2% ₹410 Cr 299,000

↑ 17,978 Aditya Birla Real Estate Ltd (Basic Materials)

Equity, Since 30 Sep 22 | 5000402% ₹403 Cr 1,607,279 Techno Electric & Engineering Co Ltd (Industrials)

Equity, Since 31 Jan 19 | TECHNOE2% ₹388 Cr 2,473,042 Kirloskar Pneumatic Co Ltd (Industrials)

Equity, Since 31 Aug 22 | 5052832% ₹376 Cr 2,444,924 KFin Technologies Ltd (Technology)

Equity, Since 31 Aug 24 | KFINTECH2% ₹374 Cr 2,429,736

↑ 139,336 Trent Ltd (Consumer Cyclical)

Equity, Since 31 Jan 17 | 5002512% ₹338 Cr 474,400

↓ -63,150 Time Technoplast Ltd (Consumer Cyclical)

Equity, Since 31 Jan 24 | TIMETECHNO2% ₹336 Cr 6,810,500

↑ 656,671 5. TATA Digital India Fund

CAGR/Annualized return of 19.8% since its launch. Return for 2024 was 30.6% , 2023 was 31.9% and 2022 was -23.3% . TATA Digital India Fund

Growth Launch Date 28 Dec 15 NAV (07 Feb 25) ₹51.8432 ↓ -0.06 (-0.12 %) Net Assets (Cr) ₹12,963 on 31 Dec 24 Category Equity - Sectoral AMC Tata Asset Management Limited Rating Risk High Expense Ratio 0 Sharpe Ratio 1.21 Information Ratio 0.89 Alpha Ratio 7.66 Min Investment 5,000 Min SIP Investment 150 Exit Load 0-3 Months (0.25%),3 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹15,254 31 Jan 22 ₹23,775 31 Jan 23 ₹20,584 31 Jan 24 ₹27,482 31 Jan 25 ₹32,904 Returns for TATA Digital India Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 7 Feb 25 Duration Returns 1 Month -3.7% 3 Month -1.1% 6 Month 8.7% 1 Year 17.3% 3 Year 11.7% 5 Year 27% 10 Year 15 Year Since launch 19.8% Historical performance (Yearly) on absolute basis

Year Returns 2023 30.6% 2022 31.9% 2021 -23.3% 2020 74.4% 2019 54.8% 2018 7.5% 2017 24.9% 2016 19.6% 2015 -6% 2014 Fund Manager information for TATA Digital India Fund

Name Since Tenure Meeta Shetty 9 Mar 21 3.9 Yr. Kapil Malhotra 19 Dec 23 1.12 Yr. Data below for TATA Digital India Fund as on 31 Dec 24

Equity Sector Allocation

Sector Value Technology 74.43% Consumer Cyclical 7.89% Industrials 4.94% Communication Services 4.21% Financial Services 3.86% Asset Allocation

Asset Class Value Cash 4.67% Equity 95.33% Top Securities Holdings / Portfolio

Name Holding Value Quantity Infosys Ltd (Technology)

Equity, Since 31 Jan 16 | INFY17% ₹2,168 Cr 11,530,857 Tata Consultancy Services Ltd (Technology)

Equity, Since 31 Jan 16 | TCS11% ₹1,485 Cr 3,626,873 Tech Mahindra Ltd (Technology)

Equity, Since 30 Apr 16 | 5327559% ₹1,219 Cr 7,145,933 Wipro Ltd (Technology)

Equity, Since 31 Jul 18 | 5076858% ₹990 Cr 32,787,324 HCL Technologies Ltd (Technology)

Equity, Since 31 Jan 16 | HCLTECH7% ₹956 Cr 4,983,886 Zomato Ltd (Consumer Cyclical)

Equity, Since 31 Oct 22 | 5433206% ₹808 Cr 29,067,000 LTIMindtree Ltd (Technology)

Equity, Since 28 Feb 21 | LTIM4% ₹552 Cr 988,062 Persistent Systems Ltd (Technology)

Equity, Since 31 Jan 16 | PERSISTENT4% ₹490 Cr 759,192 Firstsource Solutions Ltd (Technology)

Equity, Since 30 Nov 21 | FSL3% ₹381 Cr 10,123,112 Sonata Software Ltd (Technology)

Equity, Since 30 Jun 23 | SONATSOFTW2% ₹307 Cr 5,125,514 6. BOI AXA Manufacturing and Infrastructure Fund

CAGR/Annualized return of 11.8% since its launch. Return for 2024 was 25.7% , 2023 was 44.7% and 2022 was 3.3% . BOI AXA Manufacturing and Infrastructure Fund

Growth Launch Date 5 Mar 10 NAV (07 Feb 25) ₹52.61 ↓ -0.22 (-0.42 %) Net Assets (Cr) ₹537 on 31 Dec 24 Category Equity - Sectoral AMC BOI AXA Investment Mngrs Private Ltd Rating Risk High Expense Ratio 2.57 Sharpe Ratio 1.25 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹12,210 31 Jan 22 ₹18,356 31 Jan 23 ₹18,974 31 Jan 24 ₹29,005 31 Jan 25 ₹33,073 Returns for BOI AXA Manufacturing and Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 7 Feb 25 Duration Returns 1 Month -4.7% 3 Month -7.7% 6 Month -8.3% 1 Year 11.7% 3 Year 21.3% 5 Year 26.7% 10 Year 15 Year Since launch 11.8% Historical performance (Yearly) on absolute basis

Year Returns 2023 25.7% 2022 44.7% 2021 3.3% 2020 52.5% 2019 28.1% 2018 2.5% 2017 -22.8% 2016 56% 2015 1% 2014 0.3% Fund Manager information for BOI AXA Manufacturing and Infrastructure Fund

Name Since Tenure Nitin Gosar 27 Sep 22 2.35 Yr. Data below for BOI AXA Manufacturing and Infrastructure Fund as on 31 Dec 24

Equity Sector Allocation

Sector Value Industrials 28.83% Basic Materials 21.97% Consumer Cyclical 12.11% Utility 6.41% Health Care 5.61% Energy 5.16% Communication Services 4.47% Technology 4.11% Consumer Defensive 3.88% Real Estate 3% Asset Allocation

Asset Class Value Cash 4.46% Equity 95.54% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 31 Mar 10 | LT7% ₹35 Cr 97,169

↑ 21,367 NTPC Ltd (Utilities)

Equity, Since 31 May 21 | 5325555% ₹26 Cr 773,906 Vedanta Ltd (Basic Materials)

Equity, Since 31 Mar 24 | 5002954% ₹22 Cr 487,680

↑ 10,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Oct 20 | RELIANCE3% ₹18 Cr 150,806 Manorama Industries Ltd (Consumer Defensive)

Equity, Since 31 May 24 | 5419743% ₹15 Cr 137,935 Swan Energy Ltd (Industrials)

Equity, Since 31 Dec 23 | SWANENERGY2% ₹13 Cr 178,821

↑ 19,195 Indus Towers Ltd Ordinary Shares (Communication Services)

Equity, Since 31 Jan 24 | 5348162% ₹13 Cr 375,411 Eris Lifesciences Ltd Registered Shs (Healthcare)

Equity, Since 31 Jul 23 | ERIS2% ₹12 Cr 84,903 Sterling and Wilson Renewable Energy Ltd (Technology)

Equity, Since 31 Mar 24 | SWSOLAR2% ₹11 Cr 244,992 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Dec 22 | BHARTIARTL2% ₹11 Cr 70,260

↑ 42,631 7. IDFC Infrastructure Fund

CAGR/Annualized return of 11.7% since its launch. Ranked 1 in Sectoral category. Return for 2024 was 39.3% , 2023 was 50.3% and 2022 was 1.7% . IDFC Infrastructure Fund

Growth Launch Date 8 Mar 11 NAV (07 Feb 25) ₹46.519 ↓ -0.15 (-0.32 %) Net Assets (Cr) ₹1,791 on 31 Dec 24 Category Equity - Sectoral AMC IDFC Asset Management Company Limited Rating ☆☆☆☆☆ Risk High Expense Ratio 2.33 Sharpe Ratio 1.59 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹10,449 31 Jan 22 ₹16,786 31 Jan 23 ₹16,915 31 Jan 24 ₹28,172 31 Jan 25 ₹32,572 Returns for IDFC Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 7 Feb 25 Duration Returns 1 Month -10% 3 Month -12.3% 6 Month -15.8% 1 Year 12.5% 3 Year 23.7% 5 Year 26.4% 10 Year 15 Year Since launch 11.7% Historical performance (Yearly) on absolute basis

Year Returns 2023 39.3% 2022 50.3% 2021 1.7% 2020 64.8% 2019 6.3% 2018 -5.3% 2017 -25.9% 2016 58.7% 2015 10.7% 2014 -0.2% Fund Manager information for IDFC Infrastructure Fund

Name Since Tenure Vishal Biraia 24 Jan 24 1.02 Yr. Ritika Behera 7 Oct 23 1.32 Yr. Gaurav Satra 7 Jun 24 0.65 Yr. Data below for IDFC Infrastructure Fund as on 31 Dec 24

Equity Sector Allocation

Sector Value Industrials 58.01% Utility 12.35% Basic Materials 8.64% Technology 4.18% Communication Services 3.82% Financial Services 3.21% Energy 3.07% Consumer Cyclical 2.58% Health Care 1.77% Asset Allocation

Asset Class Value Cash 2.38% Equity 97.62% Top Securities Holdings / Portfolio

Name Holding Value Quantity Kirloskar Brothers Ltd (Industrials)

Equity, Since 31 Dec 17 | KIRLOSBROS5% ₹92 Cr 443,385 GPT Infraprojects Ltd (Industrials)

Equity, Since 30 Nov 17 | GPTINFRA4% ₹68 Cr 4,797,143 Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 12 | LT3% ₹62 Cr 171,447 KEC International Ltd (Industrials)

Equity, Since 30 Jun 24 | 5327143% ₹57 Cr 475,362 Reliance Industries Ltd (Energy)

Equity, Since 30 Jun 24 | RELIANCE3% ₹55 Cr 452,706 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Mar 14 | 5325383% ₹54 Cr 46,976 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 Dec 23 | ADANIPORTS3% ₹54 Cr 434,979 PTC India Financial Services Ltd (Financial Services)

Equity, Since 31 Dec 23 | PFS3% ₹53 Cr 12,400,122 H.G. Infra Engineering Ltd Ordinary Shares (Industrials)

Equity, Since 28 Feb 18 | HGINFRA3% ₹49 Cr 321,984 Ahluwalia Contracts (India) Ltd (Industrials)

Equity, Since 30 Apr 15 | AHLUCONT3% ₹48 Cr 470,125 8. Nippon India Power and Infra Fund

CAGR/Annualized return of 18.1% since its launch. Ranked 13 in Sectoral category. Return for 2024 was 26.9% , 2023 was 58% and 2022 was 10.9% . Nippon India Power and Infra Fund

Growth Launch Date 8 May 04 NAV (07 Feb 25) ₹314.666 ↓ -0.26 (-0.08 %) Net Assets (Cr) ₹7,453 on 31 Dec 24 Category Equity - Sectoral AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 2.05 Sharpe Ratio 1.21 Information Ratio 1.64 Alpha Ratio 8.9 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹10,728 31 Jan 22 ₹16,044 31 Jan 23 ₹17,651 31 Jan 24 ₹29,963 31 Jan 25 ₹33,188 Returns for Nippon India Power and Infra Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 7 Feb 25 Duration Returns 1 Month -7.6% 3 Month -11.9% 6 Month -12.7% 1 Year 6.1% 3 Year 26.2% 5 Year 26.1% 10 Year 15 Year Since launch 18.1% Historical performance (Yearly) on absolute basis

Year Returns 2023 26.9% 2022 58% 2021 10.9% 2020 48.9% 2019 10.8% 2018 -2.9% 2017 -21.1% 2016 61.7% 2015 0.1% 2014 0.3% Fund Manager information for Nippon India Power and Infra Fund

Name Since Tenure Kinjal Desai 25 May 18 6.7 Yr. Rahul Modi 19 Aug 24 0.45 Yr. Data below for Nippon India Power and Infra Fund as on 31 Dec 24

Equity Sector Allocation

Sector Value Industrials 44.95% Utility 15.89% Basic Materials 10.1% Communication Services 7.08% Energy 6.43% Consumer Cyclical 3.98% Real Estate 3.78% Technology 2.94% Health Care 2.45% Financial Services 1.62% Asset Allocation

Asset Class Value Cash 0.77% Equity 99.23% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 07 | LT8% ₹612 Cr 1,697,001

↓ -302,999 NTPC Ltd (Utilities)

Equity, Since 31 May 09 | 5325556% ₹467 Cr 13,999,999

↑ 999,999 Reliance Industries Ltd (Energy)

Equity, Since 30 Nov 18 | RELIANCE6% ₹431 Cr 3,550,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 18 | BHARTIARTL6% ₹413 Cr 2,600,000 Kaynes Technology India Ltd (Industrials)

Equity, Since 30 Nov 22 | KAYNES5% ₹365 Cr 492,204 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Oct 19 | 5325384% ₹309 Cr 270,000 Carborundum Universal Ltd (Industrials)

Equity, Since 30 Sep 23 | CARBORUNIV3% ₹230 Cr 1,800,000 Siemens Ltd (Industrials)

Equity, Since 31 May 21 | 5005503% ₹229 Cr 350,000 Cyient DLM Ltd (Technology)

Equity, Since 31 Jul 23 | CYIENTDLM3% ₹209 Cr 3,114,722 Brigade Enterprises Ltd (Real Estate)

Equity, Since 31 May 23 | 5329293% ₹199 Cr 1,600,000 9. Franklin India Smaller Companies Fund

CAGR/Annualized return of 15.9% since its launch. Ranked 11 in Small Cap category. Return for 2024 was 23.2% , 2023 was 52.1% and 2022 was 3.6% . Franklin India Smaller Companies Fund

Growth Launch Date 13 Jan 06 NAV (07 Feb 25) ₹164.163 ↓ -1.32 (-0.80 %) Net Assets (Cr) ₹14,069 on 31 Dec 24 Category Equity - Small Cap AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.78 Sharpe Ratio 1.06 Information Ratio 0.3 Alpha Ratio 0.36 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹11,477 31 Jan 22 ₹17,479 31 Jan 23 ₹18,112 31 Jan 24 ₹28,927 31 Jan 25 ₹31,406 Returns for Franklin India Smaller Companies Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 7 Feb 25 Duration Returns 1 Month -6.5% 3 Month -8.8% 6 Month -6.3% 1 Year 9.6% 3 Year 21.2% 5 Year 26% 10 Year 15 Year Since launch 15.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 23.2% 2022 52.1% 2021 3.6% 2020 56.4% 2019 18.7% 2018 -5% 2017 -17.4% 2016 43.5% 2015 10.2% 2014 9.6% Fund Manager information for Franklin India Smaller Companies Fund

Name Since Tenure R. Janakiraman 1 Feb 11 14.01 Yr. Sandeep Manam 18 Oct 21 3.29 Yr. Akhil Kalluri 8 Sep 22 2.4 Yr. Data below for Franklin India Smaller Companies Fund as on 31 Dec 24

Equity Sector Allocation

Sector Value Industrials 23.01% Financial Services 17.87% Consumer Cyclical 14.69% Health Care 10.46% Basic Materials 9.44% Technology 5.59% Real Estate 4.84% Consumer Defensive 3.45% Utility 2.52% Energy 0.77% Communication Services 0.16% Asset Allocation

Asset Class Value Cash 5.72% Equity 94.14% Top Securities Holdings / Portfolio

Name Holding Value Quantity Brigade Enterprises Ltd (Real Estate)

Equity, Since 30 Jun 14 | 5329293% ₹481 Cr 3,868,691 Aster DM Healthcare Ltd Ordinary Shares (Healthcare)

Equity, Since 31 Jul 23 | ASTERDM3% ₹436 Cr 8,473,781 Kalyan Jewellers India Ltd (Consumer Cyclical)

Equity, Since 31 May 22 | KALYANKJIL3% ₹380 Cr 4,963,469 Deepak Nitrite Ltd (Basic Materials)

Equity, Since 31 Jan 16 | DEEPAKNTR2% ₹346 Cr 1,387,967 Karur Vysya Bank Ltd (Financial Services)

Equity, Since 31 Oct 12 | 5900032% ₹334 Cr 15,398,917 360 One Wam Ltd Ordinary Shares (Financial Services)

Equity, Since 30 Jun 23 | 360ONE2% ₹308 Cr 2,452,684 Equitas Small Finance Bank Ltd Ordinary Shares (Financial Services)

Equity, Since 31 Oct 20 | EQUITASBNK2% ₹308 Cr 48,064,081 Crompton Greaves Consumer Electricals Ltd (Consumer Cyclical)

Equity, Since 31 Jan 24 | CROMPTON2% ₹273 Cr 6,900,000 J.B. Chemicals & Pharmaceuticals Ltd (Healthcare)

Equity, Since 30 Jun 14 | JBCHEPHARM2% ₹267 Cr 1,448,723 Eris Lifesciences Ltd Registered Shs (Healthcare)

Equity, Since 30 Sep 19 | ERIS2% ₹256 Cr 1,866,828 10. DSP BlackRock Small Cap Fund

CAGR/Annualized return of 17.9% since its launch. Ranked 7 in Small Cap category. Return for 2024 was 25.6% , 2023 was 41.2% and 2022 was 0.5% . DSP BlackRock Small Cap Fund

Growth Launch Date 14 Jun 07 NAV (07 Feb 25) ₹181.667 ↓ -1.05 (-0.57 %) Net Assets (Cr) ₹16,634 on 31 Dec 24 Category Equity - Small Cap AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.86 Sharpe Ratio 1.09 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹12,249 31 Jan 22 ₹19,631 31 Jan 23 ₹19,487 31 Jan 24 ₹28,654 31 Jan 25 ₹31,355 Returns for DSP BlackRock Small Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 7 Feb 25 Duration Returns 1 Month -7.8% 3 Month -9.1% 6 Month -3.2% 1 Year 11% 3 Year 16.9% 5 Year 26% 10 Year 15 Year Since launch 17.9% Historical performance (Yearly) on absolute basis

Year Returns 2023 25.6% 2022 41.2% 2021 0.5% 2020 58.9% 2019 33.1% 2018 0.7% 2017 -25.5% 2016 42.8% 2015 12.7% 2014 20.4% Fund Manager information for DSP BlackRock Small Cap Fund

Name Since Tenure Vinit Sambre 21 Jun 10 14.63 Yr. Resham Jain 16 Mar 18 6.89 Yr. Data below for DSP BlackRock Small Cap Fund as on 31 Dec 24

Equity Sector Allocation

Sector Value Consumer Cyclical 32.19% Basic Materials 20% Industrials 17.18% Health Care 8.21% Consumer Defensive 7.69% Technology 3.87% Financial Services 3.79% Communication Services 0.92% Utility 0.17% Asset Allocation

Asset Class Value Cash 5.99% Equity 94.01% Top Securities Holdings / Portfolio

Name Holding Value Quantity Jubilant Ingrevia Ltd Ordinary Shares (Basic Materials)

Equity, Since 31 Dec 22 | JUBLINGREA4% ₹653 Cr 7,937,996 eClerx Services Ltd (Technology)

Equity, Since 28 Feb 18 | ECLERX3% ₹553 Cr 1,586,315

↓ -175,035 Welspun Corp Ltd (Basic Materials)

Equity, Since 31 Mar 21 | 5321443% ₹529 Cr 6,500,000 Dodla Dairy Ltd (Consumer Defensive)

Equity, Since 30 Jun 21 | 5433063% ₹463 Cr 3,638,348

↑ 17,379 Cyient Ltd (Industrials)

Equity, Since 30 Sep 21 | CYIENT3% ₹450 Cr 2,447,699

↑ 347,699 Suprajit Engineering Ltd (Consumer Cyclical)

Equity, Since 30 Jun 14 | SUPRAJIT3% ₹425 Cr 9,260,495 Safari Industries (India) Ltd (Consumer Cyclical)

Equity, Since 31 Dec 21 | 5230253% ₹424 Cr 1,629,601 Triveni Engineering & Industries Ltd (Consumer Defensive)

Equity, Since 31 Aug 17 | 5323562% ₹414 Cr 9,143,737 LT Foods Ltd (Consumer Defensive)

Equity, Since 31 Dec 17 | 5327832% ₹402 Cr 9,587,705

↓ -35,413 Lumax Auto Technologies Ltd (Consumer Cyclical)

Equity, Since 30 Jun 18 | LUMAXTECH2% ₹397 Cr 6,150,000 11. Kotak Small Cap Fund

CAGR/Annualized return of 17.6% since its launch. Ranked 23 in Small Cap category. Return for 2024 was 25.5% , 2023 was 34.8% and 2022 was -3.1% . Kotak Small Cap Fund

Growth Launch Date 24 Feb 05 NAV (07 Feb 25) ₹252.677 ↓ -1.01 (-0.40 %) Net Assets (Cr) ₹17,778 on 31 Dec 24 Category Equity - Small Cap AMC Kotak Mahindra Asset Management Co Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 1.67 Sharpe Ratio 1.24 Information Ratio -0.61 Alpha Ratio 4.3 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Jan 20 ₹10,000 31 Jan 21 ₹12,684 31 Jan 22 ₹20,543 31 Jan 23 ₹20,149 31 Jan 24 ₹28,052 31 Jan 25 ₹31,564 Returns for Kotak Small Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 7 Feb 25 Duration Returns 1 Month -6.9% 3 Month -10.1% 6 Month -3.9% 1 Year 13.4% 3 Year 14.9% 5 Year 25.9% 10 Year 15 Year Since launch 17.6% Historical performance (Yearly) on absolute basis

Year Returns 2023 25.5% 2022 34.8% 2021 -3.1% 2020 70.9% 2019 34.2% 2018 5% 2017 -17.3% 2016 44% 2015 8.9% 2014 7.4% Fund Manager information for Kotak Small Cap Fund

Name Since Tenure Harish Bihani 20 Oct 23 1.29 Yr. Data below for Kotak Small Cap Fund as on 31 Dec 24

Equity Sector Allocation

Sector Value Industrials 33.09% Consumer Cyclical 21.05% Health Care 16.22% Basic Materials 13.34% Real Estate 3.53% Financial Services 3.33% Consumer Defensive 2.45% Communication Services 2.18% Technology 1.08% Asset Allocation

Asset Class Value Cash 3.72% Equity 96.28% Top Securities Holdings / Portfolio

Name Holding Value Quantity Cyient Ltd (Industrials)

Equity, Since 31 Dec 19 | CYIENT3% ₹583 Cr 3,174,852 Techno Electric & Engineering Co Ltd (Industrials)

Equity, Since 31 Dec 18 | TECHNOE3% ₹559 Cr 3,559,792 Blue Star Ltd (Industrials)

Equity, Since 31 May 18 | BLUESTARCO3% ₹539 Cr 2,518,929 Vijaya Diagnostic Centre Ltd (Healthcare)

Equity, Since 31 Mar 24 | 5433503% ₹491 Cr 4,641,335

↑ 167,450 Aster DM Healthcare Ltd Ordinary Shares (Healthcare)

Equity, Since 31 Jul 24 | ASTERDM3% ₹487 Cr 9,466,562

↑ 154,958 Century Plyboards (India) Ltd (Basic Materials)

Equity, Since 31 Oct 18 | 5325483% ₹485 Cr 6,569,467

↑ 162,093 Krishna Institute of Medical Sciences Ltd (Healthcare)

Equity, Since 31 Dec 23 | 5433083% ₹484 Cr 8,096,930 Amber Enterprises India Ltd Ordinary Shares (Consumer Cyclical)

Equity, Since 31 Jan 18 | AMBER3% ₹455 Cr 616,512 Garware Technical Fibres Ltd (Consumer Cyclical)

Equity, Since 30 Jun 21 | GARFIBRES2% ₹430 Cr 904,067

↑ 4,435 Ratnamani Metals & Tubes Ltd (Basic Materials)

Equity, Since 31 Jan 18 | RATNAMANI2% ₹422 Cr 1,328,764

നിക്ഷേപകർ അവർക്കിഷ്ടമുള്ള SIP പ്ലാനുകളിൽ നിക്ഷേപിക്കാൻ നിർദ്ദേശിക്കുന്നു. മുകളിൽ സൂചിപ്പിച്ച മികച്ച 11 മ്യൂച്വൽ ഫണ്ടുകൾ എല്ലാ തരത്തിലുമുള്ള നിക്ഷേപകർക്ക് അനുയോജ്യമാണ്. അതിനാൽ, ഒന്നുകിൽ നിങ്ങൾ ഉയർന്ന അപകടസാധ്യതയുള്ള ആളാണ്നിക്ഷേപകൻ അല്ലെങ്കിൽ താരതമ്യേന താഴ്ന്നത്, ഈ SIP ഫണ്ടുകളാണ്നിക്ഷേപിക്കാൻ മികച്ച മ്യൂച്വൽ ഫണ്ടുകൾ. അതിനാൽ, കാത്തിരിക്കരുത്, ഇപ്പോൾ നിക്ഷേപിക്കുക!

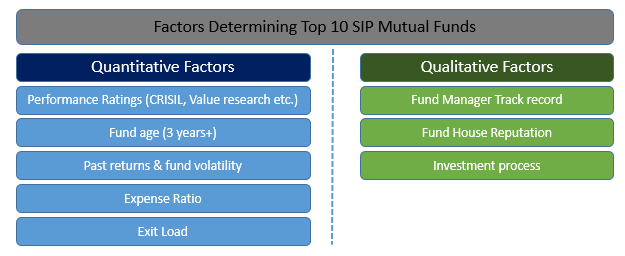

മികച്ച ചിട്ടയായ നിക്ഷേപ പദ്ധതികളിൽ നിക്ഷേപിക്കുമ്പോൾ പരിഗണിക്കേണ്ട പാരാമീറ്ററുകൾ

മികച്ച പ്രകടനം കാഴ്ചവെക്കുന്ന എസ്ഐപി ഫണ്ടുകൾ വിലയിരുത്തുന്നതിന്, നിക്ഷേപിക്കുന്നതിന് മുമ്പ് പരിഗണിക്കേണ്ട ഘടകങ്ങൾ എന്തൊക്കെയെന്ന് നമുക്ക് നോക്കാം.

ടോപ്പ് എസ്ഐപിയിൽ നിക്ഷേപിക്കാനുള്ള അളവ് ഘടകങ്ങൾ

എസ്ഐപി വഴി നിക്ഷേപിക്കുന്നതിന് മുമ്പ് ഒരാൾ പരിഗണിക്കേണ്ട അളവ് ഘടകങ്ങളിൽ പ്രകടന റേറ്റിംഗ് (ക്രിസിൽ, മൂല്യ ഗവേഷണം മുതലായവ പ്രകാരം), ഫണ്ടിന്റെ പ്രായം, മുൻകാല റിട്ടേണുകളും ഫണ്ടുകളുടെ ചാഞ്ചാട്ടവും, ചെലവ് അനുപാതവും എക്സിറ്റ് ലോഡും ഉൾപ്പെടുന്നു.

ടോപ്പ് എസ്ഐപിയിൽ നിക്ഷേപിക്കാനുള്ള ഗുണപരമായ ഘടകങ്ങൾ

വിശകലനം ചെയ്യാനുള്ള ഗുണപരമായ പ്രധാന സ്ഥിതിവിവരക്കണക്കുകളിൽ ഫണ്ട് മാനേജരുടെ ട്രാക്ക് റെക്കോർഡ്, ഫണ്ട് ഹൗസിന്റെ പ്രശസ്തി, എസ്ഐപി ഫണ്ടിന്റെ നിക്ഷേപ പ്രക്രിയ എന്നിവ ഉൾപ്പെടുന്നു.

SIP MF ഓൺലൈനിൽ എങ്ങനെ നിക്ഷേപിക്കാം?

Fincash.com-ൽ ആജീവനാന്ത സൗജന്യ നിക്ഷേപ അക്കൗണ്ട് തുറക്കുക

നിങ്ങളുടെ രജിസ്ട്രേഷനും KYC പ്രക്രിയയും പൂർത്തിയാക്കുക

രേഖകൾ അപ്ലോഡ് ചെയ്യുക (പാൻ, ആധാർ മുതലായവ).കൂടാതെ, നിങ്ങൾ നിക്ഷേപിക്കാൻ തയ്യാറാണ്!

ഇന്ന് തന്നെ SIP ഉപയോഗിച്ച് നിങ്ങളുടെ നിക്ഷേപ യാത്ര ആരംഭിക്കൂ!

പതിവുചോദ്യങ്ങൾ

1. മ്യൂച്വൽ ഫണ്ടുകൾ എന്തൊക്കെയാണ്?

എ: മ്യൂച്വൽ ഫണ്ടുകൾ സിസ്റ്റമാറ്റിക് ഇൻവെസ്റ്റ്മെന്റ് പ്ലാനിന്റെ ഭാഗമാണ് അല്ലെങ്കിൽ എസ്ഐപികൾ സാധാരണയായി പിന്നീട് മികച്ച വരുമാനം നൽകുന്നു. നിങ്ങൾ എപ്പോൾമ്യൂച്വൽ ഫണ്ടുകളിൽ നിക്ഷേപിക്കുക, നിങ്ങൾ നിങ്ങളുടെ നിക്ഷേപ പോർട്ട്ഫോളിയോ വൈവിധ്യവൽക്കരിക്കുന്നു. ഒരു മ്യൂച്വൽ ഫണ്ട് വികസിപ്പിച്ച ഒരു നിക്ഷേപ ഉപകരണമായി കണക്കാക്കാംഅസറ്റ് മാനേജ്മെന്റ് കമ്പനി ഒന്നിലധികം നിക്ഷേപകരും കമ്പനികളുടെ നിക്ഷേപവും സമാഹരിച്ചുകൊണ്ട്.

2. മ്യൂച്വൽ ഫണ്ടുകളുടെ വ്യത്യസ്ത തരം ഏതൊക്കെയാണ്?

എ: മ്യൂച്വൽ ഫണ്ടുകളെ ഇനിപ്പറയുന്ന തരങ്ങളായി തരംതിരിക്കാം:

- ഇക്വിറ്റി അല്ലെങ്കിൽ വളർച്ചാ ഫണ്ടുകൾ

- സ്ഥിര വരുമാന ഫണ്ടുകൾ അല്ലെങ്കിൽഡെറ്റ് ഫണ്ട്

- നികുതി ലാഭിക്കൽ ഫണ്ടുകൾ

- ലിക്വിഡ് ഫണ്ടുകൾ

- ബാലൻസ്ഡ് ഫണ്ട്

- ഗിൽറ്റ് ഫണ്ടുകൾ

- എക്സ്ചേഞ്ച്-ട്രേഡഡ് ഫണ്ടുകൾ അല്ലെങ്കിൽഇടിഎഫുകൾ

3. വളർച്ചാ ഇക്വിറ്റി ഫണ്ടുകൾ എന്തൊക്കെയാണ്?

എ: വളർച്ചഇക്വിറ്റി ഫണ്ടുകൾ ഏറ്റവും സാധാരണമായ മ്യൂച്വൽ ഫണ്ടുകളാണ്. എന്നിരുന്നാലും, ഈ പോർട്ട്ഫോളിയോ അസ്ഥിരമായ നിക്ഷേപങ്ങൾ ഉൾക്കൊള്ളുന്നതാണ്. എന്നിരുന്നാലും, നിക്ഷേപകർ പലപ്പോഴും വളർച്ചാ ഇക്വിറ്റി ഫണ്ടുകൾ തിരഞ്ഞെടുക്കുന്നു, കാരണം ഇവയ്ക്ക് ഉയർന്ന റിട്ടേൺ ഉണ്ട്, കുറഞ്ഞ കാലയളവിലേക്ക് നിക്ഷേപിക്കാം.

4. എന്തുകൊണ്ടാണ് നിങ്ങൾ ഒരു ഡെറ്റ് ഫണ്ടിൽ നിക്ഷേപിക്കേണ്ടത്?

എ: നിക്ഷേപത്തിൽ സ്ഥിരമായ വരുമാനം തേടുന്ന വ്യക്തികൾക്ക് ഈ നിക്ഷേപങ്ങൾ അനുയോജ്യമാണ്. ഡിബഞ്ചറുകൾ, ഡെറ്റ് സെക്യൂരിറ്റികൾ, വാണിജ്യ പേപ്പറുകൾ, സർക്കാർ സെക്യൂരിറ്റികൾ എന്നിവയിൽ നിന്ന് സ്ഥിരവരുമാനം നേടാം. മ്യൂച്വൽ ഫണ്ടുകൾ വിവിധ തരത്തിലുള്ള നിക്ഷേപങ്ങളുടെ ഒരു പോർട്ട്ഫോളിയോ സൃഷ്ടിക്കുകയും അപകടസാധ്യത ഇല്ലാതാക്കുകയും ചെയ്യും.

5. നിങ്ങൾ എന്തിന് SIP-കളിൽ നിക്ഷേപിക്കണം?

എ: SIP-കൾക്ക് നിക്ഷേപകന് ഉറപ്പായ വരുമാനം നൽകാൻ കഴിയും. നിഷ്ക്രിയ വരുമാനം നേടുന്നതിൽ നിങ്ങൾക്ക് താൽപ്പര്യമുണ്ടെങ്കിൽ നിങ്ങളുടെ നിക്ഷേപം സ്ഥിരമായ വരുമാനം ഉണ്ടാക്കുന്നുവെന്ന് ഉറപ്പാക്കാൻ ആഗ്രഹിക്കുന്നുവെങ്കിൽ, നിങ്ങൾക്ക് SIP-കളിൽ നിക്ഷേപിക്കുന്നത് പരിഗണിക്കാം. .

6. നികുതി ലാഭിക്കുന്ന മ്യൂച്വൽ ഫണ്ടിൽ നിക്ഷേപിക്കുന്നത് എന്തുകൊണ്ട്?

എ: നിങ്ങൾ വളരാൻ നോക്കുകയാണെങ്കിൽ നിങ്ങളുടെമൂലധനം അതേ സമയം നികുതി ഇളവുകൾ ആസ്വദിക്കാൻ ആഗ്രഹിക്കുന്നു, തുടർന്ന് നിങ്ങൾക്ക് നികുതി ലാഭിക്കുന്ന മ്യൂച്വൽ ഫണ്ടിൽ നിക്ഷേപിക്കാം. താഴെസെക്ഷൻ 80 സി യുടെആദായ നികുതി 1861 ലെ നിയമം, നിങ്ങൾ ഇക്വിറ്റി-ലിങ്ക്ഡ് ടാക്സ് സേവിംഗ് മ്യൂച്വൽ ഫണ്ടുകളിൽ നിക്ഷേപിക്കുകയാണെങ്കിൽ, നിങ്ങളുടെ നിക്ഷേപത്തിൽ നിങ്ങൾക്ക് നികുതി ഇളവുകൾ ആസ്വദിക്കാം.

7. മ്യൂച്വൽ ഫണ്ടുകളിൽ നിക്ഷേപിക്കാൻ എനിക്ക് ഒരു ബ്രോക്കറെ ആവശ്യമുണ്ടോ?

എ: നിക്ഷേപത്തിൽ നിങ്ങളെ സഹായിക്കാൻ നിങ്ങൾക്ക് ഒരു ബ്രോക്കറുടെയോ ഒരു ധനകാര്യ സ്ഥാപനത്തിന്റെയോ പിന്തുണ ആവശ്യമാണ്. അനുയോജ്യമായ SIP-കൾ തിരിച്ചറിയുന്നതിനും നിക്ഷേപങ്ങൾ കൃത്യമായി നടത്തിയിട്ടുണ്ടെന്ന് ഉറപ്പുവരുത്തുന്നതിനും നിങ്ങൾക്ക് പിന്തുണ ആവശ്യമാണ്.

ഇവിടെ നൽകിയിരിക്കുന്ന വിവരങ്ങൾ കൃത്യമാണെന്ന് ഉറപ്പാക്കാൻ എല്ലാ ശ്രമങ്ങളും നടത്തിയിട്ടുണ്ട്. എന്നിരുന്നാലും, ഡാറ്റയുടെ കൃത്യത സംബന്ധിച്ച് യാതൊരു ഉറപ്പും നൽകുന്നില്ല. എന്തെങ്കിലും നിക്ഷേപം നടത്തുന്നതിന് മുമ്പ് സ്കീം വിവര രേഖ ഉപയോഗിച്ച് പരിശോധിക്കുക.