Table of Contents

Tips & Tricks to Personal Finance Management

Personal Finance management is a broad term that incorporates money management, saving, and Investing principles. Additionally, it encompasses banking, financial planning, budgeting, mortgages, investments, insurance, Retirement planning, and tax preparation.

It is all about achieving your personal financial goals, whether short-term financial goals, long-term retirement planning, or saving for your child's college. However, even the most financially savvy person can become confused or short-sighted when managing their finances.

Making the most of the money takes awareness and planning. This article covers some of the fundamentals of personal financial management in the modern era.

Importance of Personal Finance

The amount of money required to pay basic needs like food, housing, transportation, and healthcare is known as the cost of living. Keep in mind that assets are worth more or less depending on your location and living expenses.

This cost becomes much more essential when the house you live in or the health Savings Account you maintain regularly falls under crucial living expenditures. However, for many people, all this means is that you should keep an eye on your spending and savings.

That is not a bad policy, but it falls short of addressing the complexity and diversity of strategic financial planning.

It's vital to learn financial literacy so you can distinguish between good and bad advice and make informed investment decisions. Many schools don't teach you how to manage your money, so you can self-teach yourself and learn the basics through free online articles and courses or at the library.

Budgeting, setting up an emergency fund, paying down debt, carefully managing credit cards, and saving for retirement are all part of a well-rounded approach to personal finance.

Areas of Personal Finance

Personal finance comprises five main components, which are discussed in greater detail in the sections that follow.

Income

Income is the first step in the financial planning process that refers to the flow of income that an individual receives and then utilises to maintain themselves and their family. Some of the most popular sources of income are bonuses, monthly salaries, hourly payments, pensions, and dividends.

Each of these kinds of revenue generates cash that an individual can spend, save, or invest.

Spending

Managing one's personal finances effectively begins with having controlled spending habits. Generally, spending is divided into two categories, one is cash, and the other is credit. Some of the most typical sources of spending are rent, loan repayments, taxes, food, entertainment, vacation, and credit card payments.

If expenses exceed income, the person is in deficit. Managing spending is as vital as earning revenue, and most people have greater control over expenses than income.

Saving

One of the critical aspects of personal finance management is saving. It refers to the money allocated for future purchases. If a person's income is more than their expenses, the remaining amount can be used toward savings or investments. Examples of savings include cash, Bank account balances, and money market instruments.

Investing

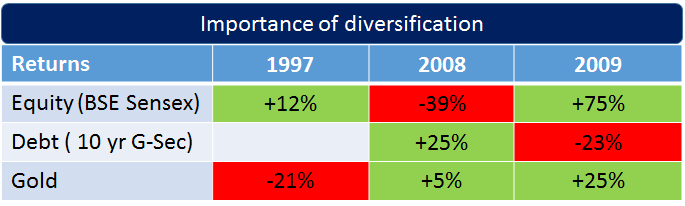

Investing is when someone buys assets that are expected to make money, with the goal that over time they will get back more money than they placed into them. This is one of the most complex areas of personal finance. Investing entails risk, and not all investments produce a favourable return.

It can take many forms, including stocks, Bonds, Mutual Funds, real estate, commodities, and other types of assets.

Talk to our investment specialist

Security

Personal protection encompasses a wide range of measures that can be taken to safeguard oneself against a potentially dangerous situation. Some of the most common types of protection include Life Insurance and health insurance. An expert opinion is necessary to thoroughly analyse the insurance needs.

Personal Financial Planning Process

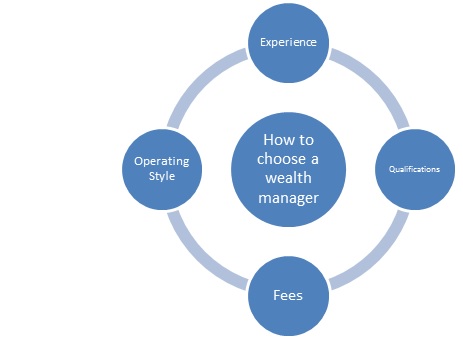

The key to effectively managing your finances is to have a proper plan and to stick to it. A budget or formal Financial plan can cover all of the abovementioned personal finance areas. Personal bankers and investment advisors often make these plans who work with their clients to figure out what they need and what they want to do next.

The key components of financial planning are:

- Evaluation

- Targets

- Plan preparation

- Implementation of plan

- Inspection

- Re-evaluation

Example of Personal Finance Budget

Preparing a budget or financial plan is crucial in accomplishing personal and family goals.

For illustration, let’s assume, each month, you get below-mentioned figures transacted to your bank account:

| Monthly Income | Amount (INR) |

|---|---|

| Salary | 1,00,000 |

| Bonus | 10,000 |

| Additional Earnings | 5,000 |

| Total Income | 1,15,000 |

And, here’s your monthly expenditure:

| Monthly Expenditure | Amount (INR) |

|---|---|

| Rent | 30,000 |

| Groceries | 15,000 |

| Restaurants | 5,000 |

| Entertainment | 2,000 |

| Child Care | 10,000 |

| Total Expenses | 62,000 |

In this case, if you calculate the monthly surplus or deficit, which is the difference between total income and total expenses, it will be:

INR 1,15,000 - INR 62,000 = INR 53,000

Personal Money Management Strategies

Some of the concrete strategies for addressing these critical areas are discussed below:

1. Income and Cash Flow Management

To get the most out of what you earn, you need a rigorous system for tracking and understanding your income and expenses. But how exactly should you do it? It's not the most sophisticated financial planning advice you'll find, but for some people, keeping detailed records is all they need.

For example, simply calculating your daily (or weekly, or monthly) income and expenses - including rent, subscriptions, insurance, etc. - you can instantly see your financial trajectory. You can then make necessary adjustments, such as reducing expenditure wherever possible to maximise the amount of money you retain. This can be done on a well-organised money management excel sheet.

2. Managing Financial Security and Growth

The two areas that come into play once you have mastered cash flow management and have some capital to invest are insurance and investment. To safeguard yourself and your family against financial hardship, you need decent insurance.

In reality, managing insurance costs is challenging because different forms of insurance (car, house, health, life, etc.) have varied variables and requirements. However, insurance costs are as important to consider as other expenses while creating the financial plan.

Financial investment requires more strategic thinking and risk evaluation. Personal financial management includes nurturing growth and accumulating valuable assets, which can be achieved by knowing how and when to invest. In general, it is advisable to begin investing with the help of a professional.

3. Establishing Liquid Savings

While planning the investments, experts advise that the money you set aside for growth or savings should be instantly available in case of an emergency. For many people, this means having a savings account with an "emergency" or "rainy day" fund in it.

However, it also means looking for different types of investments that will grow over time and can be sold quickly. Gold, silver, crude oil, and foreign currencies are all commodities that can be traded easily through private online sites at any time. These markets are less volatile and allow investors to buy and sell at any time of day.

4. Personal Finance Management Tools

Money management has never been easier, thanks to an expanding number of smartphone budgeting personal financial management apps that put everyday finances in your palm. Money manager expense and budget, walnut, money view, kmymoney, and mint money manager are some of the best personal finance management apps that are available in India.

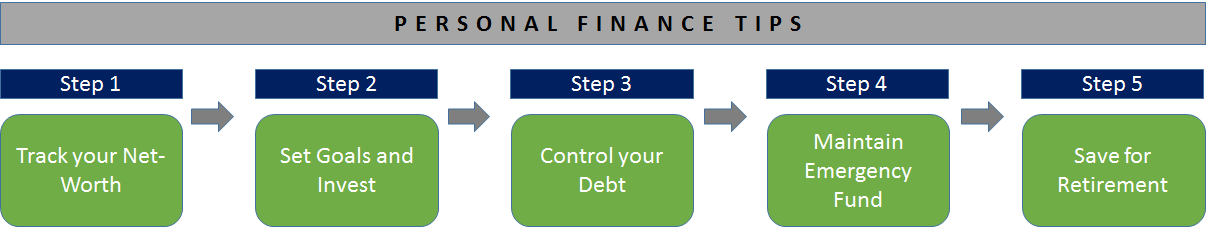

Smart Tips for Personal Finance Management

It's never too late to set financial goals for your family's financial security and freedom. Here are the top Personal finance tips and techniques.

Plan Your Budget

A budget is vital for saving money and living within your means. The 50/30/20 technique of budgeting provides an excellent framework. Here's how it works:

- 50% of your net income should be allocated to living expenses like rent, utilities, food, and transportation.

- 30% is allotted for expenditures such as dining out, clothing purchasing, and charitable contributions.

- 20% is allocated to the future, including debt repayment, retirement savings, and other emergencies.

Setting Up Emergency Fund

It's critical to have money to set money aside for unexpected expenses such as medical bills, a major automobile repair, and other expenses. It's best to have three to six months' worth of expenses in your emergency fund.

Saving 20% of your monthly salary is commonly advised by financial gurus, and don't stop once your emergency money is filled. Continue to place 20% of your income toward savings, retirement, or a down payment on a home.

Limiting Debts

Limiting debt is not spending more than you earn. Overload EMIs or pending payments will create a heavy burden on you. So, whether you're renting a residence, leasing a car, or even subscribing to computer software, ensure you plan well.

Responsible Usage of Credit Cards

Credit cards can be big financial traps, but they are necessary for today's fast-paced society. They are not only vital to building credit scores but also a terrific method to track expenditure and help with budgeting. Credit cards should be properly managed, which involves paying off your monthly bill on time or keeping your credit utilisation ratio low.

If you can pay your expenses in full, it makes sense to credit as many purchases as feasible. The most important thing to remember is to avoid maxing out your credit cards at all times. Paying bills late or, worse, missing payments is one of the quickest ways to destroy your Credit Score. Using a Debit Card, which automatically deducts funds from your bank account, is another option to avoid paying interest on little purchases.

Monitoring your Credit Score

You must have a decent credit score to lease, a mortgage, or any other kind of loan. An individual's Credit Score Ranges from 300 to 900. You should always strive to raise your credit score to 900. Credit Bureaus determine credit scores based on characteristics such as credit history, repayment history, and credit inquiries.

If you want to pay your bills automatically, enrol in automated bill payment and subscribe to credit reporting agencies that will provide you with regular credit score updates. Keeping an eye on your Credit Report will help you to spot errors or fraudulent activities. Credit scores can be obtained from TransUnion CIBIL Limited, Experian Credit Information Company of India Private Limited, Equifax Credit Information Services Private Limited (ECIS), and CRIF High Mark.

Family Protection

Make a will and, if necessary, set up trusts to protect your assets and ensure that your desires are followed out after your death. You should also consider insurance for your family, automobile, home, life, disability, and long-term care. Also, regularly evaluate your policy to ensure it matches your family's needs. All of these documents may not directly affect you, but they can save your family's time and money if you become sick or otherwise incapacitated.

Repay Loans

You can repay the loan by choosing from a variety of repayment options. Paying down the principal faster makes sense if you have a high-interest rate. On the other side, reducing repayments can free up funds for alternative investments or retirement savings.

Retirement Plan

Retirement may seem far off, yet it comes far sooner than expected. Experts estimate that most people will need around 80% of their present income in retirement. The earlier you begin, the more you profit from what financial experts refer to as the "magic of compounding interest," which describes how tiny amounts multiply over time.

Saving money for retirement not only permits it to grow over time, but it can also decrease current taxes if invested in a tax-advantaged plan.

Increase Tax Breaks

Due to unnecessarily complicated tax laws, many individuals lose out lots of money. You must begin gathering receipts and tracking expenditures to claim all available tax deductions and credits each year.

Most office supply stores sell handy "tax organisers" with pre-labelled significant categories. After that, focus on claiming every tax deduction and credit available and choose between the two as applicable. In other words, a tax deduction lowers the amount of income that is taxed, but a tax credit lowers the amount of tax payable.

Take a Break and Delegate Tasks

Budgeting and planning can appear to be fraught with deprivation. You should appreciate the results of your labour, whether it's a vacation, a purchase, or a once-in-a-while night out. This provides you with a taste of the financial freedom you've been working so hard to achieve.

Finally, remember to delegate when necessary. Even if you can handle your taxes or manage a stock portfolio, this does not imply you should. Opening an account at a brokerage and spending a few thousand rupees on a certified public Accountant or a financial planner—at least once—might be an excellent approach to get your planning underway.

Personal Finance Management Principles

Getting your money back on track doesn't require you to acquire new skills. Instead, it's about realising that the principles that contribute to business and career success will also apply to personal money management.

Prioritisation

This implies that you can evaluate your finances, determine what causes money to stream in, and ensure that you remain focused on those activities. This will not only keep you from spending more than you can afford, but it will also help you build up your wealth.

Assessment

This is a crucial ability for professionals to have to avoid becoming overburdened. Ambitious individuals are constantly brainstorming additional methods to succeed, whether a side business or investment opportunity. However, managing your money as a business requires you to sit back and honestly examine the prospective costs and rewards of any new endeavour.

Restraint

This is the last and most important aspect of successful business management that must be applied to personal finances. financial advisers often interact with high-net-worth individuals who spend more than they earn. Earning INR 10,250,000 won't help if you spend INR 10,275,000 annually. It is vital to develop the ability to postpone non-wealth-building purchases until your monthly savings or debt reduction targets are fulfilled.

Conclusion

Every aspect of our existence revolves around money. Without sound financial management, human lives can spiral out of control. Financial freedom is a desire that many individuals have, but many lack the expertise to achieve it. Every individual must manage and arrange their finances. Personal finance management teaches you how to regulate your money and achieve your financial goals.

Frequently Asked Questions (FAQs)

1. How can people track their personal finances?

A: People have varied preferences for tracking and managing their finances. Some prefer personal finance management excel sheets, while others prefer apps. These apps connect directly to the bank account and are automatically updated, making it much easier to keep track of the expenses and budgets in real-time.

2. What is the impact of the economy on one's personal finances?

A: Even small changes in the economy can significantly influence one's finances. For instance, Inflation can increase the cost of consumer items, while rising interest rates can make borrowing more expensive. Financial goals can be more difficult or easier to achieve depending on the state of the economy and other circumstances.

3. How can boosting one's credit score assist in their personal finances?

A: Improving your credit score makes it easier to secure loans and credit cards for significant and minor expenditures. Not only that, but because of your higher credit score, lenders are more likely to offer you better rates and loan terms which makes it easier to achieve your financial goals.

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.