+91-22-48913909

+91-22-48913909

Table of Contents

Plan Your Financial Goals with Mutual Funds

Many times people don’t acknowledge the importance of managing financial goals, or even plan for that! Financial set-up can be a major backbone to you at all times of your life. Regardless of your age; setting financial goals is very important. The secret to set personal financial goals is foreseeing your aspirations and future needs followed by setting smart goals. But, why Mutual Funds are one of the best avenues to fulfill your financial goals?

Mutual Funds offer a host of schemes that cater to the vast needs of the investors. Whether one is looking for short-term gains or wants to create a long-term wealth, Mutual Funds help them achieve all. A first-time investor with an average risk-appetite to a high-risk taker, the schemes offered by Mutual Funds are designed for all kinds of investors.

Here are the Mutual Fund plans as per the time frame that you could prefer Investing to achieve your financial goals on time.

Identify your Time Frame

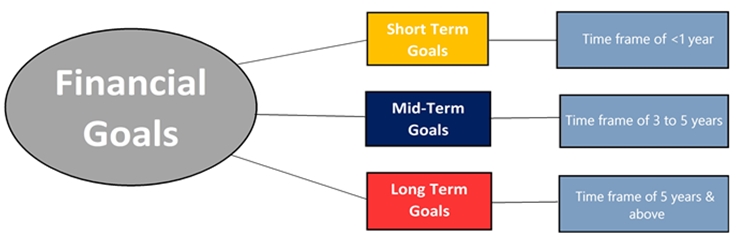

Planning for financial goals has to be very systematic, and at the same time, you have to set your fundamental targets by categorising it into time frames, such as-

Short Term Goals- Up to 1 Year

Short term goals are something that you aim for in the near future. It is associated with specific time frames and serious objectives that you would want to accomplish in a year or two years’ time. There are many things that you could pick as your short-term financial goals by setting your small wish list. For example, you can save for vacation, gadgets, pay off a debt, save for any course, etc. With so much of rapid development, technology innovation and constant wish lists, short term goals are something that never stops. You can simply invest to earn optimal returns in a shorter duration.

Talk to our investment specialist

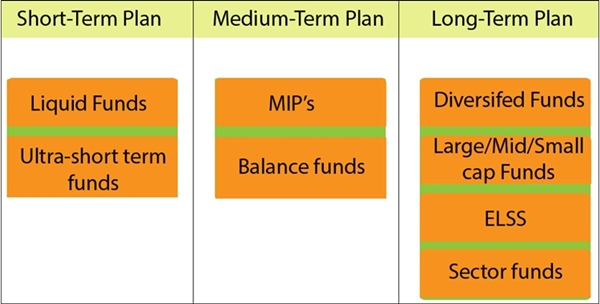

To achieve your short-term goals, you can invest in Liquid Funds and Ultra short term funds. These funds are a type of Debt fund that are meant for short-term investments. Liquid Funds invest in Certificate of Deposit, treasury bills, commercial papers, etc., that have very short maturity. The investment duration of these generally ranges from a couple of days to a few weeks (it can even be one day!). Ultra Short Debt Funds offer good returns with very less market volatility. The investors who are looking for better returns than Liquid Funds should prefer investing in Ultra Short Term fund, as the returns of these funds are better than that of Liquid funds. Some of the best liquid & Ultra Short Term Funds as per category rank are as follows:

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Sub Cat. Indiabulls Liquid Fund Growth ₹2,490.98

↑ 0.47 ₹158 1.9 3.7 7.3 6.7 7.4 7.02% 1M 2D 1M 2D Liquid Fund JM Liquid Fund Growth ₹70.2826

↑ 0.01 ₹3,341 1.8 3.6 7.2 6.7 7.2 7.13% 1M 10D 1M 13D Liquid Fund PGIM India Insta Cash Fund Growth ₹335.329

↑ 0.06 ₹391 1.9 3.7 7.3 6.8 7.3 7.17% 1M 21D 1M 24D Liquid Fund Principal Cash Management Fund Growth ₹2,272.5

↑ 0.39 ₹6,619 1.9 3.6 7.3 6.7 7.3 7.22% 1M 17D 1M 17D Liquid Fund Aditya Birla Sun Life Savings Fund Growth ₹539.519

↑ 0.25 ₹14,988 2.1 4 7.9 7 7.9 7.84% 5M 19D 7M 20D Ultrashort Bond Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 11 Apr 25

Mutual Fund Options for Short, Mid & Long Term Financial Goals

Mid Term Goals - For 3-5 years horizon

Mid-term goals are something that you wish for in next 3 to 4 years. This may include important goals like saving for a down payment to buy a car/house, saving for a marriage, paying off previous loans (any), or to an extent of planning for a business too. By the time you complete your short-term financial goals, you may start formulating mid-term goals and also plan on how you can manage them. But, before setting mid-term goals, it is important to know your dreams and desires, and where do you see yourself in next few years!

Ideally, for mid-term goals, Balanced Fund & Monthly Income Plan are highly preferred. Balanced funds are a combination of both debt and equity. The fund invests about 64% in debt and the rest in equities. Whereas in Monthly Income Plans (MIP) higher portion of funds are invested in debt securities and a small portion in equities. Therefore, the returns offered by Balanced Funds may be higher than MIPs, but these can be little risky too.

So, risk-averse investors can prefer investing in MIPs and enjoy stable returns over their tenure. These funds can also be ideal for capital appreciation. Following are the best Balanced Funds and Monthly Income Plans (as per category rank) that you can choose for your mid-term investments.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 2024 (%) Debt Yield (YTM) Mod. Duration Eff. Maturity Sub Cat. Edelweiss Arbitrage Fund Growth ₹19.1286

↑ 0.00 ₹13,644 1.8 3.6 7.2 6.7 7.7 7.27% 5M 12D 5M 12D Arbitrage Principal Hybrid Equity Fund Growth ₹149.985

↑ 2.02 ₹5,236 -3.2 -7.2 4.1 10.4 17.1 6.22% 4Y 8M 26D 6Y 7M 28D Hybrid Equity ICICI Prudential MIP 25 Growth ₹72.7458

↑ 0.34 ₹3,086 1 1 7.9 9 11.4 8.02% 2Y 1M 6D 3Y 4M 13D Hybrid Debt Kotak Equity Arbitrage Fund Growth ₹36.9751

↑ 0.00 ₹58,923 1.8 3.6 7.3 6.9 7.8 6.96% 3M 18D 3M 18D Arbitrage Aditya Birla Sun Life Equity Hybrid 95 Fund Growth ₹1,388.87

↑ 18.61 ₹6,874 -3.9 -8.3 3.1 8 15.3 7.47% 4Y 2M 5D 6Y 7D Hybrid Equity Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 11 Apr 25

Long Term Goals - For 5 years & above

Long term goals are the ones that you think will take you longer to achieve. Also, planning for the long-term will hit your major financial goals, however, it has to be very systematic and organised. This may include planning for your children’s future, their education or saving for your retirement, taking your family on a world tour and so on... Moreover, it may include paying off your debt that you might have taken for mid-term goals.

Investors who are planning for long-term goals should go for Equity Mutual Funds. Historically, these funds have proven to deliver higher returns, but these are highly risky. So, investor who have a high-risk appetite should only prefer investing in these funds. There are various types of Equity Funds that you can choose from such as- Large Cap/Mid Cap/Small cap funds, ELSS, Diversified Funds and sector funds.

Large cap funds invest in the stocks of large sized companies. These companies are essentially large companies with large businesses and a large workforce. They are companies that have a market capitalization (MC= no of shares issued by the company X market price per share) of more than INR 1000 crore. These stocks give steady returns over long periods of time. Mid Cap Mutual Funds invest the funds in mid-sized companies. From a standpoint of the investor, the investing period of mid-caps should be much higher than large-caps due to the higher fluctuations ( or volatility) in the prices of the stocks. Mid caps could be companies with a market capitalization of INR 500 Cr to INR 1000 Cr.

Small Cap Funds mainly invest in startups or firms that are in their early stage of development with small revenues. These companies have a great potential to discover the value and can generate good returns. However, given the small size, the risks are very high, hence the investment period of small-caps are expected to be the highest. Small-caps could be companies with a market capitalization of INR 500 and above.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) Sub Cat. Tata India Tax Savings Fund Growth ₹39.6618

↑ 0.85 ₹4,053 -7.3 -13 2.2 11.4 22.2 19.5 ELSS IDFC Infrastructure Fund Growth ₹44.791

↑ 1.00 ₹1,400 -8.6 -18.3 -1.4 22.3 36 39.3 Sectoral Sundaram Rural and Consumption Fund Growth ₹90.3574

↑ 1.45 ₹1,398 -6.1 -12.4 8.8 16.2 21.7 20.1 Sectoral DSP BlackRock Natural Resources and New Energy Fund Growth ₹77.453

↓ -0.97 ₹1,125 -8.5 -18.5 -9.5 9 27.5 13.9 Sectoral Aditya Birla Sun Life Banking And Financial Services Fund Growth ₹55.11

↑ 0.96 ₹3,011 3.9 -2.7 5.5 12.9 23.2 8.7 Sectoral Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 11 Apr 25

Diversified Funds invest across market capitalization, i.e., across large, mid & small caps. They typically invest anywhere between 40–60% in large-cap stocks, 10–40% in mid-cap stocks and about 10% in small-cap stocks. As these funds invest in a mixed portfolio, they tend to balance the risk. For instance, if one fund underperforms, other are there to balance the portfolio. But, the risk of equity still remains in the investment.

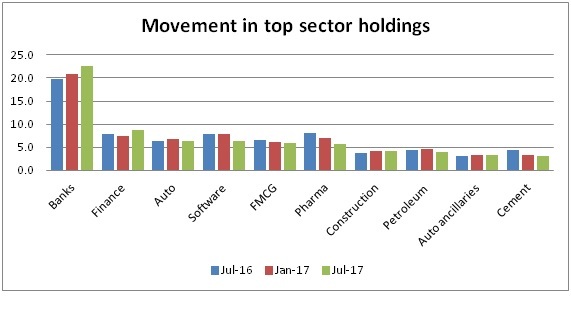

Sector Funds invests in shares of companies that trade in a particular sector or industry like, for instance, a pharma fund would invest only in pharmaceutical companies. Being a sector-specific, the risk in these funds are the highest.

Financial Advice- Manage it Smartly

- Start Investing Early

- Be clear about your priorities and make sure that you make a room in your budget to reach your goals by saving

- Set up separate savings and investing accounts for your major goals

- Keep paying your bills on time

- Set the ideal deadline for your goals. For instance, you want to make an International trip by the end of 2017 and hence save according

- Monitor your progress regularly

- Choose your investment options based on an Asset Allocation which will help you to reach your goals within a specified time frame.

Other than this, the Systematic Investment plan (SIP) is considered as one of the best ways of investing money. Whether it’s buying a house, car or any asset, Retirement planning or higher education planning, SIPs offers a very systematic way to save money and reach these goals. Investors today are always searching for the Top SIP, or the best systematic investment plan to invest in. There are various SIP calculators available in the market that try to help investors make investment plans. You can try one here:

How to Invest in Mutual Funds Online?

Open Free Investment Account for Lifetime at Fincash.com.

Complete your Registration and KYC Process

Upload Documents (PAN, Aadhaar, etc.). And, You are Ready to Invest!

Keep your financial goals realistic and constantly review your progress. Most important, don’t procrastinate and start setting your financial goals now!

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.