Table of Contents

ٹیکس بچانے والی دیگر سرمایہ کاری پر ELSS کیوں؟

ای ایل ایس ایس فنڈز جسے ایکویٹی لنکڈ سیونگ سکیم کے نام سے بھی جانا جاتا ہے ایک ایکویٹی متنوع ٹیکس بچانے والا میوچل فنڈ ہے جو بڑے پیمانے پر اپنے اثاثوں کی سرمایہ کاری کرتا ہے۔ایکوئٹیز یا ایکویٹی سے منسلک آلات جیسے اسٹاک مارکیٹس۔ ای ایل ایس ایسباہمی چندہ پیشکشمارکیٹ- منسلک ریٹرن، جو کہ اتار چڑھاؤ کا شکار ہیں اور مارکیٹ کے حالات پر منحصر ہیں۔ البتہ،مالیاتی مشیر تجویز کریںسرمایہ کاری ELSS فنڈز میں طویل مدت کے لیے، کیونکہ یہ ELSS میوچل فنڈز طویل مدت کے لیے سرمایہ کاری کرنے پر بہترین منافع پیدا کرتے ہیں۔ حالیہ رپورٹس میں، یہ دیکھا گیا کہ ELSS فنڈز نے 3 سال کے لیے سرمایہ کاری کرنے پر تقریباً 20%-30% منافع حاصل کیا، جو کہ دوسرے Mutual Funds کے ذریعے حاصل ہونے والے منافع سے بہت زیادہ ہے۔

ELSS اور دیگر ٹیکس بچانے والے سرمایہ کاری کے اختیارات کا موازنہ

ELSS اور دیگر ٹیکس کی بچت کا موازنہ مدت، ریٹرن، اہلیت جیسے پیرامیٹرز پر مبنی ہے۔کٹوتی کے تحت80cوغیرہ

آئیے ایک نظر ڈالتے ہیں:

| پیرامیٹر | پی پی ایف | این ایس سی | ایف ڈی | ای ایل ایس ایس |

|---|---|---|---|---|

| دور | 15 سال | 6 سال | 5 سال | 3 سال |

| واپسی | 7.60% (سالانہ مرکب) | 7.60% (سالانہ مرکب) | 7.00 - 8.00 % (سالانہ مرکب) | کوئی یقینی ڈیویڈنڈ / واپسی نہیں کیونکہ یہ مارکیٹ سے منسلک ہے۔ |

| کم از کم سرمایہ کاری | روپے 500 | روپے 100 | روپے 1000 | روپے 500 |

| زیادہ سے زیادہ سرمایہ کاری | روپے 1.5 لاکھ | کوئی بالائی حد نہیں۔ | کوئی بالائی حد نہیں۔ | کوئی بالائی حد نہیں۔ |

| 80c کے تحت کٹوتی کے لیے اہل رقم | روپے 1.5 لاکھ | روپے 1.5 لاکھ | روپے 1.5 لاکھ | روپے 1.5 لاکھ |

| سود/واپسی کے لیے ٹیکس | بلا ٹیکس | قابل ٹیکس سود | قابل ٹیکس سود | ایک لاکھ روپے تک کے منافع ٹیکس سے پاک ہیں۔ ایک لاکھ روپے سے زیادہ کے منافع پر 10% ٹیکس لاگو ہوتا ہے۔ |

| حفاظت/درجہ بندی | محفوظ | محفوظ | محفوظ | خطرہ |

2022 میں سرمایہ کاری کے لیے سرفہرست 5 ELSS فنڈز

ذیل میں اس فنڈ کی فہرست ہے جس کے درمیان خالص اثاثے/AUM ہیں۔100 - 200 کروڑ.

Fund NAV Net Assets (Cr) 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2023 (%) IDBI Equity Advantage Fund Growth ₹43.39

↑ 0.04 ₹485 9.7 15.1 16.9 20.8 10 HDFC Long Term Advantage Fund Growth ₹595.168

↑ 0.28 ₹1,318 1.2 15.4 35.5 20.6 17.4 JM Tax Gain Fund Growth ₹45.6874

↑ 0.60 ₹184 -0.4 -9.7 10.7 18.2 27.1 29 Baroda Pioneer ELSS 96 Growth ₹68.6676

↑ 0.33 ₹210 -6.1 -3.5 17.6 16.7 11.6 BNP Paribas Long Term Equity Fund (ELSS) Growth ₹90.7554

↑ 1.04 ₹866 1.6 -5.1 11.5 16.1 22.1 23.6 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Jul 23

Talk to our investment specialist

The Scheme will seek to invest predominantly in a diversified portfolio of equity and equity related instruments with the objective to provide investors with opportunities for capital appreciation and income along with the benefit of income-tax deduction(under section 80C of the Income-tax Act, 1961) on their investments. Investments in this scheme would be subject to a statutory lock-in of 3 years from the date of allotment to be eligible for income-tax benefits under Section 80C. There can be no assurance that the investment objective under the scheme will be realized. IDBI Equity Advantage Fund is a Equity - ELSS fund was launched on 10 Sep 13. It is a fund with Moderately High risk and has given a Below is the key information for IDBI Equity Advantage Fund Returns up to 1 year are on To generate long term capital appreciation from a portfolio that is predominantly in equity and equity related instruments HDFC Long Term Advantage Fund is a Equity - ELSS fund was launched on 2 Jan 01. It is a fund with Moderately High risk and has given a Below is the key information for HDFC Long Term Advantage Fund Returns up to 1 year are on The investment objective is to generate long-term capital growth from a diversified and actively managed portfolio of equity and equity related securities and to enable investors a deduction from total income, as permitted under the Income Tax Act, 1961 from time to time. However, there can be no assurance that the investment objectives of the Scheme will be realized. The Scheme does not guarantee/indicate any returns. JM Tax Gain Fund is a Equity - ELSS fund was launched on 31 Mar 08. It is a fund with Moderately High risk and has given a Below is the key information for JM Tax Gain Fund Returns up to 1 year are on The main objective of the scheme is to provide the investor long term capital growth as also tax benefit under section 80C of the Income Tax Act, 1961. Baroda Pioneer ELSS 96 is a Equity - ELSS fund was launched on 2 Mar 15. It is a fund with Moderately High risk and has given a Below is the key information for Baroda Pioneer ELSS 96 Returns up to 1 year are on The investment objective of the Scheme is to generate long-term capital growth from a diversified and actively managed portfolio of equity and equity related securities along with income tax rebate, as may be prevalent fromtime to time. However, there can be no assurance that the investment objective of the Scheme will be achieved. The Scheme does not guarantee / indicate any returns. BNP Paribas Long Term Equity Fund (ELSS) is a Equity - ELSS fund was launched on 5 Jan 06. It is a fund with Moderately High risk and has given a Below is the key information for BNP Paribas Long Term Equity Fund (ELSS) Returns up to 1 year are on 1. IDBI Equity Advantage Fund

CAGR/Annualized return of 16% since its launch. Ranked 21 in ELSS category. . IDBI Equity Advantage Fund

Growth Launch Date 10 Sep 13 NAV (28 Jul 23) ₹43.39 ↑ 0.04 (0.09 %) Net Assets (Cr) ₹485 on 30 Jun 23 Category Equity - ELSS AMC IDBI Asset Management Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.39 Sharpe Ratio 1.21 Information Ratio -1.13 Alpha Ratio 1.78 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹14,407 31 Mar 22 ₹17,362 31 Mar 23 ₹17,326 Returns for IDBI Equity Advantage Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 3.1% 3 Month 9.7% 6 Month 15.1% 1 Year 16.9% 3 Year 20.8% 5 Year 10% 10 Year 15 Year Since launch 16% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for IDBI Equity Advantage Fund

Name Since Tenure Data below for IDBI Equity Advantage Fund as on 30 Jun 23

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 2. HDFC Long Term Advantage Fund

CAGR/Annualized return of 21.4% since its launch. Ranked 23 in ELSS category. . HDFC Long Term Advantage Fund

Growth Launch Date 2 Jan 01 NAV (14 Jan 22) ₹595.168 ↑ 0.28 (0.05 %) Net Assets (Cr) ₹1,318 on 30 Nov 21 Category Equity - ELSS AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.25 Sharpe Ratio 2.27 Information Ratio -0.15 Alpha Ratio 1.75 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,787

Purchase not allowed Returns for HDFC Long Term Advantage Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 4.4% 3 Month 1.2% 6 Month 15.4% 1 Year 35.5% 3 Year 20.6% 5 Year 17.4% 10 Year 15 Year Since launch 21.4% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for HDFC Long Term Advantage Fund

Name Since Tenure Data below for HDFC Long Term Advantage Fund as on 30 Nov 21

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 3. JM Tax Gain Fund

CAGR/Annualized return of 9.3% since its launch. Ranked 18 in ELSS category. Return for 2024 was 29% , 2023 was 30.9% and 2022 was 0.5% . JM Tax Gain Fund

Growth Launch Date 31 Mar 08 NAV (21 Apr 25) ₹45.6874 ↑ 0.60 (1.34 %) Net Assets (Cr) ₹184 on 31 Mar 25 Category Equity - ELSS AMC JM Financial Asset Management Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 2.4 Sharpe Ratio 0.26 Information Ratio 0.48 Alpha Ratio 4.69 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,396 31 Mar 22 ₹21,099 31 Mar 23 ₹20,935 31 Mar 24 ₹30,269 31 Mar 25 ₹33,442 Returns for JM Tax Gain Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 2% 3 Month -0.4% 6 Month -9.7% 1 Year 10.7% 3 Year 18.2% 5 Year 27.1% 10 Year 15 Year Since launch 9.3% Historical performance (Yearly) on absolute basis

Year Returns 2023 29% 2022 30.9% 2021 0.5% 2020 32.2% 2019 18.3% 2018 14.9% 2017 -4.6% 2016 42.6% 2015 5.2% 2014 -0.6% Fund Manager information for JM Tax Gain Fund

Name Since Tenure Satish Ramanathan 1 Oct 24 0.41 Yr. Asit Bhandarkar 31 Dec 21 3.17 Yr. Chaitanya Choksi 18 Jul 14 10.63 Yr. Ruchi Fozdar 4 Oct 24 0.41 Yr. Data below for JM Tax Gain Fund as on 31 Mar 25

Equity Sector Allocation

Sector Value Financial Services 24.93% Consumer Cyclical 16.94% Basic Materials 12.3% Technology 11.78% Industrials 9.75% Health Care 9.45% Consumer Defensive 4.67% Communication Services 2.88% Utility 1.21% Asset Allocation

Asset Class Value Cash 4.75% Equity 95.25% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Mar 22 | ICICIBANK6% ₹9 Cr 77,975

↑ 20,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Dec 11 | HDFCBANK6% ₹9 Cr 54,131 Infosys Ltd (Technology)

Equity, Since 31 Aug 18 | INFY5% ₹8 Cr 45,965

↓ -2,500 Bajaj Finserv Ltd (Financial Services)

Equity, Since 31 Jan 25 | 5329784% ₹7 Cr 35,500

↑ 3,000 Maruti Suzuki India Ltd (Consumer Cyclical)

Equity, Since 30 Sep 24 | MARUTI3% ₹6 Cr 4,706 Bajaj Auto Ltd (Consumer Cyclical)

Equity, Since 30 Sep 24 | 5329773% ₹5 Cr 6,550 State Bank of India (Financial Services)

Equity, Since 31 Aug 20 | SBIN3% ₹5 Cr 72,900 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Mar 24 | BHARTIARTL3% ₹5 Cr 30,700 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 10 | LT3% ₹5 Cr 14,447 CreditAccess Grameen Ltd Ordinary Shares (Financial Services)

Equity, Since 31 Oct 24 | CREDITACC2% ₹4 Cr 43,600 4. Baroda Pioneer ELSS 96

CAGR/Annualized return of 8.4% since its launch. . Baroda Pioneer ELSS 96

Growth Launch Date 2 Mar 15 NAV (11 Mar 22) ₹68.6676 ↑ 0.33 (0.48 %) Net Assets (Cr) ₹210 on 31 Jan 22 Category Equity - ELSS AMC Baroda Pioneer Asset Management Co. Ltd. Rating Risk Moderately High Expense Ratio 2.55 Sharpe Ratio 2.51 Information Ratio -0.09 Alpha Ratio 5.69 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹16,937 Returns for Baroda Pioneer ELSS 96

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month -3.9% 3 Month -6.1% 6 Month -3.5% 1 Year 17.6% 3 Year 16.7% 5 Year 11.6% 10 Year 15 Year Since launch 8.4% Historical performance (Yearly) on absolute basis

Year Returns 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 Fund Manager information for Baroda Pioneer ELSS 96

Name Since Tenure Data below for Baroda Pioneer ELSS 96 as on 31 Jan 22

Equity Sector Allocation

Sector Value Asset Allocation

Asset Class Value Top Securities Holdings / Portfolio

Name Holding Value Quantity 5. BNP Paribas Long Term Equity Fund (ELSS)

CAGR/Annualized return of 12.1% since its launch. Ranked 22 in ELSS category. Return for 2024 was 23.6% , 2023 was 31.3% and 2022 was -2.1% . BNP Paribas Long Term Equity Fund (ELSS)

Growth Launch Date 5 Jan 06 NAV (21 Apr 25) ₹90.7554 ↑ 1.04 (1.16 %) Net Assets (Cr) ₹866 on 31 Mar 25 Category Equity - ELSS AMC BNP Paribas Asset Mgmt India Pvt. Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 2.29 Sharpe Ratio 0.22 Information Ratio 0.11 Alpha Ratio 3.06 Min Investment 500 Min SIP Investment 500 Exit Load NIL Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹15,840 31 Mar 22 ₹18,175 31 Mar 23 ₹17,467 31 Mar 24 ₹24,819 31 Mar 25 ₹27,184 Returns for BNP Paribas Long Term Equity Fund (ELSS)

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Jul 23 Duration Returns 1 Month 3% 3 Month 1.6% 6 Month -5.1% 1 Year 11.5% 3 Year 16.1% 5 Year 22.1% 10 Year 15 Year Since launch 12.1% Historical performance (Yearly) on absolute basis

Year Returns 2023 23.6% 2022 31.3% 2021 -2.1% 2020 23.6% 2019 17.8% 2018 14.3% 2017 -9.3% 2016 42.3% 2015 -6.6% 2014 7.7% Fund Manager information for BNP Paribas Long Term Equity Fund (ELSS)

Name Since Tenure Sanjay Chawla 14 Mar 22 2.97 Yr. Pratish Krishnan 14 Mar 22 2.97 Yr. Data below for BNP Paribas Long Term Equity Fund (ELSS) as on 31 Mar 25

Equity Sector Allocation

Sector Value Financial Services 27.76% Industrials 11.82% Consumer Cyclical 11.61% Technology 10.27% Health Care 8.44% Consumer Defensive 7.81% Basic Materials 6.73% Energy 4.19% Utility 3.21% Communication Services 3.1% Asset Allocation

Asset Class Value Cash 4.62% Equity 95.38% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 31 Oct 08 | HDFCBANK7% ₹57 Cr 328,160 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 12 | ICICIBANK6% ₹49 Cr 411,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Oct 18 | RELIANCE4% ₹34 Cr 284,200 Infosys Ltd (Technology)

Equity, Since 29 Feb 24 | INFY3% ₹27 Cr 161,100

↓ -43,900 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 May 19 | BHARTIARTL3% ₹25 Cr 160,566 Zomato Ltd (Consumer Cyclical)

Equity, Since 31 Jul 23 | 5433203% ₹20 Cr 920,813 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Apr 20 | LT2% ₹20 Cr 64,020 Sagility India Ltd (Healthcare)

Equity, Since 30 Nov 24 | SAGILITY2% ₹20 Cr 4,616,000 Cholamandalam Investment and Finance Co Ltd (Financial Services)

Equity, Since 30 Sep 23 | CHOLAFIN2% ₹17 Cr 120,500 State Bank of India (Financial Services)

Equity, Since 31 Mar 22 | SBIN2% ₹17 Cr 243,000

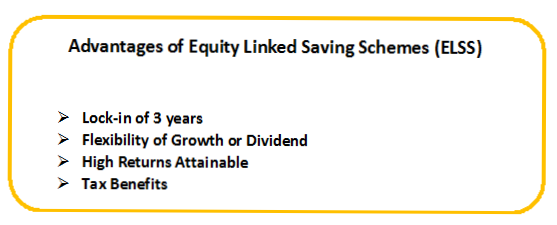

ELSS دیگر ٹیکس بچانے والی سرمایہ کاری سے کیسے بہتر ہے؟

مختلف ہیں۔ٹیکس کی بچت کی سرمایہ کاری ہندوستان میں اختیارات جن میں سے ELSS بہترین اختیارات میں سے ایک ہے۔ کیسے؟ اس کی چند وجوہات یہ ہیں۔

طویل مدتی میں زیادہ واپسی

ELSS فنڈز ٹیکس بچانے والی دیگر سرمایہ کاری کے درمیان اسٹاک مارکیٹ میں سب سے زیادہ اثاثے مختص کرتے ہیں۔ لہذا، یہ فنڈز بہترین کماتے ہیں۔مہنگائی- سب کے درمیان مار پیٹ کی واپسی اگر طویل مدت کے لیے سرمایہ کاری کی جائے تو، ELSS کے منافع کی شرح دیگر روایتی قرض پر مبنی سرمایہ کاری کے منافع کو آسانی سے مات دے سکتی ہے۔ لہذا، ELSS میوچل فنڈز سرمایہ کاروں کو دونوں جہانوں میں بہترین منافع اور ٹیکس کے فوائد فراہم کرتے ہیں۔

مختصر ترین لاک ان پیریڈ

روایتی ٹیکس بچانے والے سرمایہ کاری کے اختیارات کے مقابلے ELSS میوچل فنڈز میں مختصر لاک ان مدت ہوتی ہے۔ ELSS فنڈز کی لاک ان مدت 3 سال ہے جبکہ PPF کی مدت 15 سال ہے اوراین پی ایس تک ہےریٹائرمنٹ. لہذا، ELSS میں سرمایہ کاری کرنے سے آپ کا پیسہ زیادہ عرصے تک مقفل نہیں ہوتا ہے اور آپ لاک ان ختم ہونے کے فوراً بعد سرمایہ کاری روک سکتے ہیں۔

انتہائی لچکدار سرمایہ کاری

ELSS میوچل فنڈز کی لچک دیگر تمام ٹیکس بچانے والی سرمایہ کاری سے کہیں زیادہ ہے۔ روایتی سرمایہ کاری کے برعکس، صرف ایک قسم کے آپشن میں سرمایہ کاری کرنے کی ضرورت نہیں ہے۔ ELSS فنڈز آپ کو مختلف قسم کی سرمایہ کاری کے ساتھ اپنے پورٹ فولیو کو متنوع بنانے کے قابل بناتے ہیں۔ نیز، سرمایہ کار لاک ان مدت کے ختم ہونے کے بعد بھی ان فنڈز میں سرمایہ کاری کر سکتے ہیں۔ لہٰذا، ایک بار لاک ان ختم ہو جانے کے بعد، آپ آسانی سے اپنی سہولت کے مطابق سرمایہ کاری کرنے یا چھڑانے کا انتخاب کر سکتے ہیں۔

نتیجہ

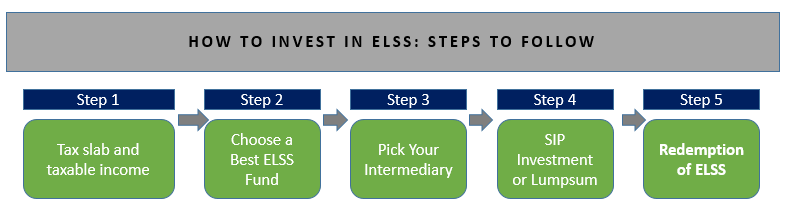

آخر میں، یہاں ELSS فنڈز میں سرمایہ کاری کرنے والے سرمایہ کاروں کے لیے چند تجاویز ہیں۔

- ELSS میں جلد سرمایہ کاری شروع کریں۔

- اپنی حدود میں سرمایہ کاری کریں۔

- ڈیویڈنڈ کی دوبارہ سرمایہ کاری کا انتخاب نہ کریں۔

- آہستہ آہستہ اور دھیرے دھیرے چھڑا لیں۔

- a کے ذریعے سرمایہ کاری کریں۔گھونٹ

یہاں فراہم کردہ معلومات کے درست ہونے کو یقینی بنانے کے لیے تمام کوششیں کی گئی ہیں۔ تاہم، ڈیٹا کی درستگی کے حوالے سے کوئی ضمانت نہیں دی جاتی ہے۔ براہ کرم کوئی بھی سرمایہ کاری کرنے سے پہلے اسکیم کی معلومات کے دستاویز کے ساتھ تصدیق کریں۔