+91-22-48913909

+91-22-48913909

Table of Contents

- ٹاپ 11 SIP فنڈز میں کیوں سرمایہ کاری کریں؟

- SIP میں سرمایہ کاری کیسے کی جائے؟

- ہندوستان میں FY 22 - 23 میں سرفہرست 11 SIP میوچل فنڈز

- بہترین نظامی سرمایہ کاری کے منصوبوں میں سرمایہ کاری کرتے وقت جن پیرامیٹرز پر غور کرنا ہے۔

- SIP MF آن لائن میں کیسے سرمایہ کاری کی جائے؟

- اکثر پوچھے گئے سوالات

- 1. میوچل فنڈز کیا ہیں؟

- 2. میوچل فنڈز کی مختلف اقسام کیا ہیں؟

- 3. گروتھ ایکویٹی فنڈز کیا ہیں؟

- 4. آپ کو قرض فنڈ میں کیوں سرمایہ کاری کرنی چاہئے؟

- 5. آپ کو SIPs میں سرمایہ کاری کیوں کرنی چاہیے؟

- 6. ٹیکس بچانے والے میوچل فنڈ میں کیوں سرمایہ کاری کریں؟

- 7. کیا مجھے میوچل فنڈز میں سرمایہ کاری کرنے کے لیے بروکر کی ضرورت ہے؟

Top 11 Funds

- ICICI Prudential Infrastructure Fund

- IDFC Infrastructure Fund

- Nippon India Power and Infra Fund

- L&T Emerging Businesses Fund

- HDFC Infrastructure Fund

- Franklin Build India Fund

- DSP BlackRock India T.I.G.E.R Fund

- IDFC Sterling Value Fund

- Franklin India Smaller Companies Fund

- Kotak Small Cap Fund

- Edelweiss Mid Cap Fund

SIP 2022 کے لیے 11 بہترین میوچل فنڈز

گھونٹ باہمی چندہ (یا ٹاپ 11 SIP میوچل فنڈز) وہ فنڈز ہیں جو اسٹاک مارکیٹ کے ناگزیر اتار چڑھاؤ کے دوران اعصابی فروخت سے بچنے کے لیے متواتر سرمایہ کاری کے سادہ فارمولے پر عمل پیرا ہوتے ہیں۔

عام طور پر، SIP یا منظمسرمایہ کاری کا منصوبہ میوچل فنڈز میں پیسہ لگانے کا ایک طریقہ ہے۔سرمایہ کاری سرفہرست 11 ایس آئی پی میوچل فنڈز میں آپ کی سرمایہ کاری کے لیے ایک منظم اور نظم و ضبط کا طریقہ ہے۔ یہ روزانہ آپ کی سرمایہ کاری کا انتظام کرنے کی آپ کی کوششوں کو کم کرتا ہے۔بنیاد. مزید یہ کہ یہ اس کا فائدہ اٹھاتا ہے۔کمپاؤنڈنگ کی طاقت وقت کے ساتھ مطلوبہ واپسی کا باعث بنتا ہے۔

مختلف ہیں۔میوچل فنڈز کی اقسام ایس آئی پی کے لیے جس میں ایکویٹی، قرض، متوازن، انتہائیمختصر مدت کے فنڈزتاہم، ایکویٹی میوچل فنڈز SIP کے ذریعے سرمایہ کاری کرنے پر زیادہ سے زیادہ منافع پیش کرتے ہیں۔ مالیاتی مشیر مشورہ دیتے ہیں کہ، سرمایہ کاروں کو سرمایہ کاری کرنی چاہیے۔بہترین باہمی فنڈز SIP کی بنیاد پر ان کی سرمایہ کاری کے مقاصد اور مدتSIP سرمایہ کاری.

ٹاپ 11 SIP فنڈز میں کیوں سرمایہ کاری کریں؟

ایس آئی پیز میوچل فنڈز میں سرمایہ کاری کے لیے ایک نظم و ضبط کا طریقہ فراہم کرتے ہیں۔

منظم سرمایہ کاری مستقبل کے خواب اور بڑے اہداف جیسے ریٹائرمنٹ، بچوں کا کیریئر، مکان، کار یا کسی دوسرے اثاثے کی خریداری میں مدد کرتی ہے۔

SIPs زیادہ سے زیادہ مرکب سازی کرنے میں مدد کرتے ہیں اور نوجوان سرمایہ کاروں کے لیے مثالی ہیں۔

منظم سرمایہ کاری کے منصوبے ایکویٹی کے اتار چڑھاو کے خطرے کو کم کرتے ہیں۔

SIP میں سرمایہ کاری کیسے کی جائے؟

پیسہ لگانا ایک فن ہے، اگر صحیح طریقے سے کیا جائے تو یہ حیرت انگیز کام کر سکتا ہے۔ اب جب کہ آپ جانتے ہیں۔ٹاپ ایس آئی پی آپ کو اس میں سرمایہ کاری کرنے کا طریقہ معلوم ہونا چاہیے۔ ہم نے ذیل میں SIP میں سرمایہ کاری کرنے کے اقدامات کا ذکر کیا ہے۔

1. اپنے مالی اہداف کا تجزیہ کریں۔

ایک SIP سرمایہ کاری کا انتخاب کریں جو آپ کے مطابق ہو۔مالی اہداف. مثال کے طور پر، اگر آپ کا مقصد قلیل مدتی ہے (اگر آپ اگلے 2 سالوں میں کار خریدنا چاہتے ہیں)، تو آپ کو ڈیبٹ میوچل فنڈز میں سرمایہ کاری کرنی چاہیے۔ اور، اگر آپ کا مقصد طویل مدتی ہے (جیسےریٹائرمنٹ پلاننگ) پھر ایکویٹی میوچل فنڈز میں سرمایہ کاری کو ترجیح دیں۔

2. سرمایہ کاری کی ٹائم لائن منتخب کریں۔

یہ یقینی بنائے گا کہ آپ صحیح وقت کے لیے صحیح رقم کی سرمایہ کاری کرتے ہیں۔

3. اس رقم کا فیصلہ کریں جو آپ ماہانہ سرمایہ کاری کرنا چاہتے ہیں۔

چونکہ ایس آئی پی ایک ماہانہ سرمایہ کاری ہے، آپ کو ایسی رقم کا انتخاب کرنا چاہیے جس کے بغیر آپ ماہانہ سرمایہ کاری کر سکیں گے۔ناکام. آپ استعمال کرتے ہوئے اپنے مقصد کے مطابق مناسب رقم کا حساب بھی لگا سکتے ہیں۔گھونٹ کیلکولیٹر یا SIP ریٹرن کیلکولیٹر۔

4. بہترین SIP پلان منتخب کریں۔

مشورہ کرکے سرمایہ کاری کا دانشمندانہ انتخاب کریں۔مشیر خزانہ یا منتخب کر کےبہترین SIP پلانز مختلف آن لائن سرمایہ کاری پلیٹ فارمز کی طرف سے پیش کردہ۔

Talk to our investment specialist

ہندوستان میں FY 22 - 23 میں سرفہرست 11 SIP میوچل فنڈز

To generate capital appreciation and income distribution to unit holders by investing predominantly in equity/equity related securities of the companies belonging to the infrastructure development and balance in debt securities and money market instruments. ICICI Prudential Infrastructure Fund is a Equity - Sectoral fund was launched on 31 Aug 05. It is a fund with High risk and has given a Below is the key information for ICICI Prudential Infrastructure Fund Returns up to 1 year are on The investment objective of the scheme is to seek to generate long-term capital growth through an active diversified portfolio of predominantly equity and equity related instruments of companies that are participating in and benefiting from growth in Indian infrastructure and infrastructural related activities. However, there can be no assurance that the investment objective of the scheme will be realized. IDFC Infrastructure Fund is a Equity - Sectoral fund was launched on 8 Mar 11. It is a fund with High risk and has given a Below is the key information for IDFC Infrastructure Fund Returns up to 1 year are on (Erstwhile Reliance Diversified Power Sector Fund) The primary investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related securities of companies in the power sector. Nippon India Power and Infra Fund is a Equity - Sectoral fund was launched on 8 May 04. It is a fund with High risk and has given a Below is the key information for Nippon India Power and Infra Fund Returns up to 1 year are on To generate long-term capital appreciation from a diversified portfolio of predominantly equity and equity related securities, including equity derivatives, in the Indian markets with key theme focus being emerging companies (small cap stocks). The Scheme could also additionally invest in Foreign Securities. L&T Emerging Businesses Fund is a Equity - Small Cap fund was launched on 12 May 14. It is a fund with High risk and has given a Below is the key information for L&T Emerging Businesses Fund Returns up to 1 year are on To seek long-term capital appreciation by investing predominantly in equity and equity related securities of companies engaged in or expected to benefit from growth and development of infrastructure. HDFC Infrastructure Fund is a Equity - Sectoral fund was launched on 10 Mar 08. It is a fund with High risk and has given a Below is the key information for HDFC Infrastructure Fund Returns up to 1 year are on The Scheme seeks to achieve capital appreciation by investing in companies engaged directly or indirectly in infrastructure related activities. Franklin Build India Fund is a Equity - Sectoral fund was launched on 4 Sep 09. It is a fund with High risk and has given a Below is the key information for Franklin Build India Fund Returns up to 1 year are on To generate capital appreciation, from a portfolio that is substantially constituted of equity securities and equity related securities of corporates, which could benefit from structural changes brought about by continuing liberalization in economic policies by the government and/or continuing investments in infrastructure, both by the public and private sector. DSP BlackRock India T.I.G.E.R Fund is a Equity - Sectoral fund was launched on 11 Jun 04. It is a fund with High risk and has given a Below is the key information for DSP BlackRock India T.I.G.E.R Fund Returns up to 1 year are on (Erstwhile IDFC Sterling Equity Fund) To generate capital appreciation from a diversified portfolio of equity and equity related instruments.It will predominantly invest in small and midcap equity and equity related instruments. Small and Midcap equity & equity related instruments will be the stocks included in the Nifty Free Float Midcap 100 or equity and equity related instruments of such companies which have a market capitalization lower than the highest components of Nifty Free Float Midcap 100. It may also invest in stocks other than mid cap stocks (i.e. in stocks, which have a market capitalisation of above the market capitalisation range of the defined small - midcap stocks) & derivatives. On defensive consideration,It may also invest in debt and money market instruments. In case of discontinuation /suspension of Nifty Free Float Midcap 100, the AMC reserves the right tomodify the definition of Mid cap and Small cap companies. In case of such amodification, the interest of investors will be of paramount importance. IDFC Sterling Value Fund is a Equity - Value fund was launched on 7 Mar 08. It is a fund with Moderately High risk and has given a Below is the key information for IDFC Sterling Value Fund Returns up to 1 year are on The Fund seeks to provide long-term capital appreciation by investing in mid and small cap companies. Franklin India Smaller Companies Fund is a Equity - Small Cap fund was launched on 13 Jan 06. It is a fund with Moderately High risk and has given a Below is the key information for Franklin India Smaller Companies Fund Returns up to 1 year are on (Erstwhile Kotak Midcap Scheme) The investment objective of the Scheme is to generate capital appreciation from a diversified portfolio of equity and equity related securities. Kotak Small Cap Fund is a Equity - Small Cap fund was launched on 24 Feb 05. It is a fund with Moderately High risk and has given a Below is the key information for Kotak Small Cap Fund Returns up to 1 year are on (Erstwhile Edelweiss Mid and Small Cap Fund ) The investment objective is to seek to generate long-term capital appreciation from a portfolio that predominantly invests in equity and equity-related securities of Mid Cap companies.

However, there can be no assurance that the investment objective of the Scheme will be realised. Edelweiss Mid Cap Fund is a Equity - Mid Cap fund was launched on 26 Dec 07. It is a fund with High risk and has given a Below is the key information for Edelweiss Mid Cap Fund Returns up to 1 year are on Fund NAV Net Assets (Cr) Min SIP Investment 3 MO (%) 6 MO (%) 1 YR (%) 3 YR (%) 5 YR (%) 2024 (%) ICICI Prudential Infrastructure Fund Growth ₹178.42

↓ -0.23 ₹6,886 100 -4.3 -12 8.1 29.5 40.9 27.4 IDFC Infrastructure Fund Growth ₹45.935

↓ -0.01 ₹1,400 100 -11.3 -18.2 6.3 26.3 38 39.3 Nippon India Power and Infra Fund Growth ₹318.03

↓ -0.05 ₹6,125 100 -8.5 -16.4 2.8 28.2 37.3 26.9 L&T Emerging Businesses Fund Growth ₹72.5753

↓ -0.24 ₹13,334 500 -18.1 -19 4.3 17.8 37.3 28.5 HDFC Infrastructure Fund Growth ₹43.275

↓ -0.11 ₹2,105 300 -7.4 -13.9 4.9 29.9 36.8 23 Franklin Build India Fund Growth ₹129.008

↓ -0.27 ₹2,406 500 -7.1 -13.1 6.8 28 36.5 27.8 DSP BlackRock India T.I.G.E.R Fund Growth ₹285.339

↑ 0.59 ₹4,465 500 -11.8 -18.2 7.5 26.9 36.5 32.4 IDFC Sterling Value Fund Growth ₹138.055

↓ -0.01 ₹8,996 100 -5.2 -12.5 4.6 16.1 35.7 18 Franklin India Smaller Companies Fund Growth ₹151.651

↓ -0.10 ₹11,257 500 -15.6 -18.5 2.9 20.3 35.1 23.2 Kotak Small Cap Fund Growth ₹236.278

↓ -0.03 ₹14,407 1,000 -14 -18.1 8.7 13.1 35.1 25.5 Edelweiss Mid Cap Fund Growth ₹89.848

↓ -0.01 ₹7,729 500 -10.8 -11.7 17.6 21.9 34.9 38.9 Note: Returns up to 1 year are on absolute basis & more than 1 year are on CAGR basis. as on 28 Mar 25 200 کروڑ میوچل فنڈز کی ایکویٹی کیٹیگری میں 5 سالہ کیلنڈر سال کے ریٹرن کی بنیاد پر آرڈر کیا گیا ہے۔1. ICICI Prudential Infrastructure Fund

CAGR/Annualized return of 15.9% since its launch. Ranked 27 in Sectoral category. Return for 2024 was 27.4% , 2023 was 44.6% and 2022 was 28.8% . ICICI Prudential Infrastructure Fund

Growth Launch Date 31 Aug 05 NAV (28 Mar 25) ₹178.42 ↓ -0.23 (-0.13 %) Net Assets (Cr) ₹6,886 on 28 Feb 25 Category Equity - Sectoral AMC ICICI Prudential Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 2.22 Sharpe Ratio -0.25 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹18,670 31 Mar 22 ₹25,304 31 Mar 23 ₹30,899 31 Mar 24 ₹50,465 Returns for ICICI Prudential Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Mar 25 Duration Returns 1 Month 9.1% 3 Month -4.3% 6 Month -12% 1 Year 8.1% 3 Year 29.5% 5 Year 40.9% 10 Year 15 Year Since launch 15.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 27.4% 2023 44.6% 2022 28.8% 2021 50.1% 2020 3.6% 2019 2.6% 2018 -14% 2017 40.8% 2016 2% 2015 -3.4% Fund Manager information for ICICI Prudential Infrastructure Fund

Name Since Tenure Ihab Dalwai 3 Jun 17 7.75 Yr. Sharmila D’mello 30 Jun 22 2.67 Yr. Data below for ICICI Prudential Infrastructure Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 37.53% Basic Materials 21.32% Financial Services 16.4% Utility 8.67% Energy 6.7% Communication Services 1.27% Consumer Cyclical 1.01% Real Estate 0.39% Asset Allocation

Asset Class Value Cash 6.12% Equity 93.3% Debt 0.59% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 09 | LT9% ₹687 Cr 1,925,850

↑ 221,167 Shree Cement Ltd (Basic Materials)

Equity, Since 30 Apr 24 | 5003874% ₹302 Cr 108,747

↑ 13,090 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 May 24 | ADANIPORTS4% ₹296 Cr 2,695,324

↑ 955,233 NCC Ltd (Industrials)

Equity, Since 31 Aug 21 | NCC4% ₹265 Cr 10,506,117

↑ 2,958,417 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Dec 16 | ICICIBANK3% ₹249 Cr 1,990,000 NTPC Ltd (Utilities)

Equity, Since 29 Feb 16 | 5325553% ₹235 Cr 7,260,775

↓ -450,000 Vedanta Ltd (Basic Materials)

Equity, Since 31 Jul 24 | 5002953% ₹213 Cr 4,823,662

↑ 1,000,935 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Jan 22 | HDFCBANK3% ₹208 Cr 1,225,000

↑ 200,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 28 Feb 23 | INDIGO3% ₹206 Cr 477,106

↑ 20,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Jul 23 | RELIANCE3% ₹204 Cr 1,609,486 2. IDFC Infrastructure Fund

CAGR/Annualized return of 11.4% since its launch. Ranked 1 in Sectoral category. Return for 2024 was 39.3% , 2023 was 50.3% and 2022 was 1.7% . IDFC Infrastructure Fund

Growth Launch Date 8 Mar 11 NAV (31 Mar 25) ₹45.935 ↓ -0.01 (-0.02 %) Net Assets (Cr) ₹1,400 on 28 Feb 25 Category Equity - Sectoral AMC IDFC Asset Management Company Limited Rating ☆☆☆☆☆ Risk High Expense Ratio 2.33 Sharpe Ratio -0.3 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹20,153 31 Mar 22 ₹24,848 31 Mar 23 ₹27,324 31 Mar 24 ₹47,064 31 Mar 25 ₹50,038 Returns for IDFC Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Mar 25 Duration Returns 1 Month 12.7% 3 Month -11.3% 6 Month -18.2% 1 Year 6.3% 3 Year 26.3% 5 Year 38% 10 Year 15 Year Since launch 11.4% Historical performance (Yearly) on absolute basis

Year Returns 2024 39.3% 2023 50.3% 2022 1.7% 2021 64.8% 2020 6.3% 2019 -5.3% 2018 -25.9% 2017 58.7% 2016 10.7% 2015 -0.2% Fund Manager information for IDFC Infrastructure Fund

Name Since Tenure Vishal Biraia 24 Jan 24 1.1 Yr. Ritika Behera 7 Oct 23 1.4 Yr. Gaurav Satra 7 Jun 24 0.73 Yr. Data below for IDFC Infrastructure Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 56.44% Utility 12.75% Basic Materials 8.95% Communication Services 4.63% Energy 3.49% Financial Services 3.1% Consumer Cyclical 2.89% Technology 2.42% Health Care 1.83% Asset Allocation

Asset Class Value Cash 3.5% Equity 96.5% Top Securities Holdings / Portfolio

Name Holding Value Quantity Kirloskar Brothers Ltd (Industrials)

Equity, Since 31 Dec 17 | KIRLOSBROS5% ₹82 Cr 443,385 Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 12 | LT4% ₹61 Cr 171,447 Reliance Industries Ltd (Energy)

Equity, Since 30 Jun 24 | RELIANCE3% ₹57 Cr 452,706 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Mar 14 | 5325383% ₹54 Cr 46,976 GPT Infraprojects Ltd (Industrials)

Equity, Since 30 Nov 17 | GPTINFRA3% ₹53 Cr 4,797,143 Adani Ports & Special Economic Zone Ltd (Industrials)

Equity, Since 31 Dec 23 | ADANIPORTS3% ₹48 Cr 434,979 PTC India Financial Services Ltd (Financial Services)

Equity, Since 31 Dec 23 | PFS3% ₹47 Cr 12,400,122 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 19 | BHARTIARTL3% ₹47 Cr 289,163 KEC International Ltd (Industrials)

Equity, Since 30 Jun 24 | 5327143% ₹43 Cr 512,915

↑ 37,553 Bharat Electronics Ltd (Industrials)

Equity, Since 31 Oct 19 | BEL3% ₹42 Cr 1,431,700 3. Nippon India Power and Infra Fund

CAGR/Annualized return of 18% since its launch. Ranked 13 in Sectoral category. Return for 2024 was 26.9% , 2023 was 58% and 2022 was 10.9% . Nippon India Power and Infra Fund

Growth Launch Date 8 May 04 NAV (31 Mar 25) ₹318.03 ↓ -0.05 (-0.01 %) Net Assets (Cr) ₹6,125 on 28 Feb 25 Category Equity - Sectoral AMC Nippon Life Asset Management Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 2.05 Sharpe Ratio -0.55 Information Ratio 1.03 Alpha Ratio 1.38 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹18,563 31 Mar 22 ₹23,186 31 Mar 23 ₹26,891 31 Mar 24 ₹47,550 31 Mar 25 ₹48,861 Returns for Nippon India Power and Infra Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Mar 25 Duration Returns 1 Month 11.9% 3 Month -8.5% 6 Month -16.4% 1 Year 2.8% 3 Year 28.2% 5 Year 37.3% 10 Year 15 Year Since launch 18% Historical performance (Yearly) on absolute basis

Year Returns 2024 26.9% 2023 58% 2022 10.9% 2021 48.9% 2020 10.8% 2019 -2.9% 2018 -21.1% 2017 61.7% 2016 0.1% 2015 0.3% Fund Manager information for Nippon India Power and Infra Fund

Name Since Tenure Kinjal Desai 25 May 18 6.77 Yr. Rahul Modi 19 Aug 24 0.53 Yr. Data below for Nippon India Power and Infra Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 42.76% Utility 17.64% Basic Materials 9.73% Energy 7.95% Communication Services 7.7% Real Estate 3.94% Consumer Cyclical 3.24% Technology 2.27% Health Care 2.04% Financial Services 1.81% Asset Allocation

Asset Class Value Cash 0.91% Equity 99.09% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Nov 07 | LT8% ₹532 Cr 1,492,001

↓ -205,000 NTPC Ltd (Utilities)

Equity, Since 31 May 09 | 5325557% ₹499 Cr 15,400,000

↑ 1,400,001 Reliance Industries Ltd (Energy)

Equity, Since 30 Nov 18 | RELIANCE7% ₹474 Cr 3,750,000

↑ 200,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Apr 18 | BHARTIARTL6% ₹423 Cr 2,600,000 UltraTech Cement Ltd (Basic Materials)

Equity, Since 31 Oct 19 | 5325384% ₹276 Cr 240,038

↓ -29,962 Tata Power Co Ltd (Utilities)

Equity, Since 30 Apr 23 | 5004003% ₹236 Cr 6,475,789

↑ 1,511,030 Carborundum Universal Ltd (Industrials)

Equity, Since 30 Sep 23 | CARBORUNIV3% ₹214 Cr 1,800,000 Siemens Ltd (Industrials)

Equity, Since 31 May 21 | 5005503% ₹213 Cr 350,000 Kaynes Technology India Ltd (Industrials)

Equity, Since 30 Nov 22 | KAYNES3% ₹203 Cr 423,938

↓ -68,266 Container Corporation of India Ltd (Industrials)

Equity, Since 31 Aug 22 | CONCOR3% ₹195 Cr 2,500,000 4. L&T Emerging Businesses Fund

CAGR/Annualized return of 20% since its launch. Ranked 2 in Small Cap category. Return for 2024 was 28.5% , 2023 was 46.1% and 2022 was 1% . L&T Emerging Businesses Fund

Growth Launch Date 12 May 14 NAV (28 Mar 25) ₹72.5753 ↓ -0.24 (-0.33 %) Net Assets (Cr) ₹13,334 on 28 Feb 25 Category Equity - Small Cap AMC L&T Investment Management Ltd Rating ☆☆☆☆☆ Risk High Expense Ratio 1.73 Sharpe Ratio -0.4 Information Ratio -0.11 Alpha Ratio 1.44 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹20,010 31 Mar 22 ₹29,870 31 Mar 23 ₹31,289 31 Mar 24 ₹46,026 Returns for L&T Emerging Businesses Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Mar 25 Duration Returns 1 Month 8.1% 3 Month -18.1% 6 Month -19% 1 Year 4.3% 3 Year 17.8% 5 Year 37.3% 10 Year 15 Year Since launch 20% Historical performance (Yearly) on absolute basis

Year Returns 2024 28.5% 2023 46.1% 2022 1% 2021 77.4% 2020 15.5% 2019 -8.1% 2018 -13.7% 2017 66.5% 2016 10.2% 2015 12.3% Fund Manager information for L&T Emerging Businesses Fund

Name Since Tenure Venugopal Manghat 17 Dec 19 5.21 Yr. Cheenu Gupta 1 Oct 23 1.42 Yr. Sonal Gupta 1 Oct 23 1.42 Yr. Data below for L&T Emerging Businesses Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 27.7% Consumer Cyclical 16.29% Financial Services 14.59% Basic Materials 10.53% Technology 9.98% Real Estate 5.2% Health Care 4.47% Consumer Defensive 3.38% Energy 1.4% Asset Allocation

Asset Class Value Cash 3.74% Equity 96.26% Top Securities Holdings / Portfolio

Name Holding Value Quantity BSE Ltd (Financial Services)

Equity, Since 29 Feb 24 | BSE3% ₹452 Cr 852,600 Neuland Laboratories Limited

Equity, Since 31 Jan 24 | -3% ₹422 Cr 299,000 Aditya Birla Real Estate Ltd (Basic Materials)

Equity, Since 30 Sep 22 | 5000402% ₹344 Cr 1,595,574

↓ -11,705 K.P.R. Mill Ltd (Consumer Cyclical)

Equity, Since 28 Feb 15 | KPRMILL2% ₹306 Cr 3,286,897 Brigade Enterprises Ltd (Real Estate)

Equity, Since 31 Jul 19 | 5329292% ₹293 Cr 2,499,622

↓ -132,457 NCC Ltd (Industrials)

Equity, Since 28 Feb 21 | NCC2% ₹285 Cr 11,291,100 Karur Vysya Bank Ltd (Financial Services)

Equity, Since 31 Oct 22 | 5900032% ₹284 Cr 11,912,400 Amber Enterprises India Ltd Ordinary Shares (Consumer Cyclical)

Equity, Since 31 Jan 20 | AMBER2% ₹273 Cr 420,449 Time Technoplast Ltd (Consumer Cyclical)

Equity, Since 31 Jan 24 | TIMETECHNO2% ₹273 Cr 6,810,500 Techno Electric & Engineering Co Ltd (Industrials)

Equity, Since 31 Jan 19 | TECHNOE2% ₹267 Cr 2,473,042 5. HDFC Infrastructure Fund

CAGR/Annualized return of since its launch. Ranked 26 in Sectoral category. Return for 2024 was 23% , 2023 was 55.4% and 2022 was 19.3% . HDFC Infrastructure Fund

Growth Launch Date 10 Mar 08 NAV (28 Mar 25) ₹43.275 ↓ -0.11 (-0.24 %) Net Assets (Cr) ₹2,105 on 28 Feb 25 Category Equity - Sectoral AMC HDFC Asset Management Company Limited Rating ☆☆☆ Risk High Expense Ratio 2.31 Sharpe Ratio -0.55 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 300 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹17,356 31 Mar 22 ₹21,727 31 Mar 23 ₹25,279 31 Mar 24 ₹45,346 Returns for HDFC Infrastructure Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Mar 25 Duration Returns 1 Month 9.3% 3 Month -7.4% 6 Month -13.9% 1 Year 4.9% 3 Year 29.9% 5 Year 36.8% 10 Year 15 Year Since launch Historical performance (Yearly) on absolute basis

Year Returns 2024 23% 2023 55.4% 2022 19.3% 2021 43.2% 2020 -7.5% 2019 -3.4% 2018 -29% 2017 43.3% 2016 -1.9% 2015 -2.5% Fund Manager information for HDFC Infrastructure Fund

Name Since Tenure Srinivasan Ramamurthy 12 Jan 24 1.13 Yr. Dhruv Muchhal 22 Jun 23 1.69 Yr. Data below for HDFC Infrastructure Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 41.71% Financial Services 19.97% Basic Materials 11.11% Energy 7.53% Utility 6.76% Communication Services 3.67% Health Care 1.75% Technology 1% Real Estate 0.89% Consumer Cyclical 0.54% Asset Allocation

Asset Class Value Cash 3.98% Equity 94.91% Debt 1.11% Top Securities Holdings / Portfolio

Name Holding Value Quantity ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 09 | ICICIBANK7% ₹163 Cr 1,300,000 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 12 | LT5% ₹125 Cr 350,000

↑ 20,000 HDFC Bank Ltd (Financial Services)

Equity, Since 31 Aug 23 | HDFCBANK5% ₹119 Cr 700,000 J Kumar Infraprojects Ltd (Industrials)

Equity, Since 31 Oct 15 | JKIL5% ₹110 Cr 1,500,000 Kalpataru Projects International Ltd (Industrials)

Equity, Since 31 Jan 23 | KPIL3% ₹80 Cr 758,285 NTPC Ltd (Utilities)

Equity, Since 31 Dec 17 | 5325553% ₹71 Cr 2,200,000

↑ 115,875 Coal India Ltd (Energy)

Equity, Since 31 Oct 18 | COALINDIA3% ₹67 Cr 1,700,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 20 | BHARTIARTL3% ₹65 Cr 400,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 31 Dec 21 | INDIGO3% ₹65 Cr 150,000 Reliance Industries Ltd (Energy)

Equity, Since 31 May 24 | RELIANCE3% ₹63 Cr 500,000 6. Franklin Build India Fund

CAGR/Annualized return of 17.9% since its launch. Ranked 4 in Sectoral category. Return for 2024 was 27.8% , 2023 was 51.1% and 2022 was 11.2% . Franklin Build India Fund

Growth Launch Date 4 Sep 09 NAV (28 Mar 25) ₹129.008 ↓ -0.27 (-0.21 %) Net Assets (Cr) ₹2,406 on 28 Feb 25 Category Equity - Sectoral AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆☆☆☆ Risk High Expense Ratio 2.13 Sharpe Ratio -0.41 Information Ratio 0 Alpha Ratio 0 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹18,042 31 Mar 22 ₹22,684 31 Mar 23 ₹25,531 31 Mar 24 ₹43,699 Returns for Franklin Build India Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Mar 25 Duration Returns 1 Month 9.4% 3 Month -7.1% 6 Month -13.1% 1 Year 6.8% 3 Year 28% 5 Year 36.5% 10 Year 15 Year Since launch 17.9% Historical performance (Yearly) on absolute basis

Year Returns 2024 27.8% 2023 51.1% 2022 11.2% 2021 45.9% 2020 5.4% 2019 6% 2018 -10.7% 2017 43.3% 2016 8.4% 2015 2.1% Fund Manager information for Franklin Build India Fund

Name Since Tenure Ajay Argal 18 Oct 21 3.37 Yr. Kiran Sebastian 7 Feb 22 3.06 Yr. Sandeep Manam 18 Oct 21 3.37 Yr. Data below for Franklin Build India Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 37.8% Financial Services 12.39% Utility 11.4% Energy 10.96% Communication Services 7.6% Basic Materials 7.09% Consumer Cyclical 3.4% Real Estate 2.85% Technology 2% Asset Allocation

Asset Class Value Cash 4.19% Equity 95.81% Top Securities Holdings / Portfolio

Name Holding Value Quantity Larsen & Toubro Ltd (Industrials)

Equity, Since 29 Feb 20 | LT10% ₹257 Cr 720,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Mar 12 | ICICIBANK6% ₹150 Cr 1,200,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Oct 21 | RELIANCE5% ₹133 Cr 1,050,000

↑ 170,000 InterGlobe Aviation Ltd (Industrials)

Equity, Since 29 Feb 20 | INDIGO5% ₹130 Cr 300,000

↑ 65,000 NTPC Ltd (Utilities)

Equity, Since 30 Nov 16 | 5325555% ₹127 Cr 3,930,000 Oil & Natural Gas Corp Ltd (Energy)

Equity, Since 30 Jun 19 | 5003124% ₹118 Cr 4,500,000 Bharti Airtel Ltd (Communication Services)

Equity, Since 30 Sep 09 | BHARTIARTL4% ₹115 Cr 710,000 Power Grid Corp Of India Ltd (Utilities)

Equity, Since 28 Feb 21 | 5328984% ₹102 Cr 3,365,000 Axis Bank Ltd (Financial Services)

Equity, Since 31 Mar 12 | 5322153% ₹89 Cr 900,000 NCC Ltd (Industrials)

Equity, Since 31 Aug 23 | NCC3% ₹78 Cr 3,100,000 7. DSP BlackRock India T.I.G.E.R Fund

CAGR/Annualized return of 17.5% since its launch. Ranked 12 in Sectoral category. Return for 2024 was 32.4% , 2023 was 49% and 2022 was 13.9% . DSP BlackRock India T.I.G.E.R Fund

Growth Launch Date 11 Jun 04 NAV (28 Mar 25) ₹285.339 ↑ 0.59 (0.21 %) Net Assets (Cr) ₹4,465 on 28 Feb 25 Category Equity - Sectoral AMC DSP BlackRock Invmt Managers Pvt. Ltd. Rating ☆☆☆☆ Risk High Expense Ratio 2.24 Sharpe Ratio -0.22 Information Ratio 0 Alpha Ratio 0 Min Investment 1,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹18,218 31 Mar 22 ₹23,467 31 Mar 23 ₹26,460 31 Mar 24 ₹43,618 Returns for DSP BlackRock India T.I.G.E.R Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Mar 25 Duration Returns 1 Month 10.2% 3 Month -11.8% 6 Month -18.2% 1 Year 7.5% 3 Year 26.9% 5 Year 36.5% 10 Year 15 Year Since launch 17.5% Historical performance (Yearly) on absolute basis

Year Returns 2024 32.4% 2023 49% 2022 13.9% 2021 51.6% 2020 2.7% 2019 6.7% 2018 -17.2% 2017 47% 2016 4.1% 2015 0.7% Fund Manager information for DSP BlackRock India T.I.G.E.R Fund

Name Since Tenure Rohit Singhania 21 Jun 10 14.7 Yr. Data below for DSP BlackRock India T.I.G.E.R Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 35.97% Basic Materials 15.45% Consumer Cyclical 7.89% Utility 6.84% Energy 5.5% Financial Services 5.47% Communication Services 3.6% Health Care 2.72% Technology 2.44% Real Estate 1.45% Consumer Defensive 1.42% Asset Allocation

Asset Class Value Cash 11.26% Equity 88.74% Top Securities Holdings / Portfolio

Name Holding Value Quantity NTPC Ltd (Utilities)

Equity, Since 30 Nov 17 | 5325555% ₹232 Cr 7,145,883

↓ -932,685 Siemens Ltd (Industrials)

Equity, Since 30 Nov 18 | 5005504% ₹224 Cr 369,482 Larsen & Toubro Ltd (Industrials)

Equity, Since 30 Jun 04 | LT4% ₹211 Cr 591,385 Bharti Airtel Ltd (Communication Services)

Equity, Since 31 Oct 18 | BHARTIARTL4% ₹176 Cr 1,080,606 Kirloskar Oil Engines Ltd (Industrials)

Equity, Since 31 Mar 23 | KIRLOSENG3% ₹136 Cr 1,502,475 Coal India Ltd (Energy)

Equity, Since 31 Dec 23 | COALINDIA3% ₹131 Cr 3,321,453 Kalpataru Projects International Ltd (Industrials)

Equity, Since 31 Jan 22 | KPIL2% ₹123 Cr 1,159,431

↓ -94,280 Polycab India Ltd (Industrials)

Equity, Since 31 Jan 21 | POLYCAB2% ₹110 Cr 182,282

↓ -21,868 Welspun Corp Ltd (Basic Materials)

Equity, Since 30 Nov 23 | 5321442% ₹98 Cr 1,323,293 Apollo Hospitals Enterprise Ltd (Healthcare)

Equity, Since 31 Dec 24 | APOLLOHOSP2% ₹89 Cr 131,003

↑ 74,613 8. IDFC Sterling Value Fund

CAGR/Annualized return of 16.6% since its launch. Ranked 21 in Value category. Return for 2024 was 18% , 2023 was 32.6% and 2022 was 3.2% . IDFC Sterling Value Fund

Growth Launch Date 7 Mar 08 NAV (31 Mar 25) ₹138.055 ↓ -0.01 (-0.01 %) Net Assets (Cr) ₹8,996 on 28 Feb 25 Category Equity - Value AMC IDFC Asset Management Company Limited Rating ☆☆☆ Risk Moderately High Expense Ratio 1.81 Sharpe Ratio -0.44 Information Ratio 0.75 Alpha Ratio -0.38 Min Investment 5,000 Min SIP Investment 100 Exit Load 0-365 Days (1%),365 Days and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹21,593 31 Mar 22 ₹29,489 31 Mar 23 ₹30,476 31 Mar 24 ₹44,072 31 Mar 25 ₹46,095 Returns for IDFC Sterling Value Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Mar 25 Duration Returns 1 Month 5.3% 3 Month -5.2% 6 Month -12.5% 1 Year 4.6% 3 Year 16.1% 5 Year 35.7% 10 Year 15 Year Since launch 16.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 18% 2023 32.6% 2022 3.2% 2021 64.5% 2020 15.2% 2019 -6.2% 2018 -13% 2017 61.3% 2016 1.1% 2015 -0.3% Fund Manager information for IDFC Sterling Value Fund

Name Since Tenure Daylynn Pinto 20 Oct 16 8.37 Yr. Ritika Behera 7 Oct 23 1.4 Yr. Gaurav Satra 7 Jun 24 0.73 Yr. Data below for IDFC Sterling Value Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 28.95% Consumer Cyclical 10.93% Basic Materials 8.56% Technology 8.39% Industrials 8.15% Energy 8.1% Consumer Defensive 7.36% Health Care 5.86% Utility 2.62% Real Estate 1.78% Asset Allocation

Asset Class Value Cash 7.33% Equity 92.67% Top Securities Holdings / Portfolio

Name Holding Value Quantity HDFC Bank Ltd (Financial Services)

Equity, Since 28 Feb 22 | HDFCBANK7% ₹696 Cr 4,100,000

↑ 700,000 Reliance Industries Ltd (Energy)

Equity, Since 31 Jan 22 | RELIANCE7% ₹633 Cr 5,000,000

↑ 100,000 Axis Bank Ltd (Financial Services)

Equity, Since 30 Apr 21 | 5322154% ₹424 Cr 4,300,000

↑ 400,000 ICICI Bank Ltd (Financial Services)

Equity, Since 31 Oct 18 | ICICIBANK4% ₹376 Cr 3,000,000 Tata Consultancy Services Ltd (Technology)

Equity, Since 31 Oct 21 | TCS3% ₹327 Cr 795,000

↑ 95,000 Infosys Ltd (Technology)

Equity, Since 30 Sep 23 | INFY3% ₹282 Cr 1,500,000

↑ 100,000 Hero MotoCorp Ltd (Consumer Cyclical)

Equity, Since 31 Aug 22 | HEROMOTOCO2% ₹204 Cr 470,000

↑ 45,000 ITC Ltd (Consumer Defensive)

Equity, Since 28 Feb 22 | ITC2% ₹201 Cr 4,500,000 IndusInd Bank Ltd (Financial Services)

Equity, Since 30 Nov 22 | INDUSINDBK2% ₹198 Cr 2,000,000 Jindal Steel & Power Ltd (Basic Materials)

Equity, Since 30 Apr 17 | 5322862% ₹198 Cr 2,500,000 9. Franklin India Smaller Companies Fund

CAGR/Annualized return of 15.2% since its launch. Ranked 11 in Small Cap category. Return for 2024 was 23.2% , 2023 was 52.1% and 2022 was 3.6% . Franklin India Smaller Companies Fund

Growth Launch Date 13 Jan 06 NAV (28 Mar 25) ₹151.651 ↓ -0.10 (-0.07 %) Net Assets (Cr) ₹11,257 on 28 Feb 25 Category Equity - Small Cap AMC Franklin Templeton Asst Mgmt(IND)Pvt Ltd Rating ☆☆☆☆ Risk Moderately High Expense Ratio 1.78 Sharpe Ratio -0.43 Information Ratio 0.28 Alpha Ratio 0.6 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹19,999 31 Mar 22 ₹26,272 31 Mar 23 ₹28,549 31 Mar 24 ₹43,647 Returns for Franklin India Smaller Companies Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Mar 25 Duration Returns 1 Month 5.9% 3 Month -15.6% 6 Month -18.5% 1 Year 2.9% 3 Year 20.3% 5 Year 35.1% 10 Year 15 Year Since launch 15.2% Historical performance (Yearly) on absolute basis

Year Returns 2024 23.2% 2023 52.1% 2022 3.6% 2021 56.4% 2020 18.7% 2019 -5% 2018 -17.4% 2017 43.5% 2016 10.2% 2015 9.6% Fund Manager information for Franklin India Smaller Companies Fund

Name Since Tenure R. Janakiraman 1 Feb 11 14.09 Yr. Sandeep Manam 18 Oct 21 3.37 Yr. Akhil Kalluri 8 Sep 22 2.48 Yr. Data below for Franklin India Smaller Companies Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 21.19% Financial Services 19.04% Consumer Cyclical 13.99% Basic Materials 10.49% Health Care 10.39% Technology 6.22% Real Estate 4.75% Consumer Defensive 3.48% Utility 2.37% Energy 0.92% Communication Services 0.05% Asset Allocation

Asset Class Value Cash 5.53% Equity 94.31% Top Securities Holdings / Portfolio

Name Holding Value Quantity Brigade Enterprises Ltd (Real Estate)

Equity, Since 30 Jun 14 | 5329294% ₹453 Cr 3,868,691 Aster DM Healthcare Ltd Ordinary Shares (Healthcare)

Equity, Since 31 Jul 23 | ASTERDM3% ₹394 Cr 8,018,630

↓ -455,151 Karur Vysya Bank Ltd (Financial Services)

Equity, Since 31 Oct 12 | 5900033% ₹337 Cr 14,155,680

↓ -1,243,237 Deepak Nitrite Ltd (Basic Materials)

Equity, Since 31 Jan 16 | DEEPAKNTR3% ₹323 Cr 1,387,967 Equitas Small Finance Bank Ltd Ordinary Shares (Financial Services)

Equity, Since 31 Oct 20 | EQUITASBNK2% ₹320 Cr 48,064,081 Zensar Technologies Ltd (Technology)

Equity, Since 28 Feb 23 | ZENSARTECH2% ₹284 Cr 3,262,700

↑ 300,000 J.B. Chemicals & Pharmaceuticals Ltd (Healthcare)

Equity, Since 30 Jun 14 | JBCHEPHARM2% ₹256 Cr 1,448,723 Kalyan Jewellers India Ltd (Consumer Cyclical)

Equity, Since 31 May 22 | KALYANKJIL2% ₹250 Cr 4,963,469 Crompton Greaves Consumer Electricals Ltd (Consumer Cyclical)

Equity, Since 31 Jan 24 | CROMPTON2% ₹237 Cr 6,900,000 Eris Lifesciences Ltd Registered Shs (Healthcare)

Equity, Since 30 Sep 19 | ERIS2% ₹229 Cr 1,866,828 10. Kotak Small Cap Fund

CAGR/Annualized return of 17% since its launch. Ranked 23 in Small Cap category. Return for 2024 was 25.5% , 2023 was 34.8% and 2022 was -3.1% . Kotak Small Cap Fund

Growth Launch Date 24 Feb 05 NAV (31 Mar 25) ₹236.278 ↓ -0.03 (-0.01 %) Net Assets (Cr) ₹14,407 on 28 Feb 25 Category Equity - Small Cap AMC Kotak Mahindra Asset Management Co Ltd Rating ☆☆☆ Risk Moderately High Expense Ratio 1.67 Sharpe Ratio -0.22 Information Ratio -0.66 Alpha Ratio 4.91 Min Investment 5,000 Min SIP Investment 1,000 Exit Load 0-1 Years (1%),1 Years and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹22,777 31 Mar 22 ₹31,078 31 Mar 23 ₹29,901 31 Mar 24 ₹41,373 31 Mar 25 ₹44,967 Returns for Kotak Small Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Mar 25 Duration Returns 1 Month 8.1% 3 Month -14% 6 Month -18.1% 1 Year 8.7% 3 Year 13.1% 5 Year 35.1% 10 Year 15 Year Since launch 17% Historical performance (Yearly) on absolute basis

Year Returns 2024 25.5% 2023 34.8% 2022 -3.1% 2021 70.9% 2020 34.2% 2019 5% 2018 -17.3% 2017 44% 2016 8.9% 2015 7.4% Fund Manager information for Kotak Small Cap Fund

Name Since Tenure Harish Bihani 20 Oct 23 1.36 Yr. Data below for Kotak Small Cap Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Industrials 31.48% Consumer Cyclical 21.06% Health Care 17.37% Basic Materials 13.84% Real Estate 4.45% Financial Services 3.58% Consumer Defensive 2.57% Communication Services 2.12% Technology 0.29% Asset Allocation

Asset Class Value Cash 3.24% Equity 96.76% Top Securities Holdings / Portfolio

Name Holding Value Quantity Century Plyboards (India) Ltd (Basic Materials)

Equity, Since 31 Oct 18 | 5325483% ₹529 Cr 6,569,467 Cyient Ltd (Industrials)

Equity, Since 31 Dec 19 | CYIENT3% ₹520 Cr 3,574,852

↑ 400,000 Vijaya Diagnostic Centre Ltd (Healthcare)

Equity, Since 31 Mar 24 | 5433503% ₹509 Cr 4,918,037

↑ 276,702 Aster DM Healthcare Ltd Ordinary Shares (Healthcare)

Equity, Since 31 Jul 24 | ASTERDM3% ₹494 Cr 10,044,419

↑ 577,857 Krishna Institute of Medical Sciences Ltd (Healthcare)

Equity, Since 31 Dec 23 | 5433083% ₹493 Cr 8,096,930 Blue Star Ltd (Industrials)

Equity, Since 31 May 18 | BLUESTARCO3% ₹458 Cr 2,518,929 Brigade Enterprises Ltd (Real Estate)

Equity, Since 31 Aug 24 | 5329293% ₹431 Cr 3,678,404

↑ 1,172,924 Amber Enterprises India Ltd Ordinary Shares (Consumer Cyclical)

Equity, Since 31 Jan 18 | AMBER2% ₹401 Cr 616,512 Techno Electric & Engineering Co Ltd (Industrials)

Equity, Since 31 Dec 18 | TECHNOE2% ₹387 Cr 3,591,305

↑ 31,513 Garware Technical Fibres Ltd (Consumer Cyclical)

Equity, Since 30 Jun 21 | GARFIBRES2% ₹380 Cr 4,635,632

↑ 115,297 11. Edelweiss Mid Cap Fund

CAGR/Annualized return of 13.6% since its launch. Ranked 22 in Mid Cap category. Return for 2024 was 38.9% , 2023 was 38.4% and 2022 was 2.4% . Edelweiss Mid Cap Fund

Growth Launch Date 26 Dec 07 NAV (31 Mar 25) ₹89.848 ↓ -0.01 (-0.01 %) Net Assets (Cr) ₹7,729 on 28 Feb 25 Category Equity - Mid Cap AMC Edelweiss Asset Management Limited Rating ☆☆☆ Risk High Expense Ratio 1.86 Sharpe Ratio 0.14 Information Ratio 0.18 Alpha Ratio 8.1 Min Investment 5,000 Min SIP Investment 500 Exit Load 0-12 Months (1%),12 Months and above(NIL) Growth of 10,000 investment over the years.

Date Value 31 Mar 20 ₹10,000 31 Mar 21 ₹19,609 31 Mar 22 ₹24,640 31 Mar 23 ₹25,335 31 Mar 24 ₹37,999 31 Mar 25 ₹44,681 Returns for Edelweiss Mid Cap Fund

absolute basis & more than 1 year are on CAGR (Compound Annual Growth Rate) basis. as on 28 Mar 25 Duration Returns 1 Month 8.4% 3 Month -10.8% 6 Month -11.7% 1 Year 17.6% 3 Year 21.9% 5 Year 34.9% 10 Year 15 Year Since launch 13.6% Historical performance (Yearly) on absolute basis

Year Returns 2024 38.9% 2023 38.4% 2022 2.4% 2021 50.3% 2020 26.4% 2019 5.2% 2018 -15.7% 2017 52.3% 2016 2.5% 2015 9.4% Fund Manager information for Edelweiss Mid Cap Fund

Name Since Tenure Dhruv Bhatia 14 Oct 24 0.38 Yr. Trideep Bhattacharya 1 Oct 21 3.41 Yr. Raj Koradia 1 Aug 24 0.58 Yr. Data below for Edelweiss Mid Cap Fund as on 28 Feb 25

Equity Sector Allocation

Sector Value Financial Services 20.96% Consumer Cyclical 16.5% Industrials 14.68% Health Care 12.6% Technology 11.89% Basic Materials 7.86% Consumer Defensive 4.99% Real Estate 3.84% Communication Services 1.79% Energy 1.35% Asset Allocation

Asset Class Value Cash 3.54% Equity 96.46% Top Securities Holdings / Portfolio

Name Holding Value Quantity Dixon Technologies (India) Ltd (Technology)

Equity, Since 31 Jan 20 | DIXON4% ₹322 Cr 214,550

↑ 3,802 Persistent Systems Ltd (Technology)

Equity, Since 31 Mar 21 | PERSISTENT3% ₹283 Cr 468,879

↓ -102,975 Max Healthcare Institute Ltd Ordinary Shares (Healthcare)

Equity, Since 31 Jul 21 | MAXHEALTH3% ₹261 Cr 2,461,020

↑ 1,351,437 Indian Hotels Co Ltd (Consumer Cyclical)

Equity, Since 30 Sep 23 | 5008503% ₹244 Cr 3,185,298

↑ 680,114 Lupin Ltd (Healthcare)

Equity, Since 31 Jul 24 | 5002573% ₹237 Cr 1,140,343

↑ 27,563 Marico Ltd (Consumer Defensive)

Equity, Since 31 Oct 24 | 5316423% ₹223 Cr 3,318,848

↑ 1,715,413 Coforge Ltd (Technology)

Equity, Since 30 Jun 23 | COFORGE3% ₹221 Cr 267,153

↑ 6,457 PB Fintech Ltd (Financial Services)

Equity, Since 29 Feb 24 | 5433903% ₹213 Cr 1,231,780

↑ 29,774 Solar Industries India Ltd (Basic Materials)

Equity, Since 30 Sep 12 | SOLARINDS2% ₹196 Cr 192,679

↑ 4,656 UNO Minda Ltd (Consumer Cyclical)

Equity, Since 31 Aug 17 | UNOMINDA2% ₹176 Cr 1,859,803

↑ 249,595

سرمایہ کاروں کو مشورہ دیا جاتا ہے کہ وہ اپنی پسند کے SIP منصوبوں میں سرمایہ کاری کریں۔ مذکورہ بالا 11 میوچل فنڈز ہر قسم کے سرمایہ کاروں کے لیے موزوں ہیں۔ تو، یا تو آپ کو زیادہ خطرہ ہے۔سرمایہ کار یا نسبتاً کم، یہ SIP فنڈز ہیں۔سرمایہ کاری کے لیے بہترین میوچل فنڈز. تو، انتظار نہ کریں، ابھی سرمایہ کاری کریں!

بہترین نظامی سرمایہ کاری کے منصوبوں میں سرمایہ کاری کرتے وقت جن پیرامیٹرز پر غور کرنا ہے۔

بہترین کارکردگی کا مظاہرہ کرنے والے SIP فنڈز کا جائزہ لینے کے لیے، آئیے ان عوامل کو جانتے ہیں جن پر سرمایہ کاری کرنے سے پہلے غور کرنا چاہیے۔

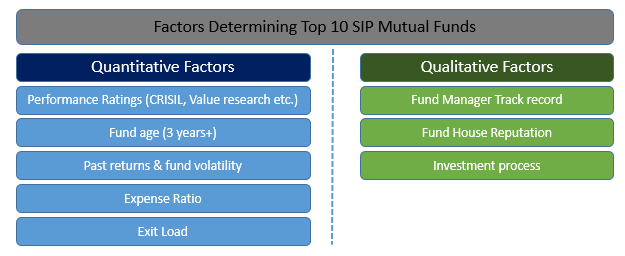

اعلی SIP میں سرمایہ کاری کے لیے مقداری عوامل

ایس آئی پی کے ذریعے سرمایہ کاری کرنے سے پہلے جن مقداری عوامل پر غور کرنا چاہیے ان میں کارکردگی کی درجہ بندی (بطور CRISIL، ویلیو ریسرچ وغیرہ)، فنڈ کی عمر، ماضی کے منافع اور فنڈ میں اتار چڑھاؤ، اخراجات کا تناسب اور ایگزٹ لوڈ شامل ہیں۔

اعلی SIP میں سرمایہ کاری کرنے کے قابلیت والے عوامل

تجزیہ کرنے کے لیے کوالٹیٹو کلیدی اعدادوشمار میں فنڈ مینیجر کا ٹریک ریکارڈ، فنڈ ہاؤس کی ساکھ اور SIP فنڈ کی سرمایہ کاری کا عمل شامل ہے۔

SIP MF آن لائن میں کیسے سرمایہ کاری کی جائے؟

Fincash.com پر لائف ٹائم کے لیے مفت انویسٹمنٹ اکاؤنٹ کھولیں۔

اپنی رجسٹریشن اور KYC کا عمل مکمل کریں۔

دستاویزات اپ لوڈ کریں (PAN، آدھار، وغیرہ)۔اور، آپ سرمایہ کاری کے لیے تیار ہیں!

آج ہی SIP کے ساتھ اپنا سرمایہ کاری کا سفر شروع کریں!

اکثر پوچھے گئے سوالات

1. میوچل فنڈز کیا ہیں؟

A: میوچل فنڈز سسٹمیٹک انویسٹمنٹ پلان یا ایس آئی پی کا حصہ ہیں جو عام طور پر بعد میں بہترین منافع دیتے ہیں۔ جب تممیوچل فنڈز میں سرمایہ کاری کریں۔، آپ اپنے سرمایہ کاری کے پورٹ فولیو کو متنوع بناتے ہیں۔ ایک میوچل فنڈ کو ایک سرمایہ کاری کا آلہ سمجھا جا سکتا ہے جسے کسی نے تیار کیا ہے۔اثاثہ مینجمنٹ کمپنی متعدد سرمایہ کاروں اور کمپنیوں کی سرمایہ کاری کو جمع کرکے۔

2. میوچل فنڈز کی مختلف اقسام کیا ہیں؟

A: میوچل فنڈز کو وسیع پیمانے پر درج ذیل اقسام میں تقسیم کیا جا سکتا ہے۔

- ایکویٹی یا گروتھ فنڈز

- فکسڈ انکم فنڈز یاقرض فنڈ

- ٹیکس بچانے والے فنڈز

- مائع فنڈز

- متوازن فنڈ

- گلٹ فنڈز

- ایکسچینج ٹریڈڈ فنڈز یاETFs

3. گروتھ ایکویٹی فنڈز کیا ہیں؟

A: نشو نماایکویٹی فنڈز سب سے زیادہ عام میوچل فنڈز ہیں۔ تاہم، یہ پورٹ فولیو غیر مستحکم سرمایہ کاری پر مشتمل ہوگا۔ اس کے باوجود، سرمایہ کار اکثر گروتھ ایکویٹی فنڈز کو ترجیح دیتے ہیں کیونکہ ان میں زیادہ منافع ہوتا ہے اور ایک مختصر مدت کے لیے سرمایہ کاری کی جا سکتی ہے۔

4. آپ کو قرض فنڈ میں سرمایہ کاری کیوں کرنی چاہیے؟

A: یہ سرمایہ کاری ان افراد کے لیے مثالی ہے جو سرمایہ کاری پر مقررہ منافع کی تلاش میں ہیں۔ مقررہ آمدنی ڈیبینچرز، ڈیٹ سیکیورٹیز، کمرشل پیپرز اور گورنمنٹ سیکیورٹیز سے حاصل کی جاسکتی ہے۔ میوچل فنڈز مختلف قسم کی سرمایہ کاری کا ایک پورٹ فولیو بنائے گا اور خطرے کو ختم کرے گا۔

5. آپ کو SIPs میں کیوں سرمایہ کاری کرنی چاہیے؟

A: SIPs سرمایہ کار کو یقینی آمدنی فراہم کر سکتے ہیں۔ اگر آپ غیر فعال آمدنی حاصل کرنے میں دلچسپی رکھتے ہیں اور اس بات کو یقینی بنانا چاہتے ہیں کہ آپ کی سرمایہ کاری باقاعدہ آمدنی پیدا کرے، تو آپ SIPs میں سرمایہ کاری کرنے پر غور کر سکتے ہیں۔ .

6. ٹیکس بچانے والے میوچل فنڈ میں کیوں سرمایہ کاری کریں؟

A: اگر آپ اپنی ترقی کے خواہاں ہیں۔سرمایہ اور ایک ہی وقت میں ٹیکس کی چھوٹ سے لطف اندوز ہونا چاہتے ہیں، تو آپ ٹیکس بچانے والے میوچل فنڈ میں سرمایہ کاری کر سکتے ہیں۔ کے تحتسیکشن 80 سی کےانکم ٹیکس 1861 کا ایکٹ، اگر آپ ایکویٹی سے منسلک ٹیکس بچانے والے میوچل فنڈز میں سرمایہ کاری کرتے ہیں، تو آپ اپنی سرمایہ کاری پر ٹیکس میں چھوٹ حاصل کر سکتے ہیں۔

7. کیا مجھے میوچل فنڈز میں سرمایہ کاری کرنے کے لیے بروکر کی ضرورت ہے؟

A: سرمایہ کاری میں مدد کے لیے آپ کو بروکر یا مالیاتی ادارے کے تعاون کی ضرورت ہوگی۔ آپ کو مناسب SIPs کی شناخت کرنے اور اس بات کو یقینی بنانے کے لیے مدد کی ضرورت ہوگی کہ سرمایہ کاری صحیح طریقے سے کی گئی ہے۔

یہاں فراہم کردہ معلومات کے درست ہونے کو یقینی بنانے کے لیے تمام کوششیں کی گئی ہیں۔ تاہم، ڈیٹا کی درستگی کے حوالے سے کوئی ضمانت نہیں دی جاتی ہے۔ براہ کرم کوئی بھی سرمایہ کاری کرنے سے پہلے اسکیم کی معلومات کے دستاویز کے ساتھ تصدیق کریں۔