Table of Contents

Yield To Maturity (YTM)

What is Yield To Maturity (YTM)?

Yield to Maturity (YTM) is the Total Return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield, but is expressed as an annual rate. In other words, it is the internal rate of return (irr) of an investment in a bond if the investor holds the bond until maturity and if all payments are made as scheduled.

Yield to maturity is also referred to as book yield or Redemption yield.

Details of YTM

Yield to maturity is very similar to current yield, which divides annual cash inflows from a bond by the Market price of that bond to determine how much money one would make by buying a bond and holding it for one year. Yet, unlike current yield, YTM accounts for the present value of a bond’s future coupon payments. In other words, it factors in the time value of money, whereas a simple current yield calculation does not. As such, it is often considered a more thorough means of calculating the return from a bond.

Because yield to maturity is the interest rate an investor would earn by reinvesting every coupon payment from the bond at a constant interest rate until the bond’s maturity date, the present value of all the future cash flows equals the bond’s market price. The method for calculating YTM can then be represented with the following formula:

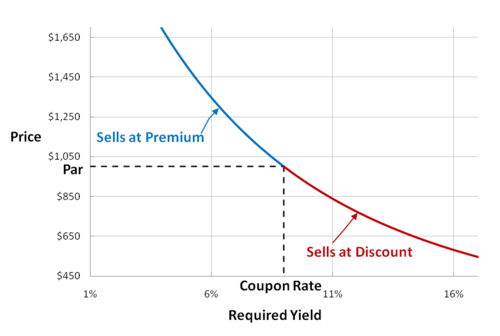

Solving the equation by hand requires an understanding of the relationship between a bond’s price and its yield, as well as of the different types of bond pricings. Bonds can be priced at a discount, at par, or at a premium. When the bond is priced at Par, the bond’s interest rate is equal to its coupon rate. A bond priced above par, called a premium bond, has a coupon rate higher than the interest rate, and a bond priced below par, called a discount bond, has a coupon rate lower than the interest rate. So if an investor were calculating YTM on a bond priced below par, he or she would solve the equation by plugging in various annual interest rates that were higher than the coupon rate until finding a bond price close to the price of the bond in question.

Talk to our investment specialist

Calculations of yield to maturity (YTM) assume that all coupon payments are reinvested at the same rate as the bond’s current yield, and take into account the bond’s current market price, par value, coupon interest rate, and term to maturity. YTM is a complex but accurate calculation of a bond’s return that can help investors compare bonds with different maturities and coupons.

The complex process of determining yield to maturity means that it is often difficult to calculate a precise YTM value. Instead, one can approximate YTM by using a bond yield table. Because of the price value of a Basis point, yields decrease as a bond’s price increases, and vice versa. For this reason, yield to maturity may only be calculated through trial-and-error, by using a business or financial calculator or by using other software like Yield To Maturity Calculator.

Though yield to maturity represents an annualized rate of return on a bond, coupon payments are often made on a semiannual basis, so YTM is often calculated on a six-month basis as well.

Uses of YTM

Yield to maturity can be quite useful for estimating whether or not buying a bond is a good investment. An investor will often determine a required yield, or the return on a bond that will make the bond worthwhile, which may vary from investor to investor. Once an investor has determined the YTM of a bond he or she is considering buying, the investor can compare the YTM with the required yield to determine if the bond is a good buy.

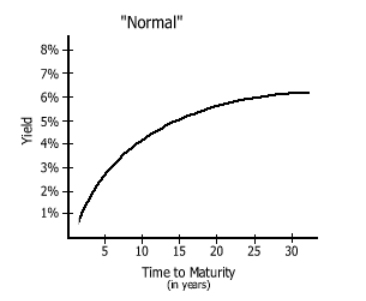

Yet, yield to maturity has other applications as well. Because YTM is expressed as an annual rate regardless of the bond’s term to maturity, it can be used to compare bonds that have different maturities and coupons since YTM expresses the value of different bonds on the same terms.

Variations of YTM

Yield to maturity has a few common variations that are important to know before doing research on the subject.

One such variation is Yield to Call (YTC), which assumes that the bond will be called, that is, repurchased by issuer before it reaches maturity, and thus, has a shorter cash flow period.

Another variation is Yield to put (YTP). YTP is similar to YTC, except for the fact that the holder of a put bond can choose to sell back the bond at a fixed price on a particular date.

A third variation on YTM is Yield to worst (YTW). YTW bonds can be called, put, or exchanged, and generally have the lowest yields out of YTM and its variants.

Limitations of YTM

Like any calculation that attempts to determine whether or not an investment is a good idea, yield to maturity comes with a few important limitations that any investor seeking to use it would do well to consider.

One limitation of YTM is that YTM calculations usually do not account for Taxes that an investor pays on the bond. In this case, YTM is known as the gross redemption yield. YTM calculations also do not account for purchasing or selling costs.

Another important limitation of both YTM and current yield is that these calculations are meant as estimates and are not necessarily reliable. Actual returns depend on the price of the bond when it is sold, and bond prices are determined by the market and can fluctuate substantially. Though this limitation generally has a more noticeable effect on current yield, because it is for a period of only one year, these fluctuations can affect YTM significantly as well.

For more on yield to maturity, read Advanced Bond Concepts: Yield and Bond Price

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment.